How to trade gold on Spot (XAUT) with Bybit

For centuries, gold has been valued as the ultimate store of value. In modern markets, the precious metal has also firmly established itself as an excellent hedge against volatility and inflation. It’s virtually an axiom that you cannot go wrong by investing in gold in times of market turbulence.

For traders who appreciate gold’s numerous benefits, Bybit offers a straightforward way to invest in the yellow metal via the gold-backed Tether Gold (XAUT) crypto. Available on Bybit’s Spot market as a swap pair with Tether (USDT), XAUT offers you a unique combination of the stability of a physical asset and the flexibility of crypto trading.

Key Takeaways:

You can flexibly buy and sell gold on Bybit via Spot trades of XAUT, the world’s highest-capped tokenized gold cryptocurrency.

Each XAUT coin tracks the price of one troy ounce of gold and is fully backed by physical gold reserves held in Swiss vaults.

What is Spot gold trading?

Tether Gold (XAUT) is the world’s leading gold-backed cryptocurrency by market capitalization. Launched in 2020 by Tether Limited Inc., the company behind the USDT stablecoin, XAUT is fully backed by physical gold reserves held in vaults in Switzerland. Each XAUT coin is backed by a troy ounce of gold, which tracks the precious metal's price.

You can trade XAUT on Bybit’s Spot market as a swap pair with USDT. Spot trading means that you can buy and sell XAUT coins directly rather than through derivatives contracts that track the asset without providing its actual ownership.

The XAUT/USDT pair also offers Spot margin trading opportunities; you can borrow up to 10x of your principal amount to amplify any gains. Naturally, the leverage used may also work against you and magnify your losses. Thus, only users with solid experience in leverage trading should use XAUT margin trades.

XAUT Spot trading is ideal for investors seeking direct exposure to gold prices without buying the physical metal. Trading XAUT via the Spot market also provides convenience, flexibility and 24/7 access.

Key market drivers for gold

Before investing in XAUT, it's crucial to understand the key market drivers for gold. Numerous factors may strongly affect the metal commodity's price. One key factor influencing the price of gold is inflation. As inflation rates increase, the worries about fiat currencies losing their value intensify, and investors move towards gold as a time-tested inflation hedge.

Another key factor is interest rates; if they increase, it may signal to investors that the economy is doing well and opportunities in asset classes other than gold are favorable. Due to this, gold often underperforms when interest rates initially rise. However, later on, if the rise in interest rates leads to higher inflation, gold may rebound strongly.

Other factors, such as US dollar rates, geopolitical uncertainty and global supply and demand, may also impact the gold price. For instance, if central banks in large economies start to buy up gold in significant quantities, this can lead to increases in the price of the precious metal.

How to Spot trade XAUT on Bybit

On desktop

To trade XAUT on Bybit’s Spot market:

