What Is Bybit Dual Asset? (Updated 2025)

What Is Bybit Dual Asset?

At a glance:

Dual Asset is a short-term speculation vehicle that lets you capitalize on small price movements in the market. All you have to do is predict the direction of a given crypto asset, such as BTC, ETH or MNT, within a preset time frame. Upon maturity, your returns will be in the form of either the base crypto (USDT or BTC) of the quoted pair, or your chosen crypto asset, depending upon the outcome of your trade.

Bybit Dual Asset 2.0 is an enhanced version of the predecessor focusing on higher returns on capital for traders with better investment flexibility. Traders could customize their orders by entering different directions of the market trend based on their predictions to enjoy high-interest yields even if the predicted asset price did not trigger. Previously, Bybit Dual Asset only offered USDT-quoted pairs. Following the upgrade, Dual Asset now includes BTC-quoted pairs, starting with ETH-BTC.

Glossary for Bybit Dual Asset

Settlement Price: The average of the Bybit Spot market price in the 30 minutes prior to Settlement Time, which is 8 AM UTC on the Settlement Date.

Target Price: The price you wish to buy or sell crypto.

Subscription Limit: The minimum and maximum subscription amount for the chosen product.

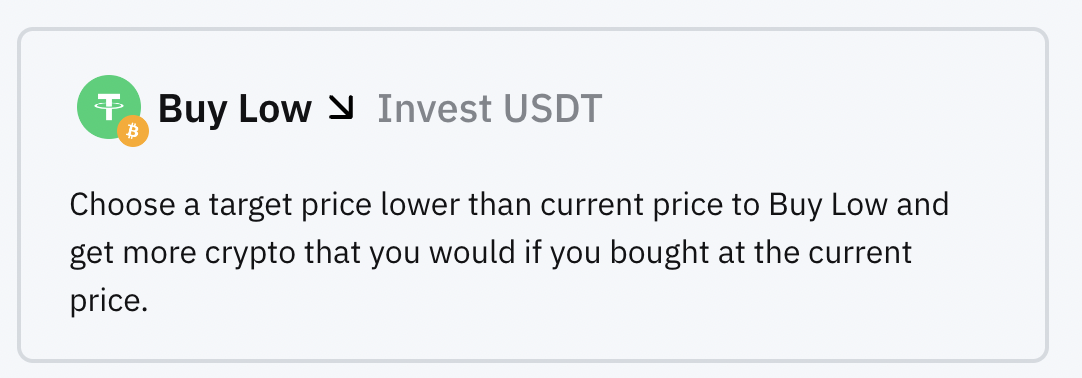

Understanding Buy Low, Sell High on Bybit Dual Asset 2.0

The Buy Low function on Bybit Dual Asset 2.0 refers to a product subscription in which traders anticipate the chosen digital asset to settle at a low targeted price at a predetermined time range. Here’s a user case scenario to help to visualize the product function:

Subscription mode: Buy Low

Underlying asset: USDT/BTC

Target asset price: $21,000

Subscription amount: 1,000 USDT

Settlement period: 1 day

Yields rate (APY): 110%

Alex chooses to buy BTC/USDT Dual Asset, and he will be using USDT as an underlying asset for the subscription to buy BTC at his desired lower crypto price. The yields vary depending on the settlement date, which ranges from 1 to 5 days. Assuming Alex opts for a 1-day subscription with 110% yields in APY, he is entitled to claim rewards in two different scenarios:

Scenario 1: When the asset target price is reached

On the settlement date, if the Settlement Price ≤ Target Price, he will successfully purchase BTC at his desired price with his subscribed USDT and interest income.

His returns will be calculated with the formula provided below:

Returns: (Subscription Amount + Interest) / Target Price

Interest: Subscription Amount x APY x Subscription Period (in days)/365

1,000 + ( 1,000 × 110% × 1/365) / 21,000 = 0.04776 BTC

Assuming the BTC price is $23,000 when cash out, Alex’s gross return on investment for the chosen Dual Asset subscription would be $1,098.48.

Scenario 2: When the asset target price fails to reach

On the settlement date, if the Settlement Price > Target Price, the target crypto will fail to be purchased, and you’ll receive your subscription amount and interest income in USDT.

Returns: (Subscription Amount + Interest)

Interest: Subscription Amount x APY x Subscription Period (in days)/365

Assuming the settlement price is higher than the target asset price, settling at $21,500. Alex’s return on investment will be calculated as below:

1,000 + (1,000 × 110% × 1/365) = 1,003.0137 USDT

Even though Alex failed to purchase BTC at his desired price, he still earned rewards on his contributed USDT in the Dual Asset pool. It is still a win-win situation for Alex, as he did not lose any money for opportunity costs.

Note: In both cases, Alex will still earn interest on his investment in the form of USDT.

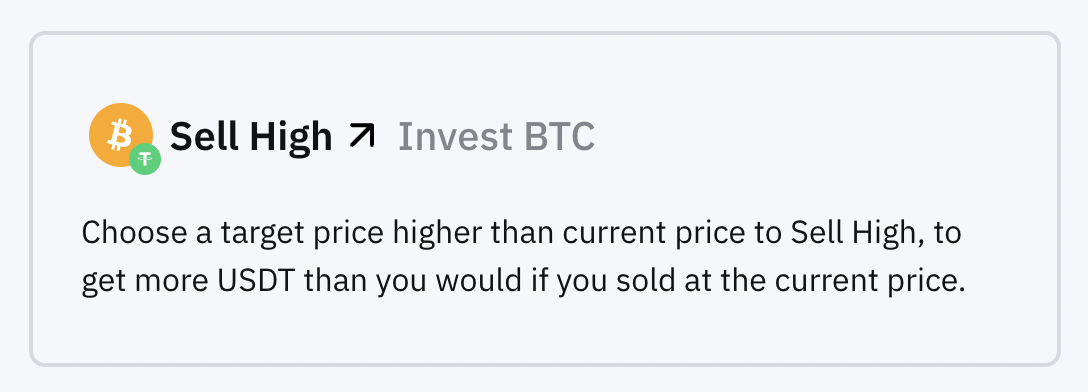

The Sell High function is the reverse of the Buy Low, in which traders anticipate selling the chosen digital assets at a higher targeted price within a predetermined date. Here’s a user case scenario to help to visualize the product function:

