Learn From Smart Money: Derivatives Data shows Divided Views on ETH as ETF Recorded Strong Inflows

The positive sentiment around BTC has resonated throughout the border cryptocurrency market as the price of the leading crypto reached another ATH. ETH also benefited from the bullish sentiment as it handily surpassed $3,000, the highest level since August 2024.

In our previous publication, Learn From Smart Money: The Case for ETH Playing Catch-Up, we noted that some options traders on Bybit have been using $2,700 and $3,600 calls with a year-end expiration for this run. Now, the $2,700 calls have already turned significant profit at the current price level.

While some believe that the BTC bull run may last at least until year-end, some ETH derivatives traders may have a different idea. In this edition of Learn From Smart Money, we’ll follow up on the latest ETH derivatives trading data on Bybit and try to unlock the reasoning behind these traders’ strategies.

Renewed Interest in ETH — But Not Overhyped

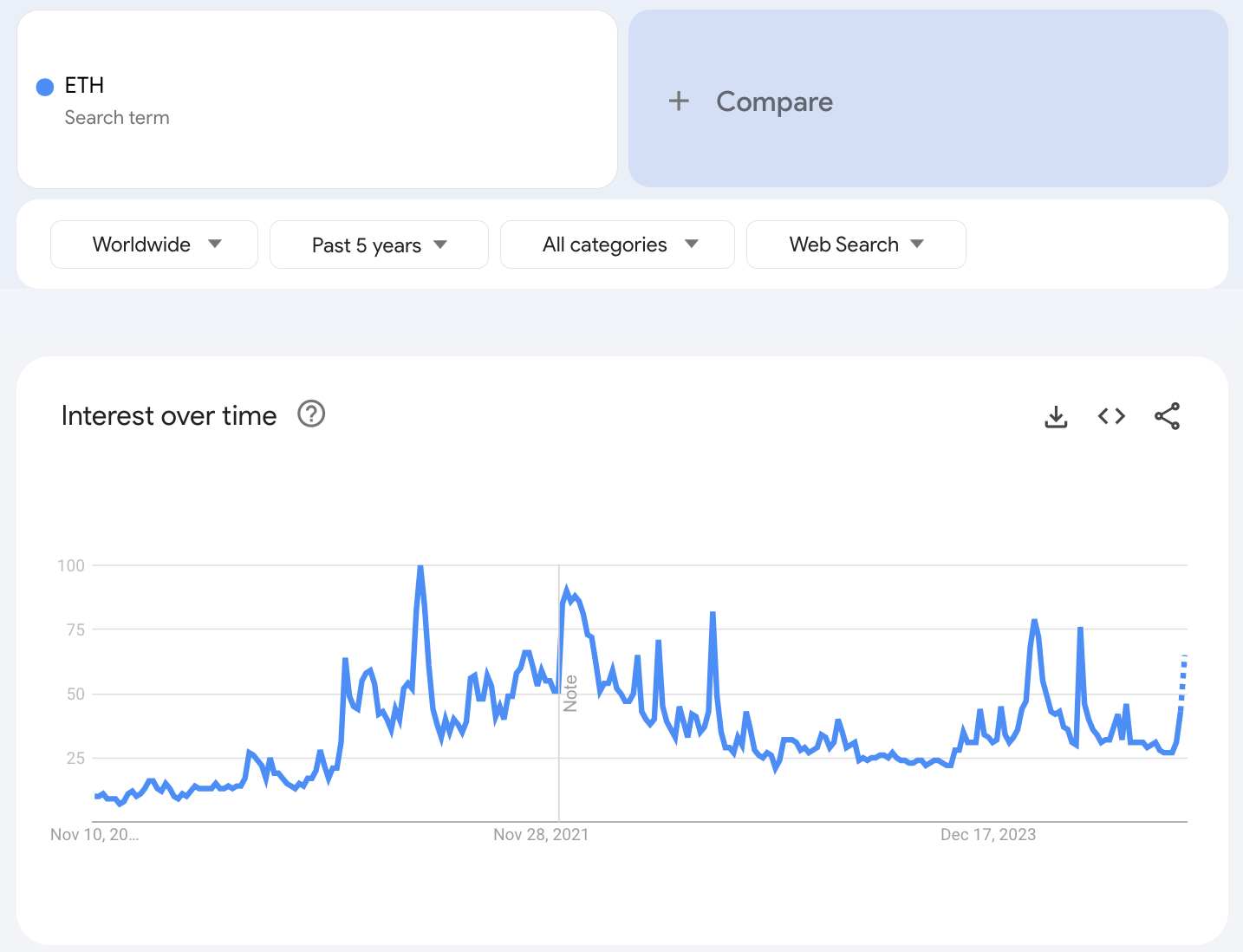

