Learn From Smart Money: The Case for ETH Playing Catch-Up

The sentiment of the broader cryptocurrency market has turned positive as the price of BTC cleared its March 2024 highs. With the current momentum, BTC could be paving the way for reaching a new all-time high. So far, BTC and SOL have snapped 60% YTD gains. However, ETH only gained about 12% in the same period.

In our previous Learn From Smart Money, we emphasized that ETH may need a break before another attempt to push higher. Since the article was published, the price of the ETHUSDT Perpetual contract has retracted from around $2,600 to nearly $2,300 before rebounding.

This edition of Learn From Smart Money will continue to dig into the derivatives trading data on Bybit to explore the possibility of ETH catching up to its peers by the end of the year.

Bulls Are Back in Charge

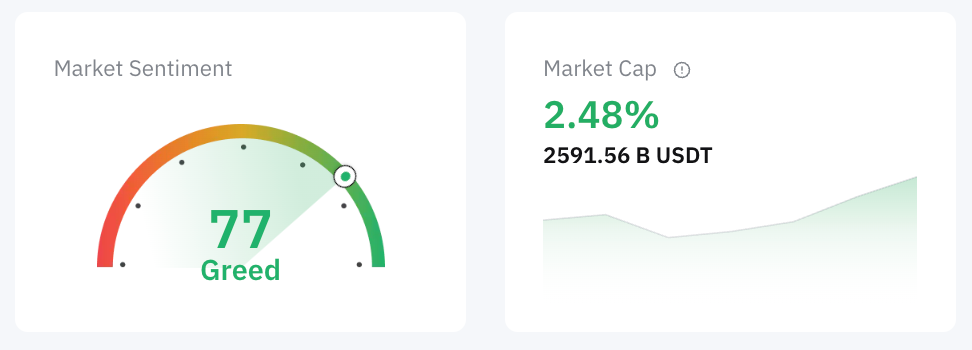

Crypto market sentiment has improved noticeably as recent BTC price actions have renewed traders' interest in the asset class. The Crypto Fear & Greed Index has returned to a healthy level.

Figure 1: Crypto Fear & Greed Index and the global crypto market cap. Source: Bybit

