How to trade gold and silver on Bybit

Gold and silver have been among the most popular assets traded on financial markets for as long as modern finance has existed. The two precious metals offer some shared benefits, but they also possess their own distinct characteristics that necessitate different strategies.

Commonly, when financial markets are gripped by fear, gold comes to the forefront of investors' consideration lists as the ultimate safe-haven asset. On the other hand, some growth-focused scenarios favor silver.

Bybit offers you three primary routes to trade gold and silver: the Derivatives and Spot markets as well as the TradFi platform. In this article, we'll review why traders choose gold and silver, and provide step-by-step instructions on how to trade these assets on Bybit.

Key Takeaways:

Gold and silver are precious metal commodities that are among the most popular assets traded on financial markets.

Gold is often used for hedging against bear markets or market uncertainty, while silver attracts traders looking to speculate on its growth potential.

Bybit's Derivatives and Spot markets, as well as its TradFi platform, offer opportunities for trading gold, while silver can be traded on TradFi.

Why traders choose gold and silver

Trading gold and silver is a multi-millennia-old activity, dating back to the ancient civilizations of Mesopotamia and Egypt. In modern financial markets, these two precious metals remain among the most popular assets.

Traders and long-term investors choose gold as the ultimate safe-haven asset, often during bear markets or times of economic uncertainty. And while silver is also a choice for value protection during stock market declines, it’s more commonly used for growth strategies. Since the price of silver is strongly affected by industrial demand and supply cycles, this metal is popular among traders focused on speculation and shorter-term profit-making.

A popular strategy is to invest in both gold and silver, at proportions tied to the investor's risk tolerance and specific goals. For instance, an investor might allocate 70% of their precious metals holdings to gold for value protection and hedging against market downturns, while retaining 30% in silver for potential upside and speculation.

Ways to trade gold and silver on Bybit

Bybit offers you three primary ways to trade gold:

The Derivatives market, where you can trade perpetual futures for the two highest-capped tokenized gold cryptocurrencies, Tether Gold (XAUt) and PAX Gold (PAXG). Both of these digital tokens track the price of one troy ounce of gold, and are backed 100% by physical gold reserves.

The Spot market, where you can trade XAUt by directly buying and selling it.

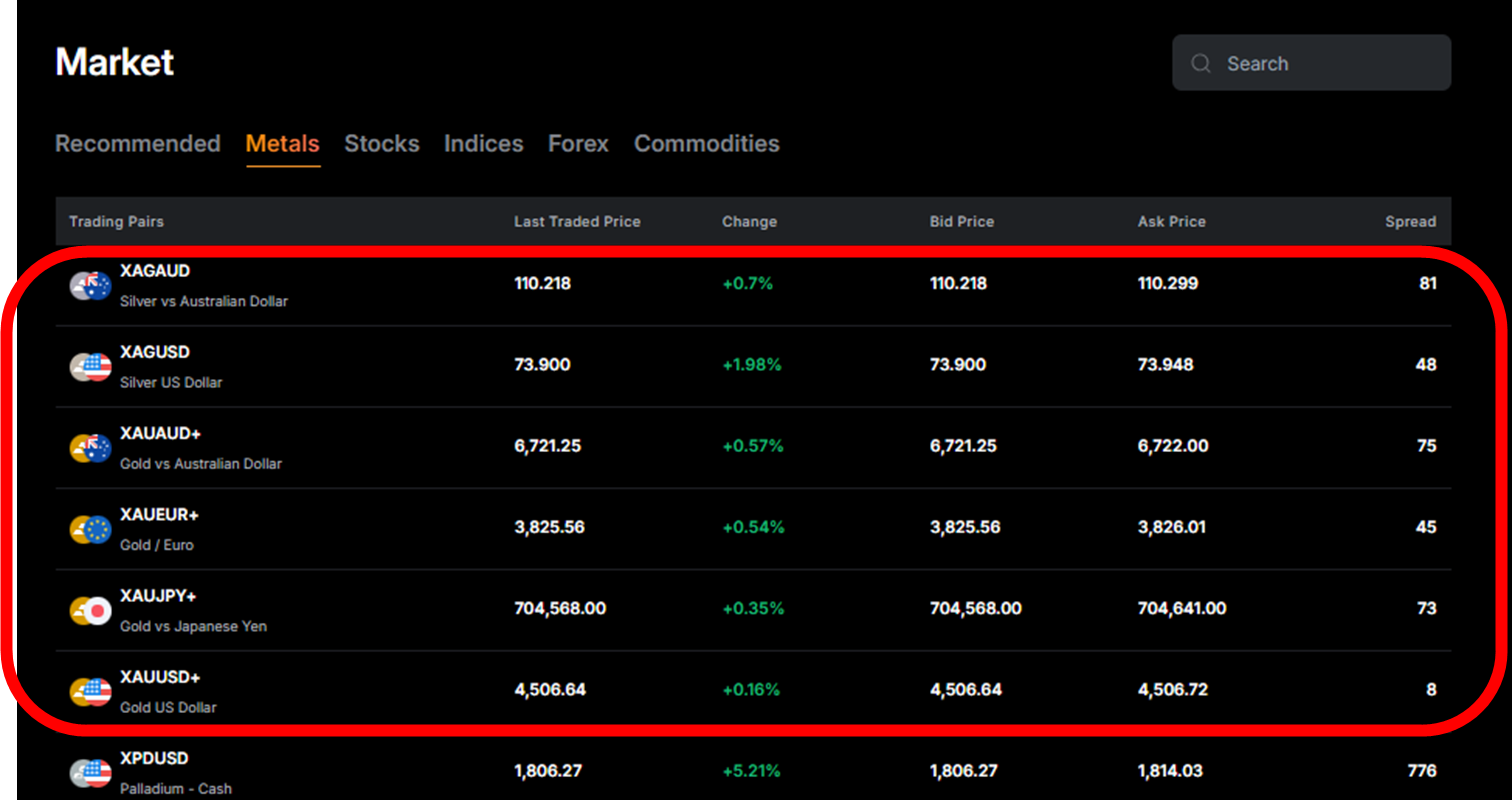

The Bybit TradFi platform, which lets you use your Tether (USDT) funds as collateral to trade a wide variety of traditional assets, including contract for difference (CFD)–based gold pairs tracked via four popular fiat currencies: XAUUSD+, XAUJPY+, XAUEUR+ and XAUAUD+.

