How to trade gold & FX with USDT on Bybit TradFi

Disclaimer: Please note that Bybit Gold & FX has been renamed to Bybit TradFi as of June 2025. Bybit TradFi is powered by Infra Capital (Mauritius FSC licensed).

As global markets face shifting economic conditions, gold and forex trading have regained momentum and Bybit TradFi now brings these opportunities to crypto traders worldwide. Gold has climbed sharply recently as investors respond to persistent inflation, shifting interest-rate expectations and geopolitical uncertainty. The surge has reignited global interest in traditional markets like gold and foreign exchange (FX), as traders seek stability and diversification beyond crypto.

To meet this growing demand, Bybit TradFi now enables users to trade gold and major currency pairs directly with USDT. This includes popular combinations such as XAUAUD+, XAUEUR+, XAUJPY+ and XAUUSD+, offering access to real-world markets through a single, unified account.

Whether you’re new to commodities or an experienced trader looking to expand your strategy, this guide explains how to trade gold and FX on Bybit TradFi, understand key market drivers and manage risk effectively.

Key takeaways:

Inflation, interest rates and geopolitics are reigniting gold and FX trading volumes.

Bybit TradFi lets users trade gold and major currency pairs with USDT, no fiat required.

Traders can diversify beyond crypto while benefiting from institutional-grade execution.

Gold and FX make a comeback

Gold has reclaimed the spotlight in 2025, surging to an all-time high of $4,381.21 in October amid renewed global uncertainty. The rally reflects rising expectations of U.S. rate cuts, a dovish Federal Reserve outlook and escalating U.S.–China trade tensions, with new 100% tariff proposals fueling fears of slower global growth. Investors have also turned to gold as major economies signal monetary easing to counter deflation risks, while central banks continue record-level bullion accumulation.

At the same time, FX markets are seeing more substantial volumes as traders position around widening interest-rate gaps between the U.S., Japan and Europe. The yen’s weakness and euro volatility have further encouraged speculative flows into key currency pairs.

These macro dynamics are prompting investors to rebalance portfolios toward traditional safe-haven and yield markets. Through Bybit TradFi, traders can access gold and major FX pairs using USDT, bridging stability and digital convenience on one platform.

What is gold and FX trading?

Gold and foreign exchange (FX) trading allow you to speculate on price movements rather than owning the physical metal or fiat currency. Instead of buying gold bars or holding dollars in a bank, traders use Contracts for Difference (CFDs) to capture potential gains when prices rise or fall.

Through Bybit TradFi, users can trade popular pairs such as XAUUSD+, XAUEUR+, XAUJPY+ and XAUAUD+ directly with USDT margin, without needing to convert to fiat currencies. This approach offers flexibility, faster execution and exposure to global markets within one platform.

Gold and FX trading are accessible to both beginners and experienced traders. For example, if you expect the U.S. dollar to weaken, you can go long on XAUUSD+, meaning you’re buying gold against the dollar. If you think the opposite, you can short it to benefit from a potential decline.

Key market drivers

Several forces influence gold and FX price movements, shaping how pairs like XAUAUD+, XAUEUR+, XAUJPY+ and XAUUSD+ behave in real time.

Inflation and interest rates: Rising inflation typically boosts demand for gold as a hedge, while higher rates strengthen fiat currencies and can pressure gold prices. For instance, expectations of U.S. rate cuts in late 2025 pushed gold to record highs while weakening the dollar.

U.S. dollar strength: Because gold is priced in dollars, any movement in the USD directly impacts all major gold pairs.

Geopolitical events: Trade disputes, conflicts and supply disruptions often trigger safe-haven flows into gold and the Japanese yen.

Central bank policies: Decisions on rate cuts, bond purchases and gold reserves influence long-term market sentiment.

Staying updated on economic releases, such as Consumer Price Index (CPI) data, employment reports and central bank statements, helps traders anticipate volatility and make informed moves on Bybit TradFi.

How to trade on Bybit TradFi (Web version)

Bybit TradFi is seamlessly integrated into the Bybit platform, giving you direct access to gold and major FX pairs with USDT margin, no fiat conversion required. The interface is intuitive, fast and ideal for both beginners and experienced traders.

