How to trade gold on Derivatives with Bybit

Gold has traditionally been recognized as an excellent hedge against inflation, volatility, and stock market downturns. When stock bear markets arrive or when geopolitical events send asset price charts into wild zigzags, investors know there’s an island of stability and value retention in the form of the world’s premier precious metal.

Bybit makes it easy to trade gold via derivatives products like perpetual futures based on two gold-backed cryptocurrencies, Tether Gold (XAUT) and PAX Gold (PAXG). Thanks to these perp contracts, you can speculate on the price of gold without actually owning the asset, with all profits and losses settled in the highly familiar and popular stablecoin Tether (USDT).

Key Takeaways:

Bybit offers derivatives trading opportunities for gold primarily via two perpetual futures contracts, XAUTUSDT and PAXGUSDT.

Trading gold via these perp contracts offers unprecedented flexibility, 24/7 availability, the ability to open long and short positions quickly, generous leverage opportunities and settlement in the USDT stablecoin.

What are XAUT and PAXG?

Tether Gold (XAUT) and PAX Gold (PAXG) are the two leading tokenized gold cryptocurrencies by market capitalization. Both assets are backed by reserves of physical gold and track the price of one troy ounce of gold. In the small but well-established niche of tokenized gold cryptos, XAUT and PAXG collectively hold around 90% of the category’s total market cap, with XAUT at $2.2 billion capitalization and confidently at the top of the rankings, and PAXG at $1.4 billion as a runner-up (all figures are as of the time of writing on Oct 21, 2025).

Both cryptocurrencies boast full, 100% backing by physical gold, held in vaults in Switzerland for XAUT and in the vaults of the London Bullion Market Association (LBMA) for PAXG.

XAUT is issued by Tether Limited Inc., incorporated in the British Virgin Islands (BVI) and headquartered in El Salvador since early 2025. Tether Limited is also the issuer of the USDT stablecoin, the world’s most actively traded crypto asset.

PAXG is issued by Paxos Trust Company, which is incorporated and headquartered in New York and has overseas offices in London, the UK, and Singapore.

Why trade gold derivatives?

Trading gold through derivatives products like perpetual futures (perps) offers a number of advantages over spot gold trades or buying the precious metal on traditional commodity exchanges.

Firstly, using the XAUT and PAXG perp contracts, which are settled in USDT on Bybit, allows you to access leverage opportunities of up to 50x. For comparison, the XAUT/USDT pair on Bybit’s Spot market offers a leverage ratio of only up to 10x via margin trading.

You can also take long and short positions to profit from rising or falling gold prices. While gold tends to rise during bear markets and economic uncertainty, it often trends downward at times of stock market optimism. Being a low-volatility asset, the yellow metal often sets on predictable, long-term uptrends or downtrends, which allows you to benefit from longing or shorting it via perps.

Additionally, the USDT-based settlement for the XAUT and PAXG perps makes profit and loss calculations straightforward. And, of course, you can trade the contracts 24/7.

Finally, using gold-backed cryptocurrency perps is less complicated from the licensing and regulatory perspective than trading gold on traditional commodity exchanges.

Step-by-step guide to trading gold on derivatives with Bybit

On desktop

Step 1: Visit Bybit’s homepage, hover over Trade in the top menu, and then click Futures. If you are already logged in to Bybit on your browser, you might be automatically redirected from the homepage to your trading page. In that case, choose Trade and then Futures, as shown on the homepage.