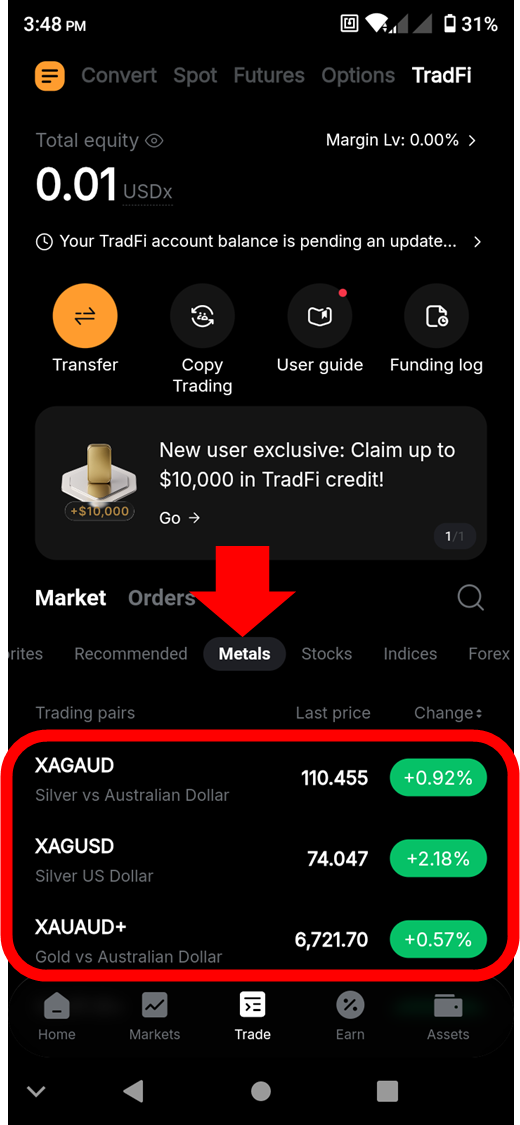

Silver trading on Bybit is available via two TradFi CFD-based silver pairs: the US dollar–based XAGUSD and the Australian dollar–based XAGAUD.

How to trade gold and silver on Bybit (step-by-step)

Derivatives (on desktop)

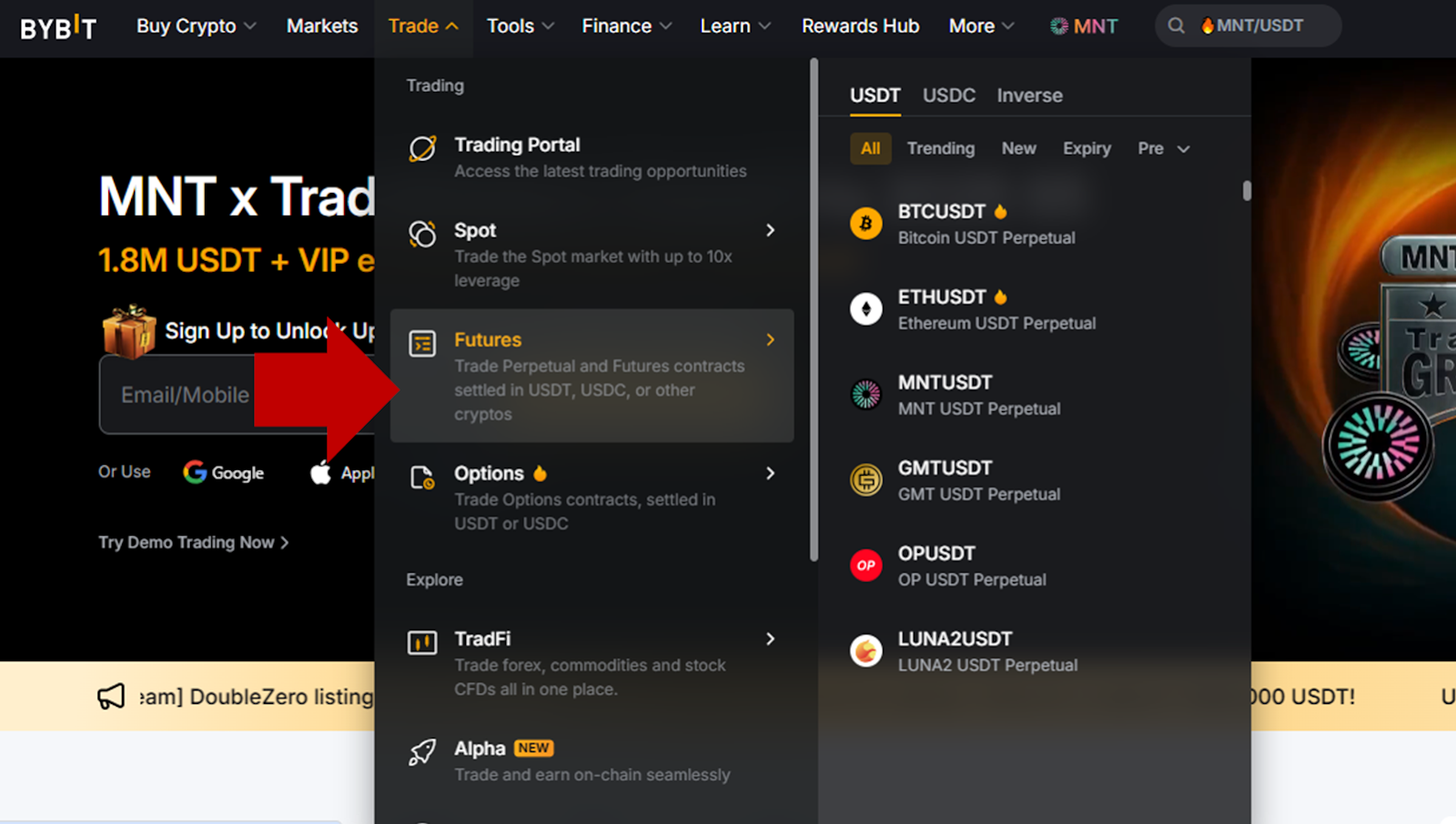

Step 1: Visit Bybit’s homepage, log in to your account, hover over Trade in the top menu and then click on Futures.