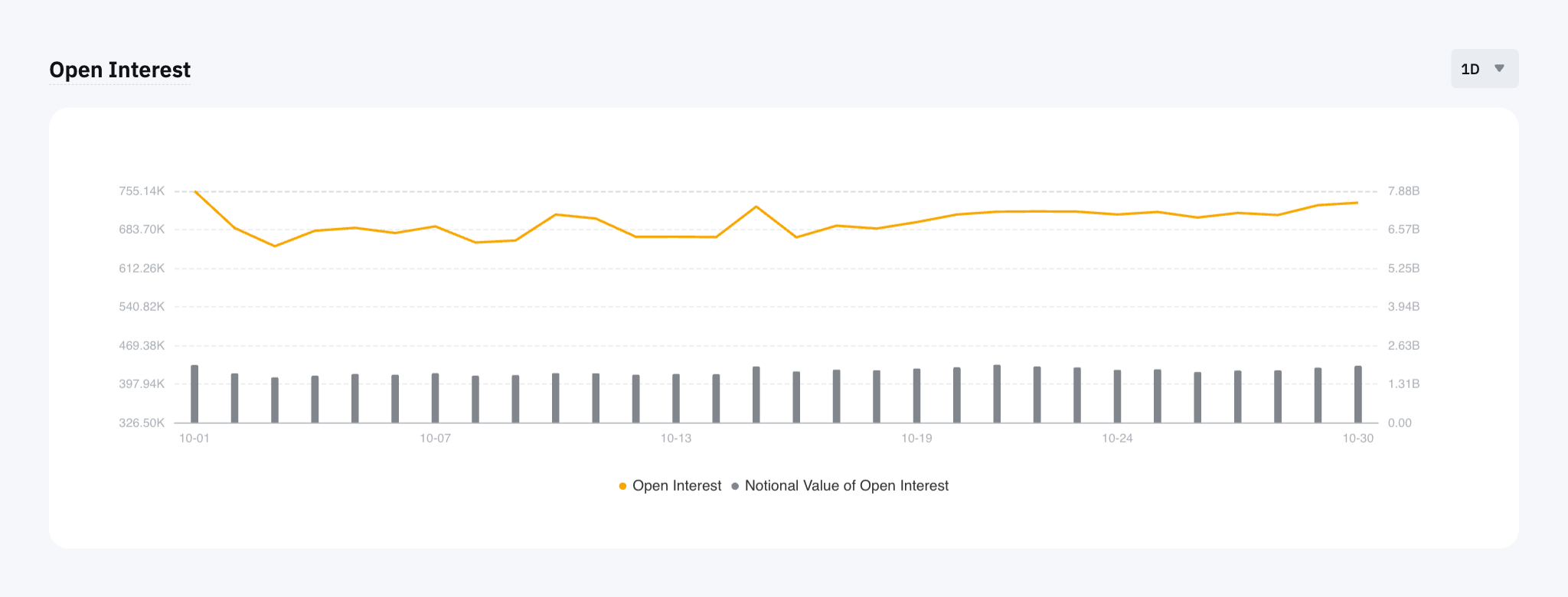

Derivatives traders' interest in ETH has increased in addition to that for other major tokens, especially in the options market. Figure 2 (below) indicates the open interest and trade volume for ETH options on Bybit, as open interest reached a fresh monthly high (highlighted in the red circle). This could indicate that traders are more willing to use options contracts to speculate on the price of ETH, potentially reinforcing the current momentum or hedging their existing positions using options.

Figure 2: Open interest and volume of ETH options on Bybit. Source: Bybit

Strong momentum has also been seen in the ETH perpetual contracts market, as open interest reached the highest level in almost a month. Although perpetuals, futures and options contracts are widely used by professional traders and institutions, there are some key differences between the three. (Please read the article entitled Explained: Options vs. Perpetual Contracts vs. Futures Contracts on Bybit Learn for more information. Also, check out this page to learn more about trade volume and open interest in derivatives trading, and why these are essential.)

Figure 3: Open interest and volume of ETHUSDT Perpetuals on Bybit. Source: Bybit

The Year-End Trade

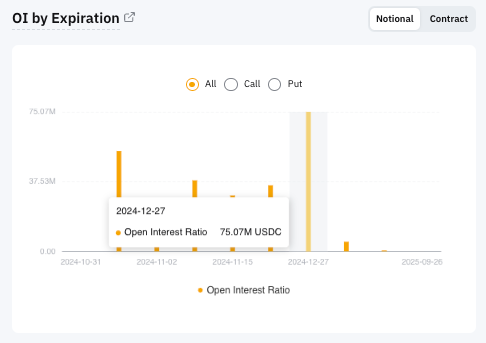

As we dive into ETH options trading data, it’s evident that the ETH options market has gotten more attention, and options traders are setting up for a year-end trade as contracts with a Dec 27, 2024 expiration have the highest open interest. This could mean that traders have been betting on the potential price actions of ETH, and these movements could be realized by the end of the year. It's also worth noting that contracts with a Nov 1, 2024 expiration received the second-highest open interest on Bybit, implying that some traders are also making short-term speculations with options.