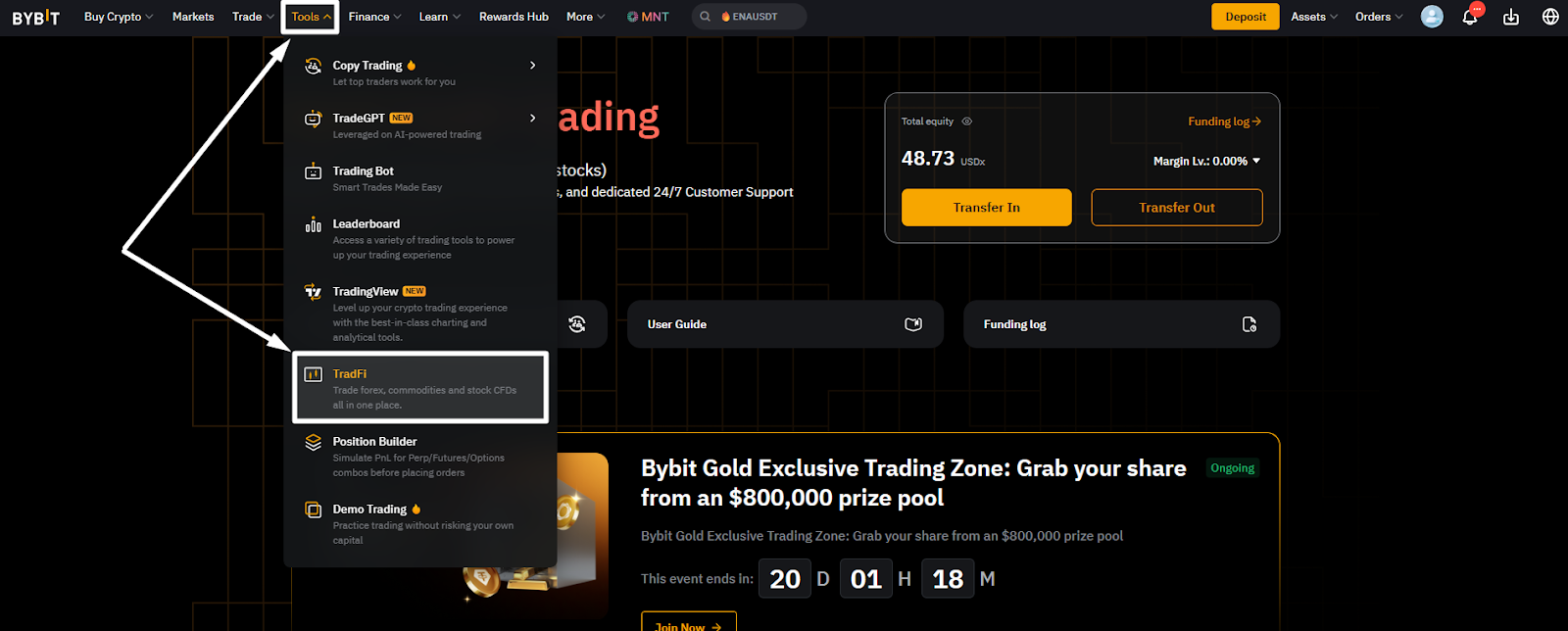

1. On the top navigation bar, hover over Tools and select TradFi from the dropdown menu.

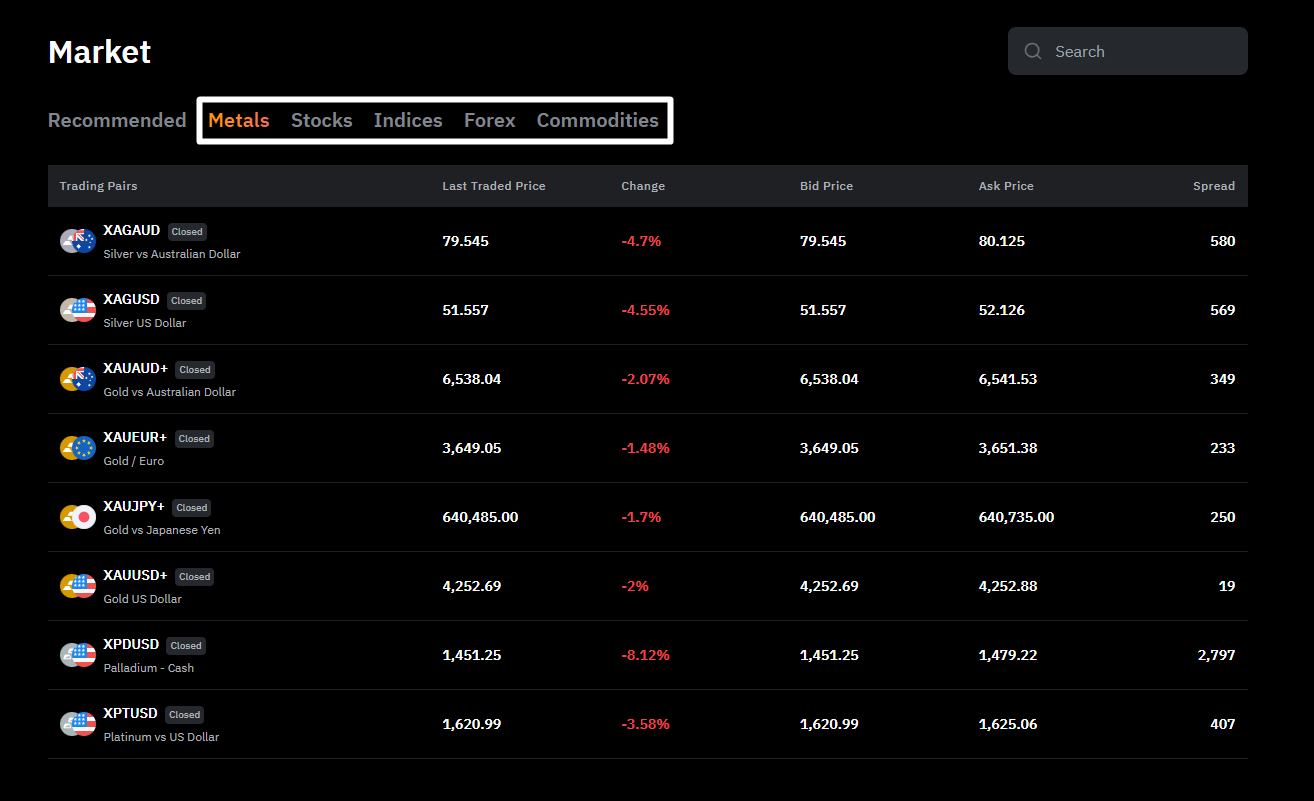

2. Choose your market: Under Market, select a category such as Metals or Forex to explore available assets.

