Bybit Card: How to Use Your Virtual Card to Make Purchases Online

Online shopping has recently become a norm for most people, particularly for its convenience and accessibility. Whether it’s grocery shopping or food deliveries, the practicality is hard to beat. So, when it comes to payments, you want a system that’s just as flexible while being robust. That's where Bybit Card comes in handy: a digital payment option designed to streamline your online shopping experience, offering a seamless, secure and efficient payment method.

The virtual Bybit Card isn't a physical plastic card, but rather exists online. It's the digital equivalent of a physical card, with a unique card number, expiration date and CVV number. It can be easily added to any supported digital wallets.

The virtual Bybit Card enhances your online shopping experience, providing added control, security and convenience. In this guide, you'll learn how a virtual Bybit Card works — and how to maximize it to the fullest.

Key Takeaways:

Bybit Card primarily focuses on enabling users to spend, store and access their crypto funds in the most streamlined way possible.

The virtual Bybit Card can be activated and used instantly upon activation, as long as the user completes the required KYC verification on Bybit’s platform.

The virtual Bybit Card can be used for various services, including online shopping on e-commerce sites, business, travel, subscription services and recurring payments.

Physical vs. Virtual Bybit Card: The Differences

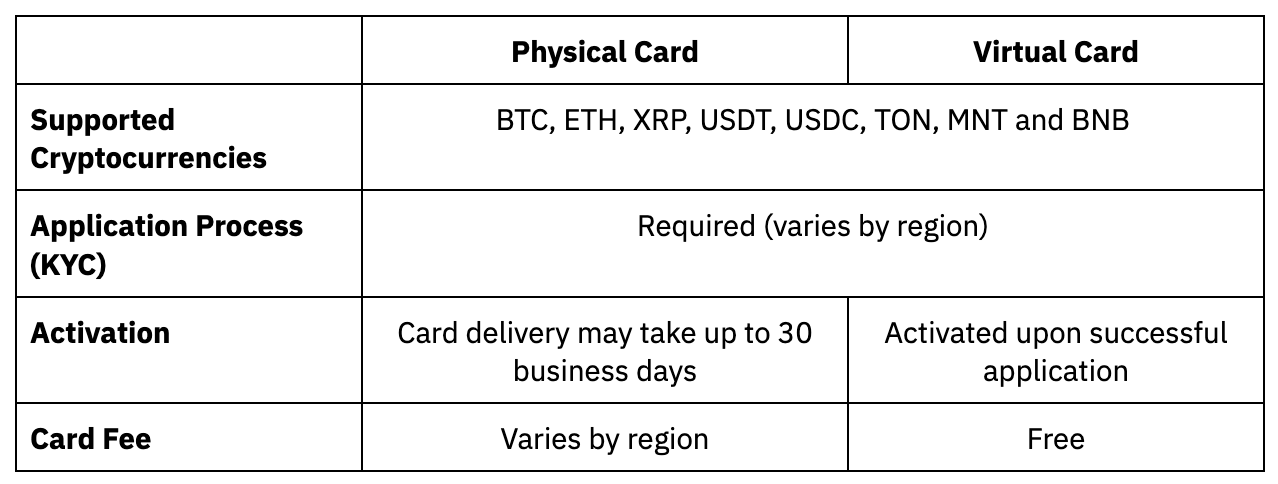

Bybit Card is a Mastercard debit card that lets you spend, store and access your funds for easy spending on the go. The card is meant to integrate the utilization of cryptocurrencies into your daily life. The virtual Bybit Card functions similarly to the physical card, except that the physical card allows you to make in-store purchases that support contactless, chip or PIN payment methods.

Bybit users who are eligible and have passed the application process are entitled to use the virtual card instantaneously upon activation. However, those who wish to have a physical card must complete the physical card application process.

How the Virtual Bybit Card Works

The virtual Bybit Card operates just like your regular credit or debit card, but with an extra layer of protection. When you're ready to make an online purchase, you enter your virtual Bybit Card details, just as you would with a physical card. The transaction is processed similarly, but without your actual card details ever being exposed.

You might be wondering about the practicality of using a virtual Bybit Card. For instance, how do you keep track of your card details if there's no physical card? The good news is that all your virtual Bybit Card information is stored securely online, accessible via your Bybit Account. This means you can access your card details anytime, anywhere — without carrying a physical card.

Start Spending with Bybit Card

Benefits of Using a Virtual Bybit Card for Online Shopping

There are a few key benefits to using a virtual Bybit Card.

Increased Security and Fraud Protection

The virtual Bybit Card provides safe and secure transactions and ensures user convenience in the digital space. Incorporating advanced security measures like end-to-end encryption and biometric authentication offers its users an extra layer of safety. Moreover, real-time transaction notifications and instant freezing options allow Bybit Card users to maintain firm control over their spending.

This cutting-edge digital solution is also ideal for those wishing to keep their banking information private, as it enables you to transact without revealing sensitive data. Indeed, the virtual Bybit Card is revolutionizing the way we conduct online transactions by prioritizing both user security and convenience.

Instant Card Pausing and Closing

Bybit Card is designed to streamline this process. As a virtual card, it can be closed instantly, if necessary, without affecting your main account on Bybit. Furthermore, with the Bybit Card, you can immediately generate a new card number and update your vendor's information without waiting for days, as traditional credit and debit cards require.

