Learn From Smart Money: Derivatives Traders Show Optimism on SOL After a Fresh ATH

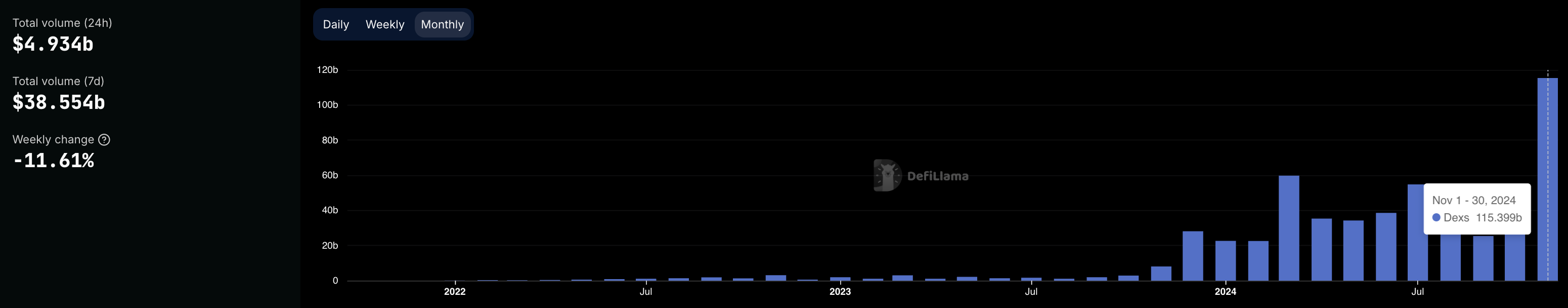

The price of SOL reached a new all-time high in mid-November 2024 as recent developments in the Solana ecosystem and support from its community strengthened the market's confidence in SOL's outlook. Some of the most actively traded tokens in the market, such as CHILLGUY, MUSTARD and FATHA, are all based in Solana’s strong community. Data from DefiLlama shows that the monthly trade volume of DEXs on Solana reached $100 billion for the first time in November 2024.

Figure 1: Monthly trade volume of DEXs on Solana. Source: DefiLlama

SOL has outperformed BTC and ETH this year with a 117% YTD gain, while BTC and ETH surged 113% and 45% in the same period (respectively). While the market seems to expect BTC to trade sideways until the end of the year, the market's attention could shift to major alts such as SOL. This week at Learn From Smart Money, we’ll dive into the derivatives trading data on Bybit to analyze traders' sentiment toward SOL.