As of Monday, Nov 11, 2024, the latest bull run has pumped ETH's YTD gains to about 35% (from the 12% previously mentioned). And yet, it's still behind most of the other major cryptos, such as BTC (83%), SOL (86%) and TON (123%). However, it's clear that the public's interest in ETH has rebounded. Google Trends indicates that the term "ETH" has gained interest in its search engine.

It's considered a good sign that the general interest in a specific crypto asset has increased. What's more encouraging, however, is that interest in ETH remains relatively low compared to previous cycles — which means that the market is still far from being at an irrational level or FOMO buying.

Figure 1: Google search interest in ETH for the past five years. Source: Google Trends

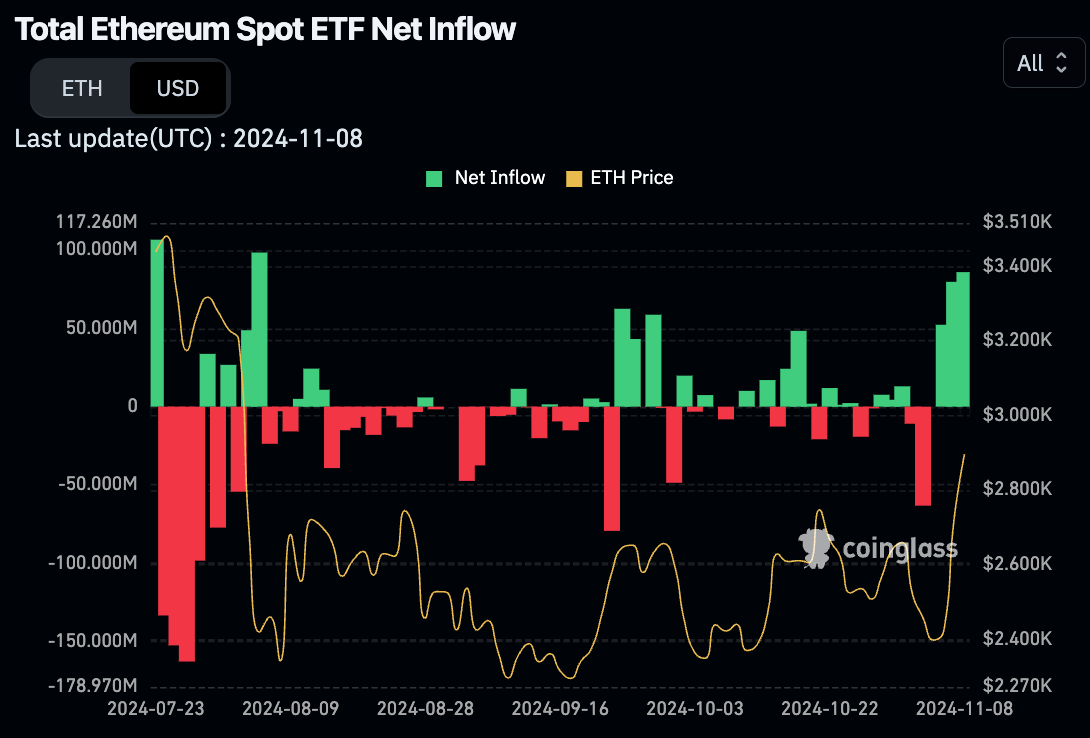

ETH's ETF capital flows may also support the same stance. Data from CoinGlass for the period from Nov 6–8, 2024 shows ETH Spot ETF net inflows of $217.9K, the biggest total since August. Since Spot ETF issuers directly hold the crypto, the capital flow of ETH Spot crypto ETFs is highly correlated with the price, and last week's net inflow aligns with the price actions, just as in August.