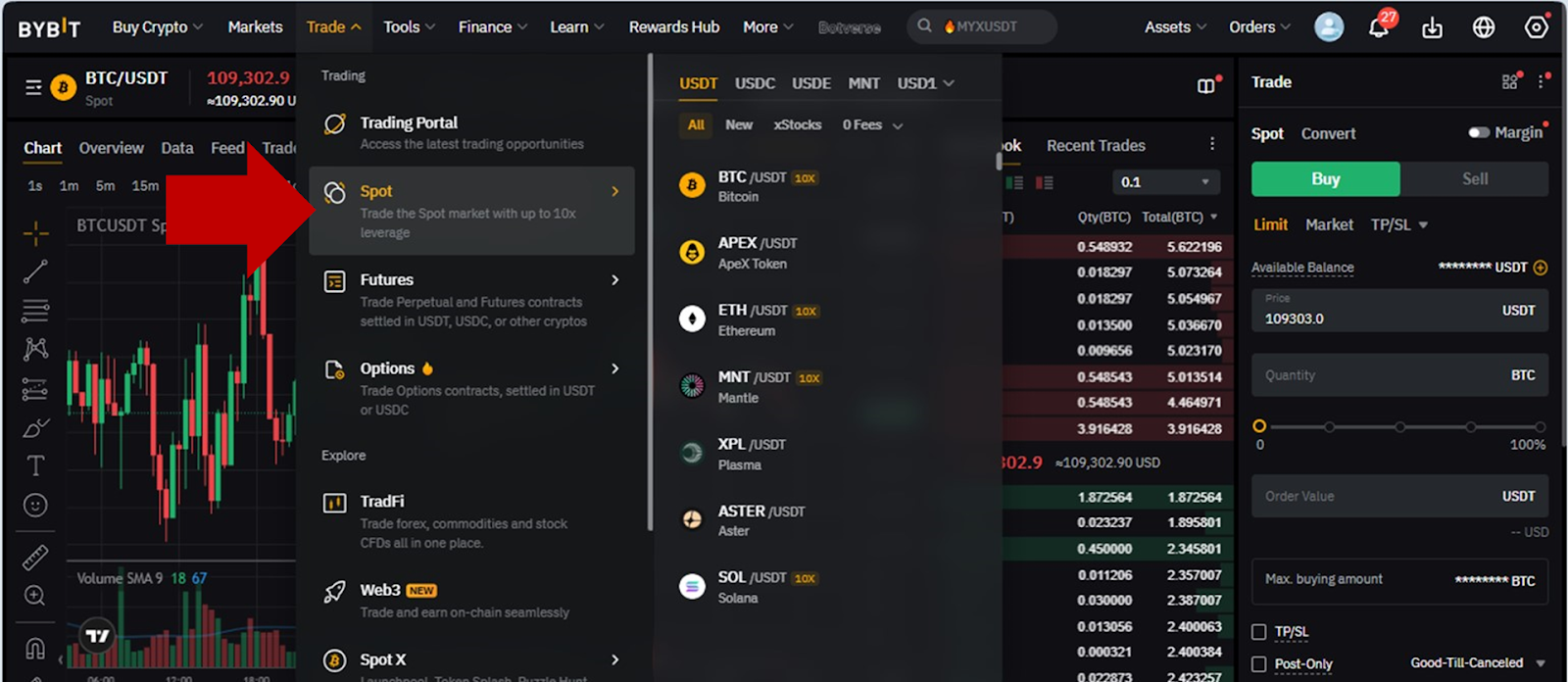

Step 1: On the main trading page, hover over Trade in the top menu and select Spot.

