Bybit Advanced Earn: Volmex Indices (BVIV & EVIV)

Bybit has introduced the Volmex Implied Volatility Indices, BVIV (Bitcoin) and EVIV (Ethereum), on Advanced Earn, giving traders a new way to monitor and respond to crypto market sentiment. Volatility indices measure the market’s expectations of future price swings. In simple terms, they reflect how “nervous” or “calm” the market feels about what’s ahead. When volatility is high, traders anticipate sharper moves. When it’s low, markets tend to be stable, but may be preparing for the next breakout.

Much like the VIX in traditional finance or the Crypto Fear & Greed Index, BVIV and EVIV track 30-day forward volatility for Bitcoin and Ether. They’re designed to help traders visualize changing sentiment in real time and build more informed strategies around those shifts.

Key Takeaways:

Bybit has launched Volmex Indices (BVIV & EVIV) on Advanced Earn to track real-time Bitcoin and Ether volatility.

BVIV and EVIV measure 30-day implied volatility, helping traders gauge market sentiment and potential price swings.

High readings signal tension and low readings suggest calm, guiding traders toward suitable long- or short-volatility strategies.

What are Volmex Indices (BVIV & EVIV)?

The Volmex Implied Volatility Indices — BVIV for Bitcoin and EVIV for Ethereum — measure the market’s 30-day forward-looking volatility expectations based on option prices from leading crypto exchanges.

In simple terms, they show how much price movement traders expect over the next month.

Higher values indicate rising market tension and greater uncertainty.

Lower values signal calmer sentiment and reduced expectations for large swings.

Both indices are built on implied volatility, a key concept in options trading that reflects the market’s forecast of how much prices might fluctuate. Instead of relying on past price data, BVIV and EVIV use real-time option premiums to represent the level of volatility that traders are currently pricing in.

Understanding the numbers: An example

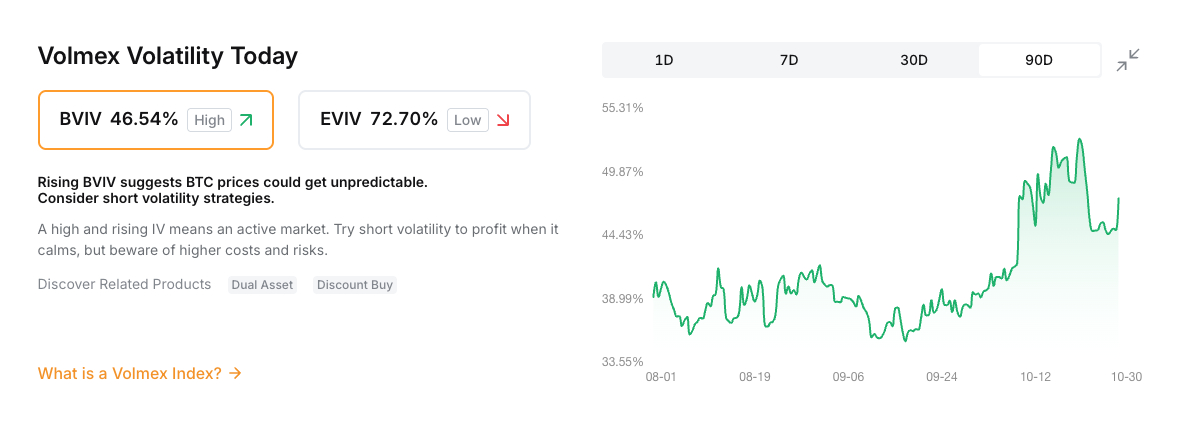

Let’s take an example. Suppose the widget displays the following:

BVIV: 45.29% (low)

EVIV: 72.59% (low)

These percentages represent the market’s implied volatility, or the level of price fluctuation traders expect over the next 30 days.

BVIV 45.29% (low) indicates that Bitcoin’s implied volatility is relatively calm. The market expects moderate price movement, meaning that traders currently see limited near-term risk or momentum.