Figure 2: Total capital of ETH Spot ETF flows. Source: CoinGlass

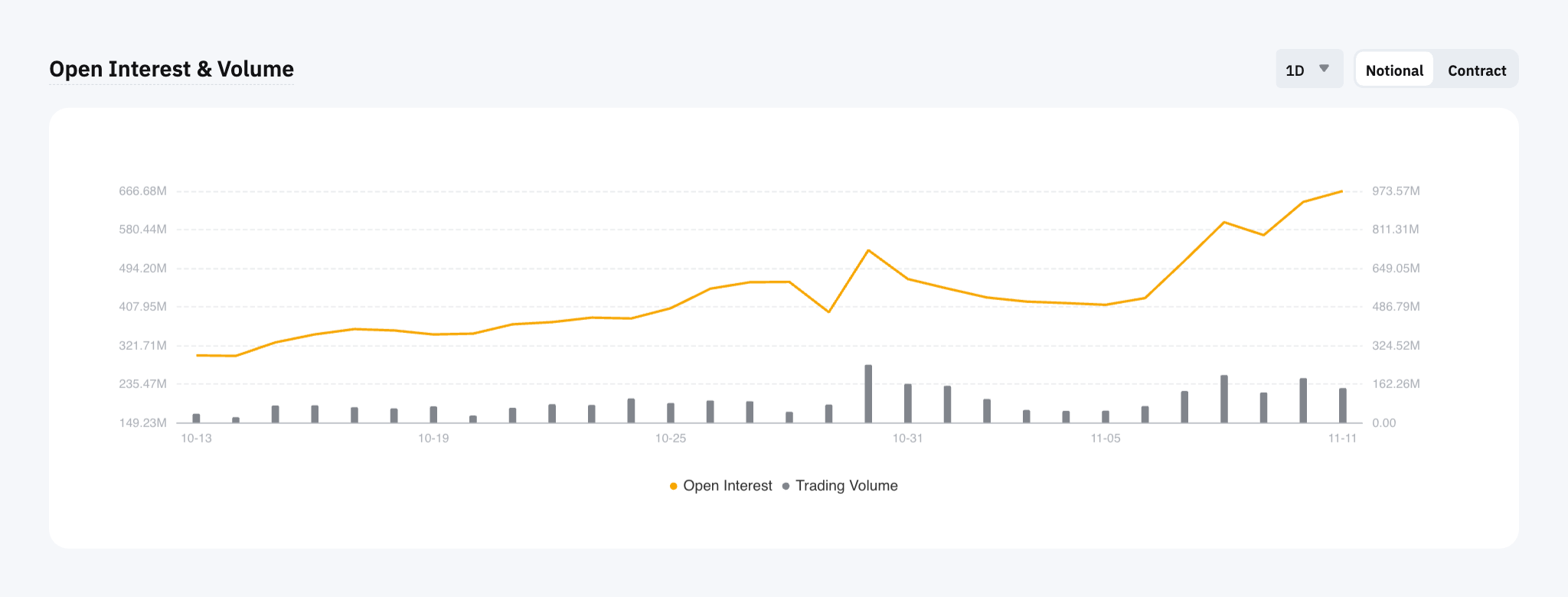

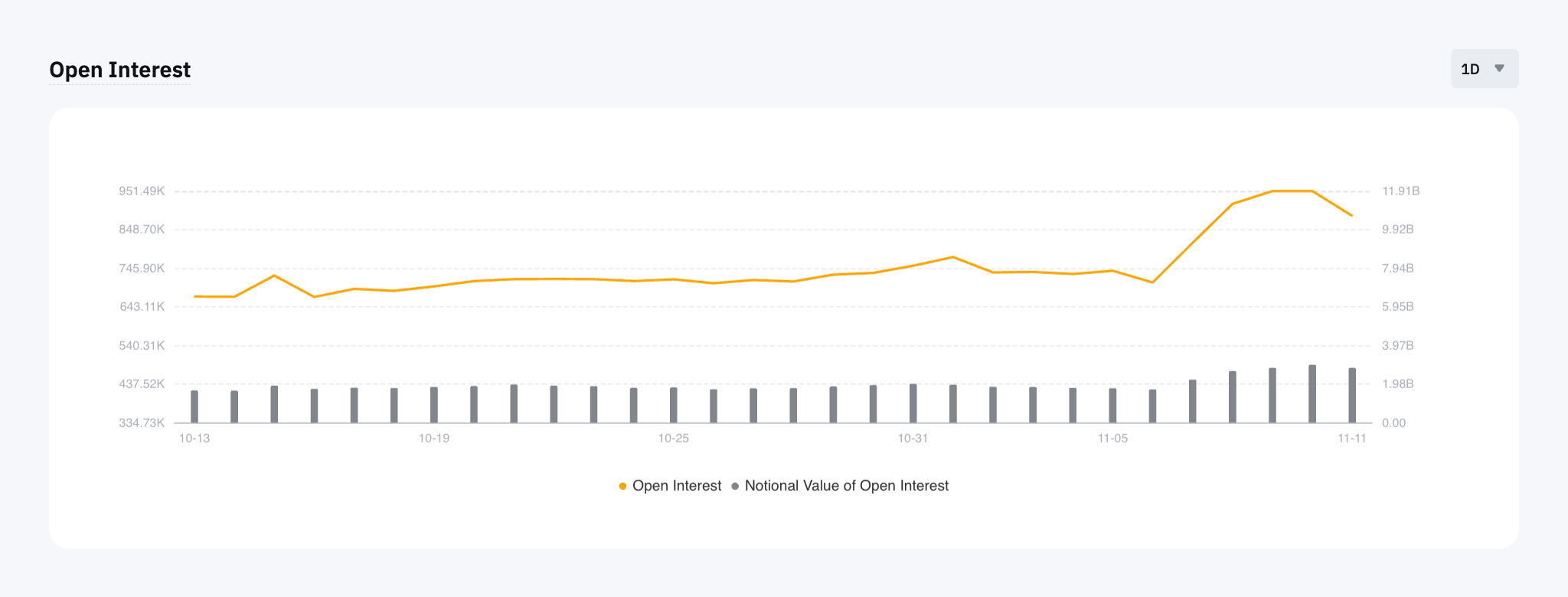

Increasing Open Interest From ETH Options and Perpetuals

The strong interest in ETH has also been observed on Bybit, especially in derivatives trading. Bybit's Contract Data page shows that open interest (OI) from ETH options has reached a new monthly high as of Nov 11, 2024, while open interest for ETHUSDT Perpetuals has been hovering near its monthly high.

Open interest is important as data because it tracks the number of active market participants and — to some extent — can reflect the level of willingness of derivatives traders. Besides, a higher level of open interest can also indicate higher liquidity in the market, as liquidity is one of the most important parts of trading. It helps traders enter and exit a trade at the desired price with minimal slippage.

Learn more about the difference between open interest and trade volume here.

