How to mint cmETH on Bybit

Liquid staking has become an essential tool for ETH holders looking to earn passive income without sacrificing liquidity. But now, with restaking solutions like cmETH, users can go beyond traditional rewards by earning layered yields through protocols such as EigenLayer.

In this guide, we’ll walk through everything you need to know about cmETH, how it compares with mETH, what rewards to expect and how to mint it easily on Bybit’s On-Chain Earn platform — especially during the 30-day, limited-time bonus event running from Jun 10, 2025 through Jul 10, 2025 in partnership with Mantle Network and EigenLayer.

Key Takeaways:

cmETH is a liquid restaking token that represents staked ETH within Mantle Network’s ecosystem.

You can mint cmETH on Bybit by using either ETH or mETH.

Bybit is collaborating with EigenLayer and Mantle for a limited-time event, bringing additional rewards like higher APRs and airdrops when you mint cmETH during the event period.

What is EigenLayer?

EigenLayer is a restaking protocol built on Ethereum that allows users to reuse their staked ETH (or liquid staking tokens, such as mETH, to secure additional networks and decentralized services called Actively Validated Services (AVS).

At its core, EigenLayer allows users to “restake” ETH or liquid staking tokens (LSTs) like mETH that are already staked for Ethereum's proof of stake (PoS) consensus. Instead of just earning base staking rewards, users can opt in to restake those same assets to support other decentralized services, including oracles, bridges, data availability layers and more.

This creates a powerful shared security model, whereby multiple protocols can leverage Ethereum’s validator set without having to bootstrap their own trust networks from scratch. For users, it means earning additional incentives (often in the form of native tokens like EIGEN) — on top of their regular staking rewards — simply by opting in to restake.

EigenLayer is quickly becoming a foundational layer for Ethereum’s modular future, attracting widespread attention from both developers and stakers. As more AVS launch on EigenLayer, the opportunities for restakers continue to grow.

How does EigenLayer work?

Following is a simple breakdown of how EigenLayer works.

Opt-in restaking

Users who have staked ETH (either directly or via LSTs) can opt in to restake their assets on EigenLayer. This means they're extending the security of their stake to other networks, not just Ethereum.

Actively Validated Services (AVS)

AVS are services that tap into EigenLayer’s pooled security. These can include oracle networks, cross-chain bridges, data availability layers, rollup sequencers and more. Restakers delegate their stakes to operators running these services, thereby helping to secure operations.

Slashing conditions

Because restakers are now providing security to multiple protocols, misbehavior (e.g., downtime or dishonest validation) on any AVS can trigger slashing of restaked assets. This ensures accountability and maintains security across all layers.

When you mint cmETH on Bybit, your ETH or mETH is automatically routed through Mantle Network and restaked on EigenLayer. This gives you exposure to EigenLayer’s AVS ecosystem and allows you to earn dual rewards (Ethereum staking yield and bonus AVS incentives) in a single step, without needing to restake manually.

What is cmETH?

cmETH is a liquid restaking token that represents staked ETH within the Mantle Network ecosystem, enabling holders to earn rewards from Ethereum staking and additional restaking protocols, such as EigenLayer. It’s designed to provide users with a seamless staking experience, and combines the benefits of Ethereum's proof of stake (PoS) rewards with additional yields from restaking strategies.

cmETH vs. mETH

While both cmETH and mETH are integral to the Mantle Network staking ecosystem, they serve distinct purposes:

mETH: Represents ETH staked directly in Mantle's liquid staking protocol. Holders earn rewards solely from Ethereum's PoS mechanism.

cmETH: Represents mETH that has been restaked across various protocols, including EigenLayer and other Actively Validated Services (AVS). This restaking allows cmETH holders to earn additional rewards beyond the base Ethereum staking yields.

In essence, cmETH offers a multi-layered yield approach, combining base staking rewards with additional incentives from restaking activities.

