Trading in volatile markets: Smart strategies for unstable crypto conditions

Volatility is one of the clearest signals in crypto. It often reveals sentiment and liquidity before headlines catch up, especially when whales adjust positions or markets move faster than expected. During these periods, traders tend to react emotionally, but unstable conditions also make it possible for structured strategies to outperform.

In fast-changing markets, instinct alone is insufficient. Traders require data that accurately reflects market sentiment and tools that instill discipline in uncertain environments. Bybit’s product suite supports this approach, helping traders read volatility in real time, hedge sharp swings, earn steady yields or automate execution when emotions get in the way.

This guide demonstrates how to transform volatility into structure, rather than stress, by matching different market phases with the Bybit tools designed explicitly for them.

Key Takeaways:

Volatility creates opportunity when paired with the right strategy.

BVIV and EVIV help traders decide whether to hedge, earn or stay defensive.

Bybit’s trading and yield tools support different volatility phases across the market.

Track market fear with Volmex Indices (BVIV & EVIV)

Reading volatility is one of the most reliable ways to gauge market sentiment before price action changes. Bybit’s Volmex Indices — BVIV for Bitcoin (BTC) and EVIV for Ether (ETH) — serve as the crypto equivalent of the VIX, measuring 30-day forward volatility based on options pricing rather than historical data. They indicate the amount of movement traders anticipate next.

