3 Steps To Get Ready for the Next Bull Run With Bybit

If you're like most people, you're probably still recovering from the last crypto bear market. But top cryptocurrencies have recently seen exciting gains even while the Federal Reserve continues to raise rates in an effort to cool inflation. In fact, in January 2023, Bitcoin rose by 39%, and Ethereum was up by around 31% and has remained at around these levels. Judging from their climb in the price charts, it's time to start thinking about the next bull run. And here we are, where the $BTC price broke the $30k price range and the trends continue, waking the bulls to push the price further, breaking the $35,000 mark per BTC on Oct 24, 2023.

There are a few necessary steps to prepare for a crypto bull market. First, you should carefully research the crypto market to identify potential opportunities. While the market is showing signs of a bull run, market conditions can change abruptly. Here are three steps to ensure you're ready for the next big crypto opportunity with Bybit.

1) Relearn how to get ahead in the crypto market by understanding the latest bull run opportunities.

2) Reset your trading strategies to venture into the market at a slow and safe pace.

3) Refresh your understanding of Bybit’s latest next-level suite of products and activities.

With a little preparation, you could be in a position to make some serious profits when the market takes off again. So let's get started!

Understanding the Crypto Bull Run

The crypto bull run is a market momentum phenomenon characterized by crypto prices rising rapidly to unprecedented heights. To be fully prepared for the next crypto bull run, you'll have to know the best strategies moving forward so that you can take advantage of this golden opportunity to reap incredible profits.

Of course, you'll always have to be prepared for any possible market pullbacks or even a bear market, especially with the Fed’s warning of ongoing interest hikes to bring inflation under control. Regardless of the market sentiment, you can always make profits as long as you understand how different markets behave during different cycles and adopt the right strategies for each cycle.

By staying informed about recent developments in crypto trading and having a solid strategy in place, you can successfully navigate any type of market conditions you may encounter. Bybit offers numerous tools and products that can help you accelerate your asset growth in all market conditions, which will be explored later on in the article. Let's first take a look at the latest opportunities you shouldn't miss.

1. Latest Bull Run Opportunities

Ethereum has fully transitioned to the proof of stake (PoS) blockchain following the Ethereum Merge. However, there are still some key developments you should look out for. The first is triple halving, which will cause the ETH supply to drop to an equivalent of three Bitcoin halvings. There is also the Ethereum Shanghai upgrade which adds liquidity to Ethereum as well as the rise of Layer 2 (L2) projects that benefit from the Merge. With such developments, the Flippening seems to be well on its way.

Ethereum Cancun Upgrade

Following the Ethereum Shanghai upgrade, the ETH Cancun upgrade is a precursor to the highly anticipated Surge upgrade. The upgrade is near its completion and promises investors the chance to take advantage of many new Ethereum-based opportunities.

What Is Ethereum Cancun Upgrade?

Ethereum’s Cancun Upgrade is the next major step forward for the network that core developers have chosen to work on. Labeled the “Surge” portion of the Ethereum Foundation’s road map, Cancun aims to improve the blockchain’s maximum number of transactions per second (TPS) without sacrificing concerns like security and ease of development for Layer 2 decentralized applications (DApps).

It's important to note that the Ethereum Cancun Upgrade isn’t merely a software update, but rather a significant milestone for Ethereum. In a nutshell, Cancun aims to improve the network's scalability and security and to lower transaction fees — which could attract more users to the network. According to researcher Alex Stokes of the Ethereum Foundation, October 2023 is a feasible goal for Cancun's activation, which will include the following EIPs:

- EIP-4844 (Shard Blob Transactions)

- EIP-1153 (transient storage)

- EIP-4788 (Beacon block root in the Ethereum virtual machine)

- EIP-5656 (memory copying instruction)

- EIP-6780 (SELFDESTRUCT only in thesame transaction)

Why Is Everyone Talking About the Ethereum Cancun Upgrade?

