How to trade spot pairs on Bybit

Spot trading is one of the primary ways many people first engage with the crypto market. Most beginning traders start their crypto journeys through the spot market, often using simple market orders — direct and immediate swapping of one crypto asset for another. Experienced crypto veterans also engage in spot trading, albeit with more advanced orders for strategic execution.

Bybit, one of the world’s leading centralized exchanges (CEXs), offers an intuitive trading platform designed for both beginners and experienced traders, providing a wide variety of additional order types.

A particularly useful feature of Bybit’s Spot market is the ability to use established stablecoins, particularly Tether (USDT), for many of the trades, ensuring stability and liquidity. Bybit offers a vast selection of spot trading pairs with major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and Ripple (XRP) and other altcoins. Users can use USDT, USDC, USDe and other stablecoins to trade spot.

In this article, we’ll cover everything related to crypto spot trading, and spot opportunities on Bybit. Whether you’re a beginner looking to swap USDT for BTC instantly or a seasoned pro searching for profitable spot opportunities, this article is for you.

Key Takeaways:

Crypto spot trading is the direct buying and selling of cryptocurrencies at current market prices, or via orders that trigger upon the asset reaching a predefined price.

Bybit offers spot traders low transaction fees, a wide variety of spot order types, margin trading opportunities and access to promising new crypto assets.

What Is Spot Trading?

Crypto spot trading involves directly purchasing and selling cryptocurrencies, usually with immediate settlement. Traders can execute various order types, such as market orders at current prices, limit orders at predefined prices and stop orders to automate entry or exit strategies.

Unlike derivatives such as futures and options, spot trading involves direct ownership of assets and is typically settled immediately, or upon reaching a specified target price.

Spot trades are often contrasted with futures, the most popular type of derivatives. When trading futures, you don’t immediately own the asset. Instead, you hold a contract that tracks its price, realizing a profit or loss in the future (at the contract’s expiration) after you’ve triggered the contract execution. Standard futures have predefined maturity periods when the contract settles, and you buy or sell the asset at the agreed-upon price. In contrast, perpetual futures — aptly named because they have no expiration date — can be settled at any time when you decide to close the contract.

Order Types

The most common and simplest form of spot trades is the market order. This type of order contains an instruction to buy or sell an asset immediately, at the best available price in the market. Market orders guarantee execution, but not the price, which will be fulfilled at the current rate at the time of the actual order processing.

Market orders generally execute near the requested price. However, depending upon a range of factors, such as market volatility, liquidity levels, order size and even the time of day, there will likely be a difference in the price between the time of the request and the time of the order execution. This difference is known as slippage.

While market orders are the most common and well-known variety of spot trades, many more types of orders are available to traders. Within Bybit’s extensive range of spot order types, there are three basic order varieties — market orders, limit orders and conditional orders.

Limit orders are instructions to buy or sell a crypto asset at a specific (or even better) price. The order only gets filled if the market reaches the specified price or improves upon it, giving you control over the price at which you buy or sell. If the market doesn’t reach that price, the order won’t execute.

For example, let’s say the current value of Bitcoin is 90,000 USDT. If you want to buy 1 BTC for 88,000 USDT (or an even lower price), you place a limit order for that price (88,000 USDT). If the market price of BTC drops to 88,000 USDT or below, your order will be executed. If the price stays above your desired limit of 88,000 USDT, the order won’t be fulfilled.

Conditional orders are executed when certain predefined conditions are met. These conditions may represent various reference prices, such as Last Traded Price or Index Price.

How Does Spot Trading Work on Bybit?

Bybit offers traders a sophisticated and varied range of spot order types to choose from, as well as competitive spot trading fees, access to promising new cryptocurrencies and even margin trading opportunities.

Above, we discussed three main spot order types offered by the platform: market, limit and conditional orders. Additionally, Bybit offers a range of other, more advanced spot order types: take profit and stop loss, iceberg, TWAP, one-cancels-the-other (OCO), post-only, time in force selections and trailing stop orders. Experienced spot traders are encouraged to review these order types via our relevant Help Center article.