Figure 4: Open interest by expiration of ETH options on Bybit. Source: Bybit

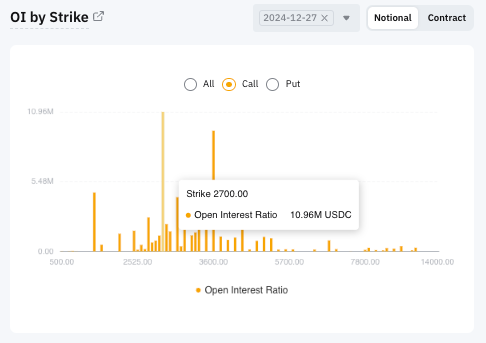

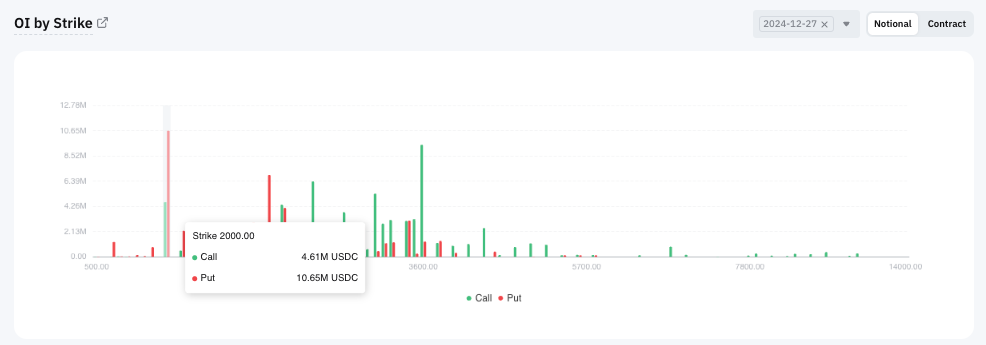

Exploring how options traders pick their contract strike prices could provide another clue. According to Bybit's Derivatives Contracts Data page, among all the ETH calls with a Dec 27, 2024 expiration, most of the open interest has been on contracts with strike prices at $2,700 and $3,600, as shown in Figures 5 and 6 below.

Figure 5: Open interest by expiration of ETH options on Bybit. Source: Bybit

Figure 6: Open interest by expiration of ETH options on Bybit. Source: Bybit

The implications could be twofold: On the one hand, some traders seem more conservative by just picking $2,700 calls with a year-end expiration. At the time of this writing (Oct 31, 2024), ETH has been trading at around $2,600. In other words, there's a good chance that these calls could eventually turn in-the-money (ITM), perhaps way before they expire.

On the other hand, some traders seem more optimistic by selecting $3,600 strike price calls with the same expiration date. If these calls became ITM, it could mean a potential 35% upside on the spot (or even higher with leverage using derivatives).

Figure 7: Open interest by strike of ETH options with a Dec 27, 2024 expiration on Bybit. Source: Bybit

Now, let's look at the puts. Most of the open interest among the year-end expiration ETH options contracts was on puts with a $2,000 strike price. While many may consider $2,000 to be one of the key psychological levels for ETH, the likelihood of reaching that level by the end of the year seems relatively low. This could in fact be part of the hedging strategy from options traders. Visit the Options section on Bybit Learn to learn more about options strategies.

Favorable Volatility

While the market is embracing upcoming macro events, such as the upcoming elections and job reports in the U.S., and the upcoming Fed meeting in early November, market volatility could soon increase. From an implied volatility perspective, it seems that the current level is relatively low, since implied volatility is one of the key elements in options pricing. In simple terms, the higher the implied volatility, the higher the prices of the options contracts. In ETH's case, the current levels may be considered favorable because implied volatility is expected to go higher for ETH options.

Figure 8: Historical volatility of ETH options on Bybit. Source: Bybit

Conclusion

Options trading is highly systematic. That's one of the reasons professional traders and institutions have been using options as a major vehicle to trade both crypto and traditional assets. By observing the options trading data, users can see how professionals have been setting up their trades, and learn about their logic and rationale. Follow Bybit Learn for more options analysis.

#BybitOpinion #LearnWithBybit

Disclaimer: Investing in cryptocurrencies and their derivatives involves substantial risk of loss, and isn’t suitable for every investor. This article provides facts for educational purposes only, and does not represent any financial advice. Prior to making any investment decisions, please ensure you fully understand the risks involved and seek independent advice if necessary. Our customer support team is available to assist you with any inquiries.