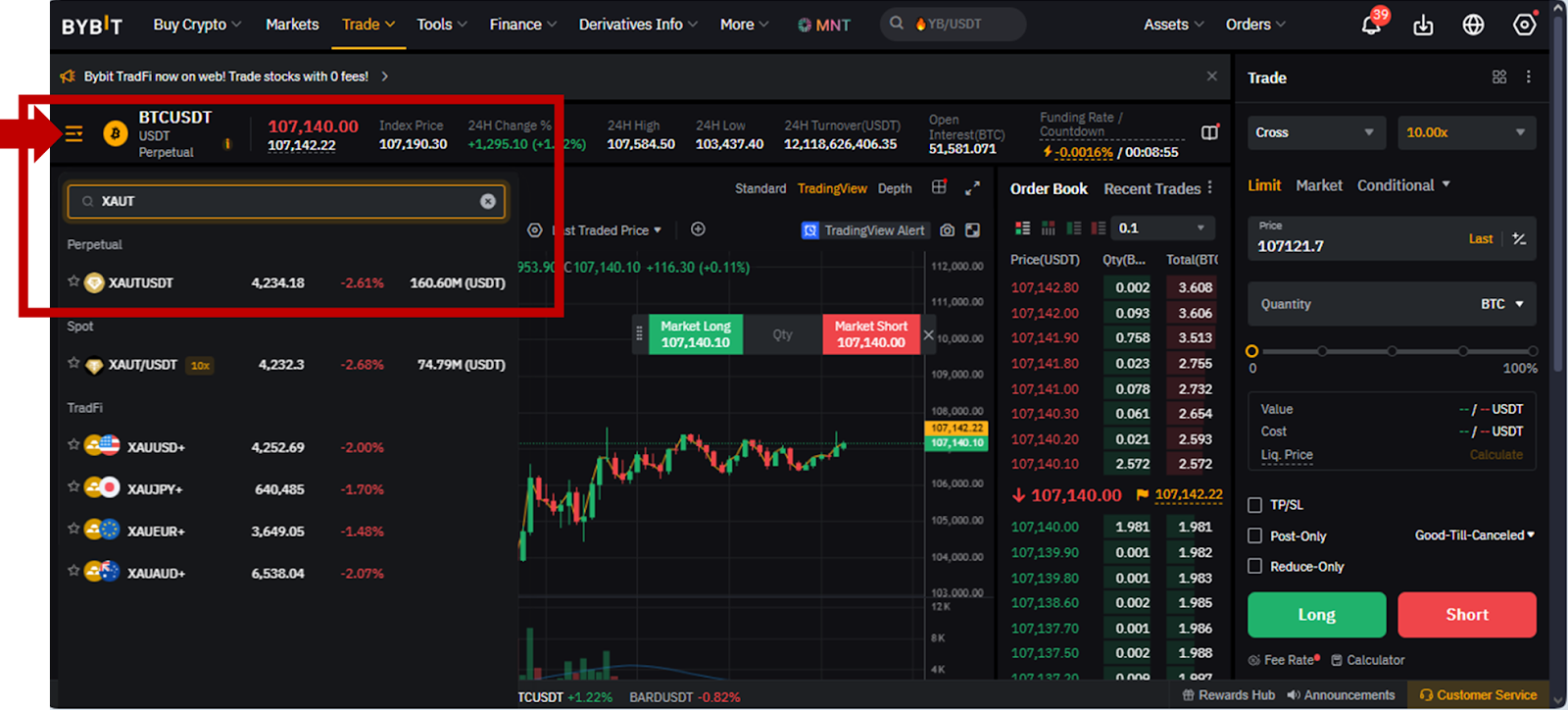

Step 2: On the Derivatives trading page, hover over the menu button in the top left, just to the left of the contract name (usually BTCUSDT by default), and in the search box that will appear, type the name of the coin, i.e., XAUT or PAXG. A list of all products with the coin will appear. Click on the XAUTUSDT or PAXGUSDT perpetual contract.