Figure 3: Open interest and volume of ETH Options on Bybit. Source: Bybit

Figure 4: Open interest and volume of ETHUSDT Perpetuals on Bybit. Source: Bybit

Short Account Ratio Accumulating Slowly

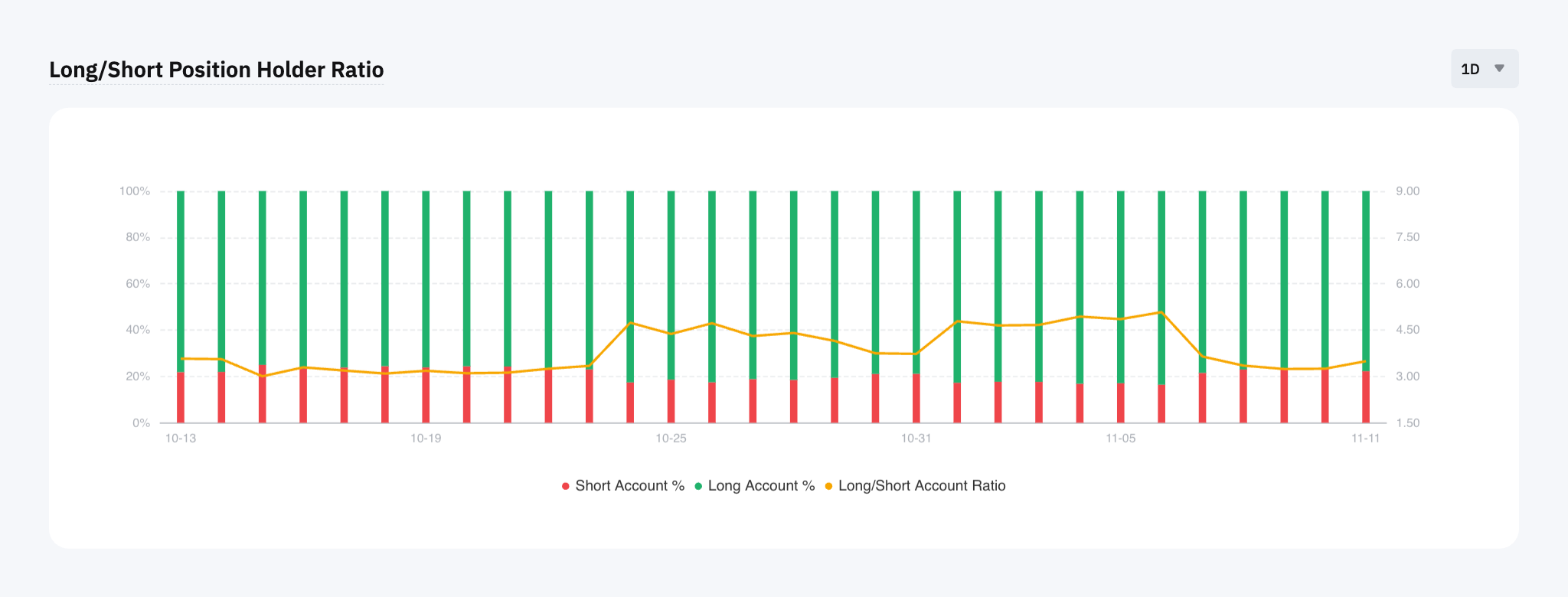

Although macro data suggests that overall interest in ETH has been increasing, the number of holders with short positions on ETH Perpetuals has also slowly been growing.

Figure 5 (below) shows the daily long/short ratio of ETHUSDT Perpetuals on Bybit. The number of holders with net short position has been increasing since Nov 7, 2024, and has stabilized at around 23% (of the net long account number).

While not alarming, a continuation of the increase in the net short account number could mean a turnaround of the bullish momentum. Thus, ETH Perp traders should closely monitor the development of this data.

