Bybit Spot vs. Derivatives trading for beginners

Newbie crypto traders are often unsure of the differences between spot and derivatives trading, as these two trading markets seemingly involve the same types of assets. However, spot trades and derivatives have significantly different characteristics, risk levels, use cases, complexity and modes of asset ownership.

Bybit offers both Spot and Derivatives markets for cryptocurrency trading, and features an unparalleled variety of assets and products. Using a Unified Trading Account (UTA) allows you to consolidate your crypto assets and perform cross-asset trading of Spot and Derivatives (Perpetuals, Futures and Options) within a single account.

In this article, we’ll cover the basics of both spot and derivatives trading and explain the differences between them.

Key Takeaways:

Spot and derivatives are the two main crypto trading markets, with the former being less complex, less risky and more beginner-friendly.

The main advantages of spot trading are simplicity, lower risk and the ability to own the traded asset directly. In contrast, the key pros of derivatives are leverage opportunities, the flexibility to long/short assets and suitability for hedging strategies.

What is spot trading?

Spot trading involves the direct buying and selling of cryptocurrencies, typically at their current market prices, with immediate settlement. By trading crypto on the spot market, you directly own the underlying asset. For example, if you buy Bitcoin (BTC) via a spot order, the coins are immediately transferred to you and are entirely owned by you. You’re free to hold these tokens in your wallet, or invest them in other financial products. Likewise, when you sell your BTC, you transfer ownership of the asset to the buyer, with the transaction settled immediately. You don't turn a profit via spot trading until you sell a previously bought asset at a higher price.

You can also sell high and later buy the same asset at a lower price, turning a profit via what can be essentially described as a spot shorting strategy.

Spot traders employ a wide variety of approaches. Some may be involved in extremely short-term, intraday trades, while others may buy and sell in a matter of days or weeks, trying to capitalize on shorter-term price swings. Those with a long-term outlook will invest using other strategies like hold on for dear life (HODL) and dollar-cost averaging (DCA).