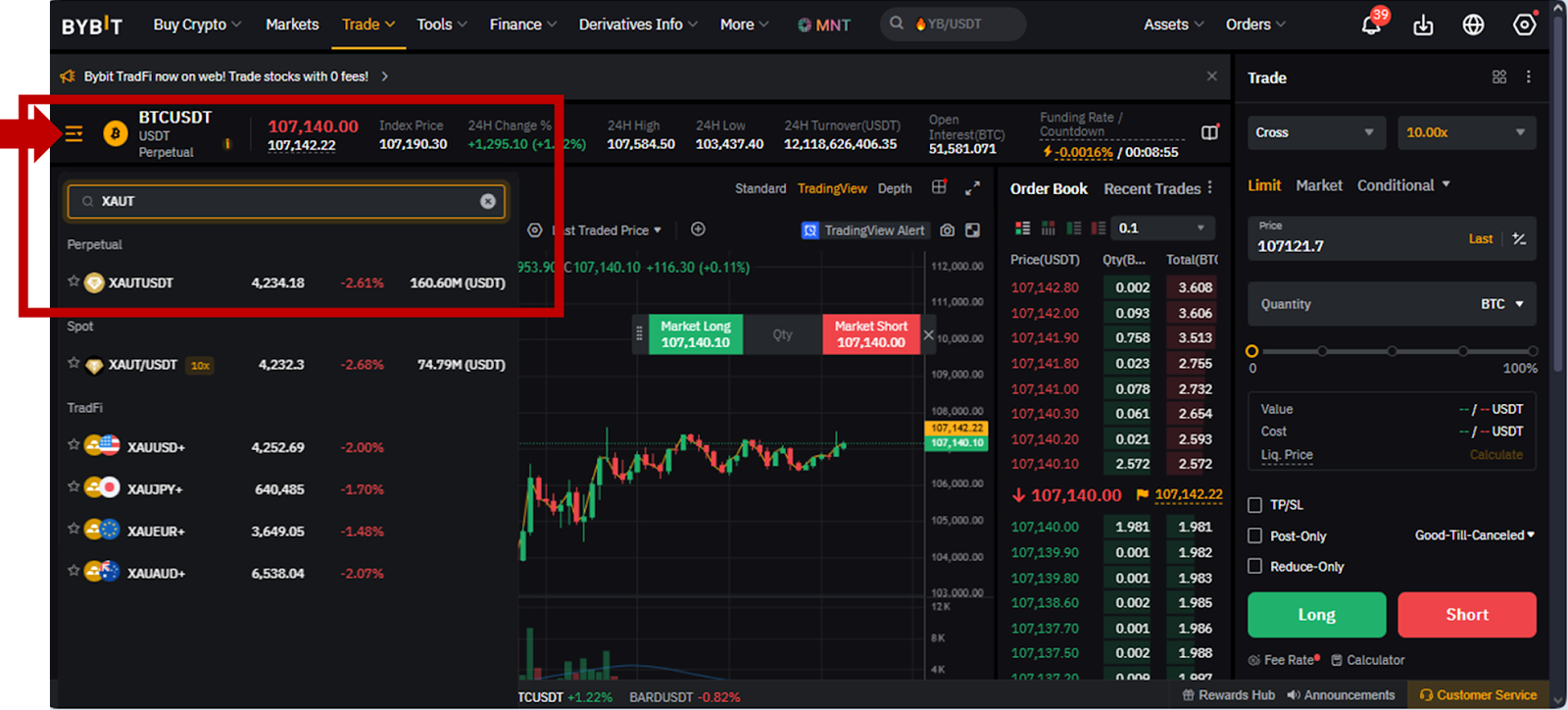

Step 2: On the Derivatives trading page, hover over the menu button in the top left, just to the left of the contract name (usually BTCUSDT by default). Then, in the search box that appears, type the name of the gold-backed coin you'd like to trade — i.e., XAUt or PAXG. A list of all products for the coin will appear. Click on the XAUTUSDT or PAXGUSDT perpetual contract.

Step 3: In the right-side panel of the trading page, specify your order details: Order Type (Limit, Market or Conditional) and Quantity (for Market orders) as a minimum. Experienced derivatives traders may also want to specify additional settings, such as the preferred leverage ratio or price points for take-profit/stop-loss (TP/SL) orders. When you’re ready to open your contract, tap on Long or Short to select your desired position.

