Why Trading Bots Are Perfect for Crypto Beginners

Introduction

If you don’t know anything about crypto investment but want to get started, then Bybit’s trading bots might be an excellent choice. As the cryptocurrency market evolves, more investors are turning to artificial intelligence (AI) and automated tools to simplify their investment strategies. This shift isn’t just a trend — it reflects a growing need for efficient, data-driven decision-making in a highly volatile market.

The Rise of Automated Trading

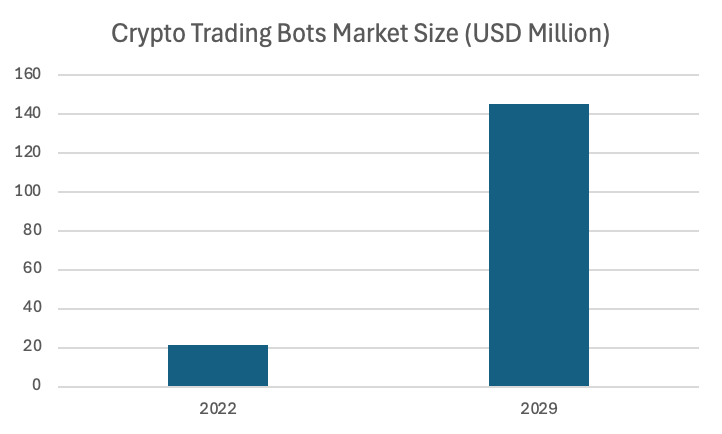

The Global AI Crypto Trading Bot Market was valued at $21.69 million in 2022 and is anticipated to reach $145.27 million by 2029, witnessing a compound annual growth rate (CAGR) of 37.2% during the forecast period of 2023–2029. This rise is primarily being driven by the desire for better investment outcomes without the need for extensive trading knowledge. Automated crypto trading allows investors to leverage sophisticated algorithms to analyze market trends and execute trades at lightning speeds that would be nearly impossible for a human trader.

For beginners, these tools offer an accessible entry point into the complex world of cryptocurrency. With Bybit, beginners and all users can engage in easy crypto investing by setting their preferences and letting the bots manage the rest. This not only saves time, but also mitigates the emotional stress often associated with trading.

The Role of AI in Crypto Trading

AI is revolutionizing how investors approach the market. In utilizing advanced machine learning (ML) techniques, trading bots can adapt to changing market conditions and optimize trading strategies in real time. By embracing technology, even those new to cryptocurrency can participate in the market with confidence, equipped with tools that were once reserved for seasoned professionals.

In conclusion, integrating AI and automated trading tools — such as Bybit’s assortment of trading bots — represents a significant leap forward in making cryptocurrency accessible. For those looking to navigate this dynamic landscape, these technologies offer a pathway to informed and strategic investing.

Overview of Bybit's Trading Tools

Bybit has established itself as a leading platform for automated crypto trading, one that caters to both seasoned investors and newcomers. This one-stop platform offers an array of powerful trading tools designed to simplify the investment process and maximize potential returns. Whether you’re looking to enhance your trading strategy or dive into the world of crypto for the first time, Bybit’s comprehensive suite of tools has something for everyone.

Trading Tools Available on Bybit

Grid Bot: Designed for those who want to capitalize on market fluctuations, the Grid Bot allows users to set up a grid trading strategy that automatically buys and sells at predetermined price intervals. This tool is perfect for navigating sideways markets, and can help you accumulate profits through systematic trading.

DCA Bot: The Dollar-Cost Averaging Bot is ideal for investors looking to build their portfolios over time. By automatically purchasing a fixed dollar amount of cryptocurrency at regular intervals, this tool helps mitigate the impact of market volatility, making it easier to invest consistently without emotional decision-making.

Martingale Bot: For those willing to take on more risk, the Martingale Bot offers a strategy that involves doubling down on losing trades. This approach can potentially recover losses and yield significant profits when the market rebounds, thus appealing to more aggressive investors.

Futures Combo: The Futures Combo Bot is a cutting-edge tool crafted to streamline your Futures trading experience. It empowers users to build portfolios consisting of multiple Futures contracts, and effortlessly rebalance positions to maintain preset ratios despite market movements.

Advantages of Preconfigured Code-Free Bots

One of the standout features of Bybit trading tools is their availability of preconfigured code-free bots. This means you don’t need to have a background in programming or extensive trading knowledge to benefit from automated trading. These user-friendly bots allow crypto bots for beginners to easily set up and customize their trading strategies with just a few clicks.

Moreover, using these automated tools minimizes human error and emotionally influenced trading, ensuring that your strategy is consistently executed. Investors can focus on refining their strategies and monitoring their performance without getting bogged down by the technical aspects of coding and market analysis.