Subscription mode: Sell High

Underlying asset: BTC/USDT

Target asset price: $23,500

Subscription amount: 1 BTC

Settlement period: 1 day

Yields rate (APY): 150%

Alex chooses to sell BTC/USDT Dual Asset, and he will be using USDT as an underlying asset for the subscription to sell BTC at his desired crypto price at a higher anticipated price. The yields vary depending on the settlement date, which ranges from 1 to 7 days. Assuming Alex opts for a 1-day subscription with 150% yields in APY, he is entitled to claim rewards in two different scenarios:

Scenario 1: When the asset target price of $24,000 is reached

On the settlement date, if the Settlement Price ≥ Target Price, he will successfully sell his BTC at his desired price and receive USDT in return.

Returns: (Subscription Amount + Interest) × Target Price

Interest: Subscription Amount × APY × Subscription Period (in days)/365

Assuming the settlement price is higher than the target asset price, settling at $24,000. Alex’s return on investment will be calculated as below:

1 + (1 × 150% × 1/365) × 24,000 = $98.6301

Alex’s return on investment would be a total of 24,098.6301 USDT, including his capital of 24,000 USDT and the yields.

His returns will be calculated with the formula provided below:

Scenario 2: When the asset target price failed to reach, settling at $23,000.

On the settlement date, if the Settlement Price < Target Price, he fails to sell his crypto at the target price and will receive yields in BTC as a return.

1 × (1 × 150% × 1/365) = 1.0041 BTC

When converting 1.0041 BTC to USDT at $23,000 per BTC, Alex will receive 23,094.30 USDT, including the yields.

Why should you invest in Bybit Dual Asset?

Benefits

Enhanced yields: Users will earn an enhanced return regardless of their predictions.

Ideal for crypto asset HODLers, especially of USDT/BTC/ETH/MNT and other popular altcoins, who seek to accumulate more of their chosen cryptocurrencies to potentially increase their crypto holdings or take profit in the form of crypto.

Flexible high investment yield options: Many users prefer to hold a major crypto, such as BTC and ETH, over a stablecoin like USDT. With the introduction of the ETH-BTC quoted pair, you’ll be able to maximize your potential returns using the two biggest cryptocurrencies.

Short tenure: Shorter deposit period allows you to manage your assets as you desire.

VIP-enhanced perks: Better subscription flexibility with a daily subscription rate, higher deposit and withdrawal assets limits, and a shorter lock-up period.

Dual Asset might be a good fit for you if:

You’re comfortable receiving yield in either USDT, BTC or alternate crypto assets.

You wish to earn potentially higher yields and accumulate alternate crypto assets even during a downturn market.

You have confidence in the predicted price movement between the two crypto assets of your chosen Dual Asset product.

Bybit VIPs Extra Perks

Bybit VIP users can unlock additional perks when investing in Bybit Dual Asset 2.0. These benefits include

Daily unlimited subscription with multiple positions

There is no position limit as to how much a VIP trader can deposit in Bybit Dual Asset. Bybit supports a large number of deposits.

VIP traders can enjoy a shorter lock-up period (24 hours from the subscription to the settlement date)

How does Bybit Dual Asset 2.0 work?

Bybit Dual Asset 2.0 leverage on sophisticated trading mechanics to allow product participants to earn high yields with greater flexibility. The subscribed assets will be deployed to Bybit Derivatives for hedging via a trusted third-party entity affiliated with Bybit. The yield generation process will not involve any on-chain activity.

Participants will earn yields by capitalizing on the asset’s price movements by predicting the price direction of a crypto asset within a predetermined time frame.

Bybit Dual Asset vs. Dual Asset 2.0: The differences

| Dual Asset 2.0 | Dual Asset (Version 1) |

Investment mechanics | Buy low, Sell High upon contract maturity. | Relies on the Settlement Price and Benchmark Price that decides the yields upon contract maturity. |

Up to 25 latest crypto tokens/coins | BTC, MNT, ETH, USDT, USDC | |

Returns calculation | Buy Low 1. Target Price is reached:

2. Target Price is not reached:

Sell High 1. Target Price is reached:

2. Target Price is not reached:

| 1. Settlement Price < Benchmark Price

2. Settlement Price ≥ Benchmark Price

|

Settlement Date | 1-, 3-, 5-days | 1-, 3-, 5-, 7-days |

Rewards | Up to 500% APY yields | Up to 400% APY yields |

Notes:

— On the Settlement Date, Bybit will use 8AM UTC as the juncture at which to decide if the Settlement Price has reached the Target Price.

— The proceeds from your Dual Asset order will be returned to you within five (5) minutes after Settlement Time (i.e., 8AM UTC on the Settlement Date).

Who should deposit in Bybit Dual Asset?

Dual Asset 2.0 is a trading tool that allows you to capitalize on price movements even in a volatile market. It provides a higher yield, and the lock-up period is short and flexible. Higher yield does bear higher risk; however, users have the liberty to decide how they feel about the current market and to deposit accordingly.

We can help you secure a high yield for your assets today, whether the market aligns with or against your forecast. If you have crypto assets or stablecoins sitting idle in your account, why not participate in Dual Asset 2.0 to gain more crypto assets or earn profit in stablecoins? Either way, a high return on your assets is guaranteed.

However, here are the risks involved:

The return on asset value is not guaranteed due to price (value) fluctuations.

In the event of adverse market movements, your returns in the settlement asset may be less than your original deposit asset upon maturity.