Benefits of minting cmETH

Staking cmETH presents several advantages for users seeking to maximize their ETH holdings:

Dual rewards: Receive a 1% bonus in cmETH, plus additional rewards in EigenLayer and partner tokens (e.g., OWN).

Full liquidity: cmETH remains tradable and usable across DeFi, even while earning.

Simple UI and tracking: View rewards, lock-in period and pending balances directly on Bybit’s interface.

No technical setup required: No need to manually restake or manage EigenLayer, as Bybit handles the back-end processes for you.

Current cmETH yield structure

During the limited-time bonus event running from Jun 10, 2025 through Jul 10, 2025, minting cmETH on Bybit will entitle users to:

A cmETH staking APR of 3.43%, which applies to all eligible cmETH minted via ETH or mETH.

Additional 2% APR in EIGEN or partner tokens: Distributed to users proportionally, based on their holdings.

A maximum bonus APR cap of 15%.

Lock-in duration of 41 days; bonus rewards are distributed after this period.

Please note that only new deposits and staking actions made during the event window are eligible for bonus rewards. A 24-hour minimum holding snapshot is used to calculate eligibility. In addition, bonus rewards are only available for cmETH minted during the event window, and they require a 41-day holding period in order to qualify for full distribution.

How to earn additional interest rate bonus

When you mint cmETH during the event period (Jun 10, 2025 through Jul 10, 2025), the bonus interest is automatically applied. The total APR for cmETH is 3.43%, which includes both the base Ethereum staking yield and additional bonus yield from EigenLayer in the form of EIGEN or partner tokens. There’s no need to claim anything manually. Once your ETH or mETH is staked, your rewards start accumulating immediately.

Please note that the interest will stop accumulating once you initiate redemption, and your rewards will be finalized based on your average holdings over the 41-day lock-in period. These rewards will be unlocked and distributed automatically on the 41st day of the event.

Additional referral perks

While the event primarily focuses on staking bonuses, Bybit is also offering an additional referral perk when you send this article to a friend and invite them to participate in this limited-time event with your referral link. Upon successful referral, you’ll receive an additional airdrop of EIGEN or USDT, which will be unlocked on the 41st day of the event.

How to mint cmETH on Bybit

There are two ways you can mint cmETH on Bybit: either through ETH or mETH. To get started, you’ll first need to create a Bybit account, then fund it with cryptocurrency and obtain ETH or mETH, which can be purchased on the Bybit Spot trading platform. Once you have ETH or mETH in your Bybit account, you may proceed with the following steps.