EVIV 72.59% (low) suggests Ether’s volatility is higher than Bitcoin’s, but still within a stable range. This shows a mild increase in uncertainty, or a possible buildup before stronger price action.

While both readings are considered low, a steady rise from these levels often hints at growing momentum and could signal the start of more active trading conditions. Traders watching such shifts may consider long-volatility setups, such as Double-Win or Smart Leverage, which tend to perform better when volatility begins to increase.

Why volatility indices matter to traders

Volatility indices such as BVIV and EVIV give traders a direct way to read market sentiment, something that can be difficult to measure in real time. By tracking implied volatility, they reveal whether traders are pricing in risk or expecting stability.

For active market participants, this data can be crucial. It helps with:

Market timing: Spot when volatility may expand or contract to prepare for breakouts or reversals.

Risk management: Adjust position sizes or hedge exposure when volatility increases.

Strategy alignment: Match volatility levels to suitable setups, as high readings may favor short-volatility products while low readings support long-volatility approaches.

Volatility indices help traders see how the market feels before it moves, providing a structured framework for entries, exits, and diversification.

Now that you understand why volatility data matters, let’s explore how to interpret and use these readings effectively.

How to interpret BVIV and EVIV readings

BVIV and EVIV act as real-time sentiment indicators, showing when the market is heating up or cooling down.