Top pro tips for maximizing Bybit Dual Asset

Our new and improved product structure has made Dual Asset 2.0 simpler than ever. However, we still encourage users to research to forecast the movement of the coin’s price.

When to use Dual Asset

Bullish market

In a bullish market, the settlement price will probably exceed the target price. The price of the coin will either begin or continue to climb each day. In such a scenario, depositing USDT is appropriate, as you stand to gain more USDT in return. If you were to deposit BTC/ETH/MNT, your coins would be converted to USDT based on the target price plus return yield. Even though you’ve lost out on the increment of BTC/ETH/MNT price on day T+1, if you intended to cash them out on day T, you’ll have achieved that with an additional yield.

Bearish market

In a bearish market, the price of the coin is in a downward trend. Whether you deposit BTC/ETH/MNT or USDT, your returns will be in other crypto assets apart from stablecoins. This will allow you to gain more coins with yield, even if the price of the coins takes a downturn. The accumulated coins can be used for trading or HODLing as a store of value to appreciate.

The earlier you deposit, the higher the APY

With every new plan released, we strongly encourage users to deposit early. The earlier you deposit, the higher the APY to which you’re entitled. The APY will be refreshed every 30 seconds to 1 minute. Once the plan is submitted, you can be sure that you’ve locked in the APY.

However, since the APY is refreshed relatively quickly, there could be a slight discrepancy if the yield at the 1-minute mark differs from that at the time the user submitted the order. Please note that new plans are released every day at 8AM UTC.

Benchmark price updated within seconds

With the benchmark price being updated so frequently, you can now enter Dual Asset 2.0 with peace of mind. Referencing the estimated benchmark price, decide which coins you’d like to deposit in order to gain your desired outcome.

The estimated target price will help you decide the price at which you’re submitting your order. However, do note that the target price is only an estimate. The actual target price will refresh after your order has been successfully submitted.

Dual Asset 2.0 can be used as an alternative for a limit order

Dual Asset 2.0 can be considered a superior replacement to a limit order on the Spot market when you’re looking to realize a profit from a coin or if you want to set a target price at which to buy it.

On days when you’d like to realize a profit from a coin, instead of placing a limit order to sell off your coins, you can deposit them with Dual Asset. This will give you a high APY, along with what you could have received if you’d sold your coins via conditional order.

In a downturn where the settlement price falls below the target price, you stand to gain more coins in return and would be better off using Dual Asset, compared to setting a target price to buy in via a limit order. This is because the return on coins is also paired with a high APY.

What are the risks of Dual Asset?

Although Dual Asset is a relatively safe investment product, risks are still involved. The following risks are associated with Dual Asset:

There is uncertainty about which token will be settled upon contract maturity during extreme market price fluctuations.

The returns on asset value are not guaranteed due to market volatility. Participants may receive lesser returns if the asset price drops below the entry price.

Subscribed assets are locked, so you cannot cancel or redeem your plan before the Settlement Date.

If the market price moves further away from the Target Price, you may lose the opportunity to buy or sell at a desired price.

The trade can only occur based on the Settlement Date price.