3. Select a trading pair: Choose from pairs like XAUUSD+, XAUEUR+, XAUJPY+ or XAUAUD+.

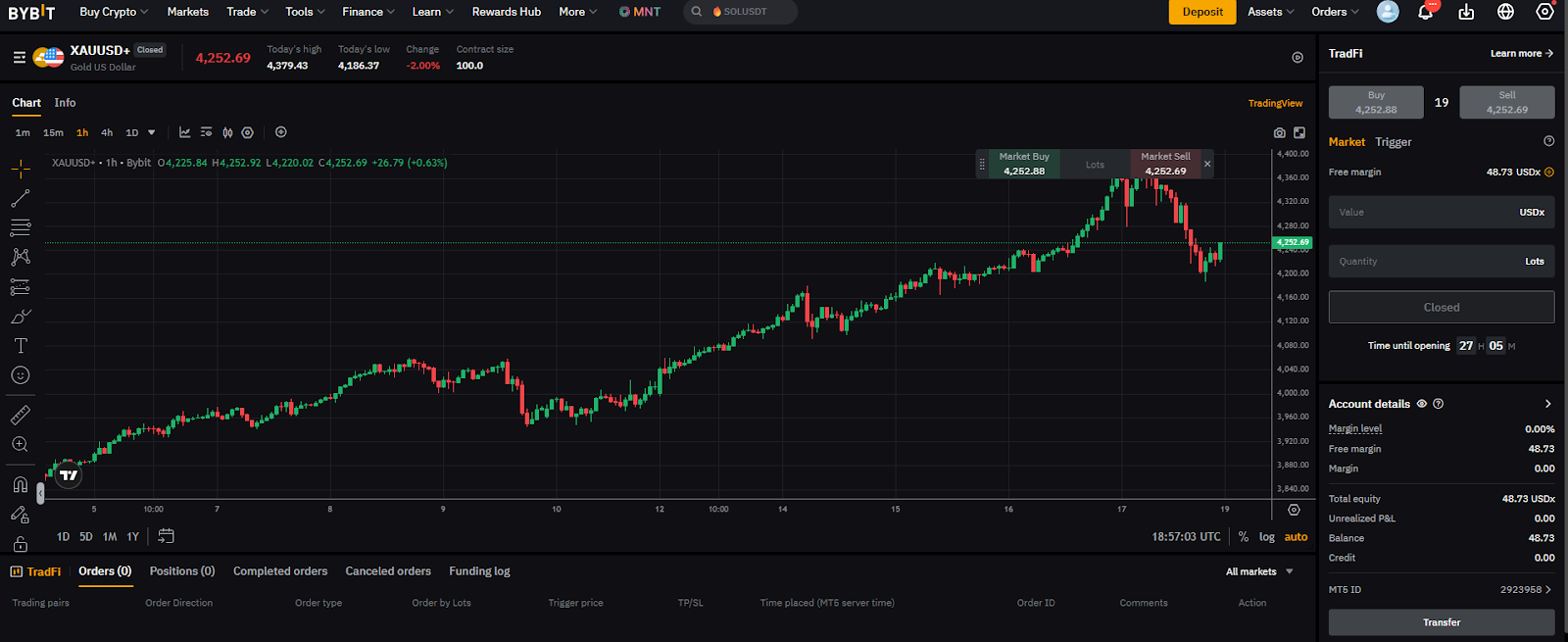

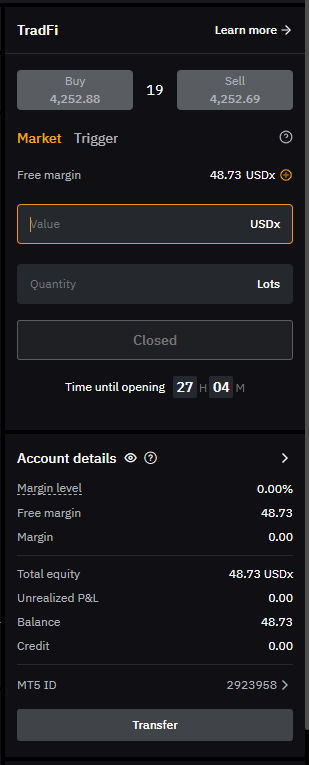

4. Set order details: Adjust margin, leverage and order type (Market, Limit or Trigger) within the TradFi panel.

5. Place your trade: Click Buy if you expect prices to rise, or Sell if you anticipate a decline.

6. Manage risk: Apply Stop-Loss and Take-Profit settings to control exposure automatically.

Start small or use demo mode to explore TradFi tools. The Bybit web platform delivers a smooth, professional trading experience with real-time pricing and institutional-grade liquidity.