Long Accounts Accumulate on SOLUSDT Perps

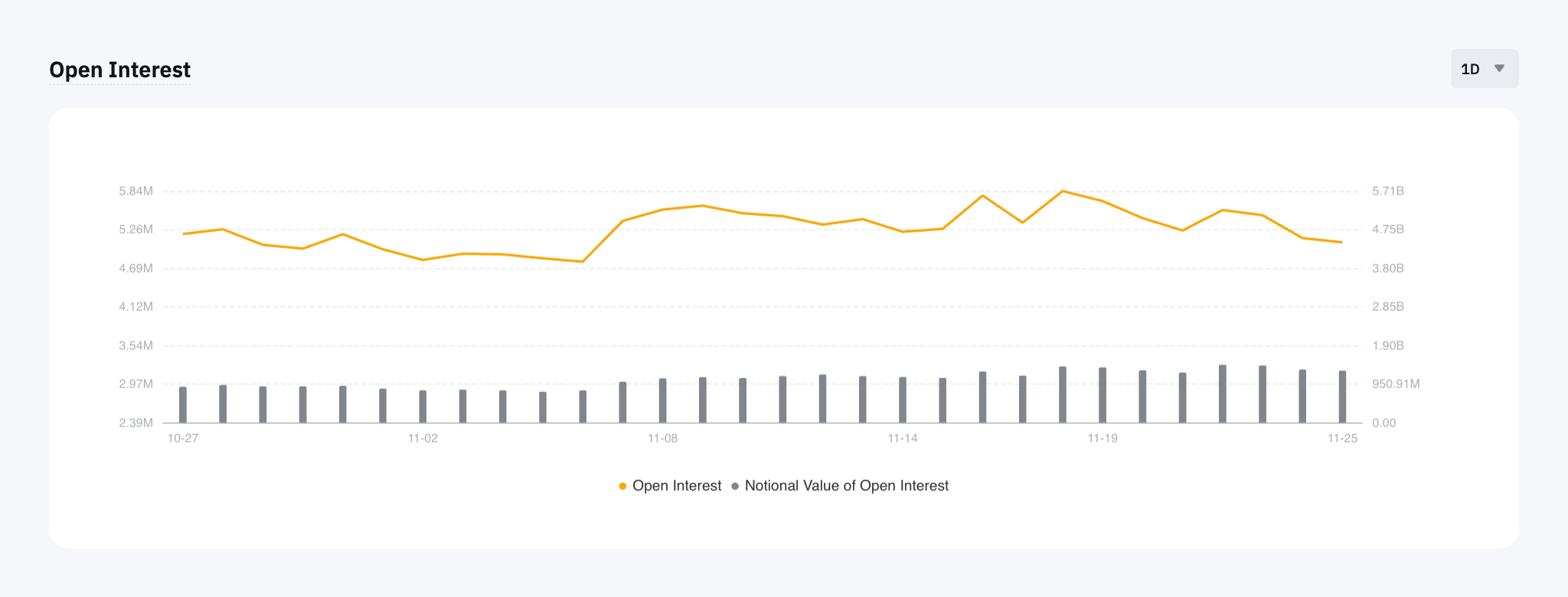

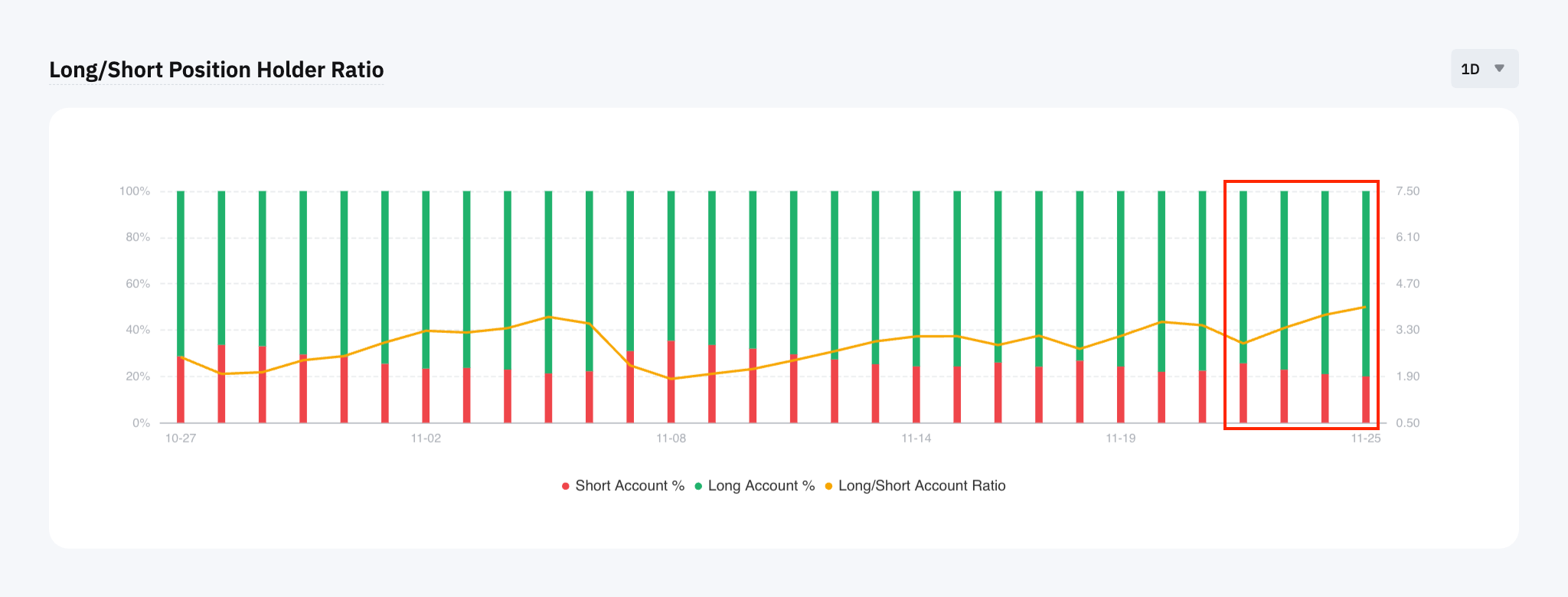

Derivatives trading on Bybit shows that traders have increased interest in betting SOL with an upside bias. The contract data page on Bybit shows that the open interest of SOLUSDT Perpetuals has been maintained at a high level, while the number of total long accounts has been increasing for at least four consecutive days.

