Bybit Smart Leverage: Max Gains in Extreme Market Volatility

The cryptocurrency market is witnessing unprecedented growth, with Bitcoin reaching new all-time highs despite experiencing some downturns. This volatility, while daunting for some, presents unique opportunities for traders. One such opportunity is using advanced trading tools like Bybit Smart Leverage to potentially enhance gains. This article delves into the intricacies of Bybit Smart Leverage, exploring its mechanism, benefits and risks, as well as how to get started with it.

Key Takeaways:

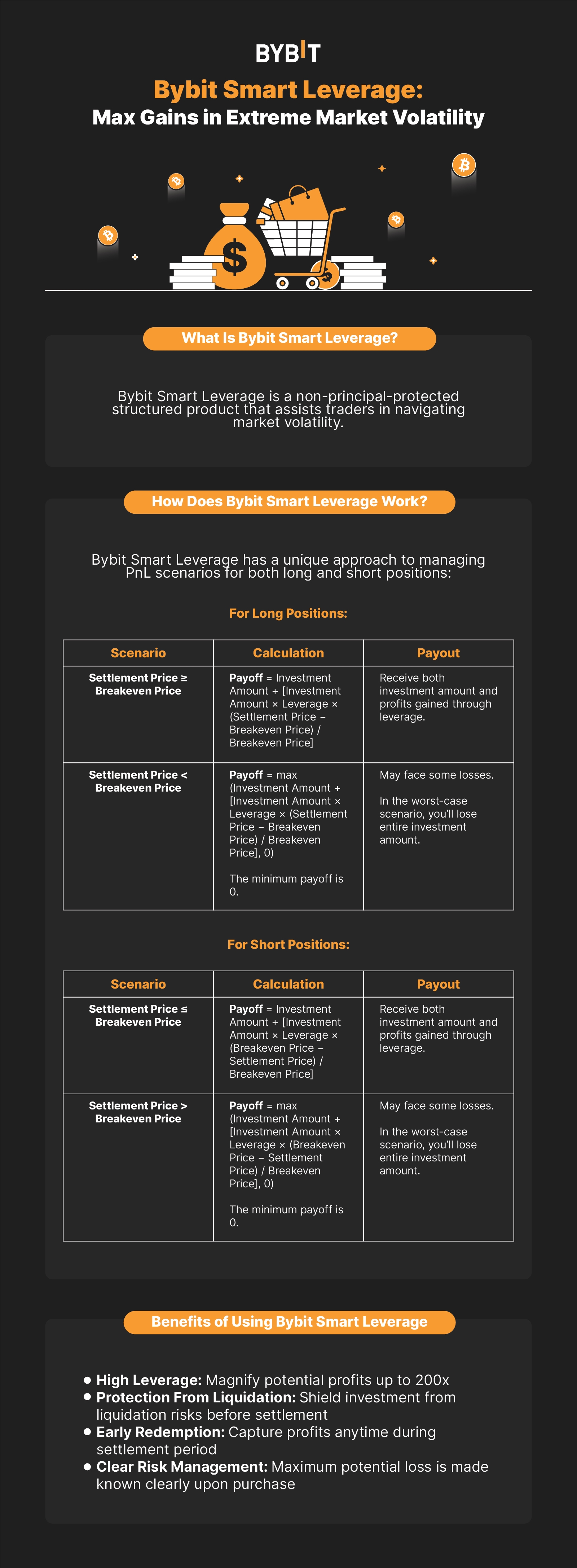

Bybit Smart Leverage is a non-principal-protected structured product that assists traders in navigating the tumultuous seas of market volatility.

It enables traders to make directional bets using substantial leverage, up to 200x, while minimizing liquidation risk before settlement.

What Is Bybit Smart Leverage?

Bybit Smart Leverage is a non-principal-protected structured product that assists traders in navigating the tumultuous seas of market volatility. It enables traders to make directional bets using substantial leverage, up to 200x, on select cryptocurrencies, effectively reducing the risk of premature liquidation before settlement times. It's especially advantageous for traders inclined toward leveraging heavily in markets characterized by abrupt price changes.

Moreover, Bybit Smart Leverage offers the option for early redemption, letting traders lock in profits before their settlement periods conclude. This flexibility is vital in fast-moving markets, where taking timely profits can significantly impact overall trading success.

Bybit Smart Leverage is available on both Bybit Web and Bybit App.

How Does Bybit Smart Leverage Work?

Bybit Smart Leverage has a unique approach to managing profit and loss (PnL) scenarios for both long and short positions. To help in your understanding of Bybit Smart Leverage, here are some terms you need to know:

Breakeven Price: A floating indicator calculated by the platform. For longs, the breakeven price is always above the entry price. For shorts, the breakeven price is always below the entry price. Once an order has been confirmed, the breakeven price will not change.

Current Price: The current Mark Price of a Perpetual contract.

Settlement Price: This is determined by calculating the average of the Derivatives Index Price every second for 30 minutes before expiration.

