Understanding Mantle Vault: Security, strategies and stablecoin yield

In the volatile crypto market, finding a reliable source of yield without exposing capital to significant market swings is a primary goal for many investors. Mantle Vault enables users to do exactly that. Situated within Bybit's On-Chain Earn suite, Mantle Vault is a new low-risk stablecoin yield product that’s designed to simplify the complexities of decentralized finance (DeFi).

Mantle Vault allows users to earn yield on USDT and USDC holdings without the need to manage private keys, gas fees or intricate DeFi strategies manually. By partnering with professional asset management institutions, the product connects users to on-chain trading strategies traditionally reserved for institutional players.

Positioned as a principal-protected DeFi yield product, Mantle Vault prioritizes the preservation of capital while targeting competitive returns. It’s built on a robust infrastructure combining Mantle Network and the Ethereum Mainnet, primarily utilizing the Aave lending protocol to generate returns. The product targets an estimated annual percentage rate (APR) of approximately 7% to 12% on USDT and USDC, offering a compelling alternative to standard savings products.

Note: While the product is designed with principal protection mechanisms, all on-chain activities carry inherent risks related to smart contracts and protocol performance.

Key Takeaways:

Mantle Vault offers a principal-protected yield solution for USDT and USDC holders by utilizing delta-neutral strategies on the Aave protocol

The product targets an estimated APR of 7% to 12% with a dynamic allocation of assets across USDe strategies and direct lending

Users benefit from flexible access to their funds, with a typical redemption period of two to three days

Why Mantle Vault was created

The cryptocurrency market has long faced a gap between high-risk trading and low-yield savings. Among crypto users, there’s a high demand for stable, predictable yields on their stablecoins (USDT and USDC). Such yields outperform traditional savings rates without carrying the volatility risk associated with altcoins or directional trading.

Traditional DeFi yields often present significant barriers to entry. Users face complexity in the form of bridging assets across chains, swapping tokens on decentralized exchanges (DEXs) and manually staking assets. Furthermore, DeFi yields can be highly volatile, fluctuating wildly based on market conditions. Perhaps the biggest burden is the need for manual management, as users must constantly monitor margin requirements and collateral value ratios to avoid liquidation, a process that requires vigilance and technical expertise.

Mantle Vault was created to solve these specific problems. Its vision is to provide a simple user experience in which one-click access via Bybit replaces the need to manage wallets or gas fees. It aims to offer an attractive APR in the 7% to 12% range, significantly higher than standard centralized exchange (CEX) savings products.

The vault employs advanced yield hedging through professional strategies to mitigate downside risk. By utilizing an off-balance-sheet funding model, Mantle Vault connects users directly to on-chain yield sources, ensuring that the yield is distinct from exchange-based lending and is derived from transparent DeFi activity.

Key features of Mantle Vault

Mantle Vault includes several core features designed to balance safety, yield and flexibility for the user.

It’s a low-risk and principal-protected product. Its underlying strategies are conservative, focusing on capital preservation above aggressive growth. This makes it an ideal choice for risk-averse investors looking to grow their stablecoin holdings.

The vault offers competitive returns, with a target estimated APR of approximately 7% to 12%. While this rate is a target and not a guarantee, it represents a significant premium over traditional passive income options in the crypto space.

The product utilizes a delta-neutral strategy. This means that the investment approach is designed to be immune to the price movements of the underlying collateral. Regardless of whether the market trends upward or downward, the value of the portfolio remains stable relative to the stablecoin standard.

Mantle Vault offers flexible withdrawals. While the funds are deployed on-chain, users aren’t locked into long-term contracts. The typical redemption timeline is T+2 or T+3, meaning users can access their funds within two to three days.

Lastly, the vault is built on trusted protocols, specifically leveraging Aave. As one of the largest and most battle-tested liquidity protocols in DeFi, Aave provides the institutional-grade infrastructure necessary for large-scale yield generation.

How Mantle Vault works

The operational flow of Mantle Vault is designed to be seamless for the user, while performing complex operations in the background.

When a user deposits USDT or USDC into the Vault on Bybit, the platform's On-Chain Earn solution aggregates and deploys these funds. The assets are then bridged or allocated to the Mantle Network and the Ethereum Mainnet.

Once the funds are on-chain, yield is generated via Aave using specific delta-neutral strategies. Finally, the realized yield is collected and distributed back to the user's Bybit account, creating a hands-off passive income stream.