Derivatives (on Bybit App)

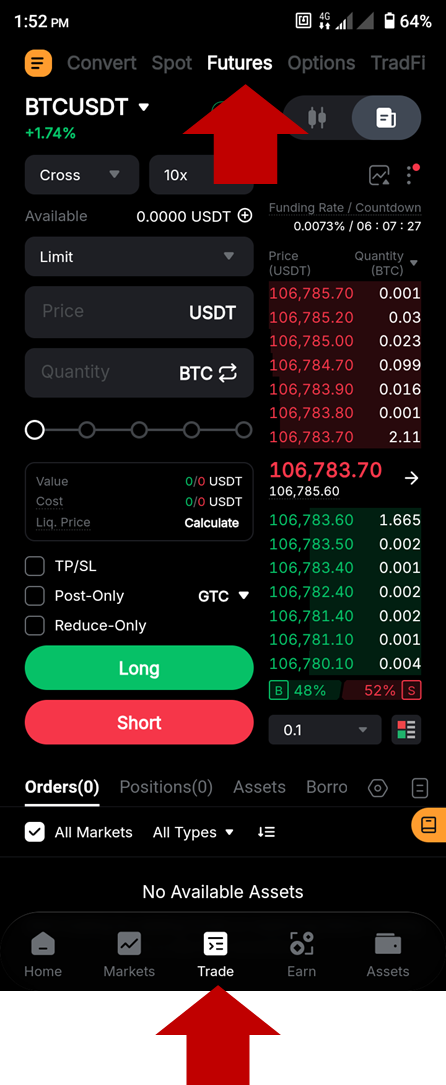

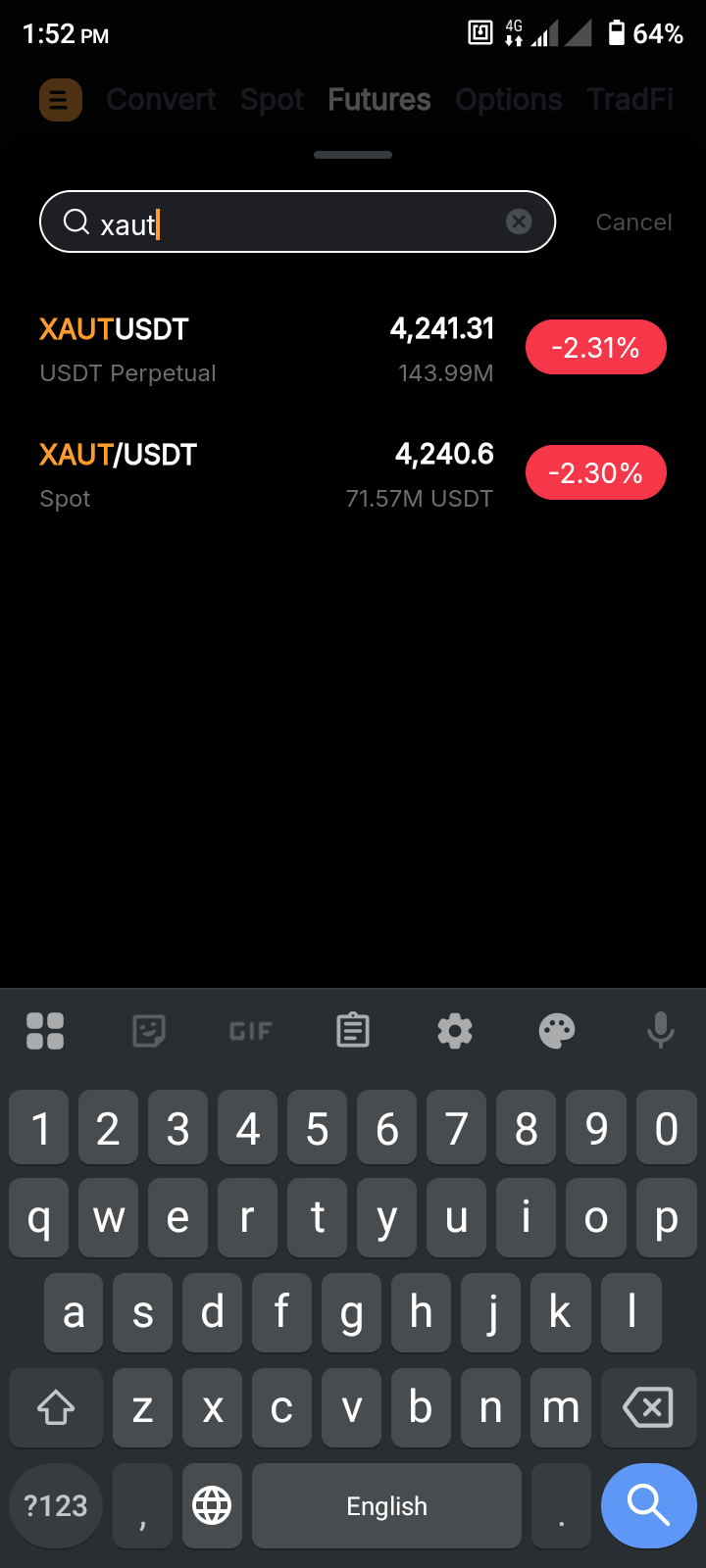

Step 1: Open the Bybit App and tap on Trade in the bottom menu, then Futures in the top menu.