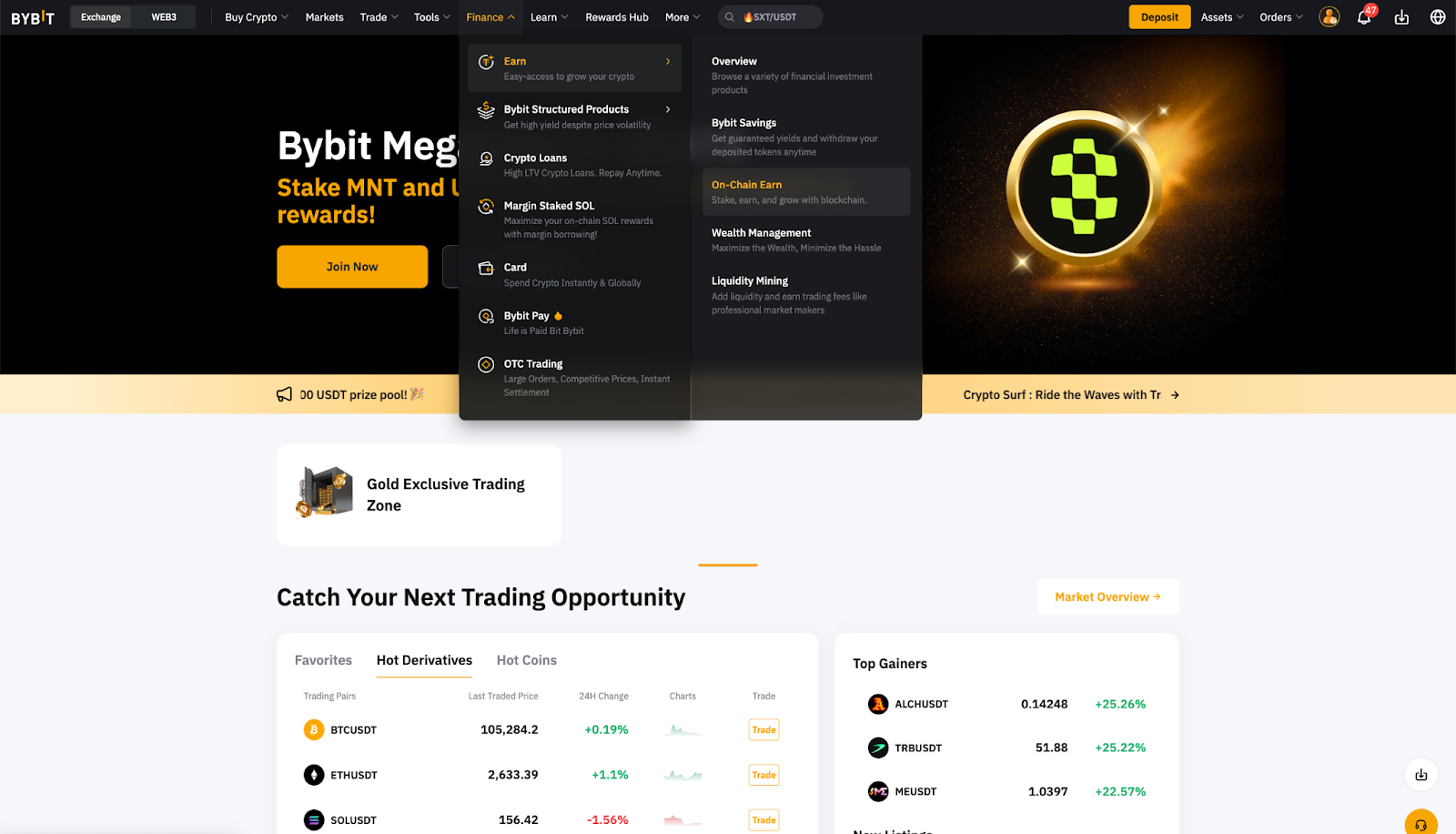

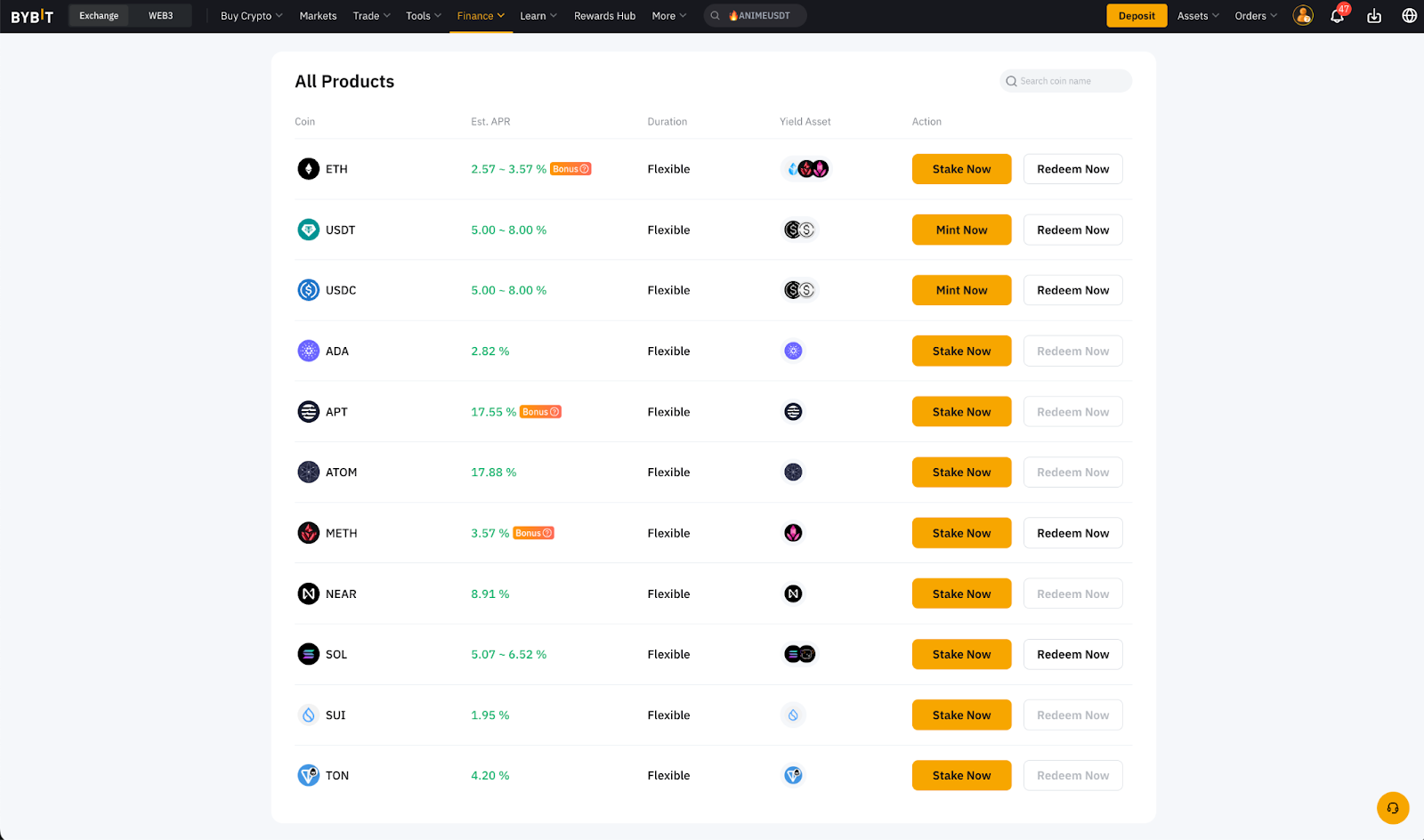

Step 1: On the Bybit homepage, hover your cursor over the Finance tab, followed by Earn, and click on On-Chain Earn.