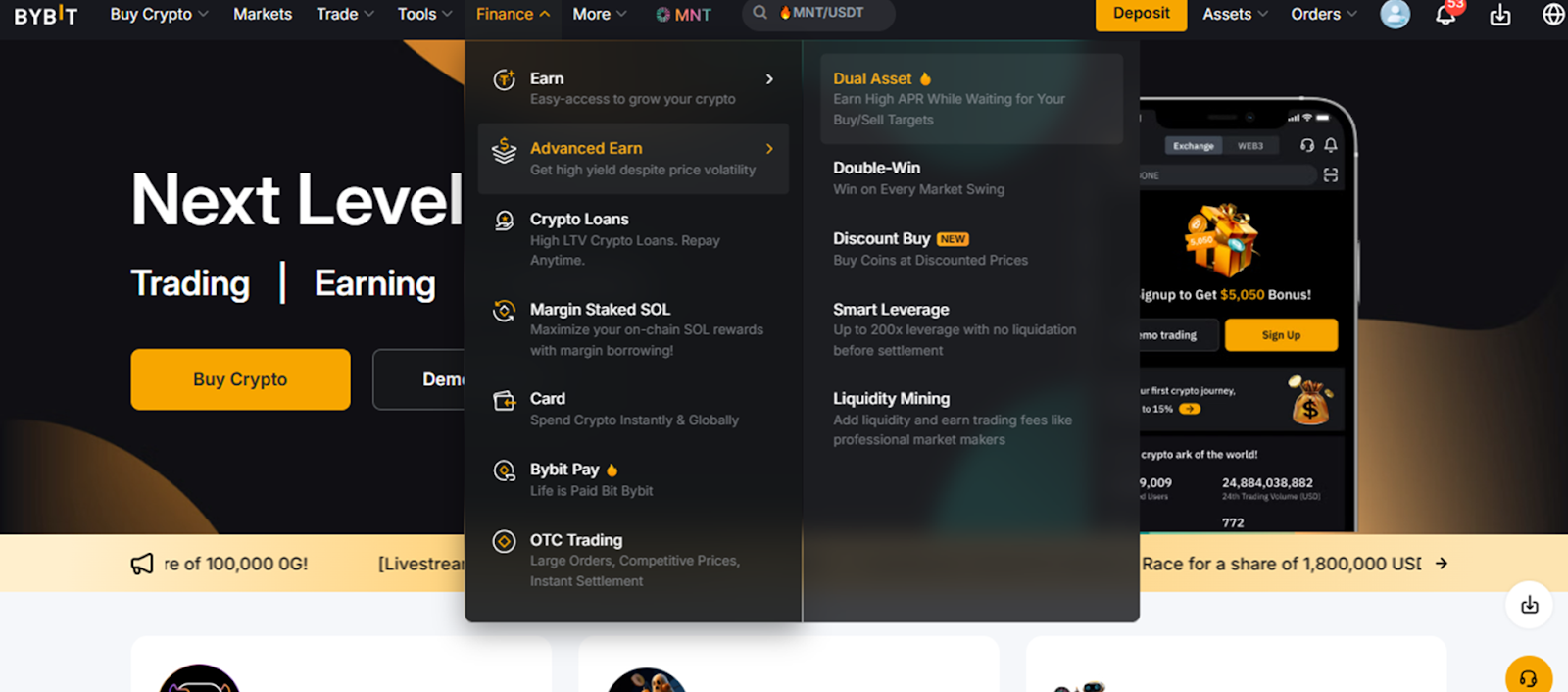

How to start investing in Dual Asset

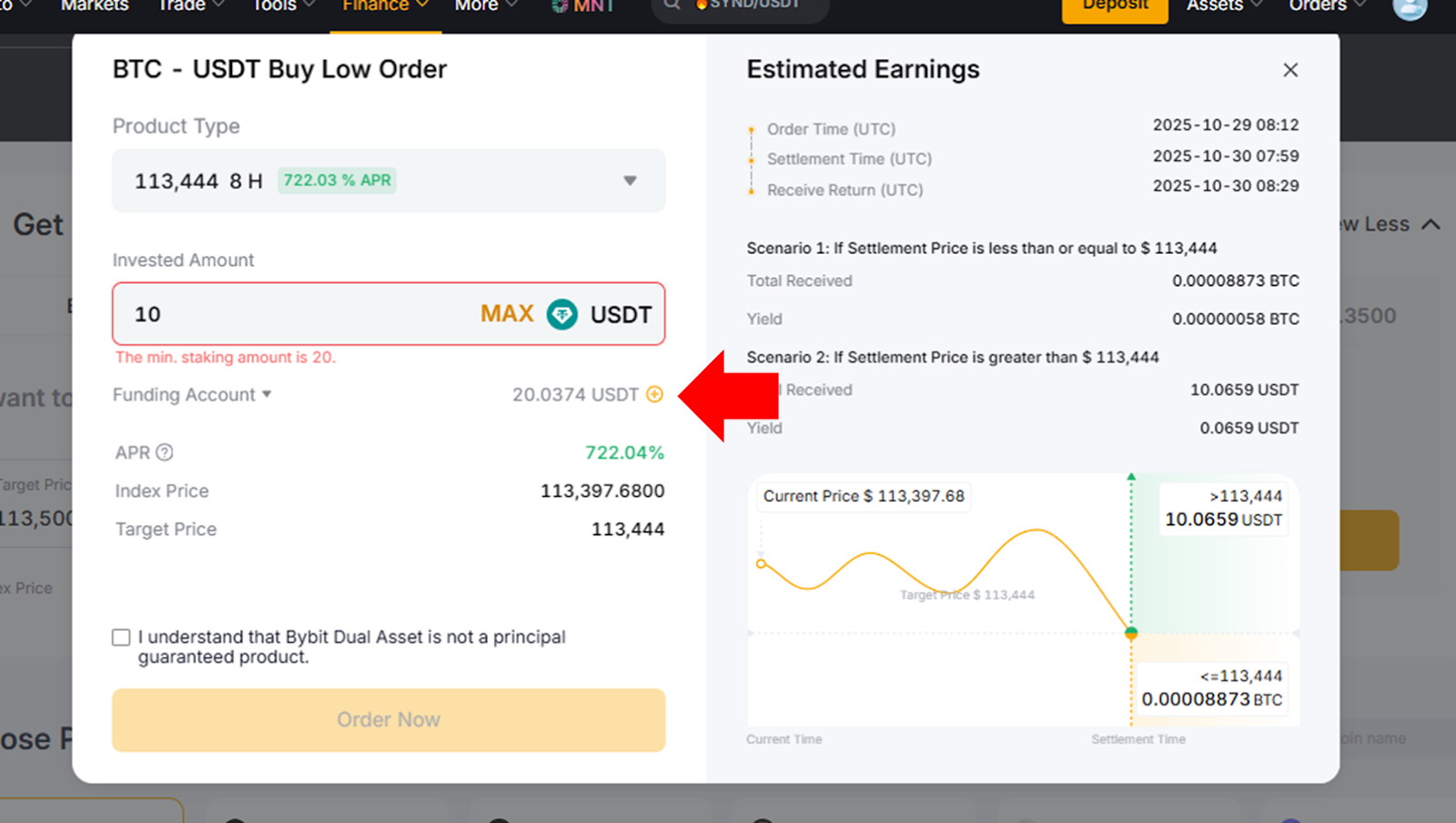

Before using Dual Asset, you’ll need to sign up for a Bybit account (if you haven’t already done so) and fund it with the minimum amount required for this product ($20, as of October 2025). After that, follow the steps below to start investing via Dual Asset.

Create your order

Step 1: Visit Bybit’s homepage, log in to your account and hover your cursor over the Finance tab in the top menu. In the drop-down menu that will appear, hover over Advanced Earn, and then click on Dual Asset.