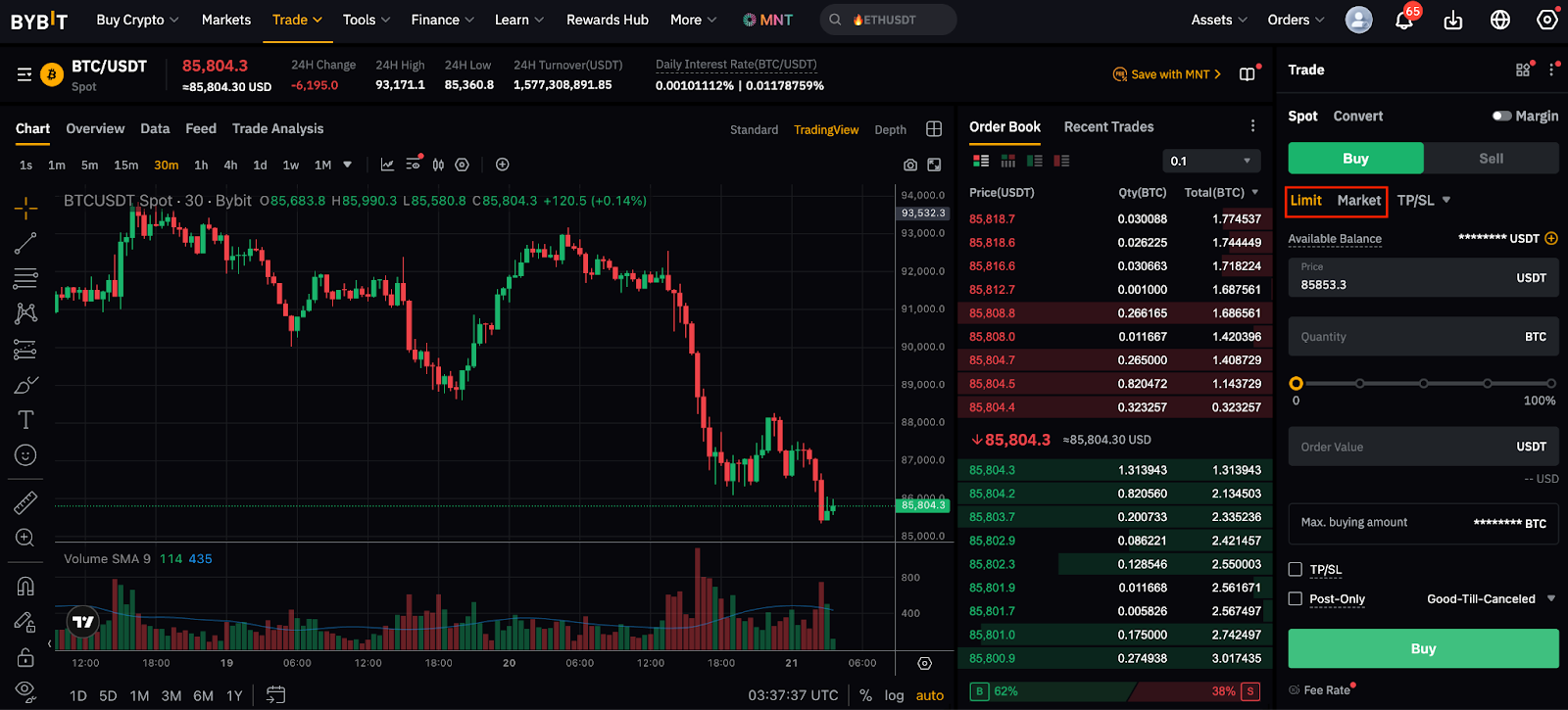

How Spot trading works on Bybit

To start Spot trading on Bybit, sign up for your account, verify your identity, visit the Spot section in your trading interface, pick pairs you’d like to trade [e.g., Tether (USDT) to BTC[ and select your Spot order type. The two basic Spot order types are Market and Limit. Market orders let you buy or sell an asset immediately, at the current market price, while Limit orders represent your instruction to buy or sell the asset if it reaches a specified target price or better. The standard transaction fee for Spot trades on Bybit is 0.1%.

Pros and cons of Spot trading

The main advantages of spot trading compared to derivatives are its simplicity, lower risk levels, direct ownership of the traded asset, transparency for beginning traders and the absence of liquidation risk.

At the same time, key disadvantages of Spot trading include the lack of leverage opportunities in standard Spot trades, being limited by the capital you own, and the presence of slippage. Slippage, the difference between the price at which you place your order and the actual price at which the order is executed, arises primarily due to market volatility.

What are derivatives?

Derivatives are financial contracts that enable you to speculate on the price of a cryptocurrency without owning it. Besides price speculation, derivatives may also be used for hedging against trading risk and for accessing leverage opportunities. The three main types of Derivatives products on Bybit are Perpetuals, Futures and Options.

Perpetual contracts on Bybit

Perpetuals, also known as perps or perpetual futures, are contracts that allow you to track the price of a crypto asset without directly owning it, and to settle the contract at a future date. By owning a perpetual contract, you can speculate on the asset’s price and settle the contract when you find it suitable to do so, as these contracts have no expiration date (hence the name).

Long perps allow you to buy an asset at a future date. Conversely, short perps are settled when you sell the tracked asset. Holders of all perps on Bybit, just as on any other trading platform, exchange periodic fees (called funding fees) while their contracts remain open. If the perpetual price of the tracked asset is above its Spot price, positive funding rates apply, whereby long traders pay the fee to short traders. If the perpetual price of the asset is below its Spot price, negative funding rates apply, and short traders pay long traders.

Funding rates are updated continuously on Bybit, but the fees are only exchanged once every eight hours (at 12AM, 8AM and 4PM UTC). The amount of the funding fee your contract will pay or receive depends upon its value and the standard funding rate.