Figure 5: Long/short ratio of ETHUSDT Perpetuals on Bybit. Source: Bybit

Some Options Traders Are More Bullish, Some Maybe Less

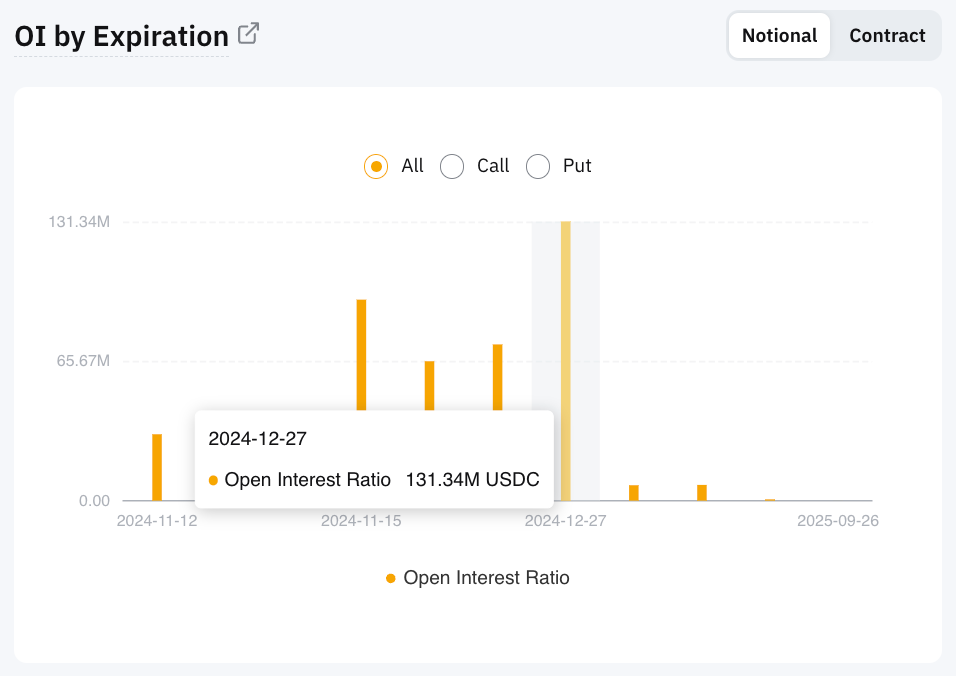

Options have been gaining popularity among ETH derivatives traders largely because of their composability and flexibility when it comes to strategy execution. Contracts with a year-end expiration remain ETH speculators' favorite tenor, as contracts with a Dec 27, 2024 expiration have the highest open interest on Bybit.

Figure 6: Open interest of ETH options with a Dec 27, 2024 expiration. Source: Bybit

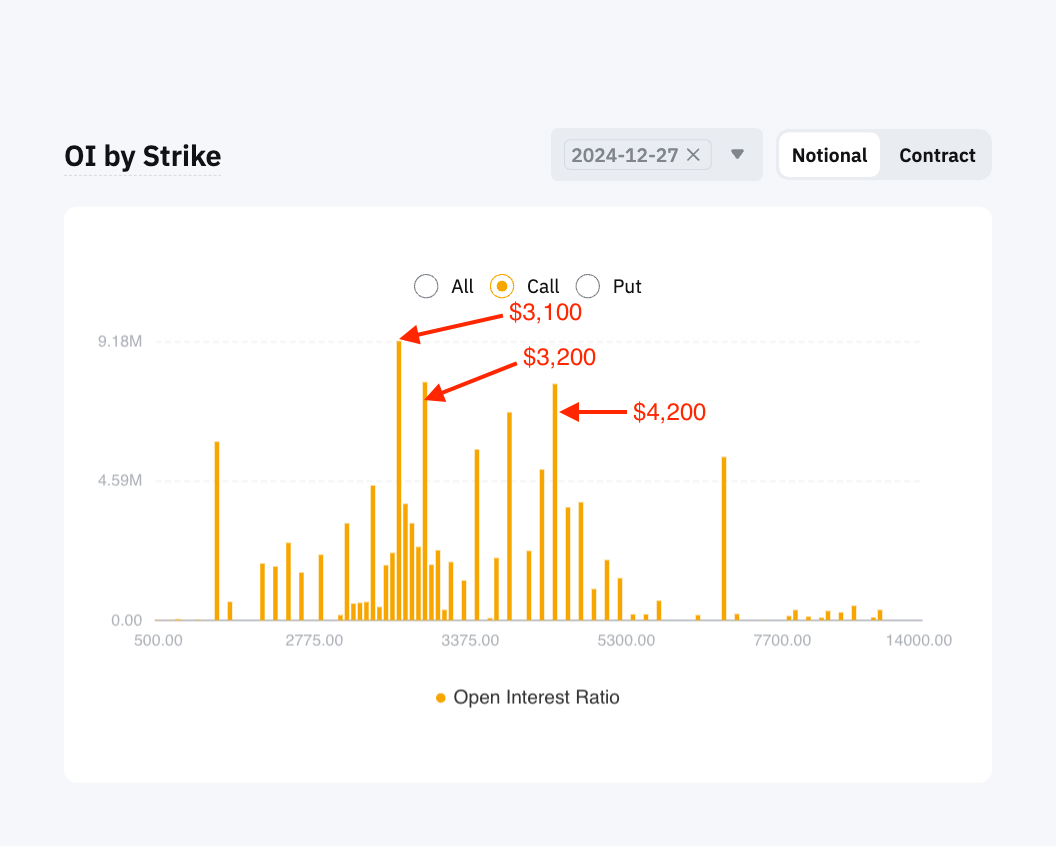

At the time of this writing (Nov 11, 2024), $3,100 and $3,200 calls — which are already in the money (ITM) — are still sitting with most of the open interest. (“ITM call options" means that the underlying asset's market price is higher than the call option's strike price.) On the other hand, $4,200 calls — which are still out-of-the-money (OTM) — have also received noticeable OI.