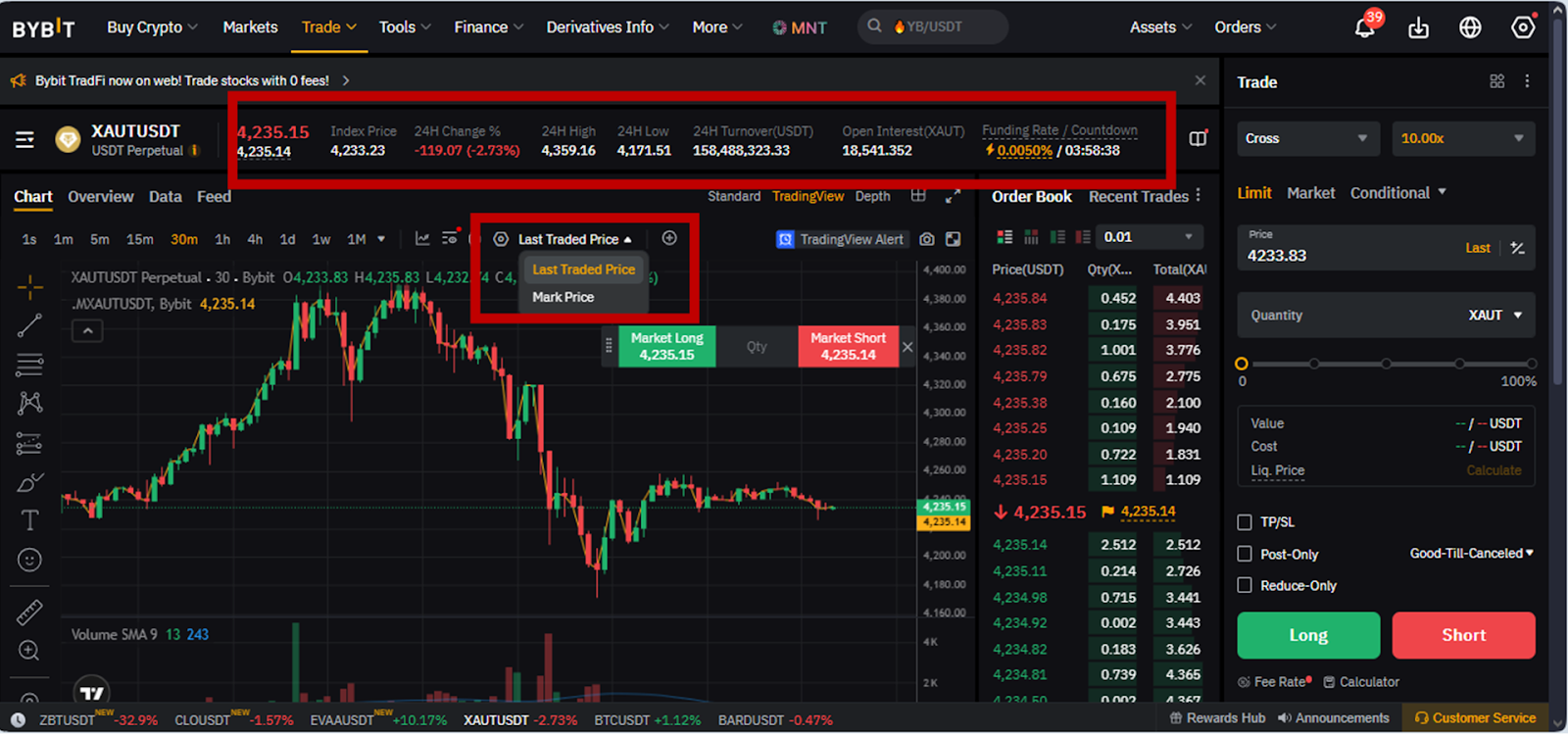

On the contract’s main page, you can review key details such as the price chart, mark price, index price, 24-hour change, open interest, and funding rate.

Step 3: After reviewing the market data, in the right-side panel, specify your order details: Order Type (Limit, Market or Conditional) and Quantity (for Market orders) as a minimum. Experienced derivatives traders may also want to specify additional settings, such as the preferred leverage ratio or price points for take-profit/stop-loss (TP/SL) orders. When ready to open your contract, tap on Long or Short to buy or sell, respectively.

On the Bybit App mobile application

Step 1: Open Bybit App, tap on Trade in the bottom menu and then Futures in the top menu.