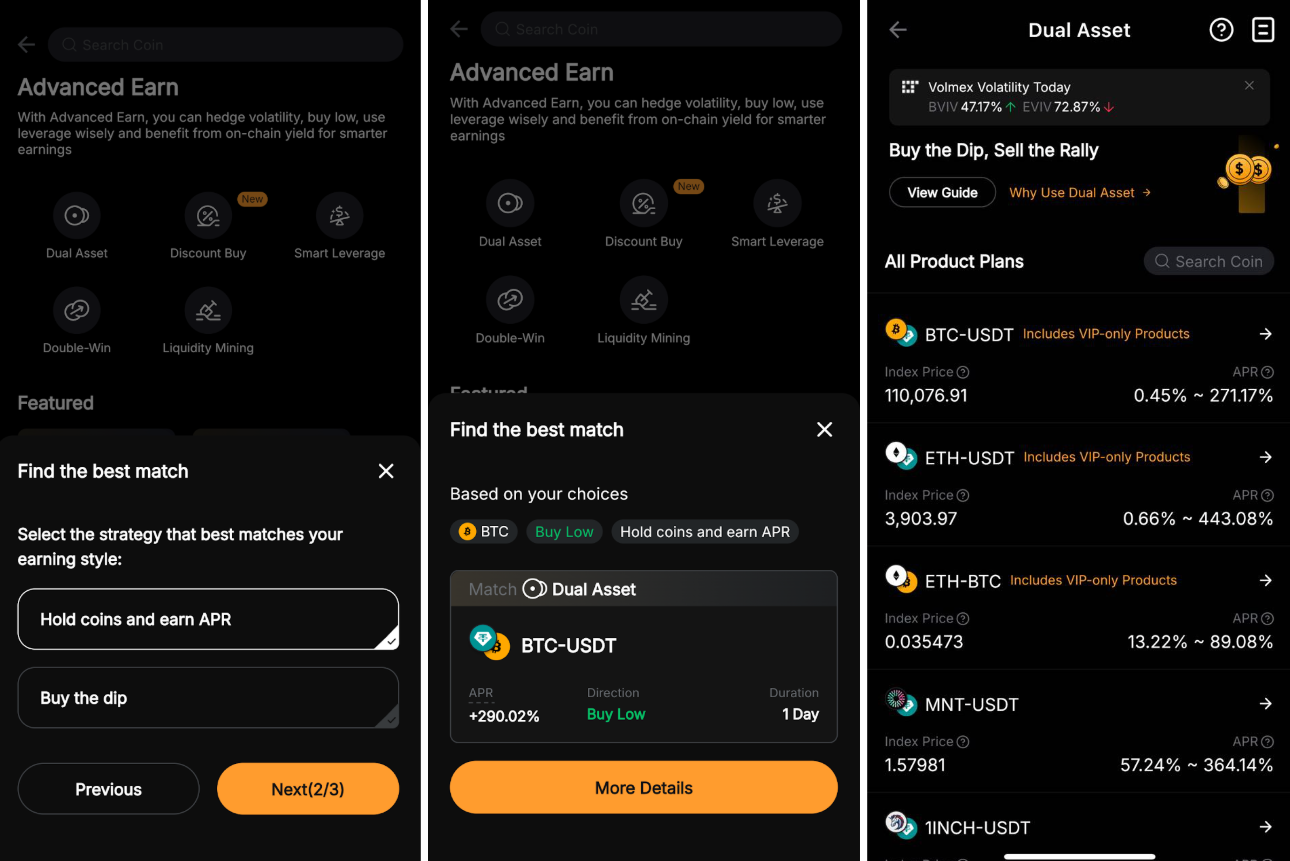

a. High volatility scenarios

When BVIV or EVIV readings are high, the market expects sharper price movements. This often reflects uncertainty, but can also open premium-earning opportunities.

Dual Asset: Capture higher yields while volatility remains elevated.

Discount Buy: Acquire assets at lower effective prices if market tension subsides.

During such periods, maintaining strong risk management and portfolio hedges is key.

b. Low volatility scenarios

When BVIV and EVIV readings are low, the market appears calm, but that quiet phase can precede large moves.

Double-Win: Profit from price movement in either direction.

Smart Leverage: Amplify gains once a clear trend emerges.

Tracking changes in BVIV and EVIV helps traders stay agile, shifting between defensive and opportunity-driven setups as conditions evolve.

