Learn From Smart Money: Increasing SOL Interest From Derivatives Traders

The price of SOL hit its highest value in almost two weeks on Monday, Oct 14, 2024, and has been changing hands at around $150. Besides the meme coin frenzy that’s been driving use of the blockchain, recent derivatives trading data suggests that the current SOL run could be running out of steam. This article will dive into the SOL derivatives trading data on Bybit and provide some trade ideas at the time of WSOT 2024.

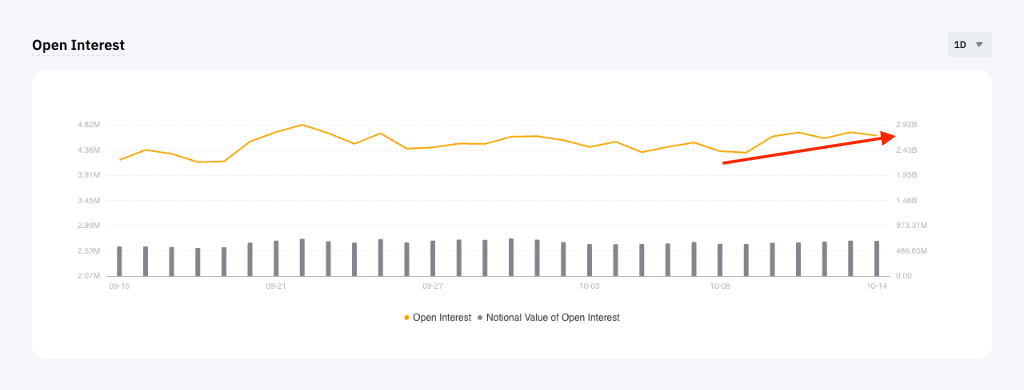

Increasing Open Interest in SOL

SOL has recently become a focus of derivatives traders. According to Bybit’s contract data, open interest in SOL options and Perpetual contracts has been posing an uptrend and hovering at a recent high. This could mean more derivatives traders are willing to bet on the potential price movement of SOL, which could give its price strong momentum.

Figure 1: SOLUSDT options open interest for recent high. Source: Bybit

Figure 2: SOLUSDT Perpetual open interest showing an uptrend. Source: Bybit

In the previous article of this series, we explained why open interest is important as data — and why every trader should know about it. We also recommend the following reading:

<Explained: Options vs. Perpetual Contracts vs. Futures Contracts>

<How to Improve Your WSOT Ranking in Trading Volume Using Bybit Options>

Perpetual Long/Short Ratio Shows a Mixed Picture

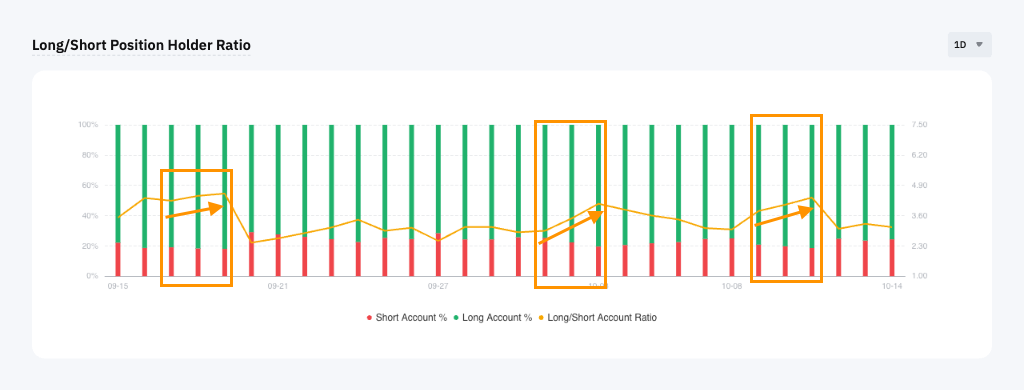

Although traders seem keen to speculate on the price of SOL using derivatives, the long/short ratio gives a mixed signal, and the upcoming development could be a crucial sign for traders.

Figure 3 (below) shows the recent SOLUSDT Perpetual daily long/short ratio on Bybit. The ratio developed three small uptrends in mid-September, late-September and early October, respectively. The first two uptrends were accompanied by some positive price actions (highlighted in Figure 4, below). Alignment of the long/short ratio and price is widely considered normal, and could mean that traders have placed their bets in the right direction.

Now, we’re looking at the third uptrend (early October). When SOL’s price reached a recent high, the long/short ratio didn’t fully follow suit, which could be a sign that the current SOL rally is running out of steam.