Convenience and Ease of Use

The virtual Bybit Card adds a new dimension to convenience, enhancing the user experience with its unique features and seamless functionality. It’s an ideal tool for managing your digital assets, given its creation, and usage. With increased control over spending and transaction security, the virtual Bybit Card caters to the demands of modern-day online shopping experiences. Moreover, its compatibility with mobile apps and online accounts ensures hassle-free use across various digital platforms.

Competitive Fees and Cashback Rewards Same As Physical Card

Bybit Card users enjoy the same competitive fees for both the physical and virtual card version. Besides its main benefits of a maximum 10% cashback and up to 50 Reward Points, you can also enjoy additional benefits such as 100% merchant rebates for any ChatGPT, Netflix, Spotify, Amazon Prime and TradingView subscriptions and 50% airport lounge access discount.

Further, you can save up to 8% APR when you turn on the Auto-Savings mode for your idle crypto inside your Bybit Funding Account. Users who wish to earn even more rewards can opt to refer new Bybit Card referees — and earn up to 20 USDT for every successful referral. Bybit also offers users more exclusive perks to redeem limited physical and digital merchandise within our Rewards Market for all eligible Bybit Card users.

Here are some of the active campaigns and initiatives for Bybit Card:

Bybit Card x Tomorrowland exclusive presale (New Bybit Cardholders purchasing Tomorrowland tickets during the Tomorrowland Brasil presale from April 4–6, 2025, can also enjoy 10% cashback on their ticket purchases)

Note: Users need to log in to their Bybit Account and hold a valid Bybit Card to access the merchandise redemption page to start redeeming their gifts.

Simplified Expenditure Tracking and Management

The virtual Bybit Card is also revolutionizing the way businesses handle financial transactions. Its sophisticated tracking and management tools provide an organized overview of all your expenditures at your fingertips. This can help you keep track of employee spending to ensure that every penny is accounted for. Thus, incorporating the virtual Bybit Card into your operations can lead to improved financial control and a more efficient business model.

Flexible and Environmentally Friendly

Virtual Bybit Card promotes flexibility for users applying and using the card for online spending at their convenience. Virtual cards are free of carbon footprints, thus eliminating plastics and earth metals waste for card production compared to a physical card. It is integrated with the system, and all requests can be made online almost instantaneously without printing and posting a package.

How to Use the Virtual Card to Make Purchases Online

Digital payments via virtual cards have a wide range of practical applications, and can be used in a variety of situations. Some of the most common use cases include:

Online Shopping and E-Commerce

Virtual cards are ideal for online shopping as they provide a secure and convenient way to purchase without needing a physical credit card. They can also be used for recurring payments, such as subscription services, to help users manage their expenses better.

For example, users can start using the virtual Bybit Card for services like Amazon, ASOS, OTTO, Zalando and more to get their groceries or shop for fashions. Users simply choose Bybit Card as a preferred payment method, and enjoy perks like cashback credited to their wallet.

Subscription Services and Recurring Payments

Virtual cards can be used to set up recurring payments for subscription services, such as streaming, software or other digital products. This can help users better manage their expenses and keep track of their subscriptions:

Add to mobile wallets — the equivalent of Apple Pay — in the EEA region.

Use for in-app purchases like Netflix, Disney+, Amazon Prime, Spotify, Apple Music, Xbox Live, Steam, App Store and Google Play, to name a few.

Note: Bybit Card is now supported on Apple Pay (EEA only), Google Pay (EEA and AU), Samsung Pay and more (EEA only).

Virtual cards for your business can also be a lifesaver, as they can be used to track employee expenses and manage corporate spending. They can also be used for travel expenses, such as hotel and rental car reservations. This can help businesses better manage their costs and keep track of employees’ spending while they travel.

How to Get a Virtual Bybit Card

Registering for a virtual Bybit Card is straightforward. First, you need to have a Bybit account. If you don't have one, you can easily sign up online. Once you have an account, you can apply for a virtual Bybit Card from your dashboard.

After your application is approved, your virtual Bybit Card is issued for free instantly. You can then access your card details from your Bybit account. It's that easy!

Learn more: How to Order and Activate Your Bybit Card (A Complete Guide)

Virtual Bybit Card FAQs

Before we wrap up, let's address some common questions you might have about the virtual Bybit Card.

Can I use my virtual Bybit Card for in-store purchases?

No. The virtual Bybit Card is designed specifically for online transactions.

What happens if I suspect my virtual Bybit Card’s details are leaked?

Bybit supports hassle-free card cancellation at your convenience. Users can request a new virtual card replacement anytime, 24/7, as a safety precaution if card details are suspected to be infiltrated. Once you receive the new Bybit Card, you can continue spending online securely.

To understand how this can be done seamlessly, visit our help center article.

What happens if I lose my virtual Bybit Card details?

Don't worry. You can easily retrieve your card details from your Bybit account.

Is there a fee for using the virtual Bybit Card?

Most of the time, no. However, some online retailers may charge a small fee.

To understand the Bybit Card fee structure, visit our help center page.

The Bottom Line

The world of online shopping is constantly evolving, and the virtual Bybit Card is part of that evolution. It's designed to make your online shopping experience more secure and convenient. With its unique features and functionalities, the virtual Bybit Card is set to revolutionize the way you shop online.

Why not simplify your online shopping experience? Get your virtual Bybit Card today and join the digital revolution.

In the rapidly changing world of e-commerce, staying ahead means embracing new technologies like the virtual Bybit Card. Don't get left behind. Embrace the future of online shopping with a virtual Bybit Card today.

#LearnWithBybit