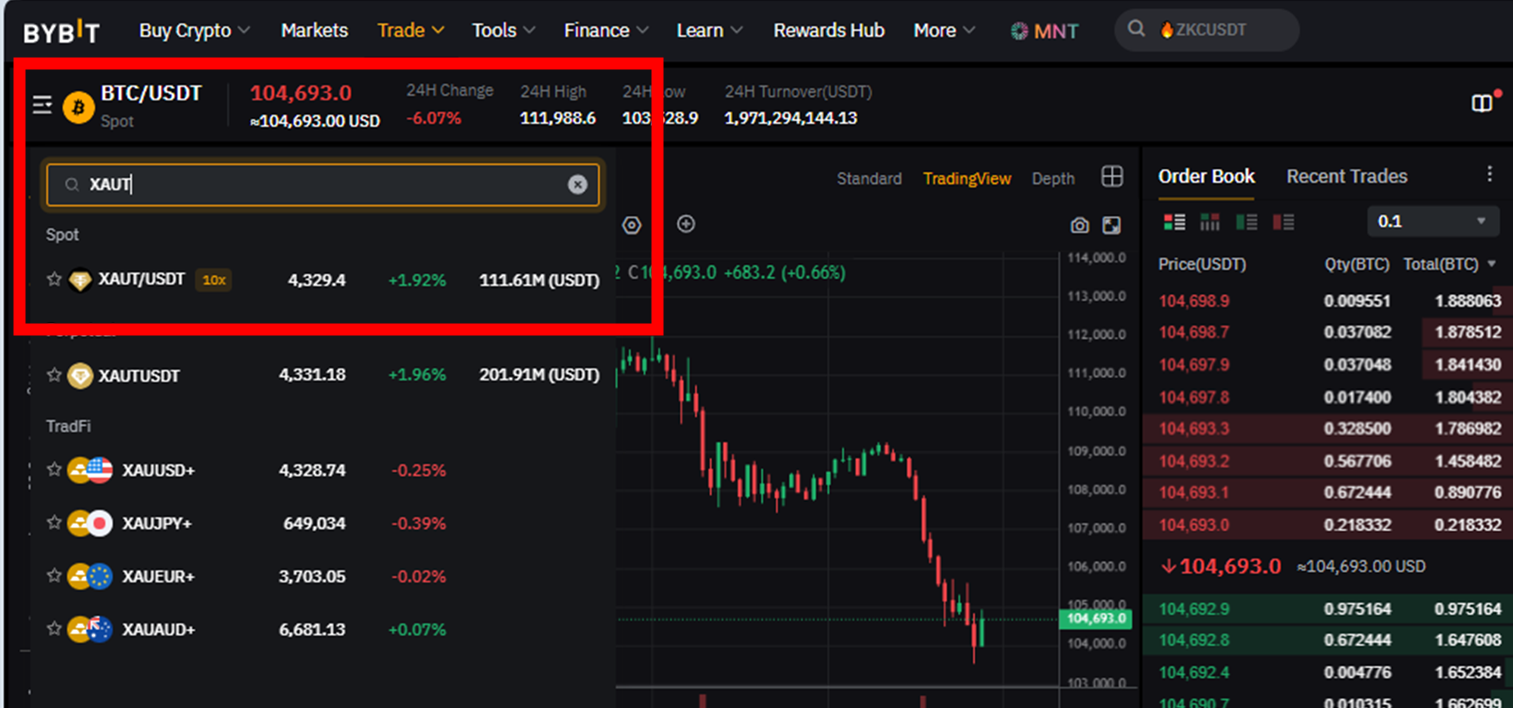

Step 2: Click on or hover over the menu icon in the upper left corner of the interface (next to the name of the trading pair). You will see a drop-down list showing all available trading pairs. Type XAUT in the search box to bring up all products with the coin and click on the XAUT/USDT Spot trading pair.

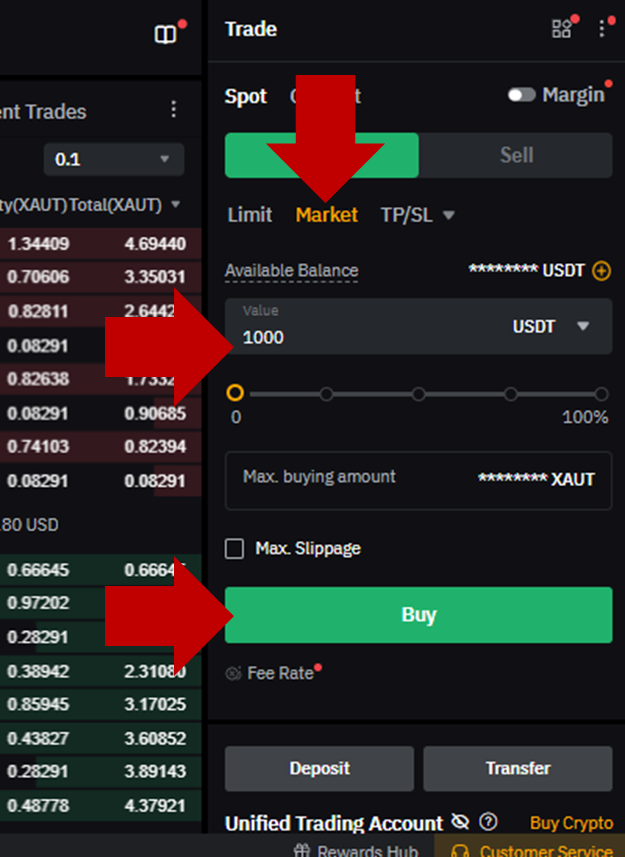

Step 3: In the order details panel on the right, select Market for order type and the Amount in USDT. Click Buy to execute your trade.