Yield strategy overview

The core of Mantle Vault's performance lies in its delta-neutral approach. In simple terms, being delta-neutral means that the strategy is hedged against the price volatility of the asset being utilized. Even if the price of an asset utilized in the strategy fluctuates, the portfolio's total value in terms of USD remains stable.

The vault relies on three pillars of yield generation:

supply yield, which is the interest paid by borrowers on the Aave protocol

staking incentives, often paid out in governance or rewards tokens

risk-controlled leverage, often referred to as looping, which multiplies the yield potential without exposing the principal to directional market risk

Aave was chosen as the foundation for these strategies because of its deep liquidity and battle-tested security. As a blue-chip DeFi protocol, Aave can handle the scale required for an institutional-grade product such as Mantle Vault.

Strategy 1: USDe supply strategy on Aave

The USDe strategy represents the high-yield portion of the portfolio. This process begins by converting the user's deposited USDT or USDC into USDe, which is Ethena's synthetic dollar. The USDe is then supplied to the Aave V3 market on Ethereum.

Users earn yield from two sources in this strategy: they receive the native supply yield on Aave paid by borrowers, and they earn Ethena incentives, which are frequently distributed as points or Sats.

To enhance these returns, the strategy employs looping, a recursive process whereby the protocol supplies collateral, borrows against it and resupplies the borrowed funds. This increases capital efficiency, and multiplies the APR generated from the base yield.

The strategy involves a specific flow: deposit stablecoins, convert them to USDe (via staking or market purchase for cost efficiency) and supply the assets to Aave V3. The expected APR for this strategy ranges from roughly 5% to 11%. The withdrawal timeline is up to two to three days, with a capacity of approximately $600 million.

Strategy 2: USDT/USDC supply strategy on Aave

The USDT/USDC supply strategy focuses on liquidity and conservation. Unlike the first strategy above, this approach involves the direct supply of USDT or USDC into Aave V3 on Ethereum. There is no conversion to other assets, so it involves less operational complexity.

The position building is straightforward: the vault deposits USDT or USDC and supplies it directly to the lending pools on Aave V3. While the expected APR is lower, ranging from roughly 1.5% to 3%, the capacity is significantly larger, estimated at around $5 billion. This strategy ensures that a large portion of the vault remains highly liquid to facilitate user redemptions.

How Mantle Vault combines USDe and USDC/USDT supply strategies

Mantle Vault doesn’t simply choose one strategy over the other. Instead, it utilizes active portfolio management to dynamically allocate funds between the two options. The goal is to balance the higher yields generated by the USDe strategy with the deep liquidity and lower risk profile of the direct supply strategy.

By maintaining this balance, the vault can offer an attractive blended APR that meets the 7%–12% target while ensuring that your funds remain safe. This mix is also crucial for operational efficiency, ensuring that withdrawals can be processed within the stated T+2 or T+3 time frame, regardless of market conditions.

Security and risk considerations

Security is paramount for any principal-protected product. Mantle Vault relies on Aave, the industry standard for lending, and operates on the secure Ethereum Mainnet and Mantle Network. All smart contracts involved are audited to ensure code integrity.

However, transparency regarding risk is essential. Even with principal protection, risks exist in the DeFi ecosystem. Smart contract risk remains a factor, as bugs in Aave or the Vault code could theoretically occur. There is also DeFi protocol risk, specifically regarding the USDe peg or the liquidity of underlying assets.

Users should also be aware of network congestion; while the target redemption time is 2–3 days, extreme clogging on the Ethereum network could cause delays.

Finally, yield fluctuations are possible, as the stated APR is an estimate that’s based on market conditions, and is not fixed.

How to use Mantle Vault on Bybit

Earning crypto via Mantle Vault is intuitive and user-friendly. Follow these steps to start earning yield:

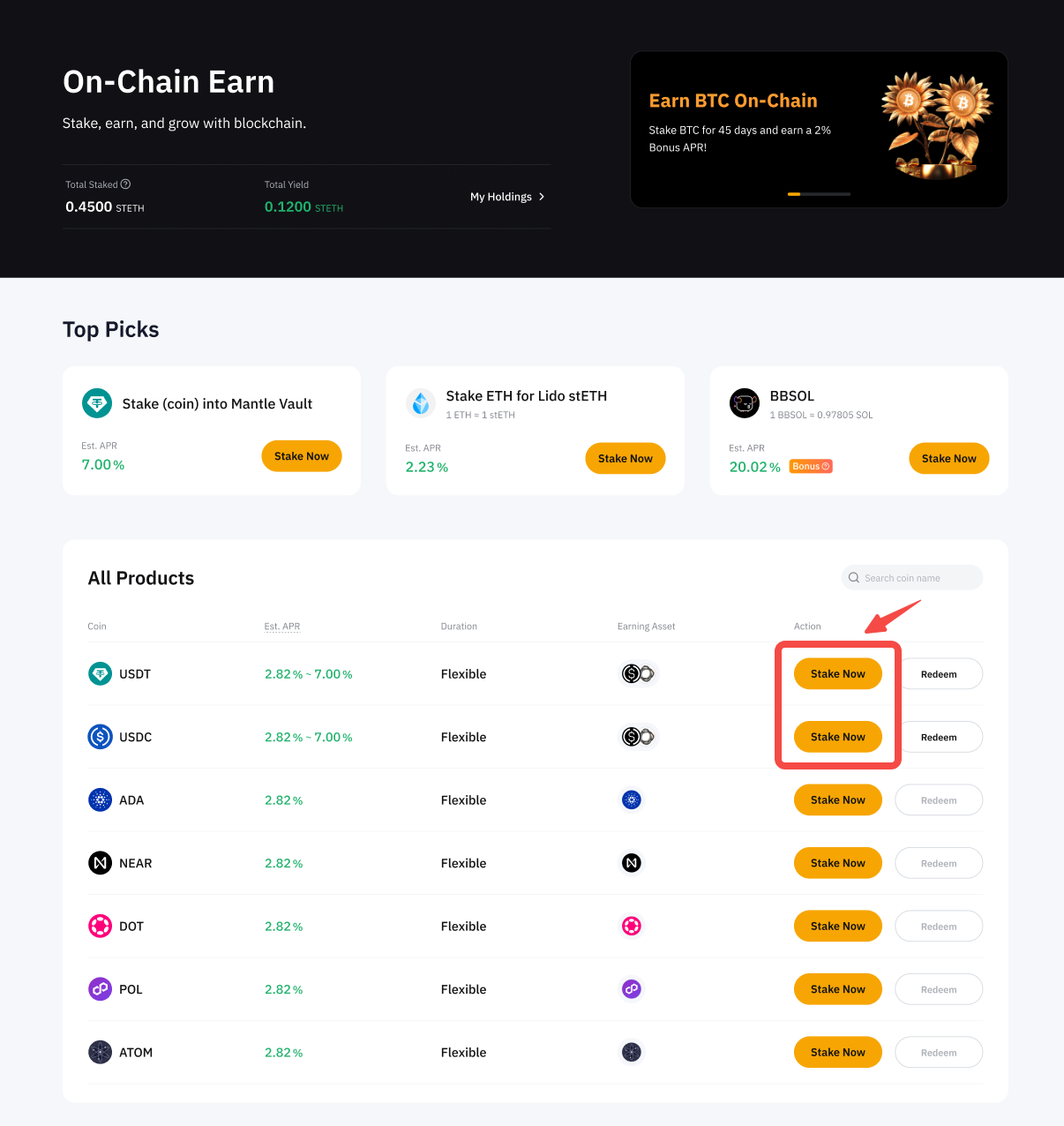

1. Navigate to the Bybit homepage, locate the Earn tab in the navigation bar and select On-Chain Earn.

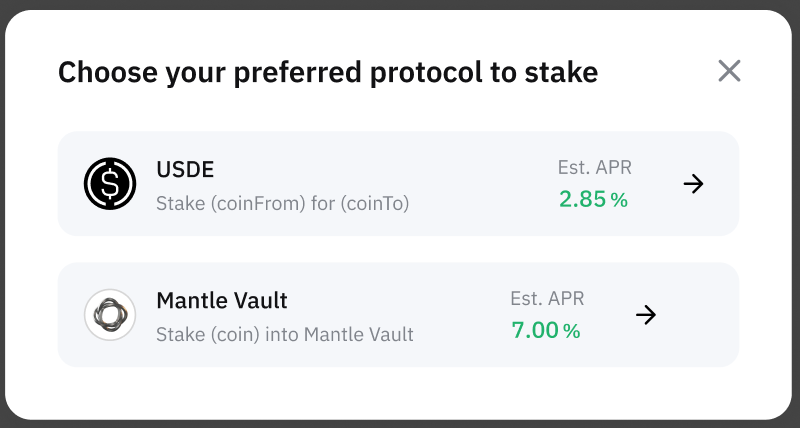

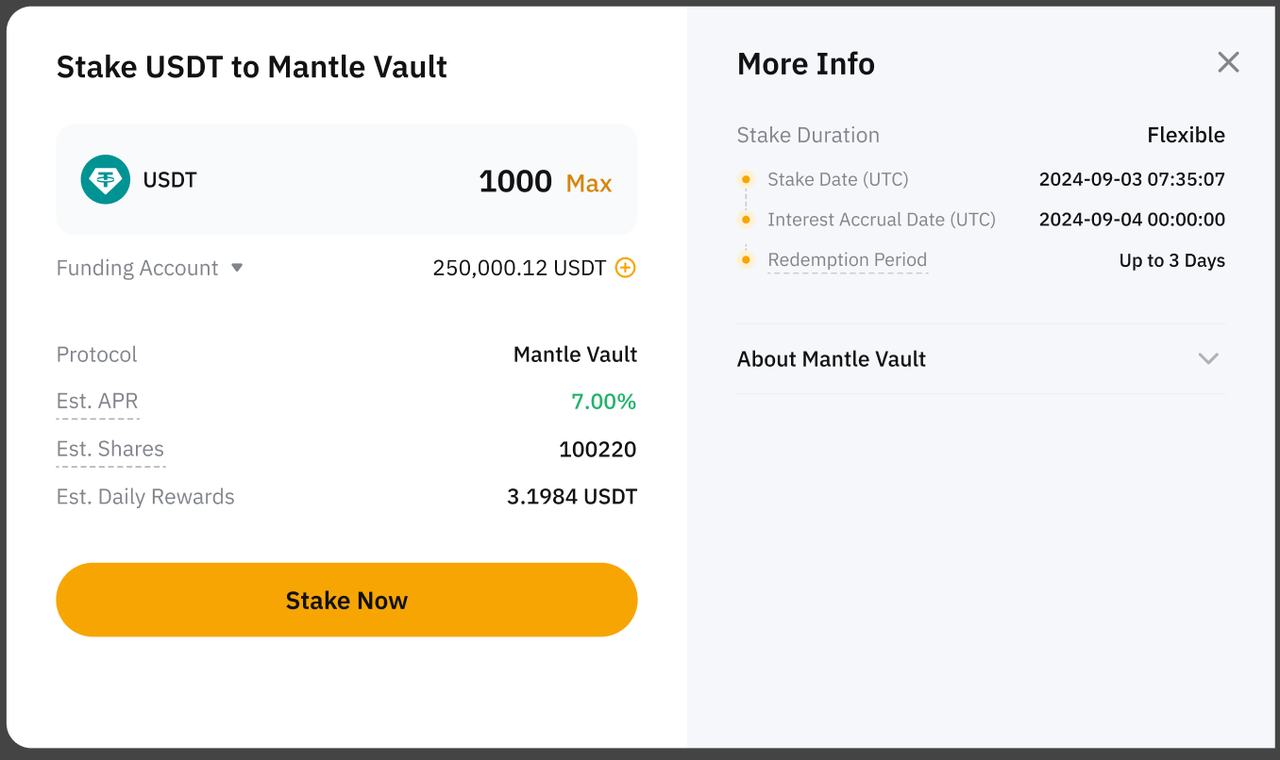

2. Look for the eligible assets, specifically USDT or USDC. Locate the Stake Now button and select Mantle Vault from the available product options.

3. Enter your desired subscription amount on the staking page. Review the terms, and confirm the transaction by clicking on Stake Now.

4. Once the transaction is confirmed, your funds are deployed and you’ll begin earning the targeted 7–12% APR.

Who is Mantle Vault suitable for?

Mantle Vault is designed with multiple crypto audiences in mind. It’s suitable for stablecoin holders who want passive income that exceeds standard savings rates, but don’t want to risk their principal. It also appeals to users who are comfortable with the concept of on-chain products and prefer a hands-off approach to DeFi.

Conversely, it’s not suitable for users who require instant liquidity. In addition, day traders or those who may need funds immediately for margin calls should avoid locking funds in Mantle Vault, as the redemption period typically takes two to three days.

Maximizing stablecoin APRs with Mantle Vault

Mantle Vault represents a significant step forward in making advanced DeFi strategies accessible to the average investor. By offering access to institutional-grade, delta-neutral strategies via a simple interface, Bybit allows users to maximize their stablecoin growth without the headache of manual execution.

Balancing security through principal protection mechanisms with a target yield of 7% to 12%, Mantle Vault bridges the gap between low-yield savings and high-risk trading.

Looking to optimize your crypto portfolio? Visit Bybit On-Chain Earn today and stake with Mantle Vault to start earning!

#LearnWithBybit