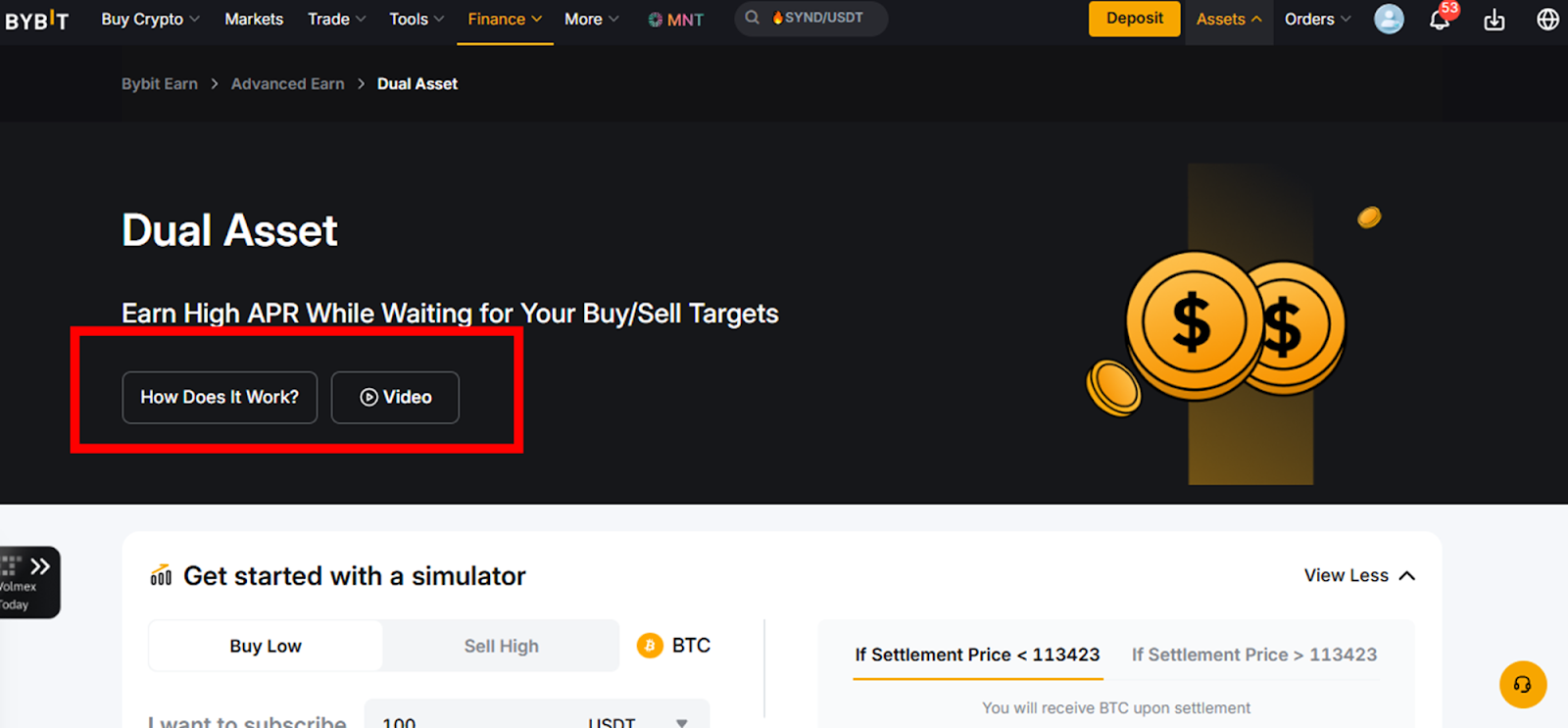

Optionally, on Dual Asset’s main page, you can familiarize yourself with the product and view all the finer details by clicking on How does it work? for text-based info, or by clicking on the Video button to watch the product description video.