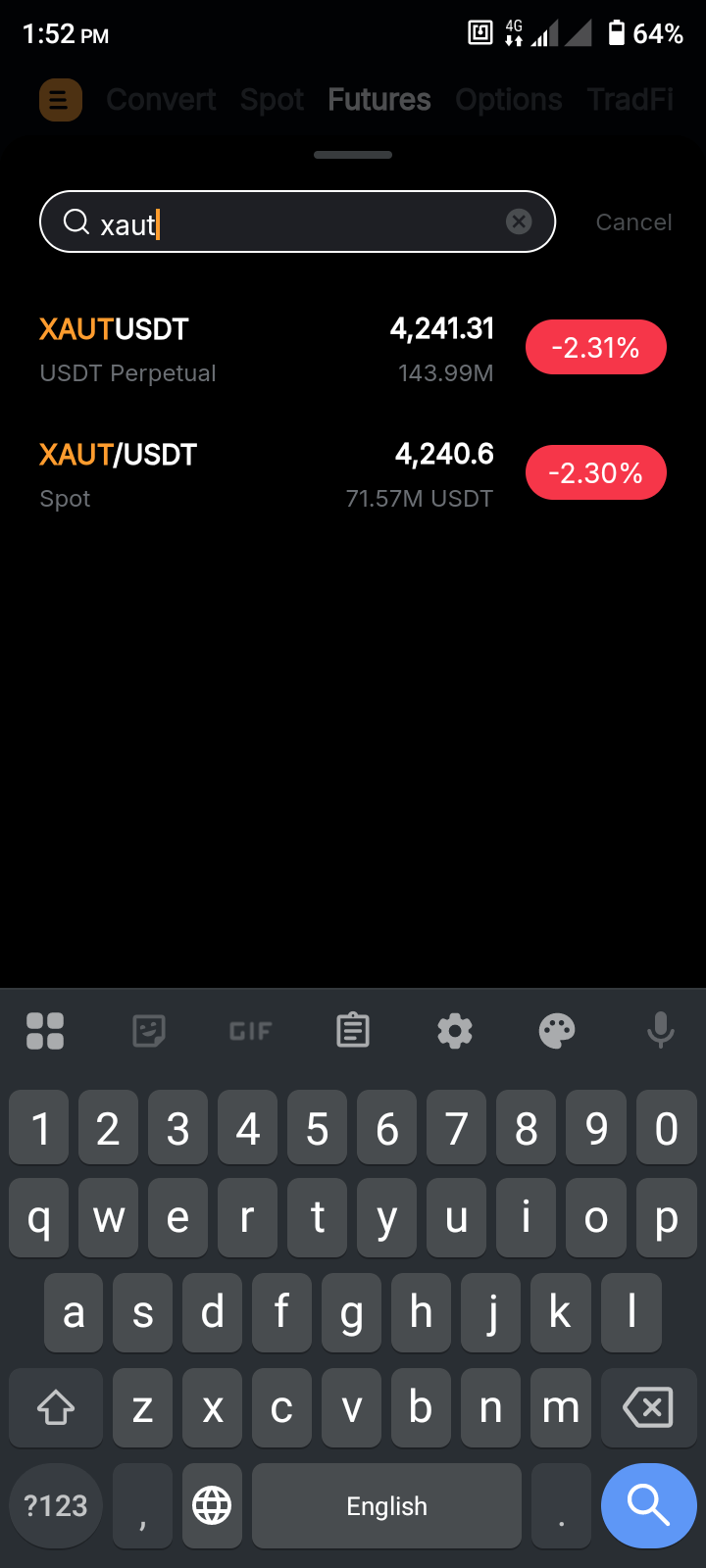

Step 2: In the futures trading screen, first tap on the contract name on the top left side (usually BTCUSDT by default). This will bring up a search box where you can type the name of the coin, i.e., XAUT or PAXG. You’ll see a list of all available products for the coin as you type it. Tap on the required perpetual contract, XAUTUSDT or PAXGUSDT.

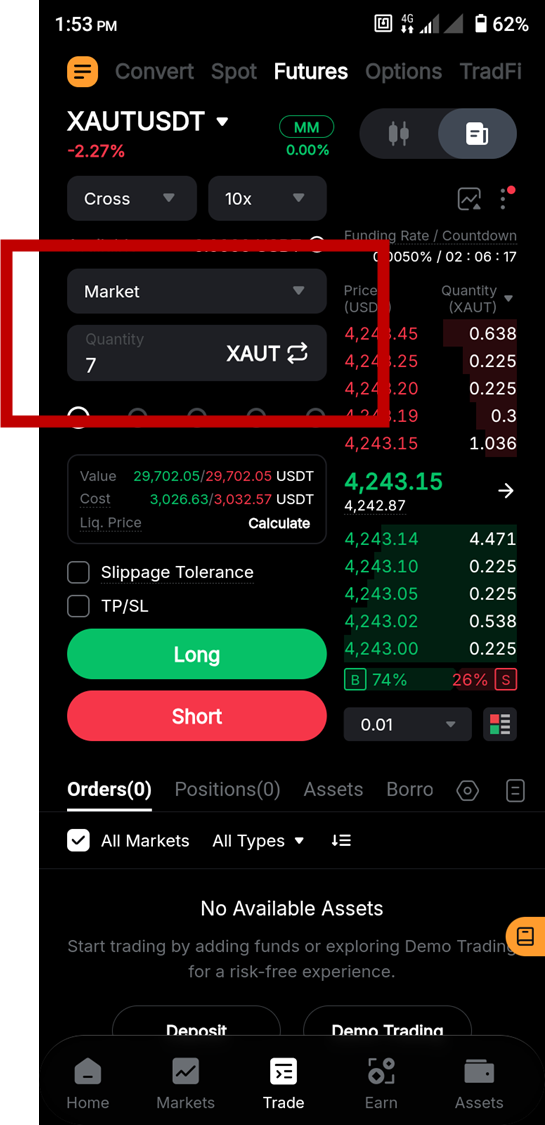

Step 3: In the trading screen for the contract, specify the order details: Order Type (Limit, Market or Conditional) and Quantity (for Market orders) as a minimum. Experienced derivatives traders may also want to specify additional settings, such as the preferred leverage ratio or price points for take-profit/stop-loss (TP/SL) orders. When ready to open your contract, tap on Long or Short to buy or sell, respectively.

Closing thoughts

Bybit’s perpetual futures XAUTUSDT and PAXGUSDT provide one of the most flexible and affordable ways to trade gold. Based on the two leading gold-backed cryptocurrencies, these perp contracts offer 24/7 availability, protections of the Bybit platform, convenient long and short position opening, generous leverage ratios and settlement in the widely used USDT stablecoin.

#LearnWithBybit