Funding fee paid = position value × funding rate

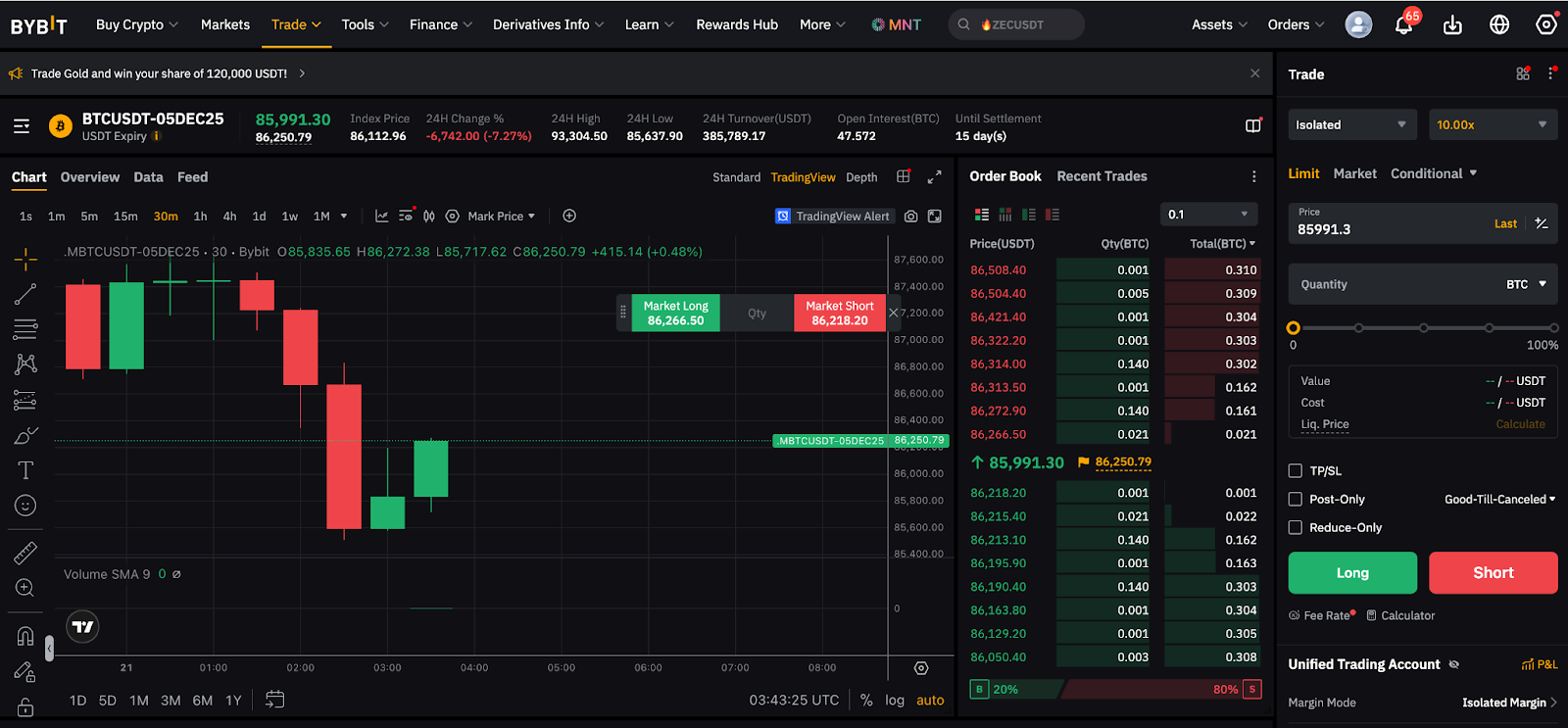

Futures contracts on Bybit

Futures contracts track the price of an asset. However, unlike perpetual contracts, futures contracts have fixed expiration dates on which they’re settled. For instance, futures can be weekly, monthly or quarterly. A futures contract is settled at 8AM UTC on the date of its expiration.

You can long or short a tracked asset via a futures contract. Bybit’s USDT and USDC Futures are cash-settled, meaning the contract seller pays the buyer's profit or loss in USDT or USDC. This is different from coin-settled contracts, also known as inverse futures, in which the settlement currency is a non-stablecoin asset — e.g., BTC or Ether (ETH) — and the contract value is calculated using USD.