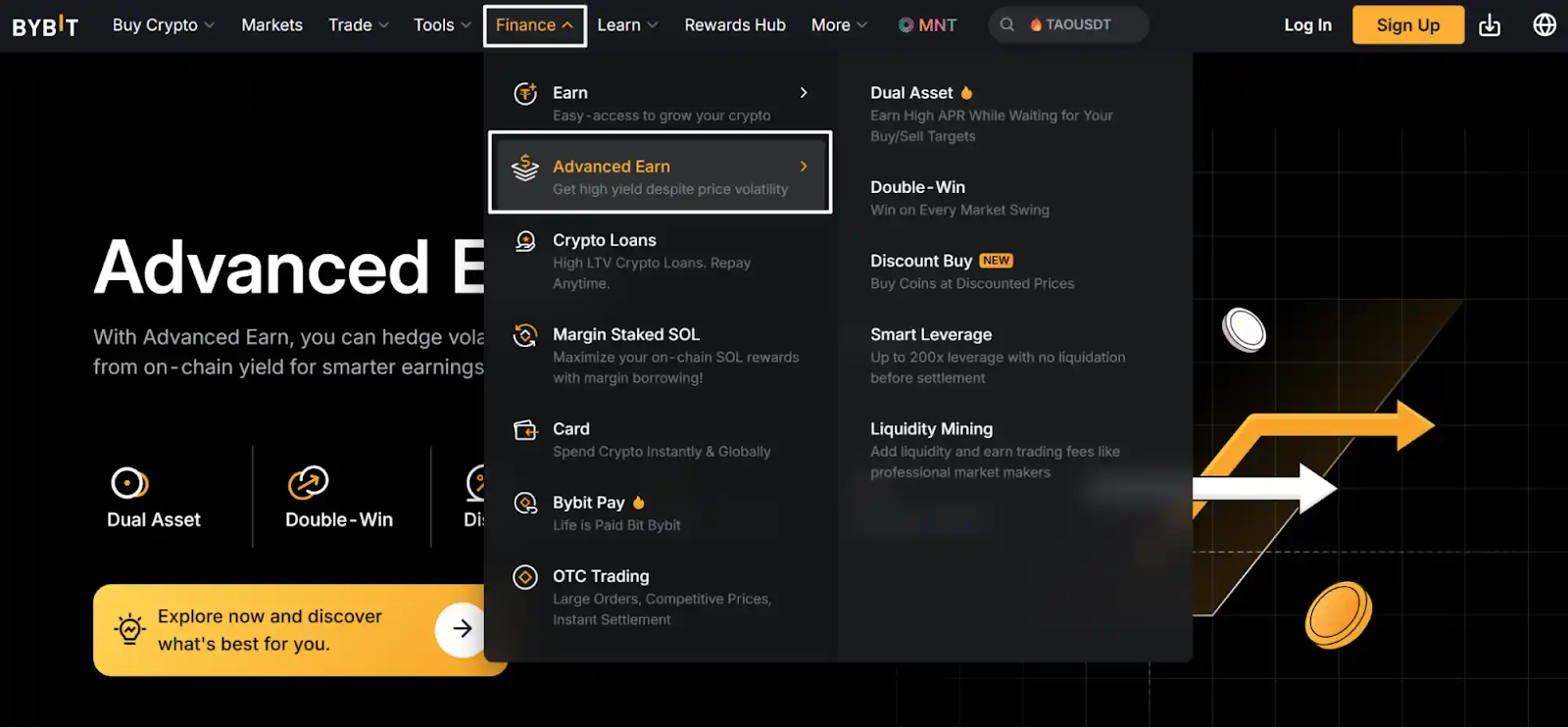

High implied volatility often appears when whales reposition, liquidity thins or uncertainty increases. Low readings signal stability, but can precede major breakouts. Traders can monitor both indices on Advanced Earn, which is updated every minute on both the web and Bybit App:

On the web, they appear under Finance → Advanced Earn with live updates.

On the Bybit app, the widget sits inside the Earn → Advanced Earn section, with one-minute refresh rates.

These readings help match market conditions to the correct strategy:

High BVIV/EVIV → Double-Win, Smart Leverage

Low BVIV/EVIV → Dual Asset, Discount Buy

Aligning products with volatility levels removes guesswork and brings structure to fast-moving markets.