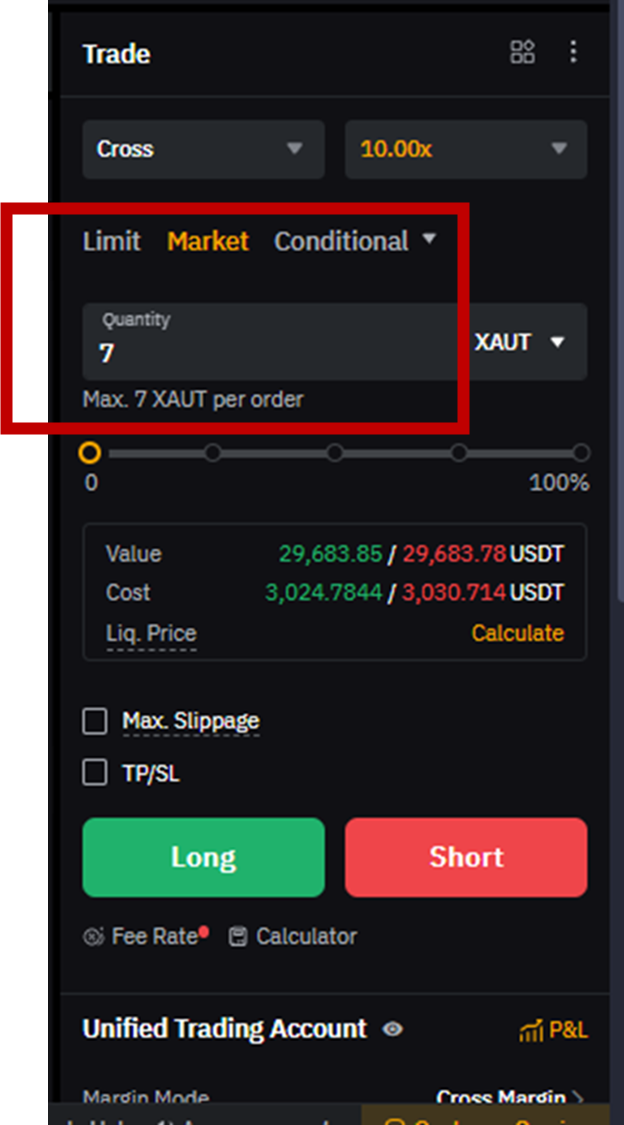

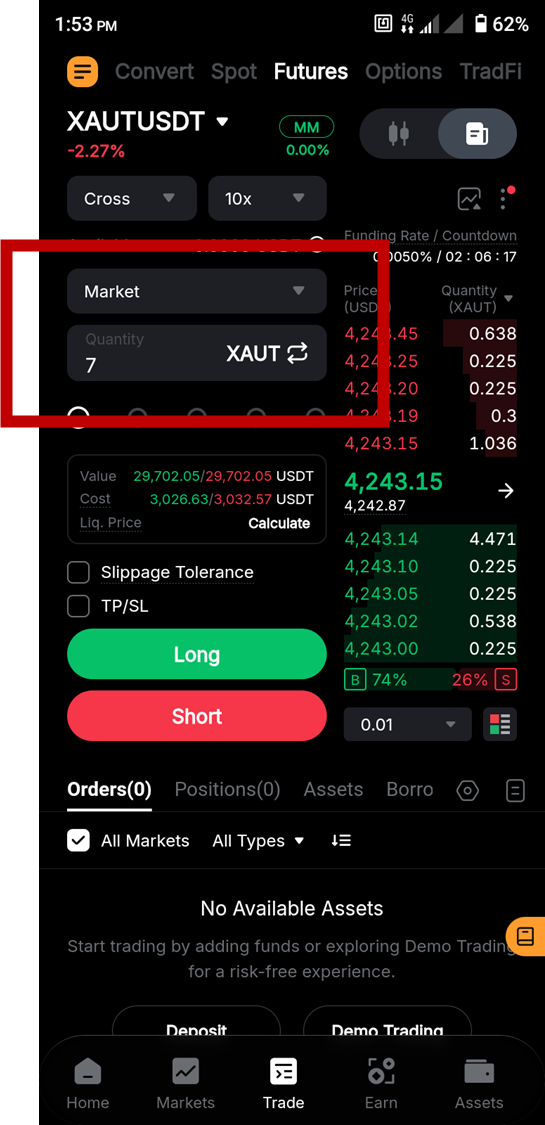

Step 2: In the futures trading screen, first tap on the contract name on the top left side (usually BTCUSDT by default). This will bring up a search box where you can type the name of the coin (i.e., XAUt or PAXG). You’ll see a list of all available products for the coin as you type it. Tap on the required perpetual contract, XAUTUSDT or PAXGUSDT.

Step 3: In the trading screen for the contract, specify the order details: Order Type (Limit, Market or Conditional) and Quantity (for Market orders) as a minimum. Experienced derivatives traders may also want to specify additional settings, such as the preferred leverage ratio or price points for take-profit/stop-loss (TP/SL) orders. When you’re ready to open your contract, tap on Long or Short to long or short, respectively.

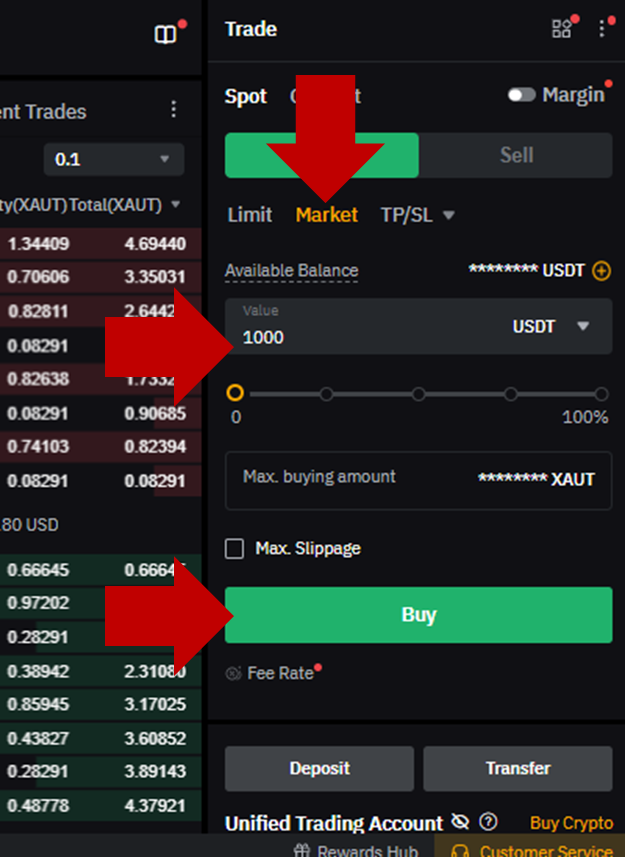

Spot (on desktop)