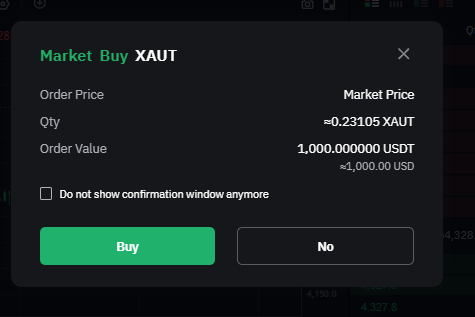

Step 4: Click Buy to place the trade in the final confirmation screen.

If you need to sell your XAUT, follow the same steps, using the red Sell button instead of Buy.

On the Bybit App mobile application

Step 1: Open Bybit App on your device, tap on Trade in the bottom menu and then tap on Spot in the top menu.

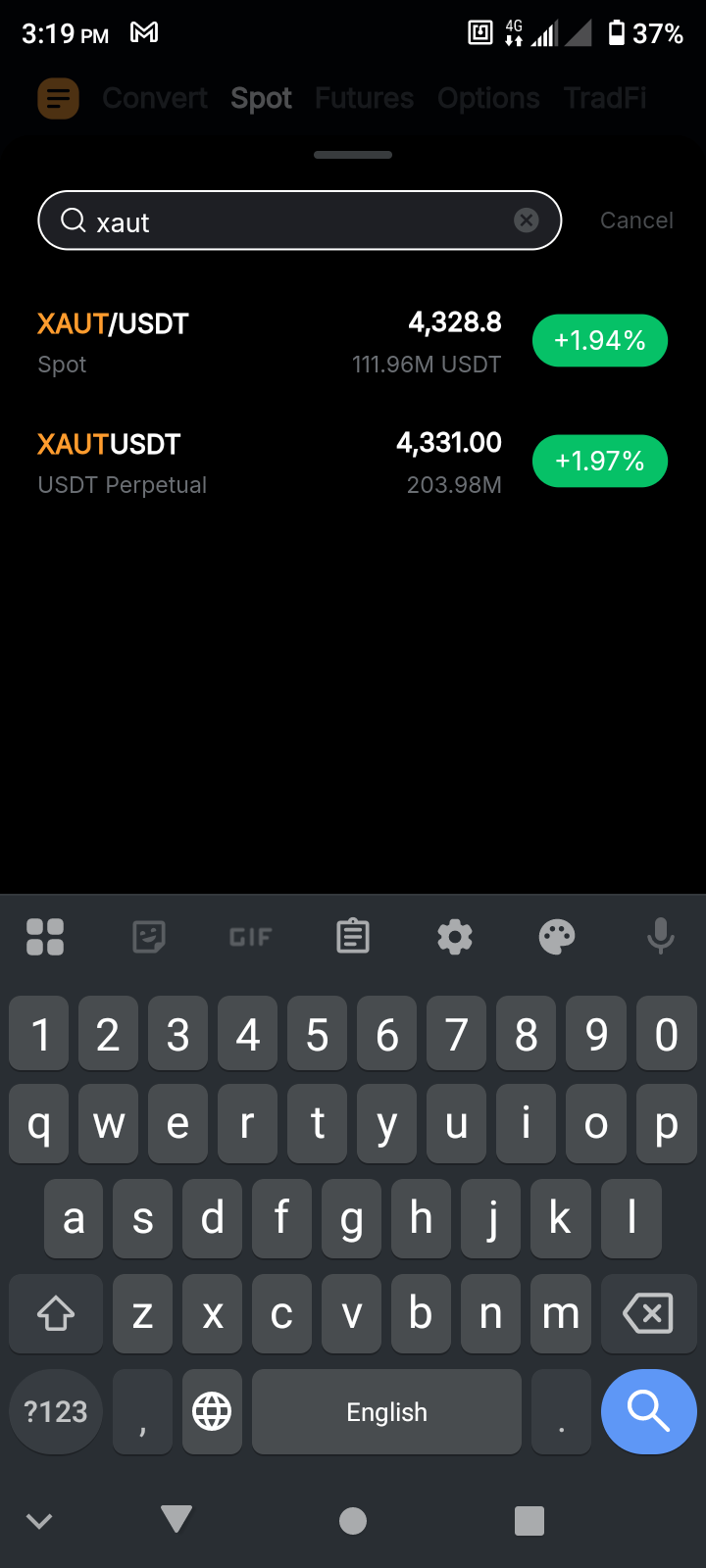

Step 2: Tap on the trading pair shown in the top left corner (usually BTC/USDT by default). In the search box that will appear, type XAUT and then tap on the XAUT/USDT Spot pair.