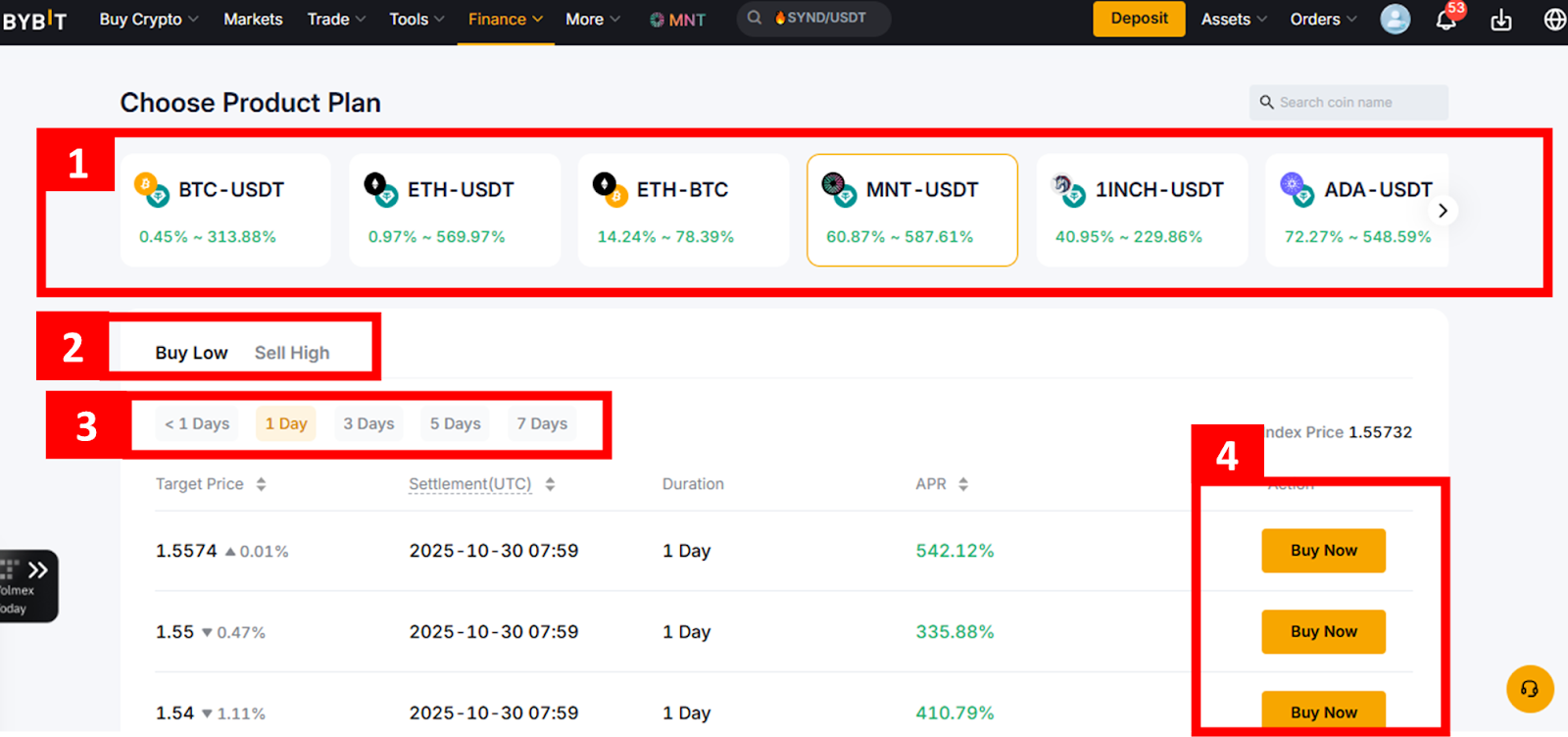

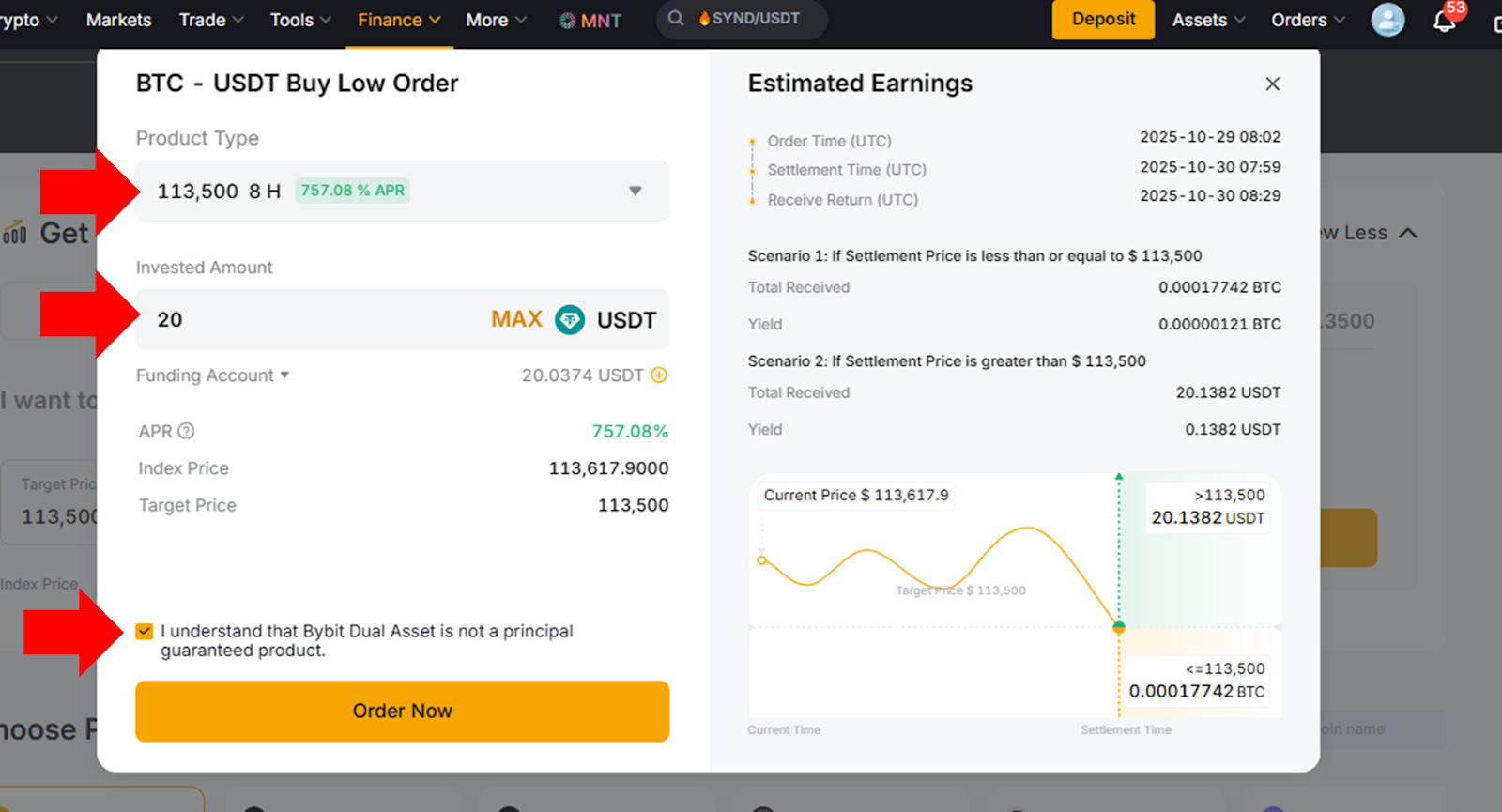

Step 2: On Dual Asset’s main page, scroll down to the Choose Product Plan section, select your preferred trading pair, choose if you want to Buy Low or Sell High and pick a plan duration (e.g., <1 day, 1 day, 3 days, 5 days or 7 days). Then, review the available plan options and click on the Buy Now button next to a preferred plan.

Step 3: In the Dual Asset order screen, choose your Product Type, enter your preferred Invested Amount, tick the box to acknowledge that you understand the nature of the product and click on the Order Now button to place your order.

Note that the APR and target price will refresh every minute, based on the latest price changes.