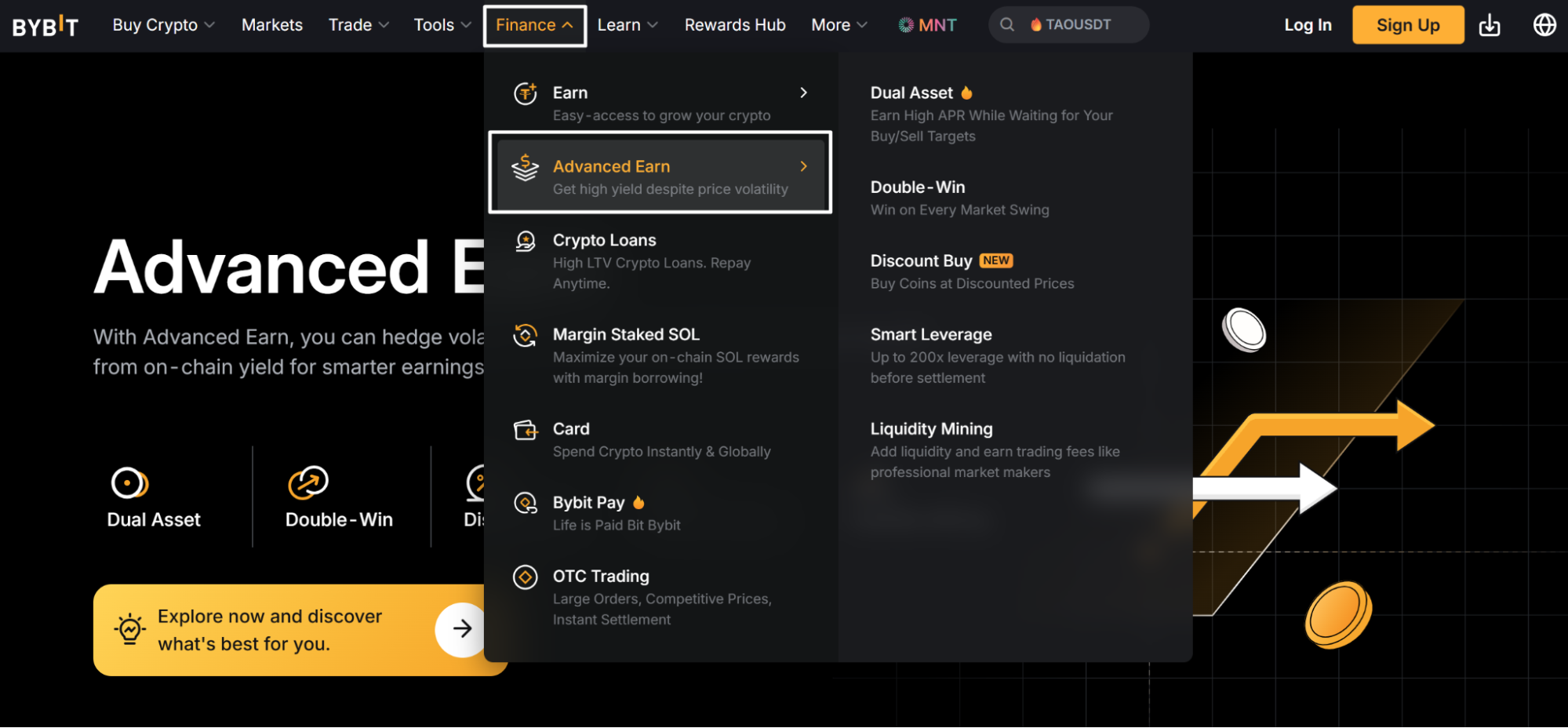

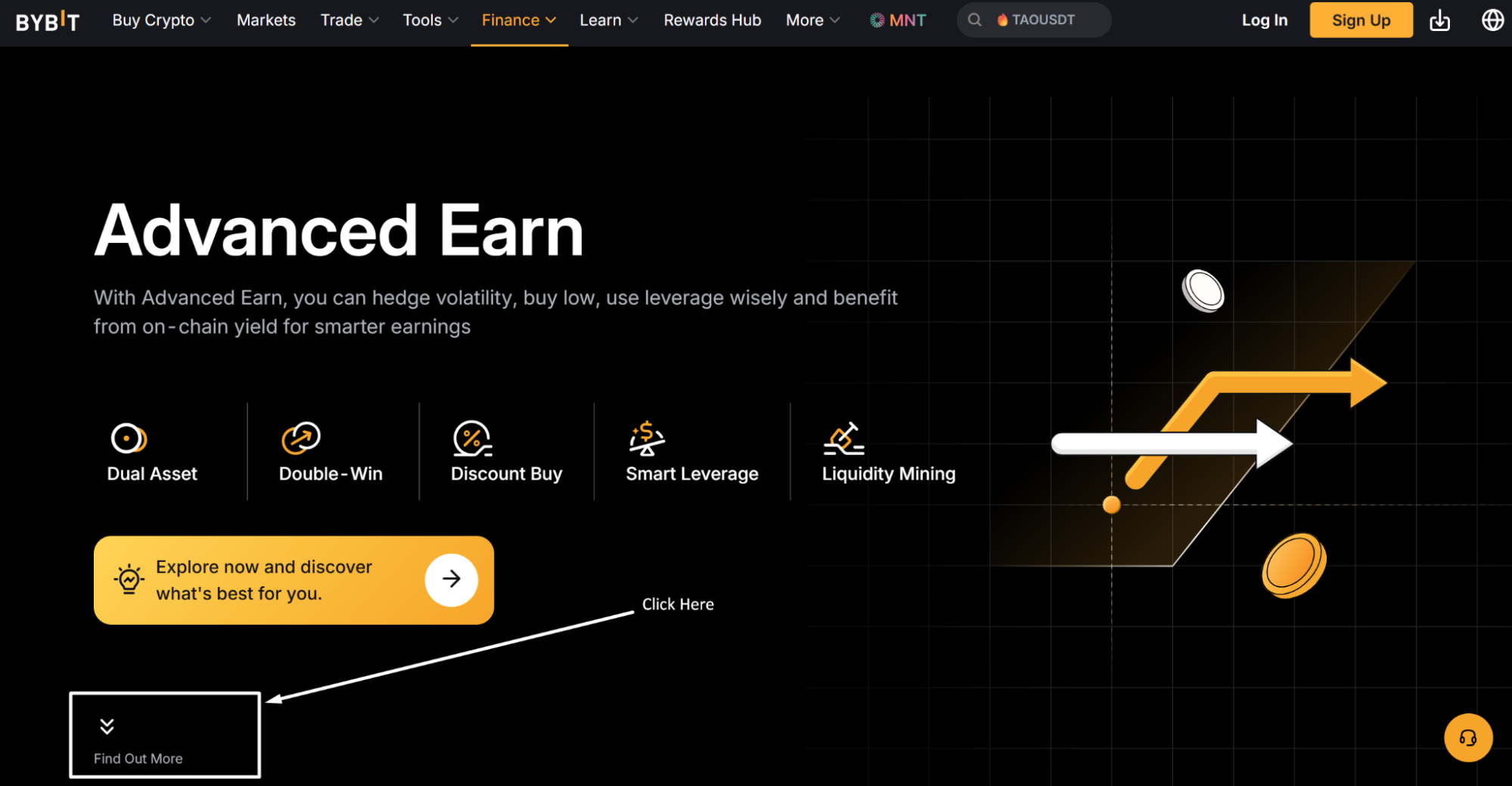

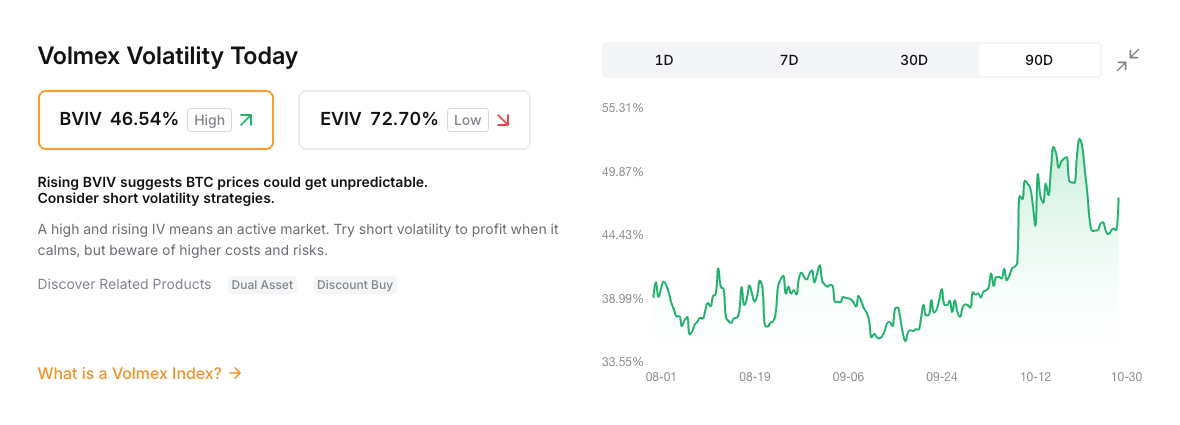

Where to find the Volmex Indices on Bybit (Web)

You can access the Volmex Volatility Today panel directly from the Advanced Earn dashboard under Finance → Advanced Earn on Bybit.

This panel displays real-time readings for the Bitcoin Volatility Index (BVIV) and Ethereum Volatility Index (EVIV), updated every minute. It provides a clear snapshot of current volatility conditions for both assets.

Through this widget, you can:

