Learn From Smart Money: BTC’s Leverage Remains High as Traders Hedge Against Downside Risks

Positive sentiment has continued to fuel the cryptocurrency market as the expectation of further institutional adoption of BTC keeps growing. Options trading of BlackRock’s Spot Bitcoin ETF IBIT debuted with a bang, attracting almost $2 billion on the first day of trading. The hope of more spot ETF derivatives to change the market structure with additional institutional money onboarding crypto is high.

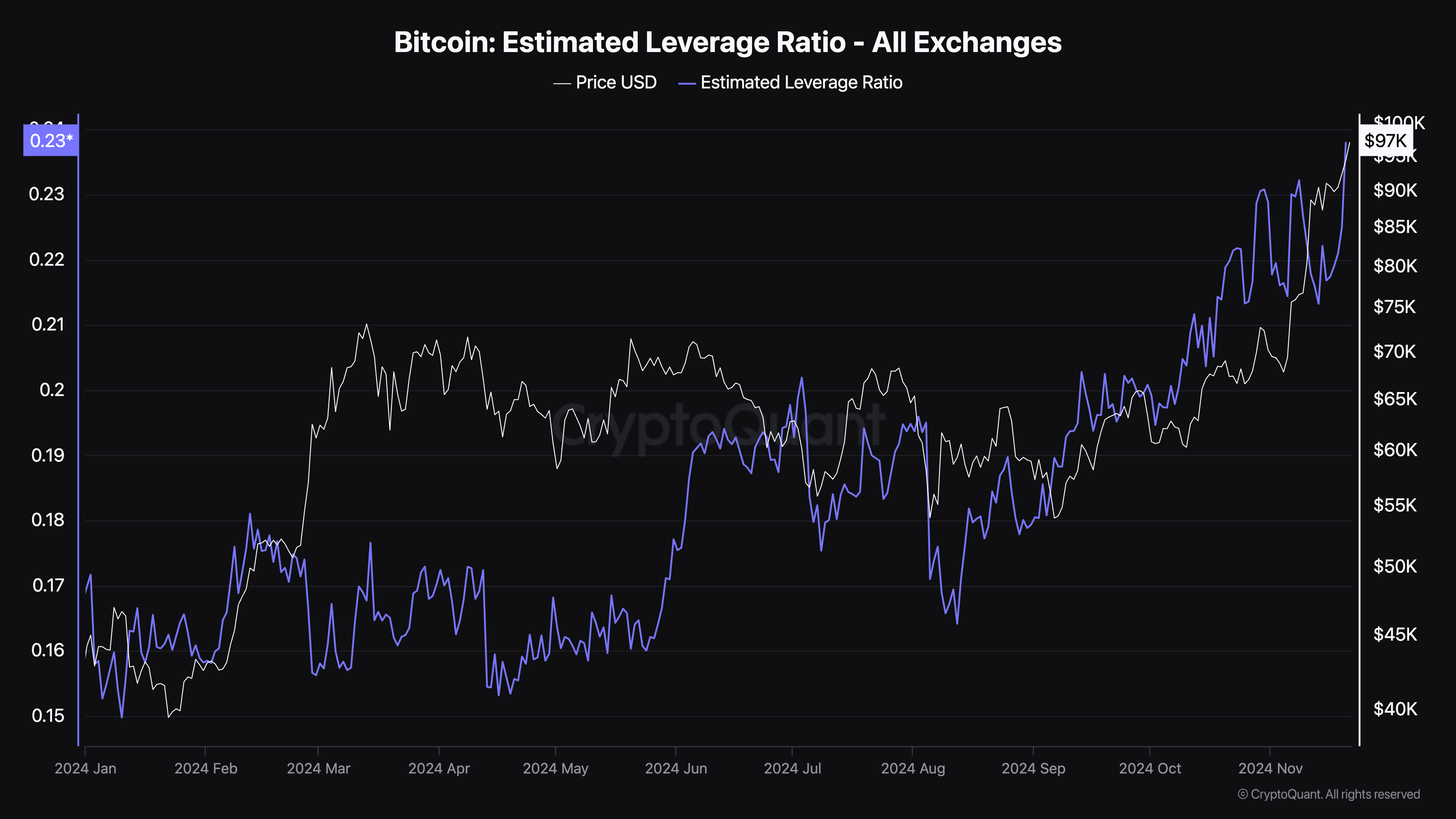

In our previous edition of Market Chatter, we explored the possibility of the market being overleveraged, which could be painful if the current leverage unwinds. Data from CryptoQuant shows that the estimated leverage of the current BTC markets has reached another YTD high.