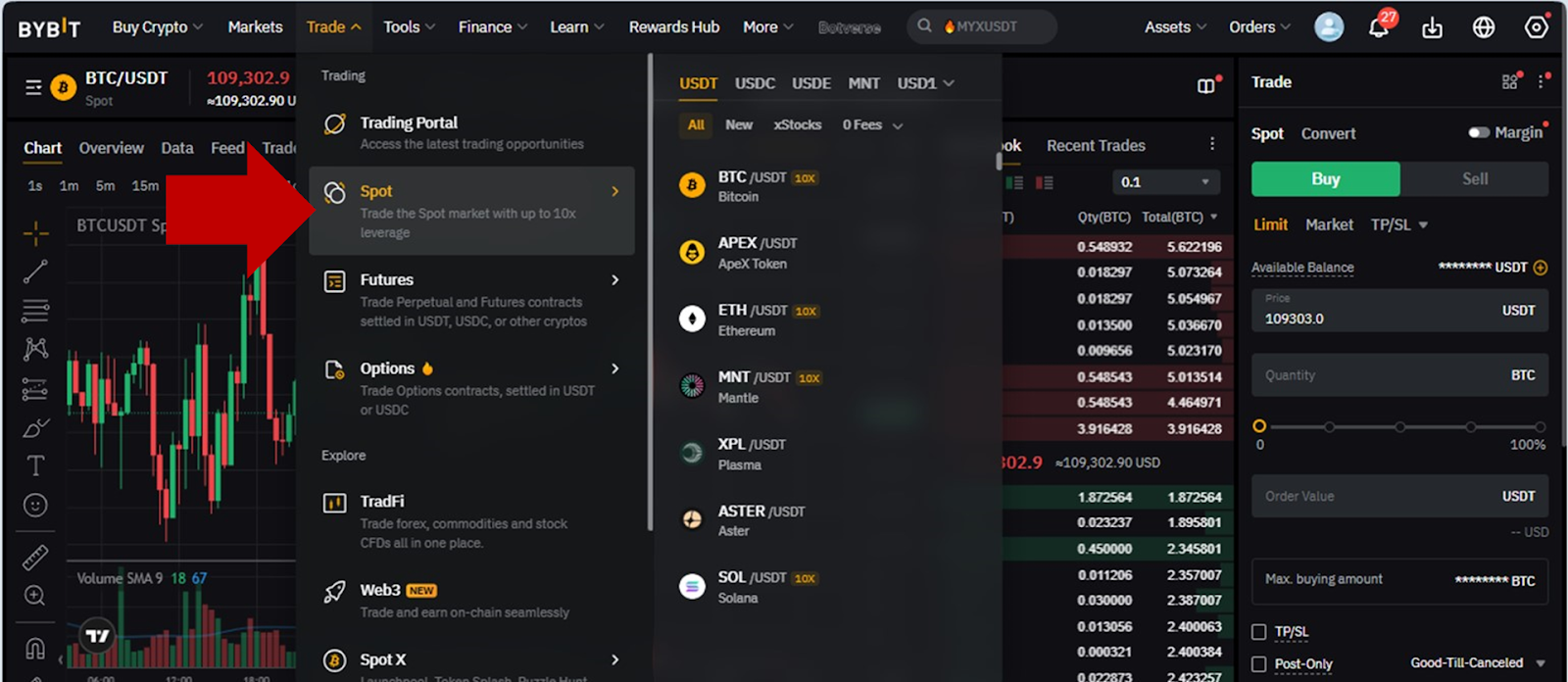

Step 1: Visit Bybit's homepage, log in to your account, hover over Trade in the top menu and select Spot.