View live BVIV and EVIV data

Track volatility trends and sentiment shifts

Access tailored product recommendations that match current market conditions

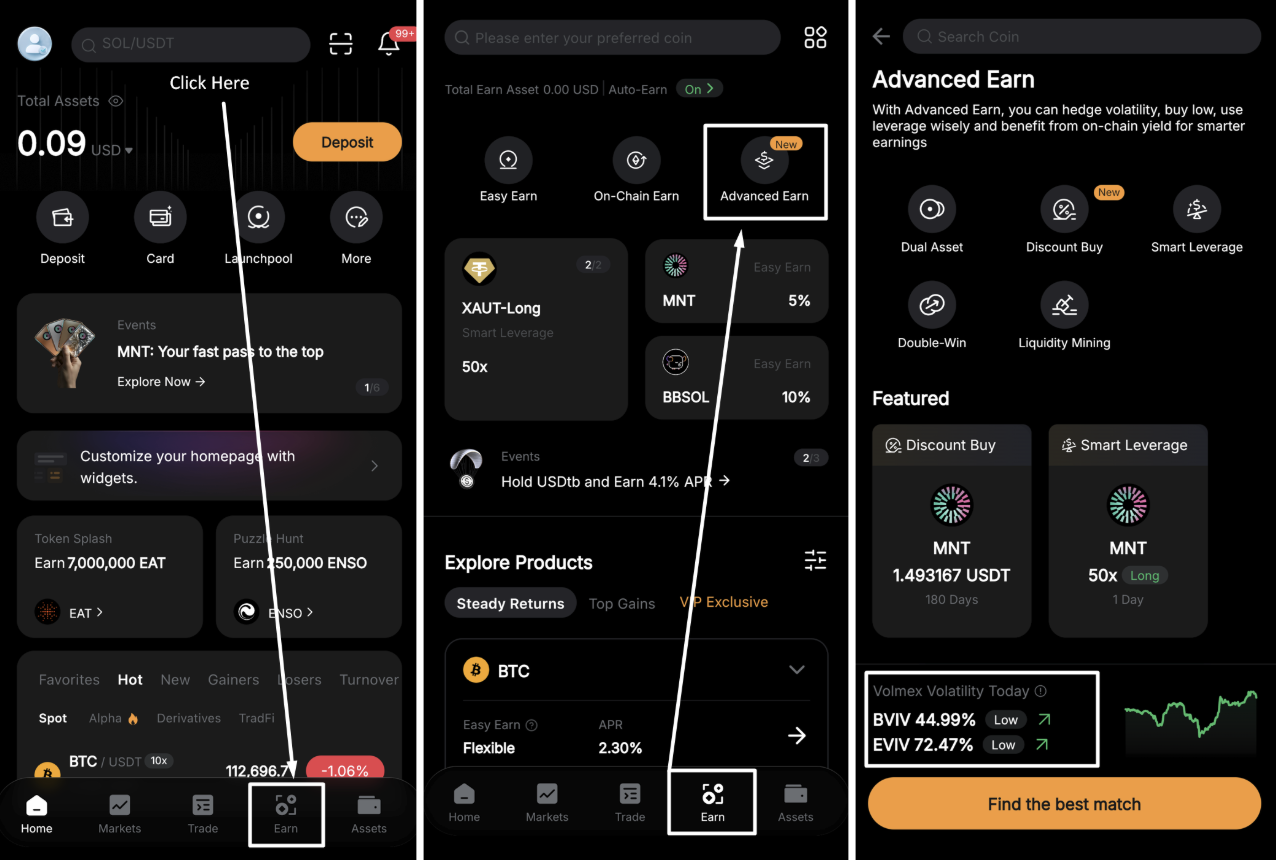

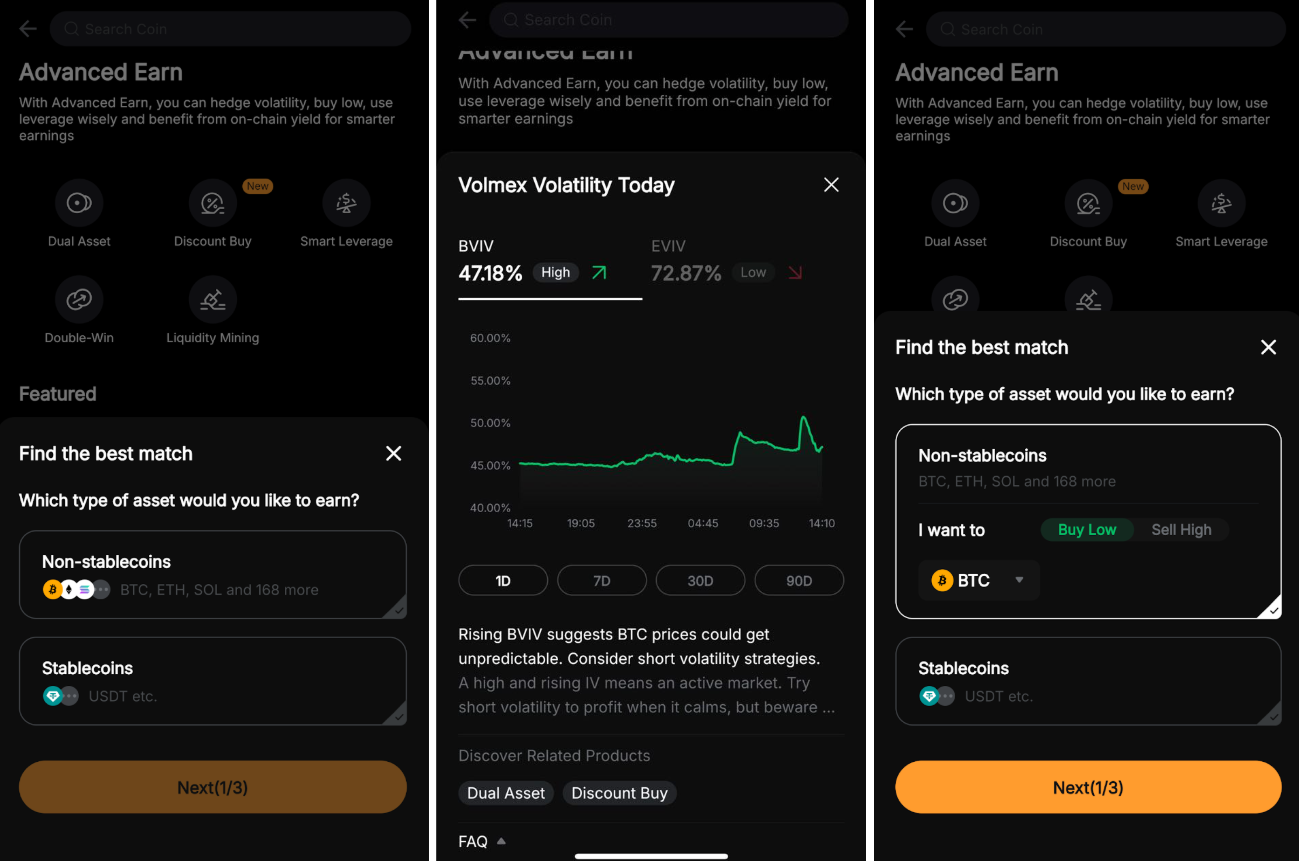

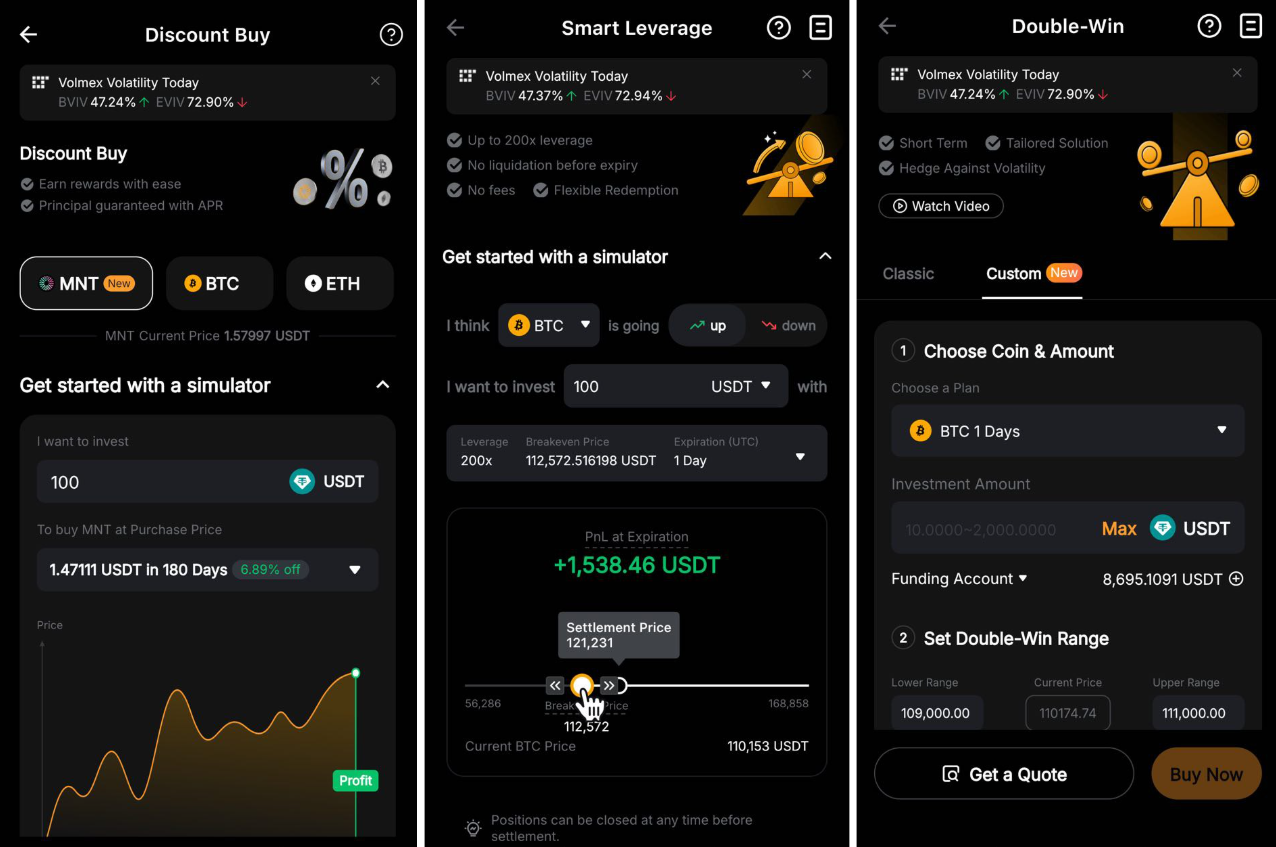

Where to find the Volmex Indices on the Bybit App (Mobile)

Since September 2025, BVIV and EVIV have also been available directly within the Bybit mobile app, allowing traders to track volatility and access matching strategies on the go.

Here’s how to find them:

Open the Bybit App and tap on Earn at the bottom of the home screen.

On the Earn page, select Advanced Earn.

Scroll down to view the Volmex Volatility Today widget, which displays live BVIV and EVIV readings updated every minute.

Tap on Find the Best Match to get personalized product recommendations, such as Dual Asset, Double Win, Discount Buy, or Smart Leverage, based on your goals and market conditions.

You can also filter by asset type (e.g., BTC, ETH, or stablecoins) and choose your preferred strategy, whether it’s Buy Low, Sell High or Hold and Earn APR.

Alternatively, you can see the real-time Volmex Volatility index at the top of each Advanced Earn page in the app.

This mobile feature mirrors the web version, giving traders full access to real-time volatility data, sentiment insights, and tailored yield strategies — anytime, anywhere.

Final thoughts: Making volatility work for you

Volatility isn’t just noise in the market — it’s information. By tracking BVIV and EVIV, traders gain a clearer understanding of how sentiment shifts and what those movements might mean for future price action.

These indices make professional-grade insights accessible to everyone, bridging the gap between institutional tools and everyday trading decisions. Whether you’re looking to manage risk, capture premiums, or anticipate trend changes, BVIV and EVIV provide a structured way to stay ahead of the market.

Visit Bybit Advanced Earn to explore the Volmex Indices, track live volatility data, and see how market sentiment can uncover new trading opportunities.