In summary, Bybit’s trading tools empower users to harness the power of automated strategies, making it easier than ever to engage in crypto trading. Whether you're exploring with the Bybit bot for the first time or looking to optimize your existing strategies, Bybit provides the resources you need to succeed in the dynamic world of cryptocurrencies.

Bybit Trading Bits

Bybit offers a variety of trading bots, each designed to cater to different investment strategies and risk appetites. Let’s take a closer look at the key bots available on the platform.

Grid Bot

The Bybit Grid Bot is designed to capitalize on price volatility by placing buy and sell orders within a defined price range. This bot creates a grid of orders at set intervals, automatically executing trades when the market price fluctuates within that range. For instance, as the price of a cryptocurrency moves up or down, the Grid Bot will buy low and sell high, effectively profiting from market swings. This strategy is particularly effective in sideways markets, where price movements are frequent but not necessarily directional. By maintaining a consistent trading rhythm, the Grid Bot can help investors take advantage of opportunities without having to constantly monitor the market.

DCA Bot

The Dollar-Cost Averaging (DCA) Bot embodies a disciplined investment approach, making it an excellent choice for those looking to steadily build their portfolios. This bot automates regular, consistent investments in a specific cryptocurrency, allowing users to avoid the stress of trying to time the market. By purchasing a fixed dollar amount at set intervals — whether daily, weekly or monthly — the DCA Bot helps mitigate the risks associated with price volatility. This strategy not only smooths out the effects of market fluctuations, but also encourages a long-term investment mindset, making it a favored option for both beginners and conservative investors.

Martingale Bot

The Bybit Martingale Bot employs a high-risk, high-reward strategy that may appeal to more aggressive traders. This bot operates on the principle of doubling down on losing trades to recover losses and potentially generate profits. When a trade results in a loss, the Martingale Bot automatically increases the investment size for the next trade. While this strategy can lead to significant gains when the market turns favorable, it also carries the risk of substantial losses during prolonged downturns. As such, it’s crucial for investors to approach this bot with caution and an understanding of their risk tolerance.

Futures Combo

The Futures Combo Bot is an innovative tool designed to streamline your futures trading experience. It enables users to construct portfolios that comprise multiple futures contracts, and automatically rebalance positions to maintain preset ratios of various contracts despite market movements. Futures Combo ensures that the portfolio aligns with the user’s strategy, providing greater flexibility in executing users’ strategies in various market conditions.

Differences Between Bybit Trading Bots

When considering which Bybit trading bot to use, it's important to compare them based on various factors, including market type, risk and liquidity.

Market Type

Grid Bot: Typically used in the spot market, the Grid Bot thrives in environments with frequent price fluctuations. Bybit offers both futures and spot grid bots.

DCA Bot: Also suitable for the spot market, this trading bot is ideal for long-term investments and consistent portfolio growth.

Martingale Bot: Primarily utilized in futures trading, the Martingale Bot is geared toward leveraging volatility in perpetual contracts. The Martingale Bot can help you double down on your investments and quickly recoup early losses.

Futures Combo Bot: Typically used in all market conditions to rebalance your portfolio.

Risk

Grid Bot: Generally low-to-moderate risk, as it capitalizes on market fluctuations without taking large positions.

DCA Bot: Considered a safer option, as it promotes a steady investment approach and minimizes the risk of significant losses.

Martingale Bot: Considered high-risk, due to its actively increasing investment sizes on losses, which can lead to rapid capital depletion if not managed properly.

Futures Combo Bot: Depends. If you use Future Combo Bot primarily for portfolio rebalancing, it is considered lower risk. If you use Future Combo Bot with high leverage to bet on differences in token performance, the risks might increase.

Return Preference

Grid Bot: More suitable for investors seeking consistent returns, as it benefits from frequent trades within a defined range.

DCA Bot: Ideal for low-risk, consistent investors who prefer a hands-off approach to building their portfolios over time.

Martingale Bot: Attracts those looking for high returns, but it requires careful monitoring and a robust risk management plan.

Futures Combo Bot: Depends. It fits risk-averse investors who use it for portfolio rebalancing. It also suits investors who adopt long-short strategies.

In summary, understanding the characteristics of each bot can help investors determine which Bybit bot is best for their individual trading style and risk appetite. A thorough comparison of the Bybit bots ensures that investors can effectively align their strategies with their financial goals.

How to Get Started With Bybit’s Trading Bots (Illustrated With DCA Strategy)

Step 1: Please click on Trade → Trading Bot in the navigation bar to enter the Bybit Trading Bot page.