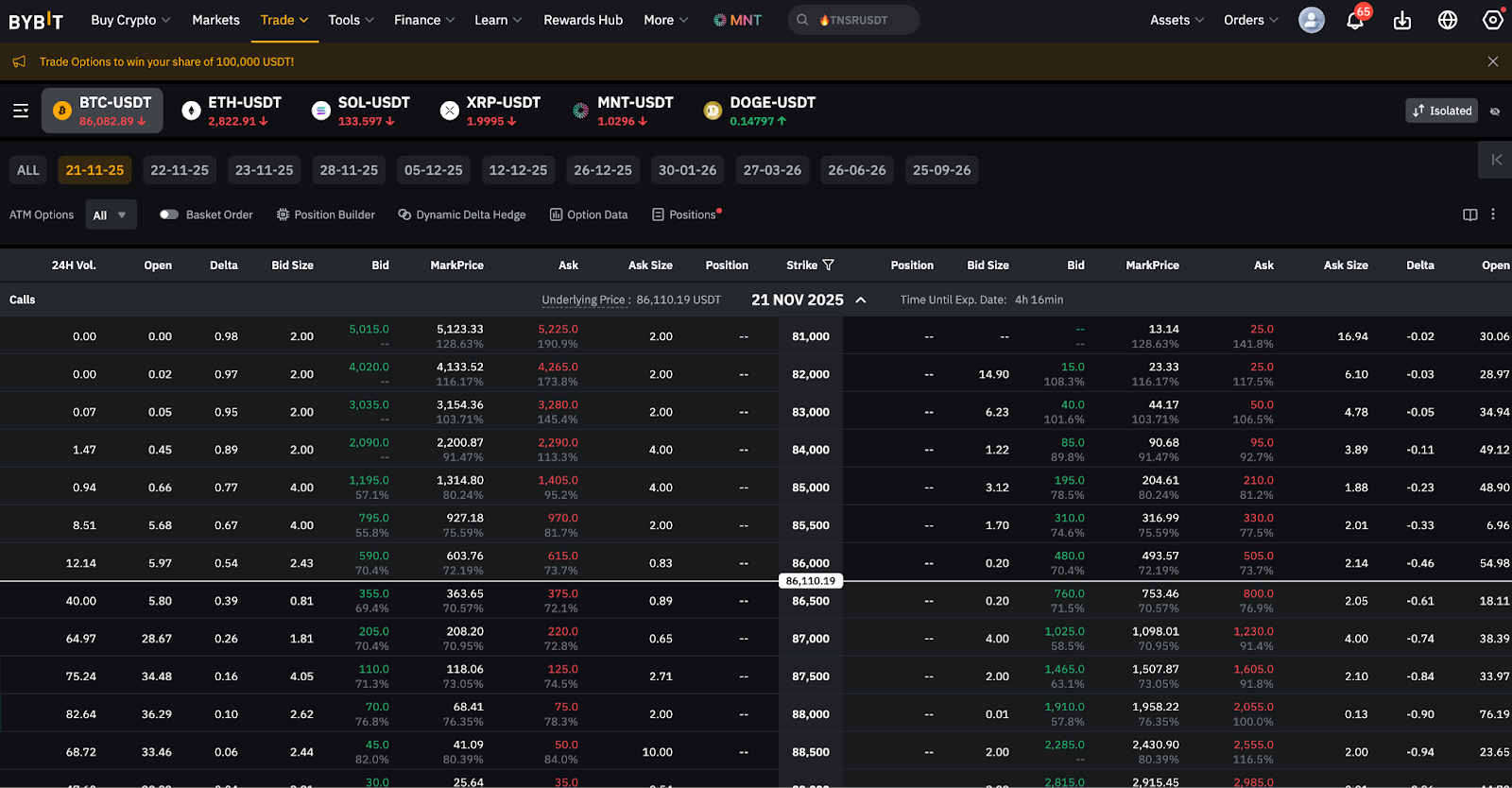

Options on Bybit

Options are derivatives contracts that track the price of an asset, have fixed expiration dates (in a similar way to futures), and provide the option but not the obligation to buy/sell the asset on the settlement date. Bybit offers options contracts margined and settled in USDT for BTC, ETH, Solana (SOL), Mantle (MNT), XRP (XRP) and Dogecoin (DOGE), as well as USDC (USDC)–based options for BTC and ETH.