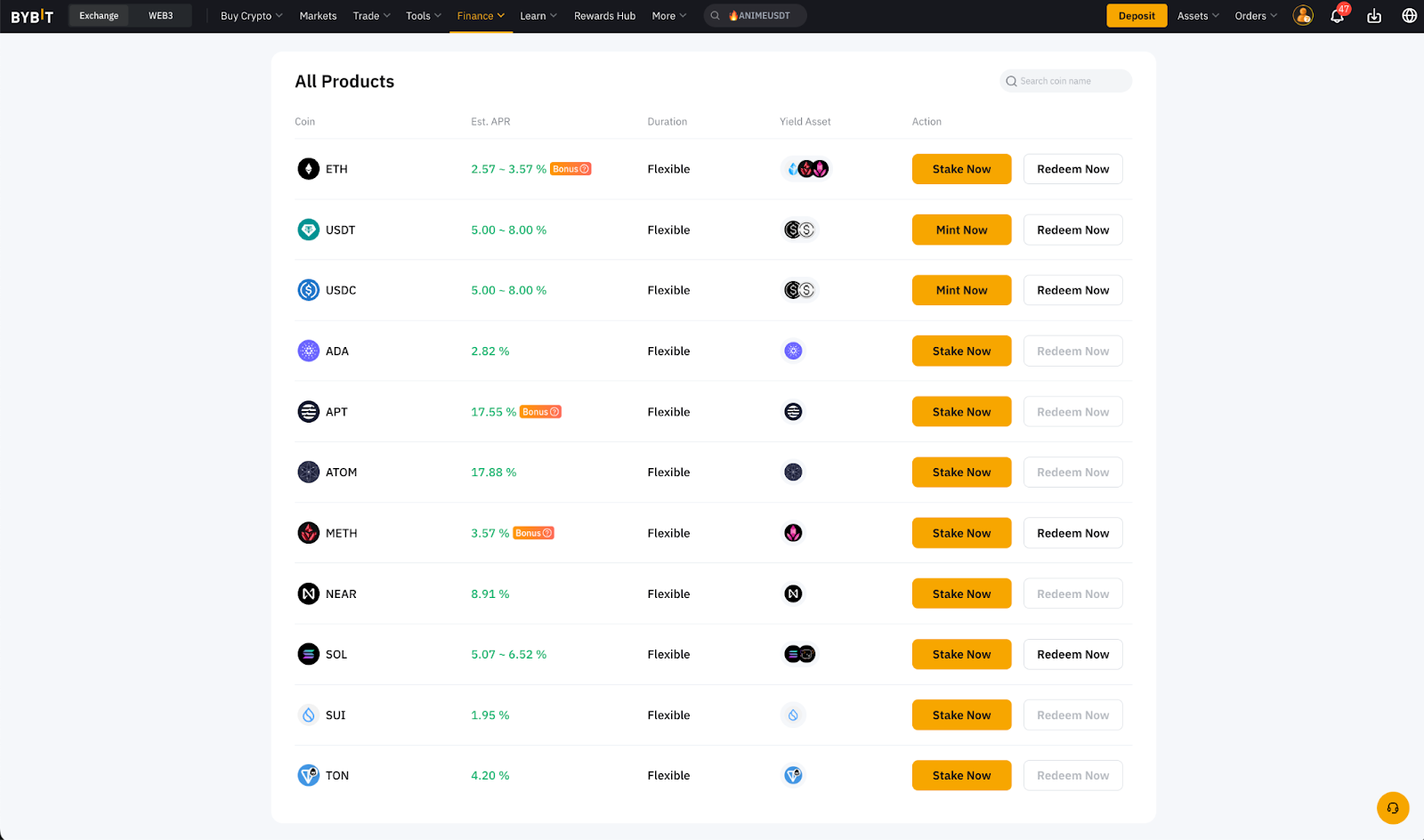

Step 2: Under All Products, locate ETH or METH and click on its corresponding Stake Now button. Alternatively, you can also enter ETH or METH in the search field to locate the token.

We’ll be using ETH as an example.

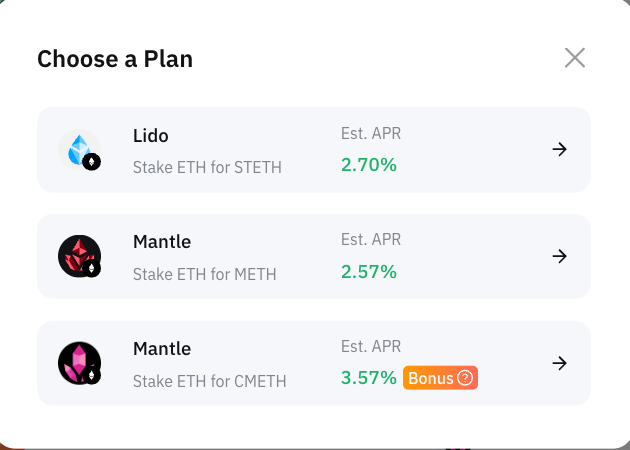

Step 3: Select Stake ETH for CMETH.