However, it’s important to observe the coming development of the long/short ratio. If the reading rises again, that may support the rally. Otherwise, we may just hit a local top here.

Figure 3: SOLUSDT Perpetual long/short ratio. Source: Bybit

Figure 4: Bybit SOLUSDT Perpetual daily chart. Sources: Bybit; TradingView

Options Traders With a Downside Bias

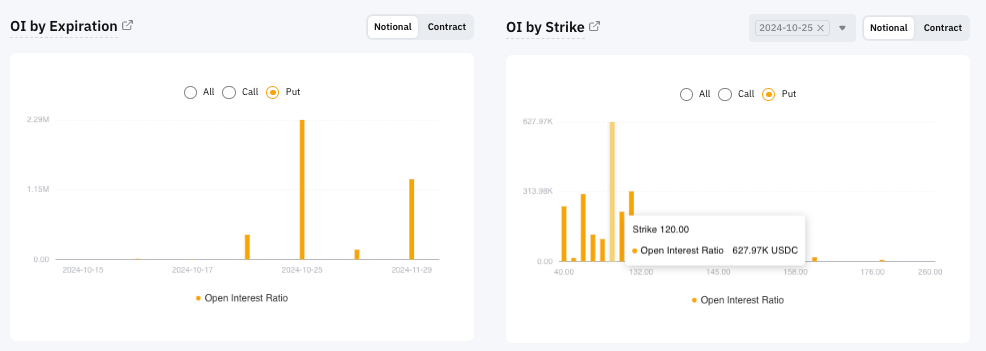

Examining key options trading data could be another piece of the puzzle to what traders have been thinking about when trading SOL. Recent data from Bybit shows that SOL put options with a month-end expiration have been gaining momentum, and the $120 strike price seems the most popular choice among traders. On the other hand, $160 call SOL options with month-end expiration seem to be what SOL bulls have picked.

Figure 5: Bybit SOL call options open interest by expiration and strike price. Source: Bybit

Figure 6: Bybit SOL put options open interest by expiration and strike price. Source: Bybit

How shall we interpret this data? Puts at $120 could mean traders are willing to use relatively OTM puts to bet that the price of SOL could hit $120 or lower before the options contracts expire. In contrast, the bulls have mainly been using $160 calls, which is relatively close to the current SOL price as of Oct 15, 2024. It seems that options traders have been thinking there could be more opportunities to make SOL downside trades, rather than trading it upside.

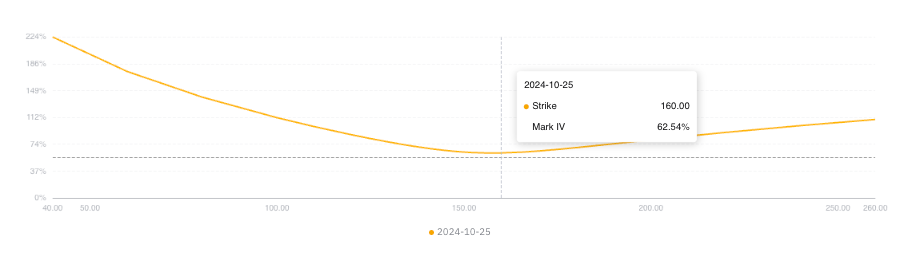

Implied volatility (IV) also supports this assumption. Figure 7 (below) shows the IV of SOL options on Bybit, indicating that OTM puts have a significantly higher IV than OTM calls, which means that OTM puts are priced higher than OTM calls.

Since options are usually priced currently, if one side is priced higher than the other, the market has a tendency to move in that direction. However, seeing a complete picture or calling a trade with just a one-day data point is difficult. It’s crucial to observe the data over multiple days and compare different data sets.

Figure 7: Bybit SOL options implied volatility. Source: Bybit

If you want to learn more about implied volatility and why it’s so important to options trading, read more at Bybit Learn.

Conclusion

The recent price actions of SOL have drawn significant attention from traders and speculators. Derivatives such as options and Perpetual contracts could be helpful tools for grasping the opportunities in SOL. However, each data point only provides a small piece of information about the whole picture, and many factors could affect the price of this token in the market.

#BybitOpinion #LearnWithBybit

Disclaimer: Investing in cryptocurrencies and their derivatives involves substantial risk of loss, and isn’t suitable for every investor. This article provides facts for educational purposes only, and does not represent any financial advice. Prior to making any investment decisions, please ensure you fully understand the risks involved and seek independent advice if necessary. Our customer support team is available to assist you with any inquiries.