If a trader is bullish on the price of a specific asset within a certain time period, they’ll likely use OTM calls with a specific expiration to speculate on that asset. In ETH's case, ETH bulls are expected to take profit from the $3,100 and $3,200 calls and rotate to calls with higher strike prices to maximize the opportunity. We’ve already seen some of these rotations toward $4,200 calls.

However, if there's no significant open interest increase in ETH calls with higher strike prices in the coming days, it could be a sign that options traders believe that the momentum of the ETH rally may need a break.

Figure 7: Open interest of ETH call options with a Dec 27, 2024 expiration by strike. Source: Bybit

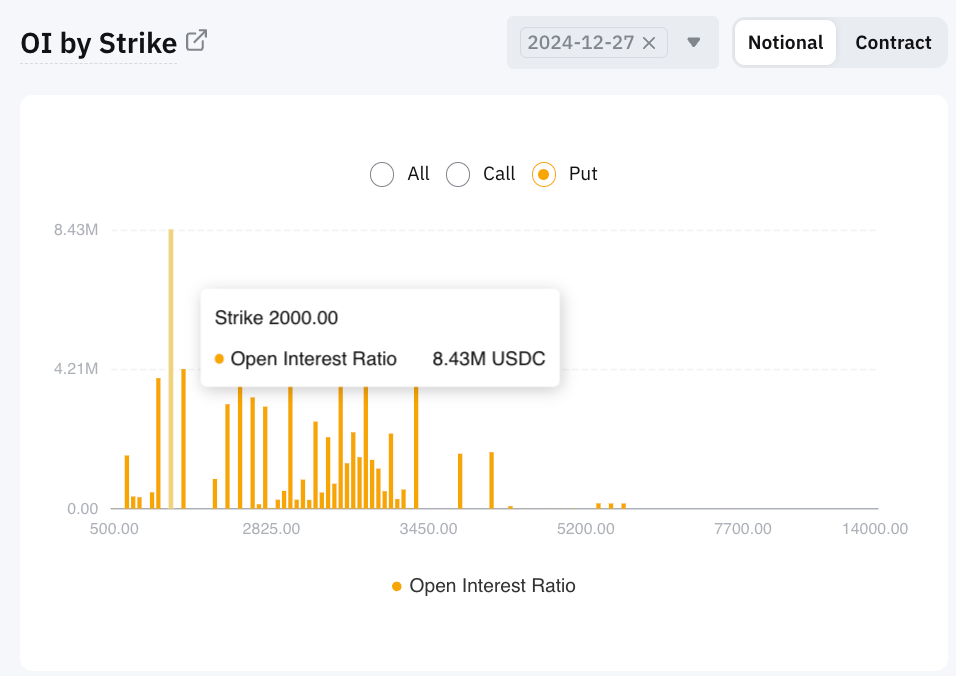

Let’s move on to the puts with year-end expiration. The $2,000 strike price remains the most popular choice among ETH options traders. With the current market momentum, the chance of ETH dropping to $2,000 by the end of the year is unlikely. However, having those puts could be part of a downside protection strategy, such as a married put or protective collar.

Learn more about options strategies in the Options section of Bybit Learn.

Figure 8: Open interest of ETH put options with a Dec 27, 2024 expiration by strike. Source: Bybit

Conclusion

While the crypto market is currently in a state of euphoria, certain macro events should be on the watchlist, including the upcoming U.S. economic data and U.S. Fed Chair Powell's speech after the FOMC meeting. With these developments, the crypto market is expected to get more clarity on the pacing of future rate cuts.

#BybitOpinion #LearnWithBybit

Disclaimer: Investing in cryptocurrencies and their derivatives involves substantial risk of loss, and isn’t suitable for every investor. This article provides facts for educational purposes only, and does not represent any financial advice. Prior to making any investment decisions, please ensure you fully understand the risks involved and seek independent advice if necessary. Our customer support team is available to assist you with any inquiries.