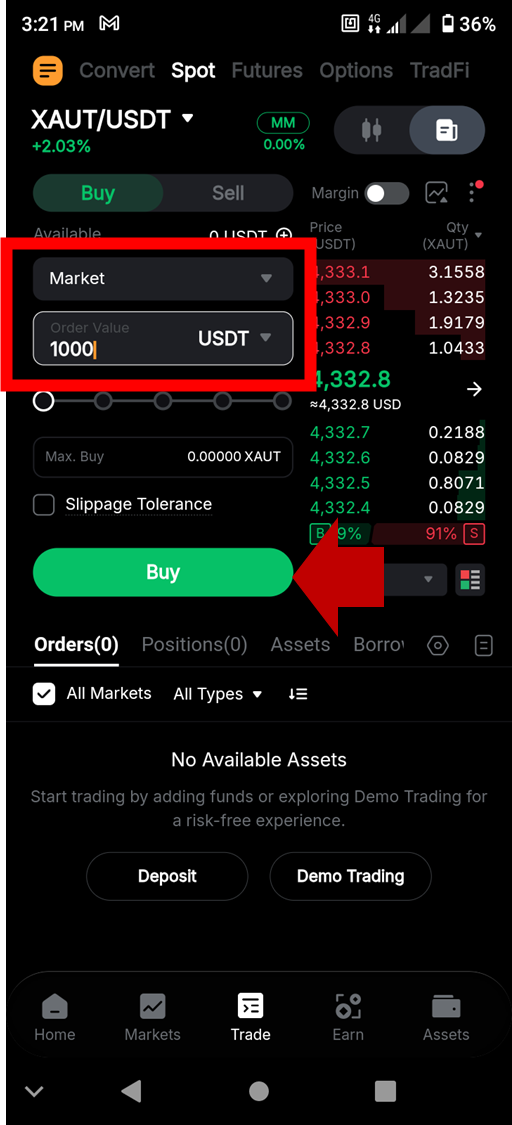

Step 3: Choose Market as the order type, enter the Amount to buy and then tap on the green Buy button.

Step 4: On the final confirmation screen, tap Buy XAUT to execute your order.

If you decide to sell your XAUT, follow the same steps, using the red Sell button instead of Buy.

The examples above are based on the most basic order type: market orders. However, you can use limit orders or take-profit/stop-loss (TP/SL) orders if you need more control over your order details. For more information on these more advanced order types, please see this guide.

Benefits of trading gold on Bybit Spot

The key benefits of trading gold on Bybit Spot via the XAUT tokens include:

Direct exposure to gold thanks to the fully gold-backed XAUT tokens.

The flexibility and security of a blockchain-based tokenized gold asset.

Trade 24/7 with USDT, with no fiat required.

Instant execution and high liquidity.

Bybit’s transparent, secure and easy-to-use platform.

Diversification away from reliance on crypto or stocks exclusively.

Closing thoughts

On Bybit’s Spot market, you can easily trade gold through XAUT, a blockchain-based token backed by real gold. Investment in XAUT can provide numerous benefits, including flexibility, security, 24/7 access, high liquidity and portfolio diversification. XAUT’s full backing by physical gold reserves and the nature of Spot market trades ensure that you actually own the underlying asset when you buy it via the XAUT/USDT pair.

Both the desktop and mobile versions of the Bybit platform allow you to quickly place your XAUT trades with just a few clicks or taps, making buying and selling gold a much smoother experience compared to investing in it via traditional commodity markets.

#LearnWithBybit