Step 2: Create your DCA bot by clicking on Create Now to go to the Create DCA Bot page.

If you've previously created Bybit trading bots, you can view the Total Equity (USD) and Unrealized P&L (USD) under My Bots in the upper right corner of the Bybit Trading Bot page.

Step 3: Create your DCA bot with the following parameters:

a) Currency: Select the coin* you’re investing in.

*Please note that once you’ve selected a coin (USDT or USDC), all transactions will be paid for in the selected coin.

b) Select Cryptocurrencies: Select the coin you wish to purchase** and enter the corresponding investment amount.

** You can select up to five coins for a DCA bot by clicking on Add Crypto.

c) Investment Frequency: Set your preferred investment frequency.

d) Maximum investment amount for DCA bot (optional): Enter the maximum investment amount*** that a DCA bot can invest.

*** • Please ensure that the maximum investment amount you’ve entered is greater than the total investment amount.

• If the total investment amount triggers the maximum investment amount, the DCA bot will automatically terminate, and all assets will be transferred to your Funding Account.

Then, click on Create Now.

Explanation of Other Parameters

Total: Total investment amount per purchase

Estimated Count: Estimated number of investments = Available balance in the current funding account / total investment amount per purchase

Note: Each fixed investment amount is subject to both the minimum and maximum order value per transaction in the Spot market. For more information, please refer to Bybit Spot Trading Rules.

Tip:You can check the available balance in your Funding Account in the Available Balance section. Based on the available balance in your Funding Account, the system calculates an estimated auto-purchase count. If you need to transfer funds to your Funding Account, please click on Transfer.

Step 4: Please double-check the DCA bot information you’ve created, and then click on Confirm to start trading.

Your DCA bot has successfully been created!

Please note that your first DCA investment starts when you’ve successfully created your DCA bot.

After you click on Confirm, the page will automatically redirect to My Bots for you to view your active DCA bots.

You can click on Details in the upper right corner of the DCA bot you want to view in order to explore more information, including Position Overview, Total APR, Average Buy Price, Executed Quantity and more.

Alternatively, you can view the details of your running DCA bots — such as Coin, Total Investment, Total P&L and Total APR — under DCA Bot on the Trading Bot Account Assets page. On the Assets page, you can view the Total Equity and Unrealized P&L of your trading bots (Spot Grid Bot and/or DCA Bot).

Create Now.

Benefits and Risks of Using Bybit Trading Bots

When you use trading bots — particularly on platforms like Bybit — it offers a range of benefits and potential risks that every investor should understand before diving into automated trading.

Key Benefits of Using Bybit Trading Bots

Time-Saving: One of the most significant advantages of using crypto bots is the time they save. By automating trades, these bots allow investors to engage in the market without the need for constant monitoring. This is particularly beneficial for busy individuals who want to participate in cryptocurrency trading, but lack the time to analyze charts and manually execute their trades.

Emotionless Trading: Trading decisions driven by emotions can lead to impulsive actions that negatively impact investment outcomes. Bybit trading bots operate based on predefined algorithms, eliminating the emotional component from trading. This disciplined approach ensures that strategies are executed consistently, reducing the likelihood of making decisions based on fear or greed.

Consistent Investing: Trading tools like the DCA Bot promote a systematic investment strategy by automating regular purchases. This consistency allows investors to build their portfolios over time without the stress of timing the market. Regular, automated investments can lead to a more robust long-term strategy, particularly in a volatile market.

Highlighting the Risks

While the advantages of using trading bots are compelling, there are also notable risks to consider, as follows.

Martingale Bots: The high-risk nature of the Martingale Bot cannot be overstated. This bot's strategy of doubling down on losing trades can lead to substantial losses during prolonged market downturns. If the market continues to move against the investor, there’s a significant risk of capital depletion and liquidation, especially in futures trading, which involves leverage.

Futures Trading Risks: Trading in futures can amplify gains, but it also increases the risk of liquidation. If your account balance falls below the required margin due to adverse market movements, positions can automatically be closed, resulting in significant losses. Therefore, understanding the mechanics of futures trading and the implications of using bots in this context are crucial for risk management.

Importance of Understanding Market Trends

In order to effectively utilize trading bots, it’s vital for investors to have a solid understanding of market trends. Automated strategies can only be as effective as the underlying assumptions they’re based on. Staying informed about market conditions, news and trends can help investors adjust their strategies and use their bots more effectively.

Using Risk Control Measures

To mitigate the risks associated with trading bots, especially with high-risk strategies like the Martingale approach, implementing robust risk control measures is essential. This may include setting stop-loss orders, diversifying investments and regularly reviewing bot performance. By proactively managing risk, investors can better position themselves to avoid substantial losses and enhance their overall trading experience.