Double-Win: Hedging and earning from both sides

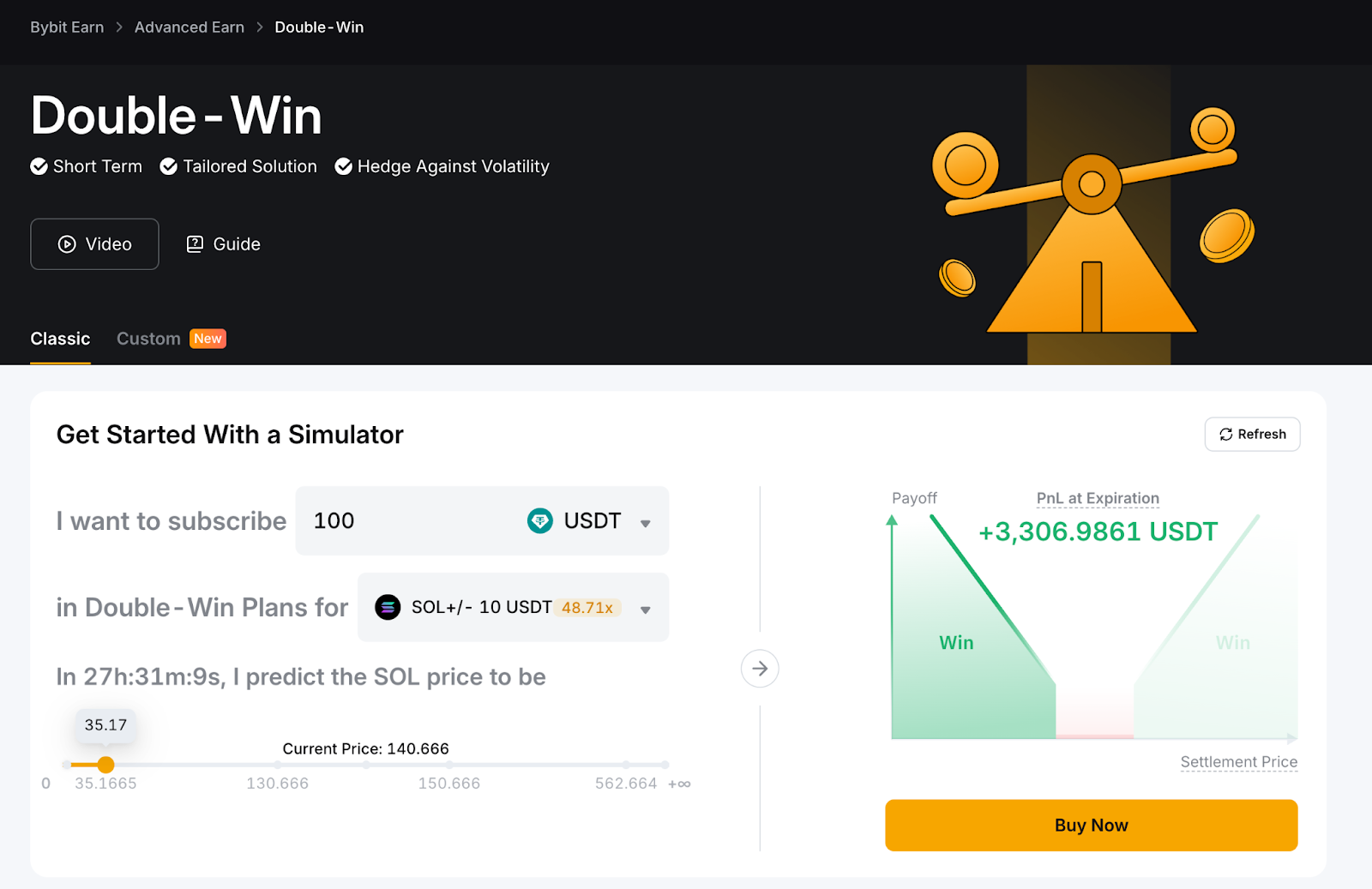

Double-Win is a short-term Advanced Earn product designed for unpredictable, volatile markets that lack clear direction. Instead of choosing a bullish or bearish stance, traders set a price range, and profit if the settlement price finishes outside that range. If it stays inside, the investment is lost.

This makes Double-Win effective in sideways or post-spike ranges, as BTC often consolidates before choosing its next move.

How Double-Win helps

Capture profits from big moves in either direction

Hedge uncertain ranges without choosing a trend

Turn volatility into a defined short-term setup

Double-Win is non–principal-protected, and is best used when movement is expected but direction is unclear.

How to start with Double-Win

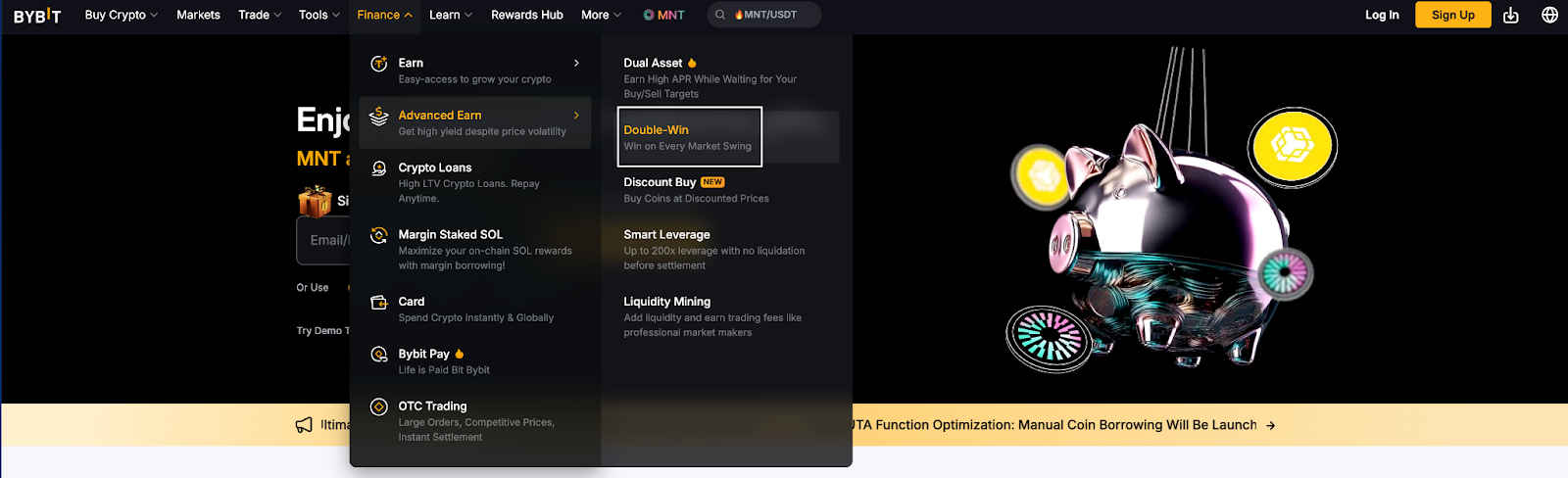

Go to Finance → Earn → Advanced Earn, and select Double-Win.