Like The Merge, the Ethereum Cancun Upgrade represents yet another step in the right direction for the Ethereum Foundation and its core developers as they strive to complete the Surge portion of their road map. The execution of Cancun for the Ethereum blockchain marks the first significant step toward overall project progress, since Proto-Danksharding is a key EIP that must be executed to enhance transaction throughput.

This has once again sparked interest in the long-term value of investing in Ethereum. It continues to become the most widely adopted smart contract platform to deliver on fulfilling the promises of its road map. With Cancun being imminent, interest is peaking in the potential upcoming volatility to come from the execution of this major network upgrade.

How You Can Profit From Ethereum Cancun Upgrade on Bybit

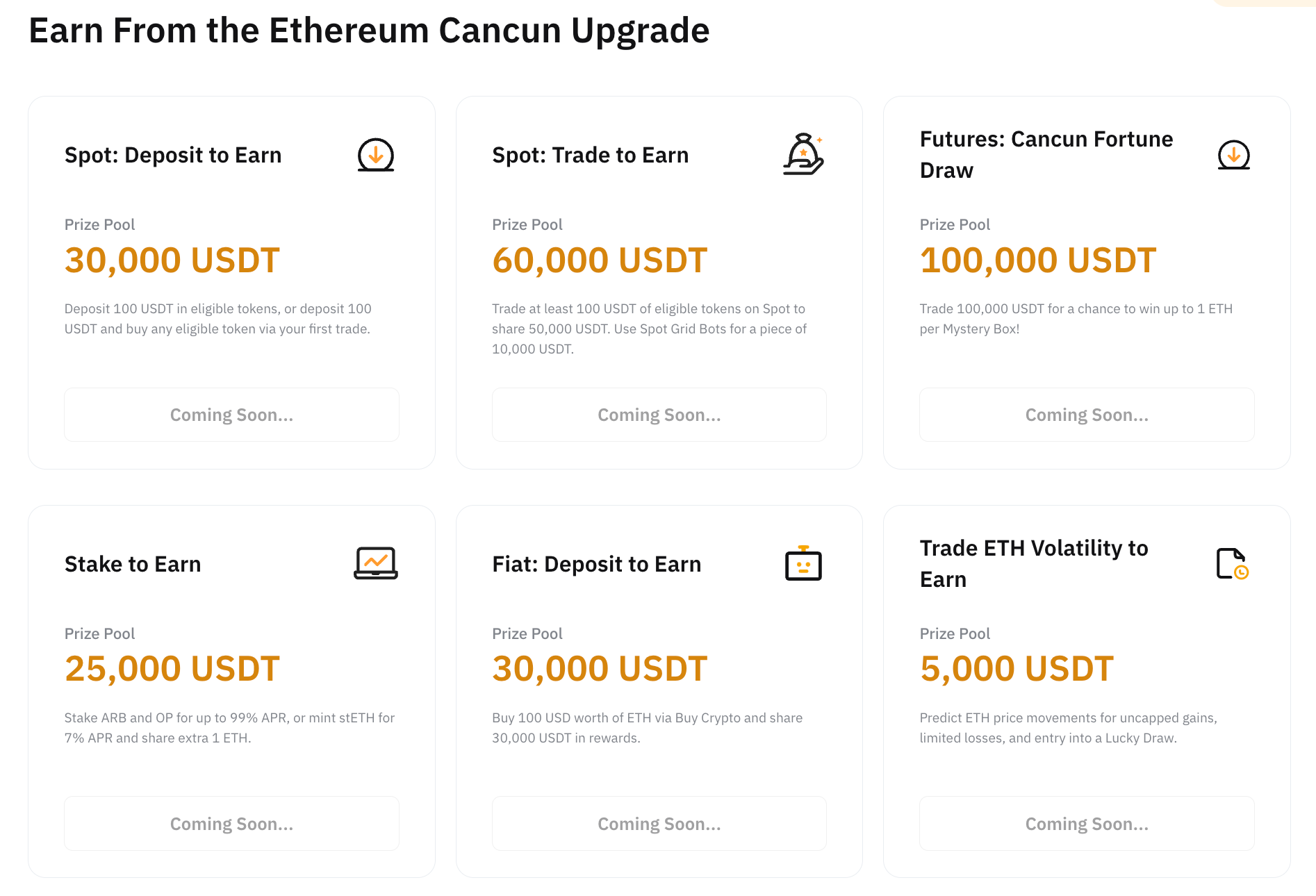

The upgrade presents the possibility of driving the crypto bull run, but there is no guarantee. This exciting Ethereum hard fork is brimming with endless possibilities. Bybit will also be launching campaigns and activities in line with the upcoming Cancun upgrade. The reward price pool is a whopping $335k USDT for investors and traders to bring home.

Join the ETH Cancun Upgrade Events

Ethereum Layer 2 Projects

If you’re considering investing in Ethereum L2 projects, Mantle is a project to keep an eye on. One challenge that has plagued Ethereum is its scalability. Numerous L2 projects have strived to address this challenge, and Mantle is the newest of these projects. Mantle aims to make Ethereum hyper-scalable with its unique Modular Rollup approach that effectively solves the scalability, security, and decentralization blockchain trilemma. Through Mantle, you’ll be able to enjoy faster transaction finality with high security and low fees. Mantle is incubated by BitDAO. The governance token MNT is used as a gas token on the network, thereby giving more utility and value to MNT. This makes MNT a potentially favorable investment that you should consider buying and HODLing.

2. Best Trading and Investment Strategies for a Bull Run

In a bull market, prices can rise quickly while consumer sentiment remains high. These conditions may entice some investors to throw caution to the wind. However, the crypto market can be unpredictable. So even in a hot crypto bull run, taking a conservative approach and entering slowly to balance your risk and reward would be more advantageous.