The price of SOL has been relatively soft after hitting its ATH at $264. That's when the number of long accounts started to increase. This divergence could imply that derivatives traders have been gearing up for a potential trend reversal, thereby opening more long positions.

We've highlighted the importance of open interest and the long/short ratio in perpetuals trading here. Learn more about how to interpret this data in the Bybit 360 section on Bybit Learn.

Figure 2: SOLUSDT Perpetuals daily open interest on Bybit. Source: Bybit

Figure 3: SOLUSDT Perpetuals daily long/short ratio on Bybit. Source: Bybit

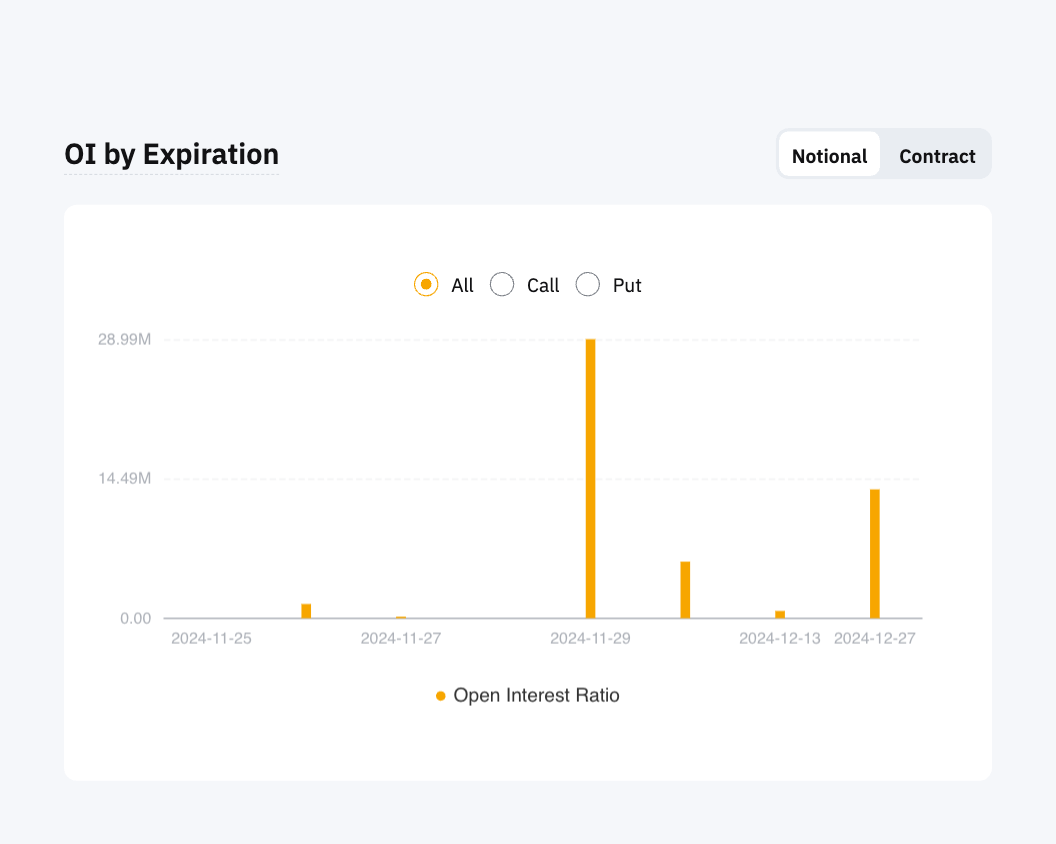

SOL Options Gain Traction

The upside bias of SOL can also be seen in the Bybit options market. Daily notional open interest in SOL options has been increasing to over $50 million, indicating that options traders have been increasingly willing to enter the SOL market with options. This could also be a sign of possible strength in the momentum of the price. Data shows that most traders have been eyeing contracts with a Nov 29, 2024 expiration, while open interest in December 27 expiration contracts is expected to increase as we move forward to year's end.