Pick a plan based on coin, range and expiration.

Use the Simulator to estimate potential outcomes.

Enter your amount, and confirm the subscription.

Smart Leverage: Controlling risk in volatile markets

Smart Leverage is another Advanced Earn product for traders who want directional exposure without facing the sudden liquidation risk common in high-leverage trades. Instead of using a liquidation threshold, Smart Leverage sets a breakeven price. If the settlement price finishes beyond that breakeven level, the plan pays out based on the chosen leverage. If it fails to break that level, the loss is limited to the initial investment amount.

This design makes Smart Leverage useful in volatile environments where sharp wicks often close regular leveraged positions. Traders can take long or short exposure, with leverage up to 200x, while keeping their maximum loss clear and predictable. Early redemption also lets traders lock in gains before expiration when the market moves quickly.

For instance, If a trader buys a long Smart Leverage plan on BTC at a breakeven price of $102,000, and BTC settles at $105,000, the trade pays out because the final price is above breakeven. If BTC settles below $102,000, the trader loses only the amount invested, not the entire leveraged position.

Why traders use it

Helps avoid premature liquidation during volatility

Keeps losses capped at the investment amount

Supports disciplined position sizing and controlled amplification

Smart Leverage provides a structured approach to staying active during fast market swings, without turning each move into a gamble.