Buy and Hold

Usually, bull runs are expected to last for an extended period, so a great strategy would be to simply buy and hold your crypto. Some ways to buy and hold your crypto are through spot trading where transactions are settled immediately, and going long to ride on the rising prices. Besides profiting on gains from price increases through trading, you could also lock in staking rewards. Through Bybit Savings, you can choose between fixed and flexible terms to meet your specific staking objectives.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) helps to moderate volatile price fluctuations and smoothen out average prices. That said, in a strong bull market, DCA may not be the best option if the prices keep rising. In such cases, it may be more profitable to invest a significant amount in a blue chip crypto and hold it.

Manage Risk

The crypto market is fraught with risks, but there are ways to manage them regardless of market conditions. One method is to place stop-loss orders to automatically execute your order once the asset’s price dips to a predefined level. Another is to calculate the risk/reward ratio which helps you determine a reasonable stop-loss and take-profit limit.

Don’t Overleverage

Leveraging describes the process of using borrowed funds to make crypto investments to magnify your position. Always practice leveraged trading in moderation because while you can amplify your gains, it also exposes you to significant loss as your investment may be subject to a margin call or even liquidated if the price drops below a certain threshold.

Take Profits Periodically

Timing the crypto market is virtually impossible due to constantly changing conditions and extreme volatility. With this in mind, securing profits regularly is a smart idea. By selling a small portion of your position for a profit, you can lock in your gains while still keeping the opportunity to profit from future price increases.

Diversify Your Portfolio

When you diversify your investments, you open up yourself to new opportunities and lower your risk simultaneously. Besides blue chip crypto and blue chip NFTs, consider investing in stablecoins such as USD Coin (USDC) and Tether (USDT). Bybit’s USDC Fiesta, for example, offers up to 2,000 USDC in rewards. You can stand to earn these rewards by simply depositing at least 50 USDC and meeting a minimum volume for derivatives trades.