Figure 4: Open interest of SOL options on Bybit. Source: Bybit

Figure 5: Open interest by expiration of SOL options on Bybit. Source: Bybit

Medium-Dated Options Show Optimism

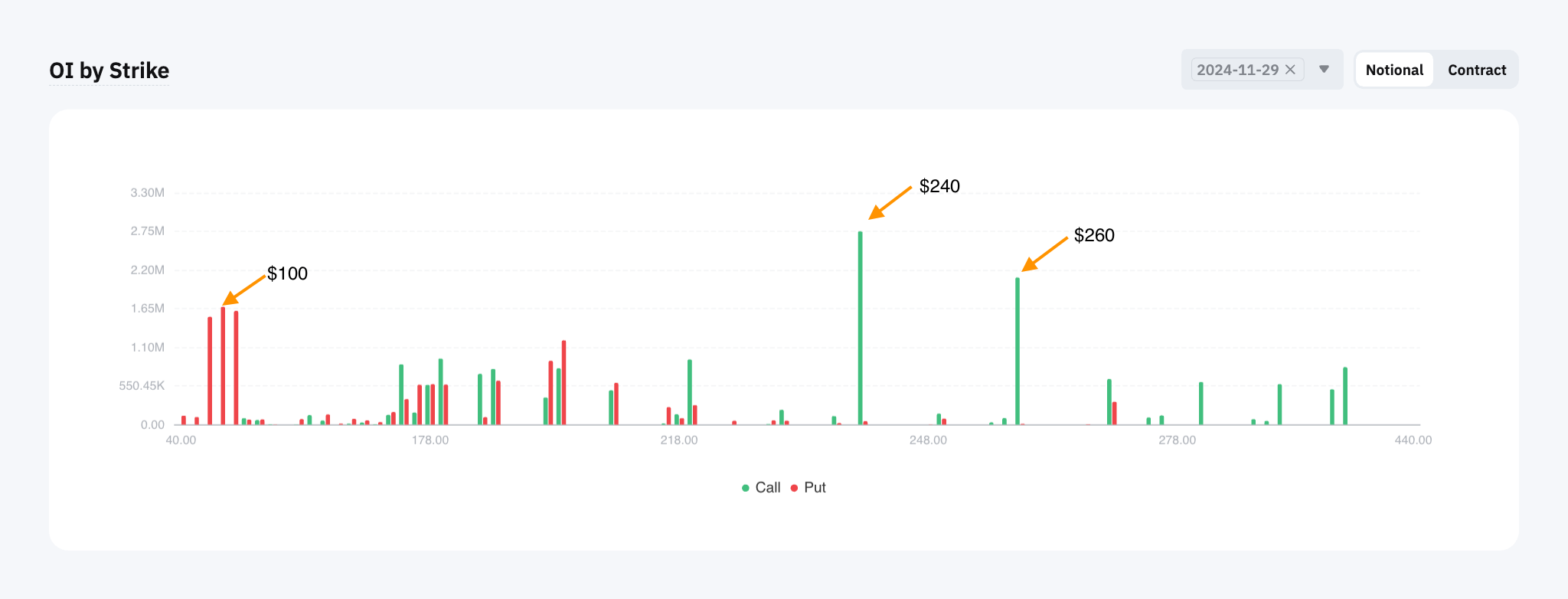

For options contracts with a Nov 29, 2024 expiration, most of the open interest is focused on the $240 and $260 strike prices, as indicated in Figure 5. While both strike prices are too far off from the current price level (about $230 as of Nov 26, 2024), this could imply that some options traders still believe that the price of SOL could hit its ATH again by the end of the month, while the OI on $100 puts could be part of the overall hedging strategy.