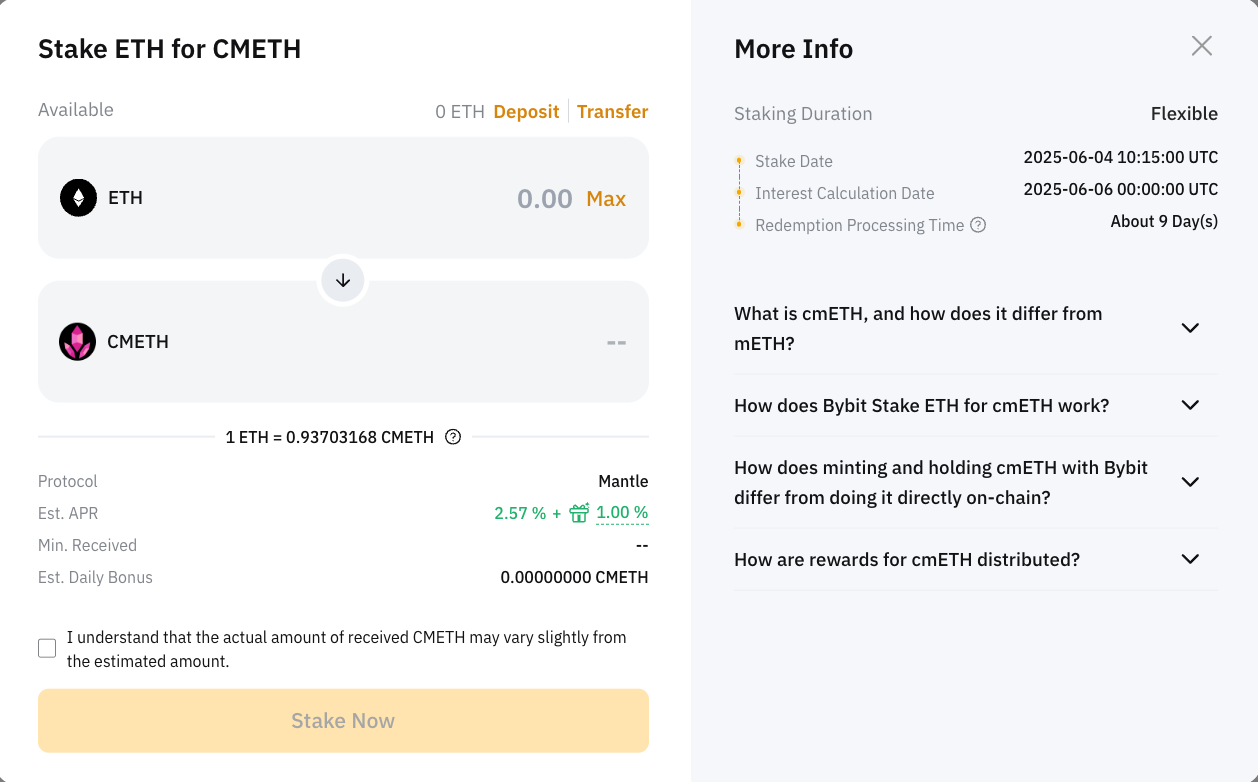

Step 4: Input the amount of ETH you would like to stake, or the amount of cmETH you would like to receive. Confirm the details and click on Stake Now.

Once you’ve successfully staked ETH for cmETH, you may head to the Assets page or Orders page and view your earned yields under Pending Rewards.