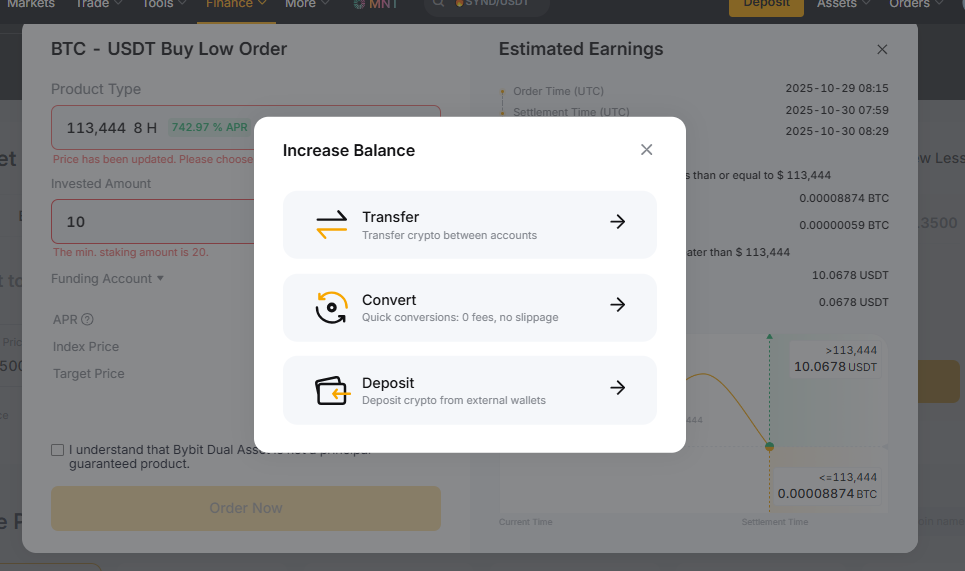

For the order to go through, your Funding Account must have sufficient funds for the minimum amount required for the Dual Asset product. As of October 2025, the minimum required is an equivalent of $20. If you don’t have enough funds in your Funding Account, you can click on the + icon just below the Invested Amount field to top up your account using one of three methods:

- Transfer (from your other accounts)

- Convert (to convert other crypto funds in your account)

- Deposit (to fund your account from external wallets or exchange accounts)

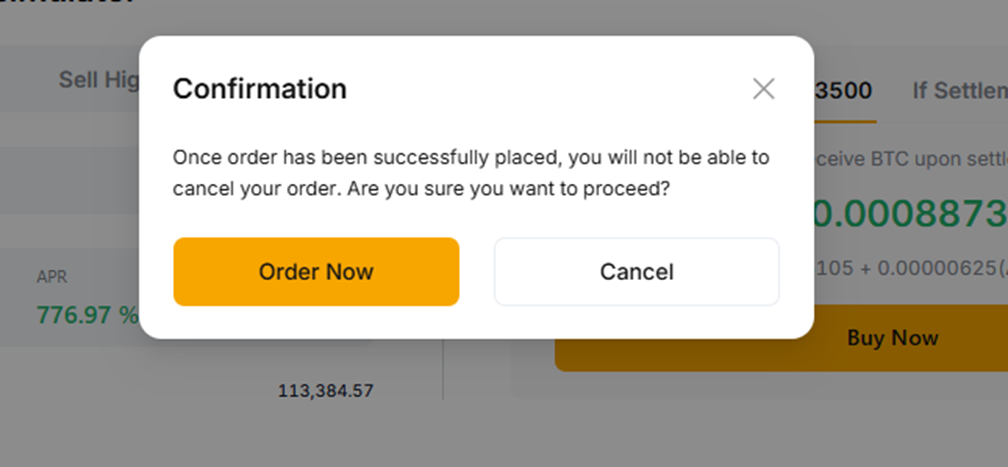

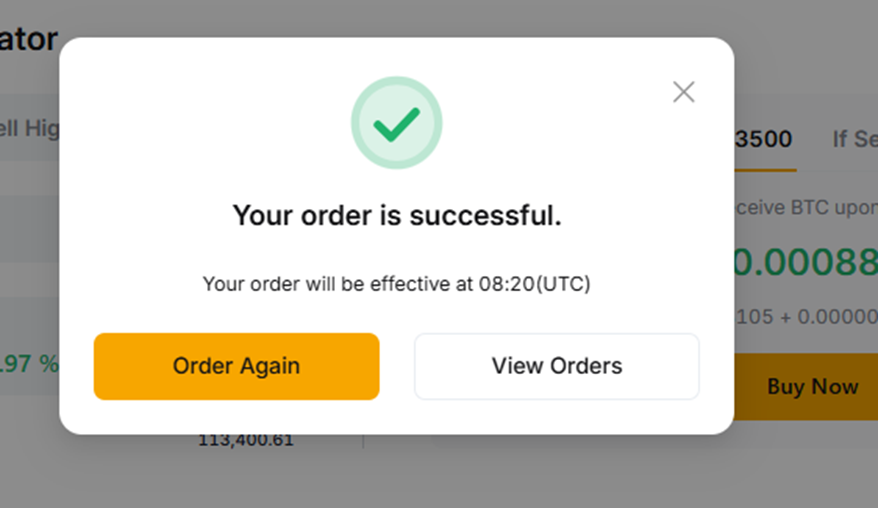

Step 4: After going through the Dual Asset order screen, you’ll see a dialog screen asking you to provide the final confirmation. Click on Order Now. In a few seconds (up to a minute maximum), you’ll receive a confirmation that your order has been placed.