Options products on Bybit are all European-style, meaning they settle on the precise expiration date.

The two types of options are call and put. Calls give you the right to buy the tracked asset on the expiration date, while puts allow you to sell the asset on the expiration date.

By opening an options contract, you pay a fee called the premium. If you simply let your options contract expire without buying/selling, all you lose is the premium paid, as options don’t oblige you to buy/sell before or on expiration date (unlike perps and futures).

How Derivatives work on Bybit

Bybit’s Derivatives products allow you to use leverage, meaning that you can use your own money as collateral and borrow additional funds from the platform to execute your trades. For example, if you put in 1,000 USDT of your own capital, which is called Initial Margin (IM), and borrow 9,000 USDT, you can now place trades for 10,000 USDT, or 10 times greater than what you could do with only your own money. In this example, you’re using 10x leverage.

Leverage trading can magnify both your gains and your losses. For instance, the 10x leverage ratio above means that each 1% gain or loss turns into a 10% difference for your position. Therefore, it’s critical to keep in mind a key measure for your Derivatives contracts called maintenance margin (MM). MM is the minimum margin you must maintain in your account to avoid liquidation. Depending upon the value of your open positions, the MM is typically between 2% and 4%.

The three main margin modes you can use on UTA are isolated, cross and portfolio. In isolated margin mode, the liquidation risk is limited to the specific, manually set amount of collateral assigned to a single position. Cross-margin mode commits your entire account balance in order to prevent liquidation of all open positions. Finally, portfolio mode calculates margin based on the net risk of your entire portfolio, including hedges, futures and options, significantly lowering capital requirements for complex strategies.

Pros & cons of derivatives

The main pros of derivatives contracts include generous leverage ratios, flexibility to long/short, and hedging opportunities. At the same time, the primary disadvantages include the liquidation risk associated with leverage, funding costs in the case of perpetual contracts (perps), general complexity as compared to spot trading, and the emotional stress involved in these trades, due to their relatively high-risk profile.

Spot vs. derivatives: Side-by-side comparison

The table below summarizes the key differences between Spot and Derivatives trading.

| Spot | Derivatives |

Ownership | Own the asset directly | Track the price without directly owning the asset |

Risk | Lower | Higher |

Leverage | None in standard Spot trades | Up to x125 |

Fees | 0.1% | Variable — funding fees for perps, premiums for options |

Expiration | N/A | Fixed dates for futures and options; flexible for perps |

Suitable for beginners | Yes | No |

Typical use cases | Holding or trading for profit at lower risk | High-risk speculation; in some uses, hedging |

In Spot trading, you directly own the asset, while Derivatives are based on speculation on the asset’s price by holding contracts with varying expiration terms (without assuming actual ownership). Spot trading is more suitable for beginning traders than trading Derivatives is, as it involves lower risk levels, less complexity, has no amplified risks due to leverage and features more straightforward fees.

Which one should beginning traders choose?

For most beginning crypto traders, spot trading is a better choice than derivatives, for the reasons outlined in the section above. A typical newbie spot trader may wish to make profit in a relatively less risky environment, one that’s free from the temptations and emotional pressure of leveraged trading.

Users wanting to try derivatives are typically those who have gained a certain level of experience in crypto trading, and understand the associated risks.

How to start trading safely on Bybit

To trade safely on Bybit:

Make sure that you understand the basic order types

Start with Spot trades, or with low-leverage ratios if you decide to try Derivatives

Learn about more advanced order types, such as stop-loss and take-profit, in order to better manage trading risks

Understand the fees involved in each trade type

Avoid being swayed by your emotions while trading

Conclusion

While both spot and derivatives markets have their unique advantages, the former is a simpler and lower-risk alternative for those taking their initial steps in crypto trading. As a beginning trader, you’re advised to start slow, build confidence using spot trades, sharpen your knowledge and experience, understand the risks that leveraged trading may involve, and only then dive into the world of derivatives if you wish to do so.

For those who acquire the necessary knowledge and experience, the derivatives market offers flexibility, trading tools and higher-return opportunities.

#LearnWithBybit