Hedge With Options

Through options trading, you can hedge your position to reduce your overall risk and maximize returns during bullish market cycles. Bybit is the only exchange that offers USDC Options, giving you the utmost stability.

3. Best Bybit Products To Try During Bull Run

Bybit brings you a great selection of products matched with top-notch reliability and service that can help you to profit from the next crypto bull market. Bybit Blog’s weekly round-up highlights all the latest updates and product introductions, so by subscribing to the Bybit Blog, you can stay tuned and keep your eyes peeled for any new developments. What are some of the current Bybit products to consider?

Bybit Savings

Bybit Savings is a low-risk product that enables you to stake your favorite tokens and earn stable passive interest on them. It offers both flexible and fixed terms and you can choose to stake and unstake your tokens at any time.

Margin Trading

With Bybit margin trading, you use assets in your Spot Account as collateral to borrow funds from Bybit to trade. This allows you to enter at a larger position than regular spot trading and realize greater gains as a result, though it is also potentially riskier.

Unified Trading Account

If you have more than one account on Bybit, you can consolidate those accounts with Bybit’s Unified Trading Account (UTA) for endless optimized trades. With UTA, you can easily manage Spot, Spot Margin, USDT and USDC Perpetuals as well as USDC Options all in one account without a need to transfer assets from one account to another. Your risk management is also enhanced as the margin is calculated at the account level rather than on the position.

Bybit Copy Trade

Bybit’s Copy Trade platform empowers you with the choice to either manually imitate or automatically replicate an established trader’s trading strategies. By copying another trader’s portfolio, you can benefit from their experience without having to do any of the research yourself. Enhanced with Smart Copy Mode, you have all the tools that will simplify your trade and reduce your risks so that you can make secure profits.

Bybit Trading Bot

The Bybit Trading Bot lets you cruise through your trades with ease through automation. With trading bots, you will set the parameters for trading activities up front, and the bot will automatically execute activities to optimize returns and minimize losses. For the bull market, consider the DCA Bot, which is ideal regardless of any market conditions. The DCA Bot automates the DCA strategy for you and is highly customizable according to your investing preferences. And unlike standard grid trading, the Bybit Futures Grid Bot also works well in uptrending markets as it gives you the option to execute Long orders.

Bybit Dual Asset Mining

Bybit Dual Asset Mining is another tool that allows you to profit based on market movement over a predetermined period. Whether the market moves upward or downward, an accurate prediction can yield a return, thereby making it suitable to use during bull runs.

Bybit Liquidity Mining

Liquidity is always high during bull markets thanks to high levels of trading activities. That means as a liquidity provider, you can earn more by adding liquidity to the liquidity pool. Bybit Liquidity Mining allows those who add liquidity to its liquidity pools to profit off swap fees and trading fees. More trading equals more fees collected. You simply contribute assets to the liquidity pool and you will receive a daily yield. There is no locked period so you’re free to remove your assets anytime you want.

Bybit Web3

During a crypto bull run, one can expect more initial DEX offerings (IDOs) and initial coin offerings (ICOs) to be held, which means more investment opportunities. With Bybit Web3 IDO, you can get informed about the latest IDO projects and participate in them to purchase a token at its launch price to reap profits when the price rises later on. If you’re interested in trading NFTs, the Bybit NFT Marketplace also offers you early access to low-price, high-quality NFTs that will appreciate quickly in value. In addition, you can enjoy the perks of a simplified decentralized exchange (DEX) with low fees and high leverage of up to 20x through ApeX Pro, which uses the order book trading model that traditional traders are more familiar with.

Final Thoughts

So, are you ready for the next crypto bull run? All you need to do is understand the latest opportunities in the crypto market, adjust your trading and investment strategies, and Bybit can help you with the rest with its comprehensive range of tools and products that are collectively suitable for all investment strategies and market conditions. So sign up today and start trading on Bybit! #Bybit #TheCryptoArk