How to redeem cmETH

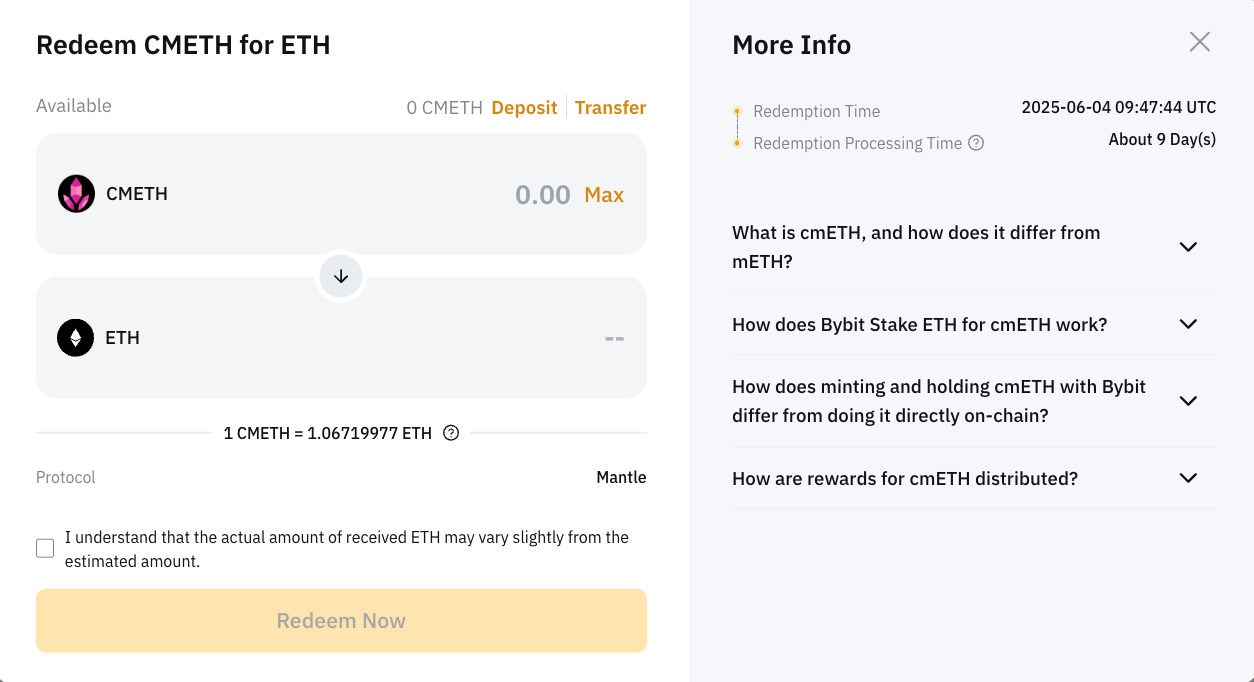

Step 1: Navigate to the On-Chain Earn page and click on the corresponding Redeem Now button for mETH.

For this example, we’ll be using ETH.

Step 2: Click on Redeem CMETH for ETH.

Step 3: Input the amount of cmETH you would like to exchange, or the ETH you would like to receive. Confirm the details and click on Redeem Now.

Frequently asked questions

What is the source of cmETH’s income?

cmETH earns from Ethereum staking rewards via mETH, and additional yield through restaking on EigenLayer. During the event, users also receive bonus tokens, such as EIGEN and OWN.

How do I redeem cmETH?

You can redeem cmETH through the Bybit On-Chain Earn platform. Redemption takes T+9 days, after which your ETH or mETH will be returned to your account. However, if you redeem before the 41-day lock-in period ends, you will forfeit the pending bonus rewards (e.g., EIGEN airdrops).

Is minting cmETH safe?

Yes. Minting cmETH on Bybit is secure. The platform integrates restaking protocols like EigenLayer in a fully custodial environment, meaning Bybit handles the back-end staking and restaking processes on your behalf. Users retain full visibility over their funds, with real-time reward tracking, secure redemption and no need for manual delegation or validator setup.

How do I obtain the interest rate bonus?

The interest rate bonus is automatically applied upon successful minting of cmETH. Please note that the interest will no longer accumulate upon cmETH redemption.

How do I obtain the airdrop?

Mint cmETH during the event period, or refer a friend using your link. Airdrops (EIGEN or USDT) will unlock on day 41 of the event.

Closing thoughts

Minting cmETH on Bybit is more than just another staking opportunity — it’s a gateway into the future of ETH restaking. With the Mantle x EigenLayer x Bybit collaboration, users receive access to dual rewards, event-exclusive bonuses and a seamless interface to track and grow their crypto holdings.

Start minting cmETH on Bybit today!

#LearnWithBybit