In conclusion, while there are clear benefits from using crypto bots — such as time savings, emotionless trading and consistent investing — it's equally important to be aware of the risks involved. By understanding market dynamics and employing effective risk management strategies, investors can learn how to avoid losses with crypto bots and make the most of their automated trading experience.

Why Bybit’s Trading Bots Are Ideal for Beginners

For those new to the world of cryptocurrency, navigating the complexities of trading can be daunting. However, Bybit’s trading bots are designed to simplify the process, making them an excellent choice for beginners. Here’s a summary of the main benefits that make these bots particularly appealing.

Main Benefits for Beginners

User-Friendly Interface: Bybit’s trading bots come with an intuitive interface that doesn’t require extensive technical knowledge. Those who are new to trading can easily set up their bots, customize strategies and monitor their performance without feeling overwhelmed.

Automated Trading: With automated trading, beginners can take a hands-off approach. This feature allows users to execute trades based on predefined strategies, minimizing the need for constant market monitoring. This is especially beneficial for anyone who may not have the time or expertise to actively manage their investments.

Reduced Emotional Stress: Trading can often be an emotional roller coaster, especially for newcomers. Using Bybit’s bots, beginners can avoid the pitfalls of emotional decision-making. The bots operate purely on data-driven strategies, ensuring that trades are executed consistently, regardless of market fluctuations.

Educational Opportunities: Bybit’s trading bots offer a great learning experience. As beginners observe how the bots operate and react to market changes, they can gain valuable insights into trading strategies and market dynamics. This knowledge can be instrumental in developing their trading skills over time.

Start Small and Learn as You Go

For those just starting out, it's wise to begin with small investments. By doing so, beginners can familiarize themselves with the platform and the different trading strategies without taking on excessive risk. As their confidence grows and their understanding deepens, users can gradually increase their investments and explore more complex strategies.

If you’re ready to dive into the world of automated trading, there’s no better time than now. Start using Bybit bots today, and experience the benefits of easy crypto investing firsthand. Visit Bybit, set up your first bot and embark on your trading journey with confidence. With Bybit’s trading tools for beginners, you’ll have the support you need to navigate the exciting landscape of cryptocurrency trading.

FAQs

1. What is a crypto trading bot?

Answer: A crypto trading bot is an automated program that buys and sells cryptocurrencies based on preset conditions. Bybit offers several types of bots, such as the DCA Bot, Grid Bot and Martingale Bot, which allow users to automate their trading strategies and minimize the need for constant monitoring.

2. Is Bybit’s trading bot good for beginners?

Answer: Yes. Bybit’s trading bots are perfect for beginners because they’re easy to set up and use. In particular, the DCA Bot is a great option for new users as it follows a simple strategy of regular investments, helping you build your portfolio over time.

3. How do I set up a trading bot on Bybit?

Answer: Setting up a trading bot on Bybit is simple. After logging in to your Bybit account, navigate to the Trading Bot section, select the type of bot (DCA, Grid or Martingale), and customize the settings based on your preferred investment strategy. You can also use the AI strategy for a hands-off approach.

Sign up links:

4. Can I lose money using a trading bot?

Answer: Yes. As with any investment, there are risks involved when using trading bots. While these bots do help you automate strategies, market conditions can still result in losses, especially with riskier bots such as the Martingale Bot. Always ensure you understand the risks, and manage your capital responsibly.

5. What’s the difference between Bybit’s Grid Bot, DCA Bot and Martingale Bot?

Answer:

Grid Bot: Works by placing buy and sell orders at preset price levels, and is ideal for volatile markets.

DCA Bot: Automatically invests a set amount at regular intervals, which is perfect for long-term strategies.

Martingale Bot: A higher-risk bot that doubles investments after losses in order to recover and make a profit when the market turns favorable.

Futures Combo Bot: build portfolios of multiple futures contracts and effortlessly rebalance positions to maintain preset ratios despite market movements.

6. Are Bybit’s trading bots free to use?

Answer: Bybit’s trading bots themselves are free to use. However, all trades executed by the bots are subject to standard trading fees, and funding fees may apply to perpetual contracts.

7. Do I need to monitor my trading bot all the time?

Answer: No. That’s the beauty of automated bots. Bybit’s bots will operate 24/7, according to your settings. However, it’s always a good idea to occasionally check in and adjust the settings in case market conditions change.

8. Can I use Bybit’s trading bots on my mobile phone?

Answer: Yes. Bybit’s trading bots are fully accessible on both desktop and mobile platforms, allowing you to set up and manage your bots on the go.