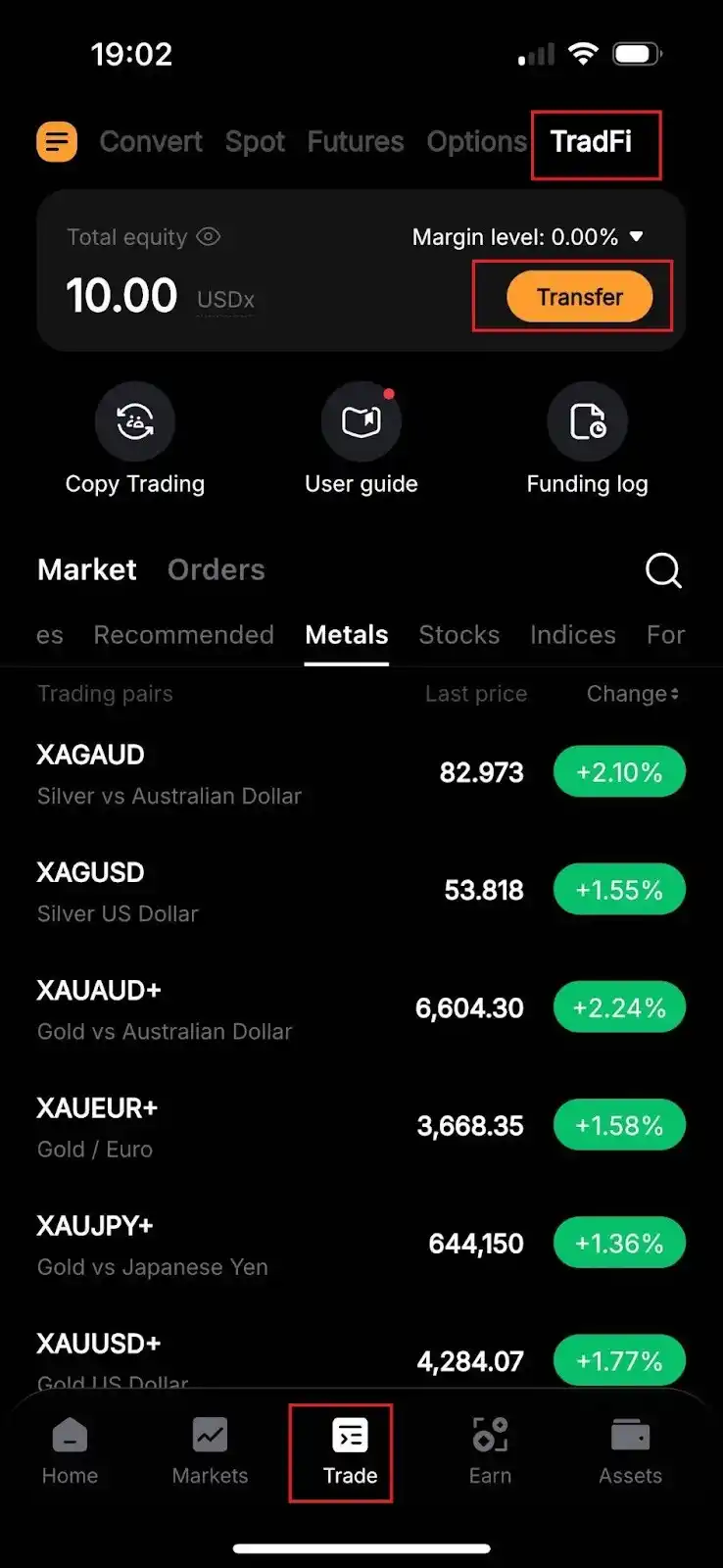

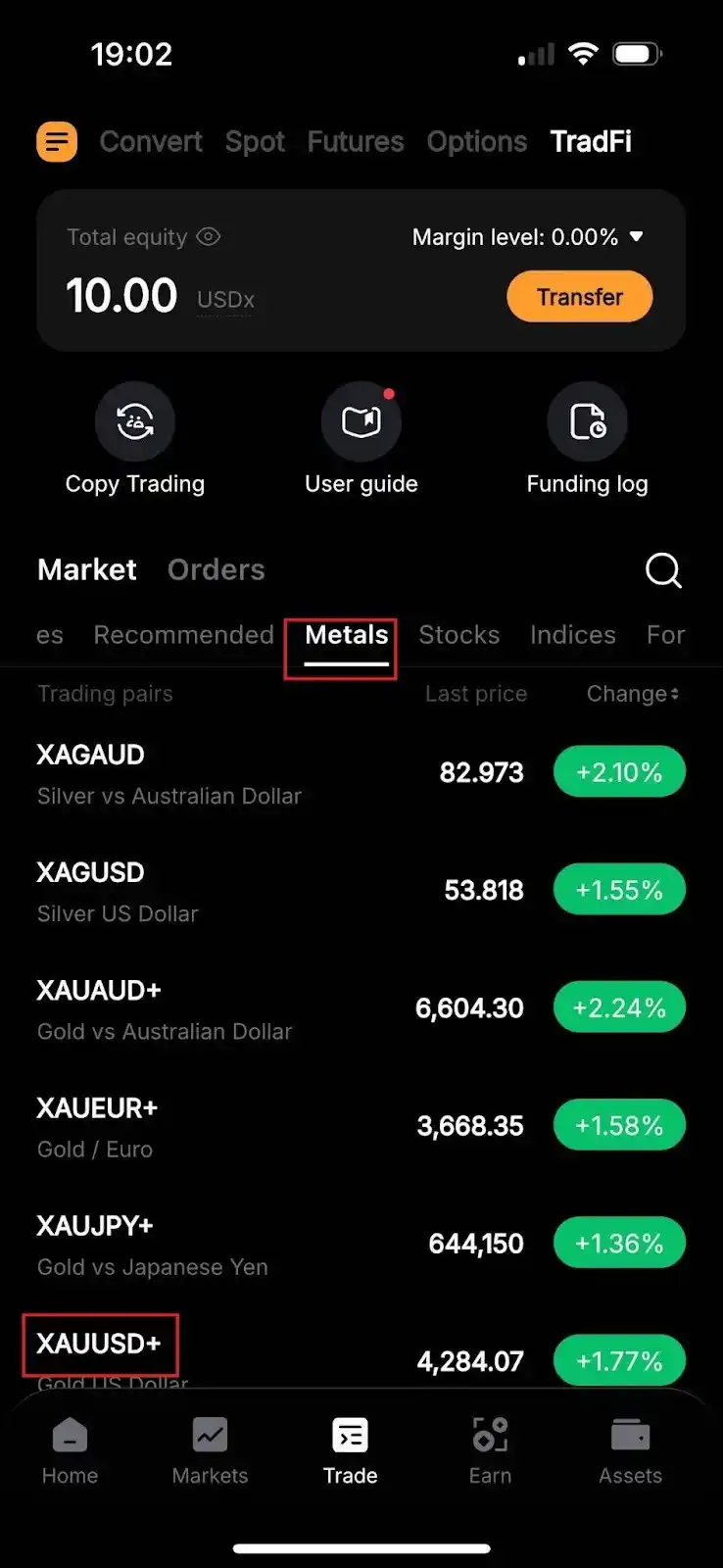

How to trade on Bybit TradFi (App version)

With the Bybit App, you can trade gold and major FX pairs on the go, directly using USDT margin. The app is optimized for fast navigation, quick execution and real-time market insights, making it ideal for both new and experienced traders.

1. Open the Bybit App: Download or open the Bybit App from the App Store or Google Play, then log in to your account.

2. Navigate to TradFi: Tap Trade on the bottom navigation bar, then select the TradFi tab at the top.

3. Choose your market: Select a category, such as Metals or Forex to view available pairs.

4. Pick your trading pair: Choose from XAUUSD+, XAUEUR+, XAUJPY+ or XAUAUD+ depending on your strategy.

5. Set order details: Adjust your order type (Market or Trigger), margin and leverage, then input the order value.

6. Place your trade: Tap Buy if you expect prices to rise, or Sell if you expect a drop.

7. Manage your risk: Toggle TP/SL to add Stop-Loss and Take-Profit before confirming your trade.

The Bybit App offers a sleek, secure and user-friendly experience built for traders who want instant access to gold and FX markets anytime.

Benefits of trading gold & FX on Bybit TradFi

Bybit TradFi bridges the flexibility of crypto with the stability of traditional markets, offering traders a seamless way to diversify their portfolios. You can trade gold and forex directly in USDT, eliminating the need for fiat conversions and extra transfer steps.