Figure 6: Open interest by strike of SOL options with Nov 29, 2024 expiration on Bybit. Source: Bybit

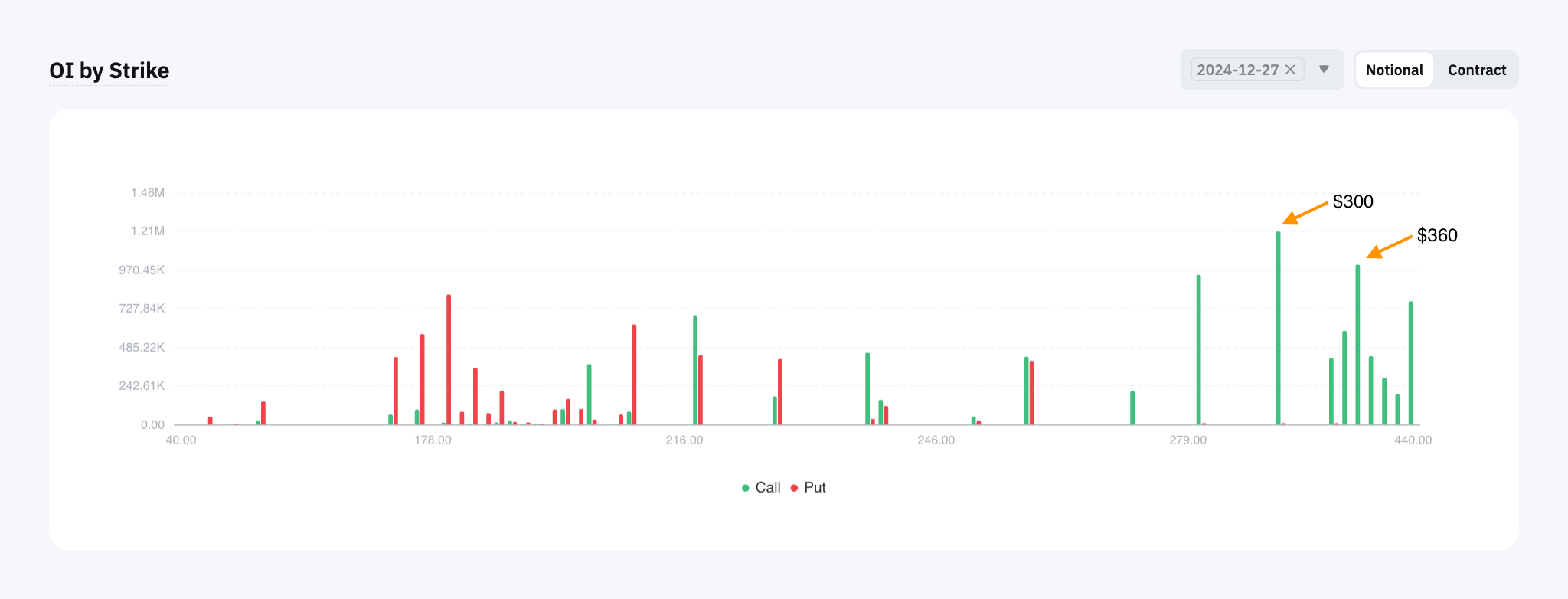

What's even more interesting is the open interest of SOL options contracts with a Dec 27, 2024 expiration. It shows a notable build-up of open interest at the $300 and $360 strikes. This could indicate that some options traders are bullish on SOL, and are betting the price will have a chance to jump over $300 by the end of the year.

Figure 7: Open interest by strike of SOL options with Dec 27, 2024 expiration on Bybit. Source: Bybit

Conclusion

The derivatives market's response to Solana's new all-time high reveals a sophisticated approach by institutional traders. While a new ATH could be exciting, the real story lies in the positioning of derivatives, where smart money maintains controlled bullish exposure through options and perpetuals. However, the crypto market is known for its constantly changing nature. It's important to keep up-to-date and reassert such data from time to time, as market sentiment may shift at any time.

#BybitOpinion #LearnWithBybit

Disclaimer: Investing in cryptocurrencies and their derivatives involves substantial risk of loss, and isn’t suitable for every investor. This article provides facts for educational purposes only, and does not represent any financial advice. Prior to making any investment decisions, please ensure you fully understand the risks involved and seek independent advice if necessary. Our customer support team is available to assist you with any inquiries.