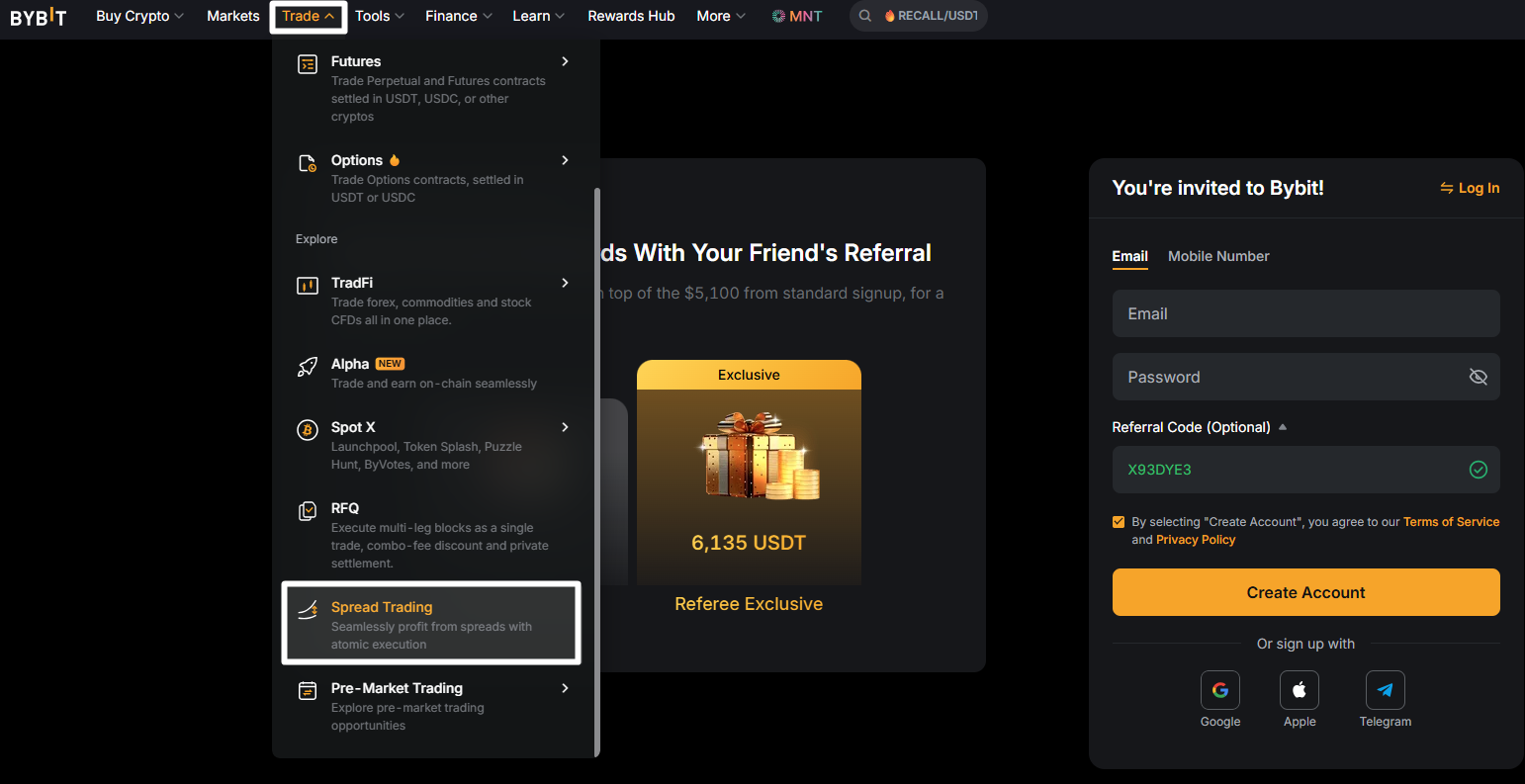

Spread Trading: A professional way to hedge volatility

Spread Trading lets traders buy one contract and sell another at the same time. Instead of predicting direction, you trade the difference between two related markets. This is why institutional traders use it during volatile periods, as it reduces exposure to sudden price swings.

Bybit Spread Trading makes this simple with the use of combo orders. Both legs are filled together through atomic execution, so you never end up with only one side of the trade. This is important when markets move fast and liquidity changes quickly.

For instance, if you think the gap between BTC Perpetual and BTC Quarterly Futures will widen, you can go long on the quarterly contract and short the perpetual in one click. If the spread grows, the trade profits, even if BTC moves sideways or whipsaws.

Why traders use it:

Reduces directional risk during volatility

Trades relative value, not absolute price

Requires lower fees than placing two separate orders

Provides an easy interface for Spot, Perp and Expiration combos

Spread Trading gives traders a controlled way to stay active when markets are unstable and direction is unclear.