The platform provides 24/7 market access, allowing you to capture global price movements beyond traditional trading hours. With institutional-grade liquidity, trades execute quickly and efficiently with minimal slippage.

All assets, crypto and TradFi products like gold, forex and stocks, are managed within a single unified account, while flexible leverage lets you tailor positions to your personal risk tolerance.

This integration makes portfolio diversification simple, fast and fully accessible through Bybit.

Risk management for trading gold & FX

Gold and FX may move fast, so disciplined risk control is key. Always use Stop-Loss and Take-Profit tools to protect your capital and lock in gains automatically. Limit each position to around 1–2% of your total portfolio, ensuring that no single trade impacts your overall balance significantly. Diversify across multiple pairs, such as XAUUSD+, XAUEUR+ and XAUJPY+, to reduce exposure to any one currency. Staying informed on global news, particularly central bank decisions, inflation data and rate outlooks, is vital, as these can shift market sentiment instantly.

Bybit TradFi provides built-in risk controls, charting tools and analytics to help you make measured, data-driven decisions every time you trade.

Closing thoughts

Bybit TradFi blends the convenience of crypto trading with the depth of traditional markets, empowering users to diversify easily within one platform. Whether you trade from desktop or mobile, Bybit TradFi offers the same seamless experience, fast, intuitive and built for every market condition. Start trading gold and forex pairs using USDT on Bybit TradFi now.

#LearnWithBybit