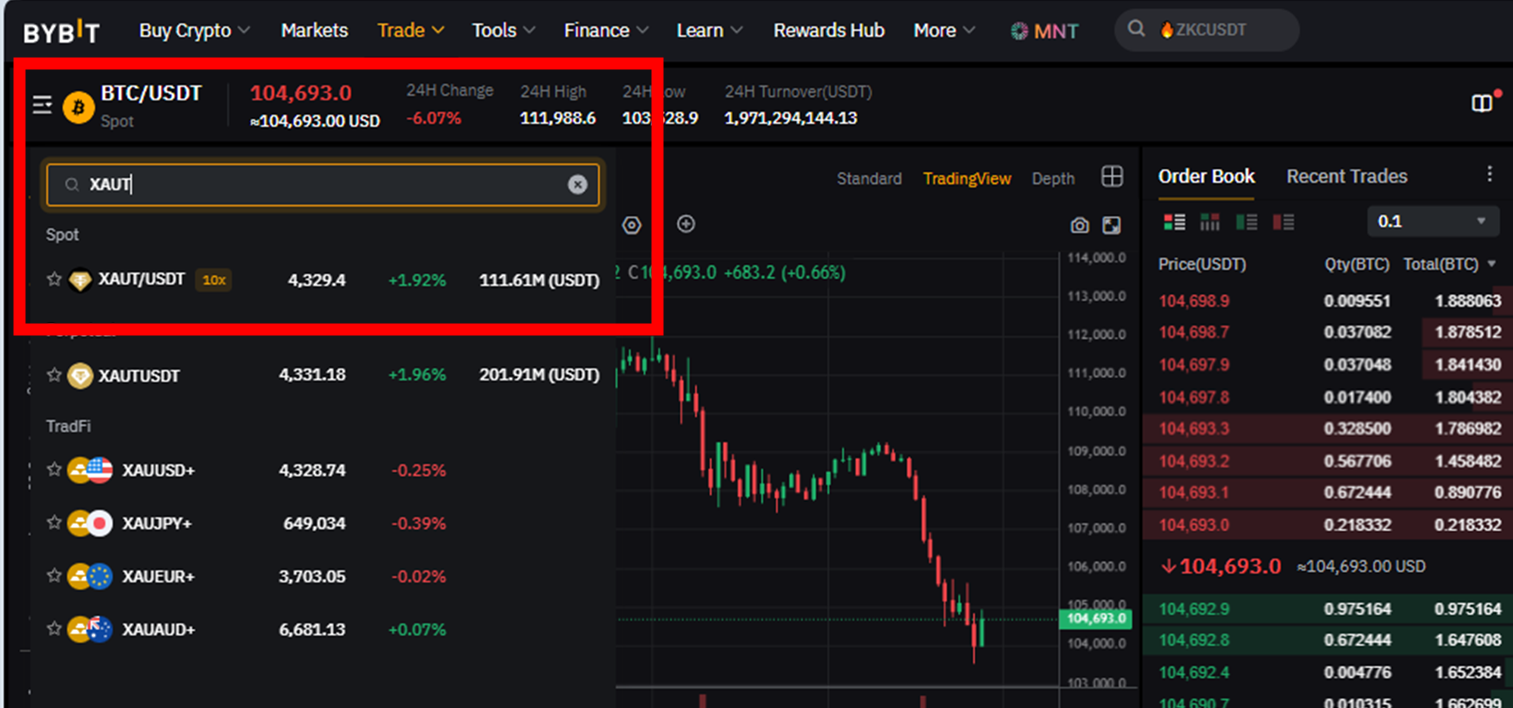

Step 2: Click on or hover over the menu icon in the upper-left corner of the interface (next to the name of the trading pair). You’ll see a drop-down list showing all available trading pairs. Type XAUT in the search box to bring up all products with the coin, and click on the XAUT/USDT Spot trading pair.

Step 3: In the order details panel on the right, select Buy or Sell at the top, select Market for order type, and specify the Amount in USDT. Experienced traders might explore additional options, such as more advanced order types. Click on the Buy or Sell button at the bottom to execute your trade.