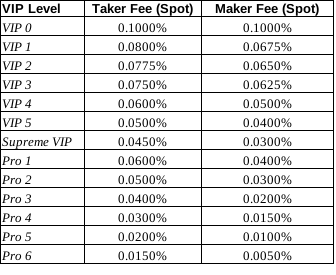

In Bybit’s Spot market, there are two primary types of traders — takers and makers. Takers execute trades and consume liquidity in the platform’s order book as their orders match with those on the order book. Meanwhile, Makers add more liquidity to the order book with their orders. Both takers and makers on Bybit are charged a transaction fee of just 0.1% per order on the amount traded. The fee is calculated based on the amount of cryptocurrency being bought. There’s no transaction fee for canceled orders, or for orders that aren’t completely fulfilled.

The 0.1% fee applies to non-VIP users of the platform. Depending upon your trading volume over the previous 30 days, you may qualify for one of the Bybit VIP levels. The higher your VIP level, the lower your transaction fees. The table below shows the taker and maker fees applicable to each VIP level.

You can also access margin trading opportunities via Bybit’s Spot market. Both margin and leverage trading are typically associated with derivatives products. However, Bybit offers margin trading within its Spot market, allowing users to borrow funds to increase their trading position. These trades significantly increase the available liquidity for your orders. They may also magnify your gains and losses.

Additionally, you can access cryptocurrencies of promising early-stage projects via Bybit’s Spot Trading Adventure Zone. These crypto assets may deliver excellent returns, though due to their early-stage nature they also come with increased investment risk.