Here’s how these scenarios unfold:

For Long Positions:

Scenario | Calculation | Payout |

Settlement Price ≥ Breakeven Price | Payoff = Investment Amount + [Investment Amount × Leverage × (Settlement Price − Breakeven Price) / Breakeven Price] | Receive both investment amount and the profits gained through leverage. |

Settlement Price < Breakeven Price | Payoff = max (Investment Amount + [Investment Amount × Leverage × (Settlement Price − Breakeven Price) / Breakeven Price], 0) The minimum payoff is 0. | You may face some losses. In the worst-case scenario, you’ll lose your entire investment amount. |

For Short Positions:

Scenario | Calculation | Payout |

Settlement Price ≤ Breakeven Price | Payoff = Investment Amount + [Investment Amount × Leverage × (Breakeven Price − Settlement Price) / Breakeven Price] | Receive both investment amount and the profits gained through leverage. |

Settlement Price > Breakeven Price | Payoff = max (Investment Amount + [Investment Amount × Leverage × (Breakeven Price − Settlement Price) / Breakeven Price], 0) The minimum payoff is 0. | You may face some losses. In the worst-case scenario, you’ll lose your entire investment amount. |

This mechanism allows traders to strategically leverage their positions up to 200x, significantly amplifying their potential gains or losses. Bybit Smart Leverage is meticulously designed to offer traders the ability to engage in high-leverage trades with a clear understanding of their maximum risk exposure — specifically, the risk of losing their initial investment in adverse market conditions.

Benefits of Using Bybit Smart Leverage

The advantages of using Bybit Smart Leverage are manifold:

High Leverage: Significantly magnify your potential profits through leverage up to 200x.

Protection From Liquidation: You’re shielded from the risk of liquidation before settlement, which is a crucial safeguard during volatile market conditions.

Early Redemption: Capture profits at any point during the settlement period, offering flexibility in profit-taking strategies.

Clear Risk Management: The maximum potential loss is made known clearly upon purchase, enabling you to make informed decisions based on your risk tolerance.

Risks of Using Bybit Smart Leverage

While Bybit Smart Leverage offers numerous benefits, it also comes with its set of risks. Even though Bybit Smart Leverage can increase your gains, it can also amplify your losses. As such, you must be aware of the potential for significant financial loss if the market moves against your position. Additionally, while the risk of liquidation is minimized before settlement, it’s not entirely eliminated. Therefore, you need to ensure that you manage your leverage in a cautious manner.

How to Use Bybit Smart Leverage

Now that you’re better equipped by knowing how Bybit Smart Leverage works, let’s explore how you can use it to maximize your gains. You’ll first need to create a Bybit account, which you can do by following our detailed sign-up guide.

Once you’ve created your Bybit account, follow the steps outlined below to get started with Bybit Smart Leverage.

Buying a Smart Leverage Plan

Step 1: Log in to your Bybit account and hover your cursor over the Finance tab on the navigation bar at the top of the page. Then, hover over Earn and click on Bybit Structured Products.

Step 2: Click on Smart Leverage to enter the Bybit Smart Leveragehomepage.

Step 3: Scroll down under All Product Plans to explore the available plans based on Direction(Long or Short), Product Name, Leverage, Breakeven Price and Expiration. Once you’ve chosen your desired plan, click on its corresponding Buy Now button.

Step 4: Enter the amount you would like to invest, and make sure you acknowledge all the parameters you’ve chosen. Then, click on Buy Now.

Tip: Use the simulator on the top of the Bybit Smart Leverage homepage to estimate your potential Profit and Loss (PnL) by selecting the coin, indicating the direction and entering the investment amount.

Step 5: Once you’ve confirmed that all the order parameters you’ve set are accurate, click on Confirm. Then, you’ll be successfully subscribed to the plan you’ve chosen.

Notes:

The breakeven price is determined by various factors, including volatility and time remaining until expiration, and is calculated in real time.

Profit is only realized if the settlement price exceeds the breakeven price in the corresponding direction.

Viewing Your Orders

After you’ve successfully subscribed to a Smart Leverage plan, you can check your order details by clicking on the View Orders button in the pop-up window.

Alternatively, you can click on Assets at the top right corner of the Bybit page to enter the Earn Account page. Then, you can view your existing orders under the Smart Leverage tab.

Early Redemption

Step 1: Hover your cursor over the Assets page and select Earn under Invested Products. Click on Smart Leverage to view your active plans.

Step 2: Click on the corresponding Redeem button for the plan you’d like to redeem, and you’ll see a confirmation pop-up window. Verify the redemption details before clicking on Confirm.

Should You Use Bybit Smart Leverage?

Bybit Smart Leverage is best suited to traders who are comfortable with high-risk, high-reward strategies, and who are adept at navigating volatile market conditions. It’s particularly beneficial for those looking to capitalize on sharp price reversals in V-shaped markets, without the constant fear of liquidation.

However, it’s advisable for traders to thoroughly understand the mechanics of Smart Leverage and to proceed with caution, particularly if they’re less experienced with leveraged trading.

The Bottom Line

Bybit Smart Leverage offers a dynamic tool for traders looking to navigate the crypto market's volatility more effectively. By automatically adjusting leverage, it helps balance risk and reward, potentially leading to greater profitability. However, the use of leverage can amplify both gains and losses, so it’s crucial that you use this tool judiciously and with a clear understanding of the risks involved.

#LearnWithBybit