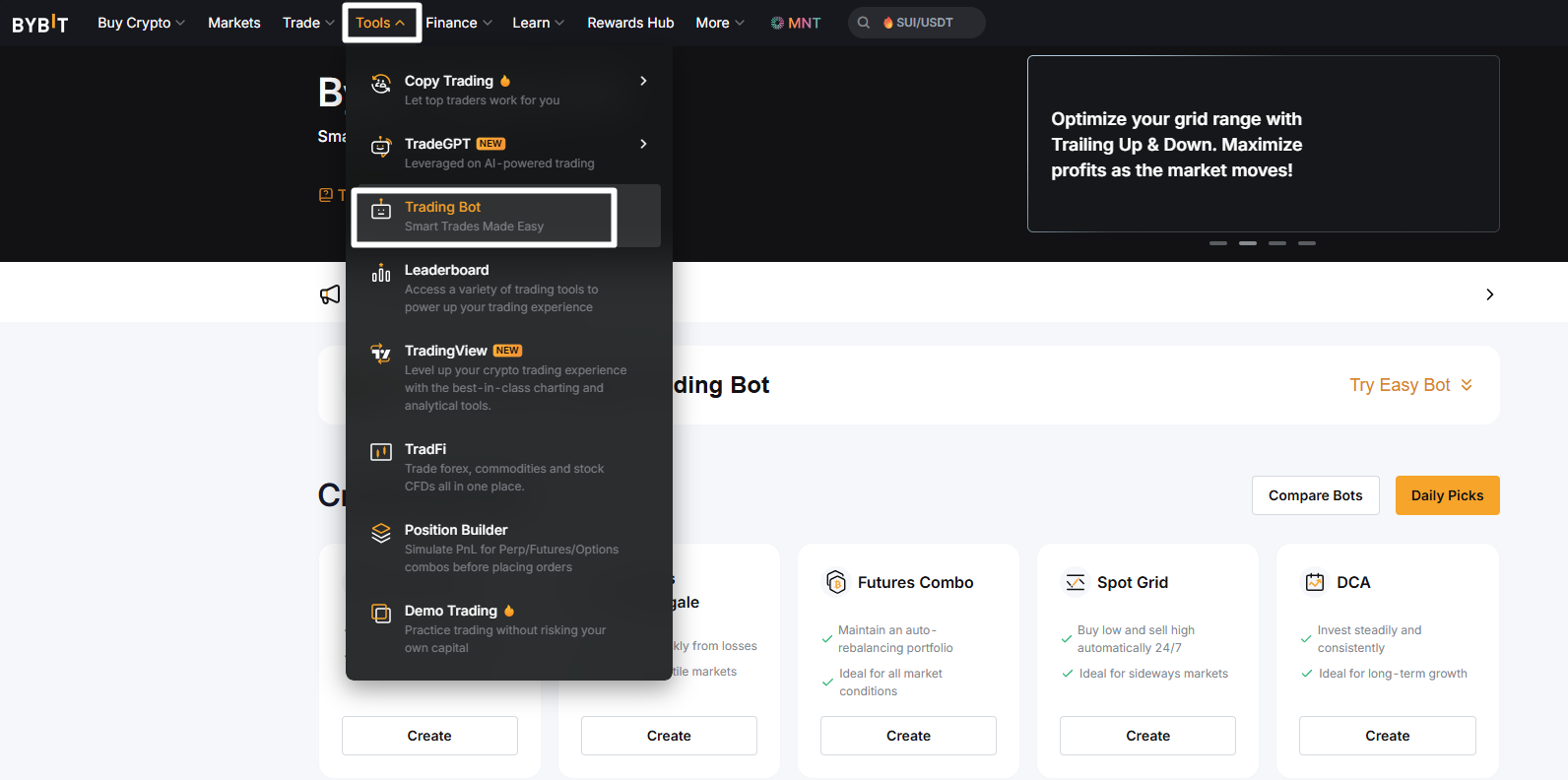

Automate your volatility strategy with trading bots

Trading bots can be useful in volatile markets, because they follow rules consistently without reacting to sudden price swings or changing plans mid-trade. When emotions often lead traders to chase entries or to exit too early, bots keep execution steady.

Martingale Bot: Cost averaging during sharp moves

The Martingale Bot adds to a position when price moves against you, lowering your average entry. This helps when markets snap back.

For example, if BTC falls from $100,000 → $97,000, the bot may add another small long position. If BTC later rebounds to $99,000, the lower average entry improves your chances of closing the cycle in profit.

The risk arises when the market continues to trend. If BTC continues to fall without a reversal, the bot will keep adding at worse prices. This is why traders use small allocations, and pause the Martingale Bot when the market shows a clear direction.

Futures Grid Bot: Capturing range-bound volatility

The Futures Grid Bot suits range-bound volatility. It places buy orders below the market, and sell orders above it, capturing repeated “buy low, sell high” opportunities as the price oscillates.

This makes it effective after a volatility spike when the market settles into a broader range. It requires minimal forecasting, and can run continuously with predefined rules.

When bots help most

Trading bots perform best when markets move sideways or reverse frequently. However, they struggle during strong trends, or when BVIV and EVIV jump sharply. Pausing automation during breakout phases and reactivating it in stable ranges helps control risk, and makes automation more effective.

Safer ways to earn during volatility: Easy Earn and Copy Trading

Some traders prefer to step back during volatile periods and avoid active risk. Instead of trying to time sharp swings, they switch to passive tools that keep returns steady while reducing stress.

Easy Earn offers Flexible and Fixed Term yield products. Flexible Term plans allow deposits or withdrawals at any time, while Fixed Term plans offer higher, predictable returns. For example, if BTC is stuck between $100,000 and $120,000 with no clear direction, a trader may place funds in a Fixed Term plan to earn stable yield while waiting for better conditions.

Copy Trading is another low-effort option. Traders can follow experienced masters who already specialize in volatile markets. By checking their track record and drawdowns, users can mirror strategies that match their risk tolerance, and learn from real-time decisions without managing trades themselves.

Passive tools are most helpful when traders seek stability rather than reacting to every move. In volatile markets, preserving capital can be a winning strategy all on its own.