View your orders

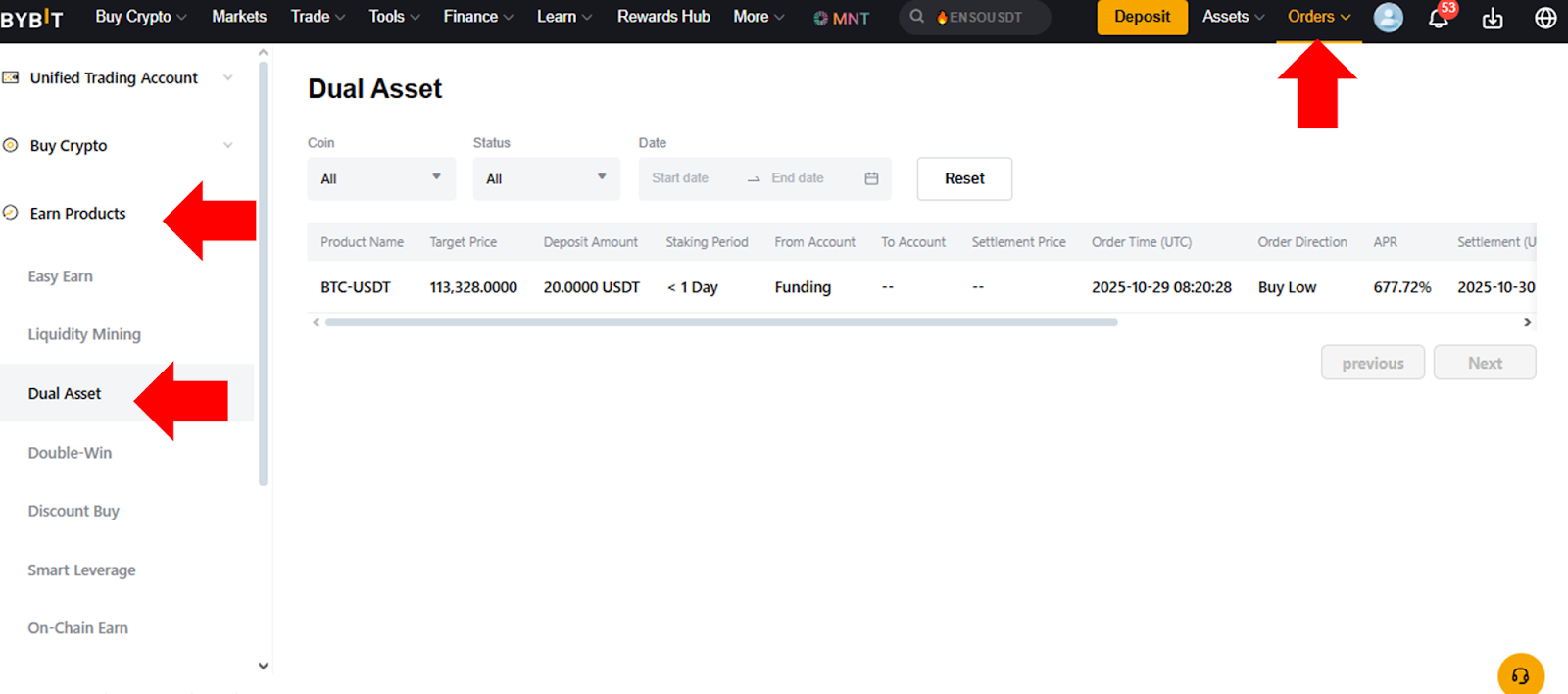

To view your Dual Asset orders, click on the View Orders button in the final confirmation screen above.

You can also view your Dual Asset orders at any time. Simply click on the Orders tab in the top-right menu of your screen (when logged in), then click on the Earn Products link in the left panel of your Orders page, and finally click on Dual Asset.

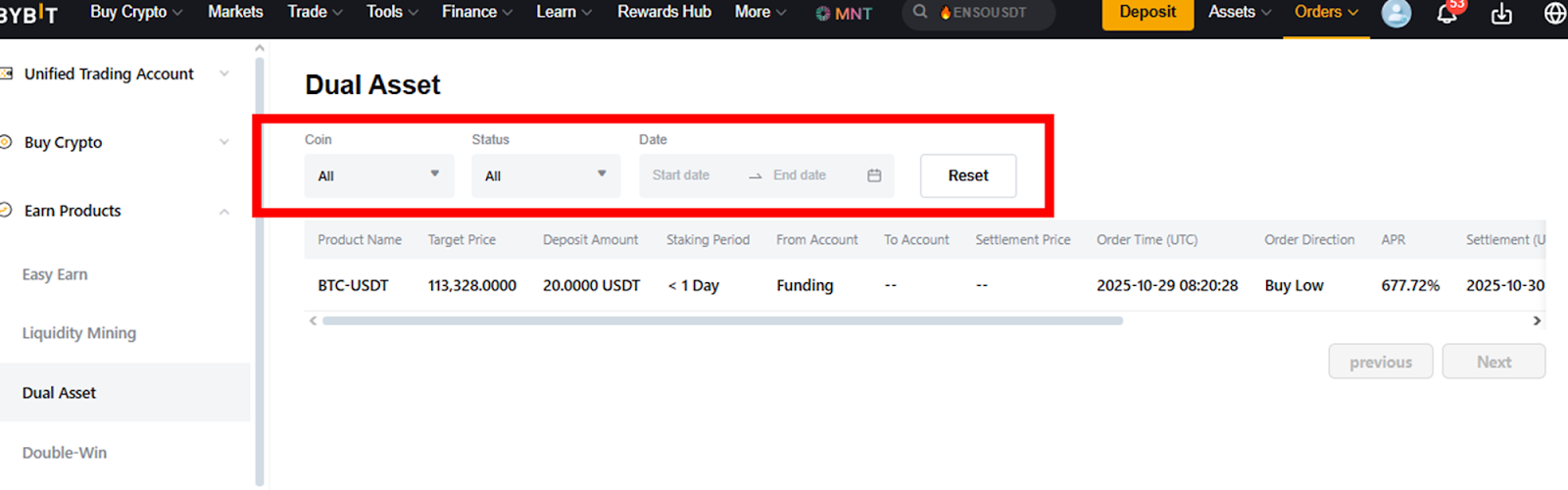

On the Dual Asset page, you can filter your orders by coin or status (Processing, Active, Completed or Failed). You can also view the history of your orders by using the Date filter.

#LearnWithBybit