Top Bybit Spot Pairs by Trading Volume

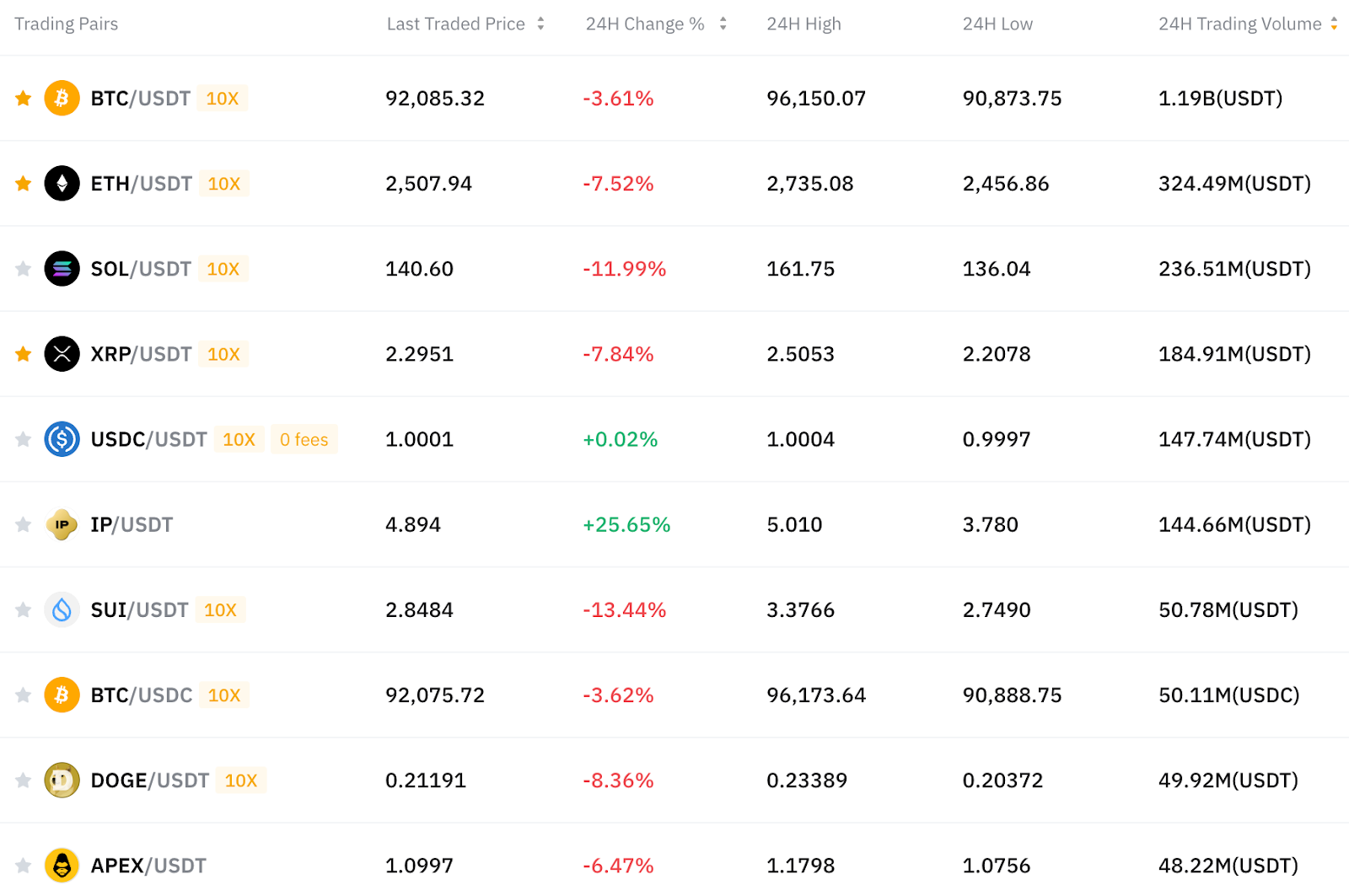

Bybit’s Spot market offers a wide variety of spot pairs for trade. The leading pairs by volume usually involve popular high-cap assets, such as BTC, ETH, SOL or XRP on one side, and the USDT stablecoin on the other. Other popular trading pairs include high-cap stablecoin-to-stablecoin pairs — e.g., USDC/USDT and USDE/USDT. In most cases, the pairs come with margin trading opportunities, offering leverages of up to 10x.

The image below shows the top 10 pairs on Bybit Spot by trading volumes, as of Feb 25, 2025.

How to Trade a USDT Spot Pair on Bybit

To begin spot trading on Bybit, first register for your account and fund it through one of the accepted payment methods. For crypto, this includes transferring funds from your external crypto wallet or account on a different exchange. For fiat payments, you can deposit funds via bank transfers, card payments, eligible third-party providers and online payment processors.

After your account has been funded, you can start trading on Bybit using the steps covered in the section above for USDT-based pairs, as well as any other spot pair.

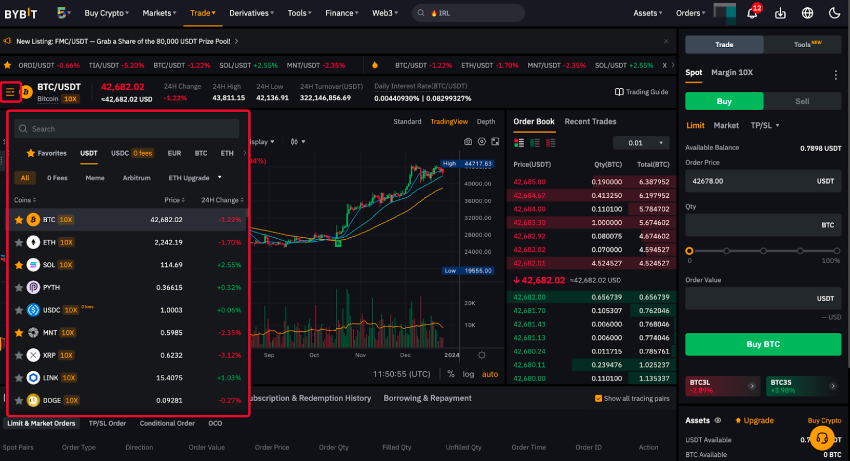

Step 1: Log in to your account and hover over the left panel on your main trading page. This will bring up the available pairs on the market. You can also select the USDT filter to view pairs based on USDT only.

Alternatively, you can type in a desired crypto asset in the search box to bring up all of the available pairs for it.

Step 2: Select the desired pair, and then fill in the order details in the panel on the right.

Step 3: Specify your preference for either a standard spot trade or a margin-based one.

Step 4: Under the Buy tab, select your preferred order type — e.g., Market or Limit.

Step 5: Enter the amount of cryptocurrency you wish to purchase, review your selection and click on Buy (asset name).

Step 6: A confirmation window will pop up. Review your order details — price, quantity and total order value — and click on Buy (asset name).

Conclusion: Getting Started With Spot Trading on Bybit

In addition to the unmatched variety of order types offered on Bybit Spot — market orders, limit orders, conditional orders and more advanced types — Bybit’s Spot trading platform offers high security, deep liquidity levels in its order book, competitive maker and taker fees, hundreds of crypto assets on offer, margin trading opportunities and access to promising early-stage coins via the Adventure Zone.

With all of these benefits, Bybit’s Spot market is an ideal environment for crypto spot traders, both beginners and seasoned pros. Moreover, starting on the platform is quick and easy — just fund your account and trade following the steps described above to experience one of the world's leading crypto spot trading environments.

#LearnWithBybit