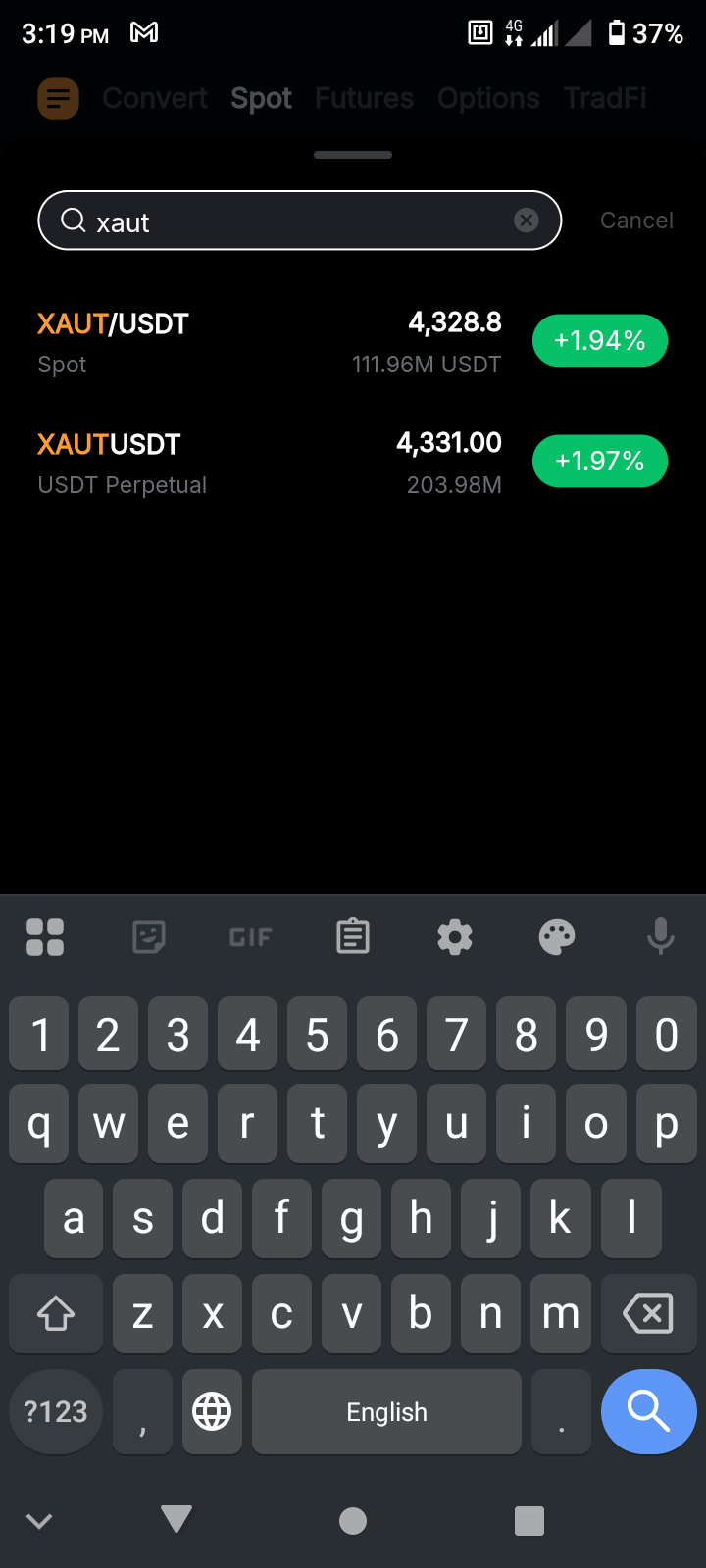

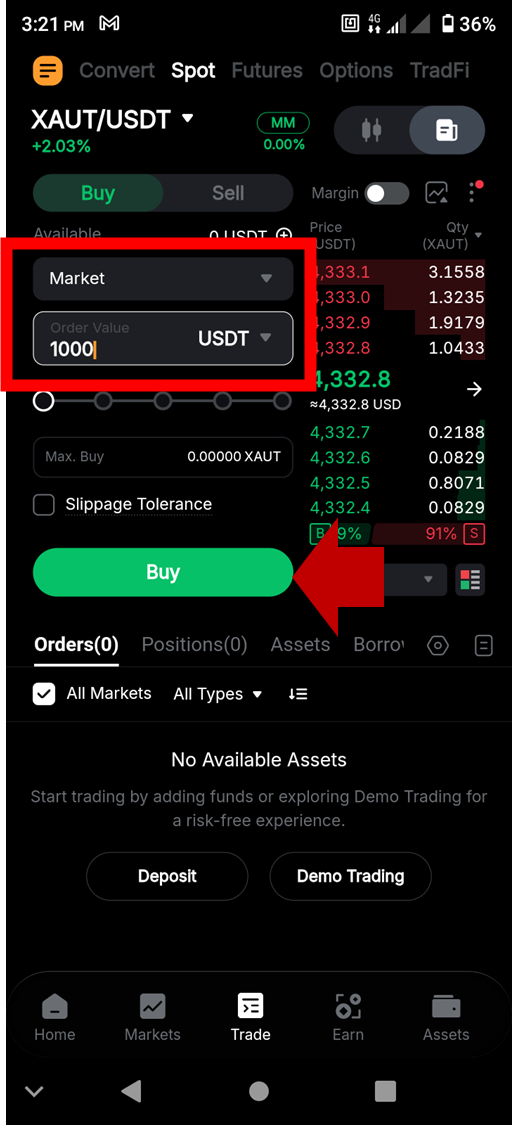

Spot (on Bybit App)

Step 1: Open the Bybit App and tap on Trade in the bottom menu, then Spot in the top menu.

Step 2: Tap on the trading pair shown in the top-left corner (usually BTC/USDT by default). In the search box that appears, type XAUT and then tap on the XAUT/USDT Spot pair.

Step 3: Select Market as the order type, enter the Amount to buy/sell and then tap on the Buy or Sell button. Experienced traders might also prefer to explore more advanced order types.

Step 4: On the final confirmation screen, tap Buy to execute your order.

Bybit TradFi (on desktop)

Step 1: Visit the Bybit TradFi main page, log in to your account, scroll down to the Market section, select the Metals tab and click on your preferred gold or silver trading pair (e.g., XAUUSD+ for gold or XAGUSD for silver).

Step 2: In the trading screen's order panel (on the right), specify your order details (Buy or Sell, Value in USDx (an internal TradFi display unit that maintains a 1:1 ratio with USDT) or Quantity in lots). Then, click on the Buy or Sell button to place your order.

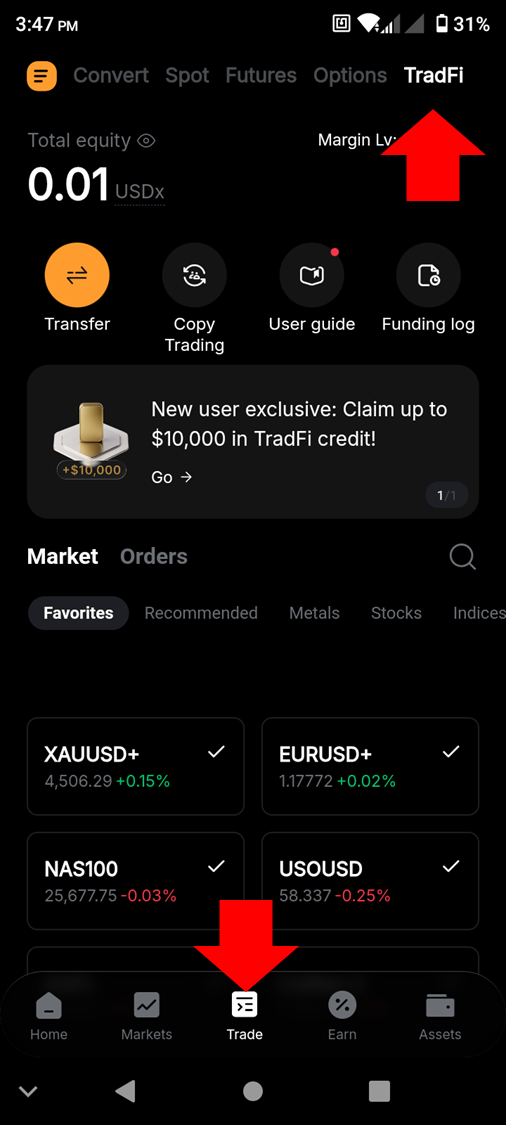

Bybit TradFi (on Bybit App)

Step 1: Open the Bybit App and tap on Trade in the bottom menu, then TradFi in the top menu.

Step 2: In the TradFi screen's Market section at the bottom, tap on the Metals tab, and then select your preferred gold or silver pair.

Step 3: In the selected pair's trading screen, tap on the Buy or Sell button at the bottom.

Step 4: Specify the Order value in USDx or Quantity in lots, and tap the Buy or Sell button at the bottom of the screen to place your order.

How gold and silver prices move

While these two metals may often move in the same direction, there are clear differences in their behavior. Gold prices typically experience uptrends or sideways moves when growth-focused assets are declining. On the other hand, silver commonly rises and falls in line with industrial demand and supply cycles.

Popular gold and silver trading strategies

Among the popular gold strategies are trend-following, dollar inverse trade and safe-haven investing to protect value. Some popular silver trading strategies are gold-silver ratio trading and industrial demand–based speculation.

Gold vs silver: Which one should you trade?

Gold is most suitable for risk-averse, conservative traders focused on value preservation, while silver holds more potential for short-term- and medium-term-focused growth speculators.

Risk management when trading gold and silver

Valuable risk management strategies when trading these two precious metals include:

Mixing gold and silver in the same portfolio for hedging and diversification

Careful position sizing

Placing stop-loss orders to limit losses in case of adverse market developments

Hedging with derivatives

Being conservative with leverage ratios

Conducting careful fundamental and technical analyses of the underlying market before making your trading moves

Closing thoughts

The precious metals market presents unique opportunities for both growth-focused and conservative traders. With Bybit, you can trade gold and silver through its Derivatives and Spot markets and via its TradFi platform. For both beginning and experienced metal commodity traders, these options offer unparalleled flexibility, versatility and accessibility.

#LearnWithBybit