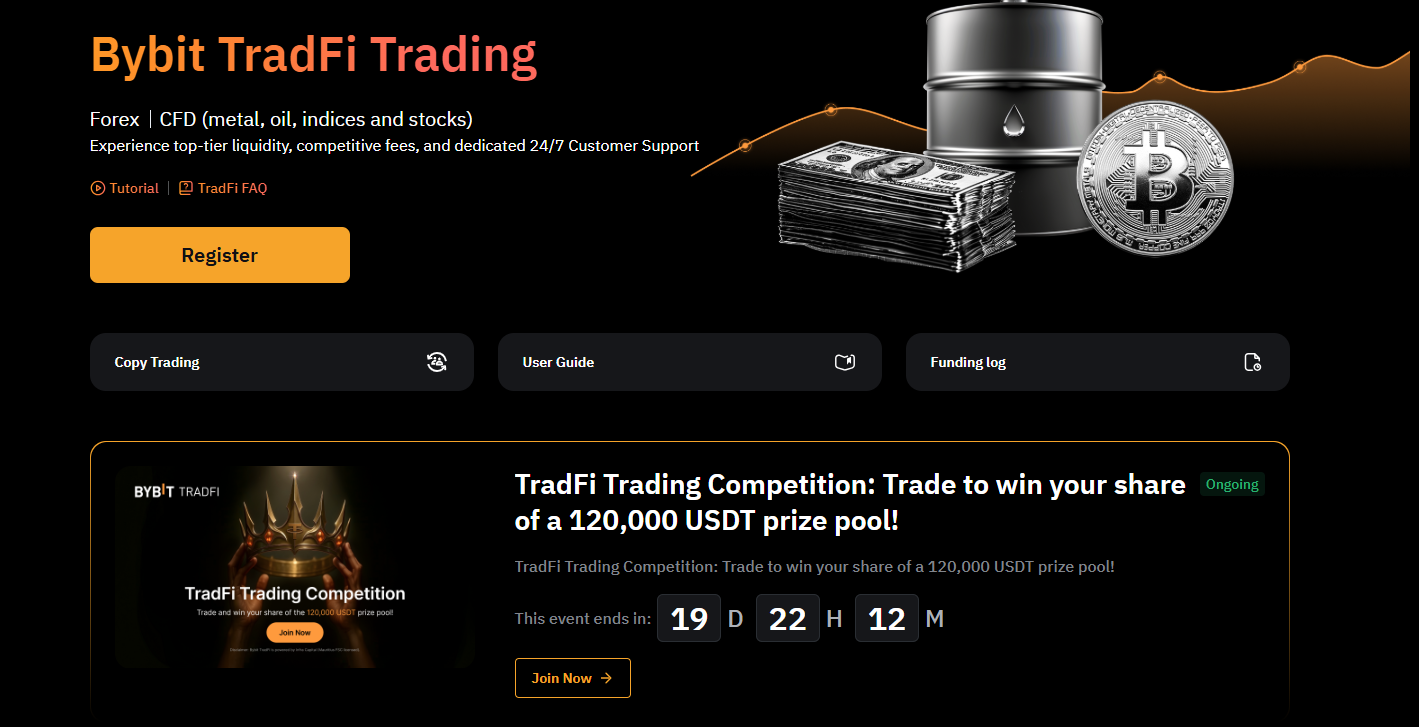

Diversify beyond crypto volatility with Bybit TradFi

Crypto often moves faster than traditional markets, so adding non-crypto assets can help stabilize a portfolio when volatility spikes. Bybit TradFi lets traders access gold, major forex pairs and commodities in the same account they already use for BTC and ETH.

With Bybit TradFi, you can trade gold, forex and commodities using the same USDT balance that you already use for crypto. This gives you quick hedging options. For example, if BTC is unstable, but gold is rising on safe-haven demand, holding XAU/USD can offset crypto drawdowns. Forex pairs such as EUR/USD or USD/JPY also offer liquid opportunities driven by interest rates and global data, rather than sentiment spikes.

If you’re a hands-off user, Copy Trading TradFi allows you to follow expert macro traders who already specialize in gold and forex cycles. This provides exposure to diversified strategies without needing to manage positions manually.

Adding TradFi reduces correlation, smooths volatility and helps build a more resilient portfolio when crypto alone becomes too unpredictable.

Closing thoughts

Volatility will always be part of crypto, but traders who prepare for it gain a clear advantage. Utilizing advanced Earn products (such as BVIV/EVIV, Double-Win and Smart Leverage), along with automated bots, helps convert unstable conditions into calculated opportunities. For risk-averse investors, shifting toward Easy Earn, Copy Trading or Bybit TradFi adds stability and reduces reliance on a single asset class.

The edge comes from balance. Monitor volatility, choose the right product for each phase and stay disciplined. With the right mix of tools and awareness, volatility becomes something to manage, not fear.

#LearnWithBybit