Derivatives data on Bybit shows that traders seem to expect that BTC’s momentum could slow down a bit after the price hit over $97,000, and are focusing more on downside protection.

Figure 1: Bitcoin estimated leverage ratio at 0.23. Source: CryptoQuant

BTC Options Open Interest Returns to Previous High While Perps Are Catching Up

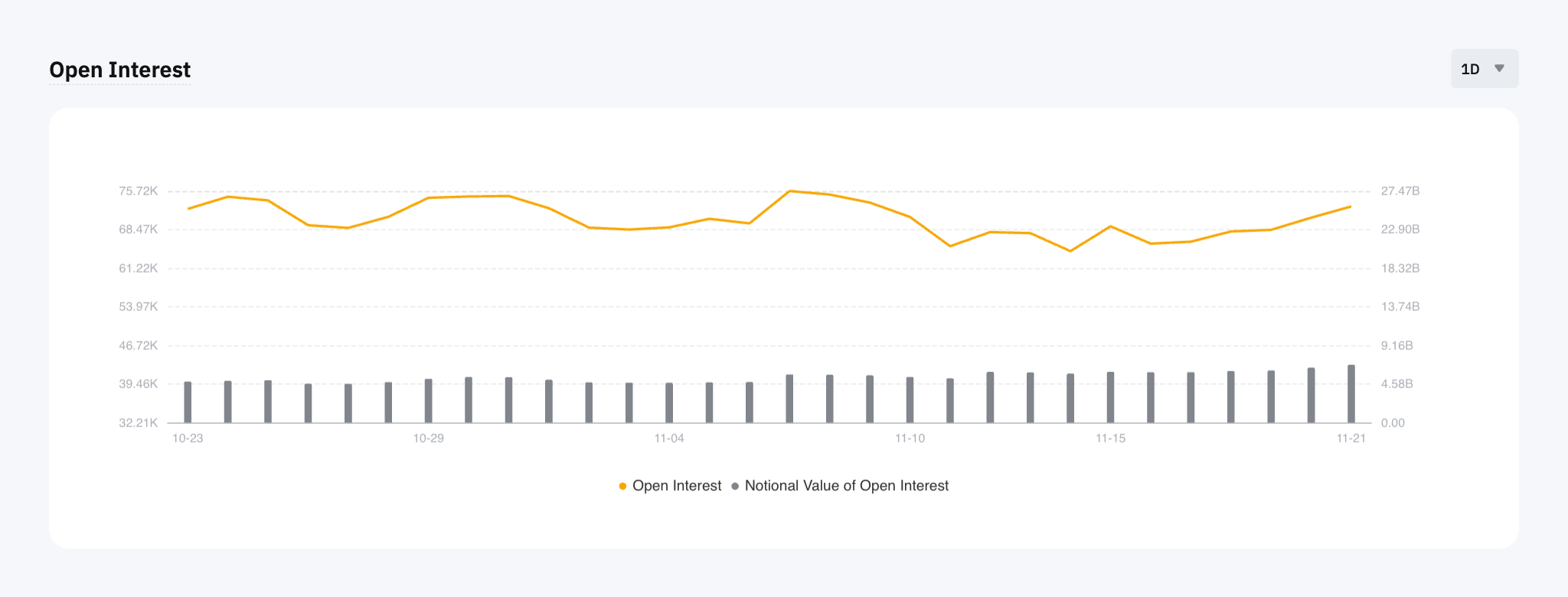

Derivatives traders have been actively participating in BTC markets as open interest (OI) for BTC Options on Bybit has surged to over $3 billion, on par with the previous high on Nov 14, 2024. Although the options OI has increased, it still hasn’t surged above the previous high. At the time, BTC’s price had already jumped to over $97,000. If the OI doesn’t follow suit and break above the previous high in the coming days, this could be a sign that the market could become a bit exhausted — something for all market participants to be aware of.

Figure 2: Daily open interest for BTC options on Bybit. Source: Bybit

BTCUSDT Perpetuals have also seen increased open interest in recent days. Perpetuals have been among the most favorable products for day traders and short-term speculators. Rising open interest could indicate that more traders are looking for short-term profit, which could bring additional volatility to the market.

Figure 3: Daily open interest for BTCUSDT Perpetuals on Bybit. Source: Bybit

Downside Protection

Dec 27, 2024 remains the most popular expiration date for BTC Options on Bybit, with most of the open interest there. Within that expiration, $120,000 calls had the most OI, and $100,000 calls accumulated the second-largest OI.

Figure 4: Open interest by strike for BTC Options with a Dec 27, 2024 expiration. Source: Bybit

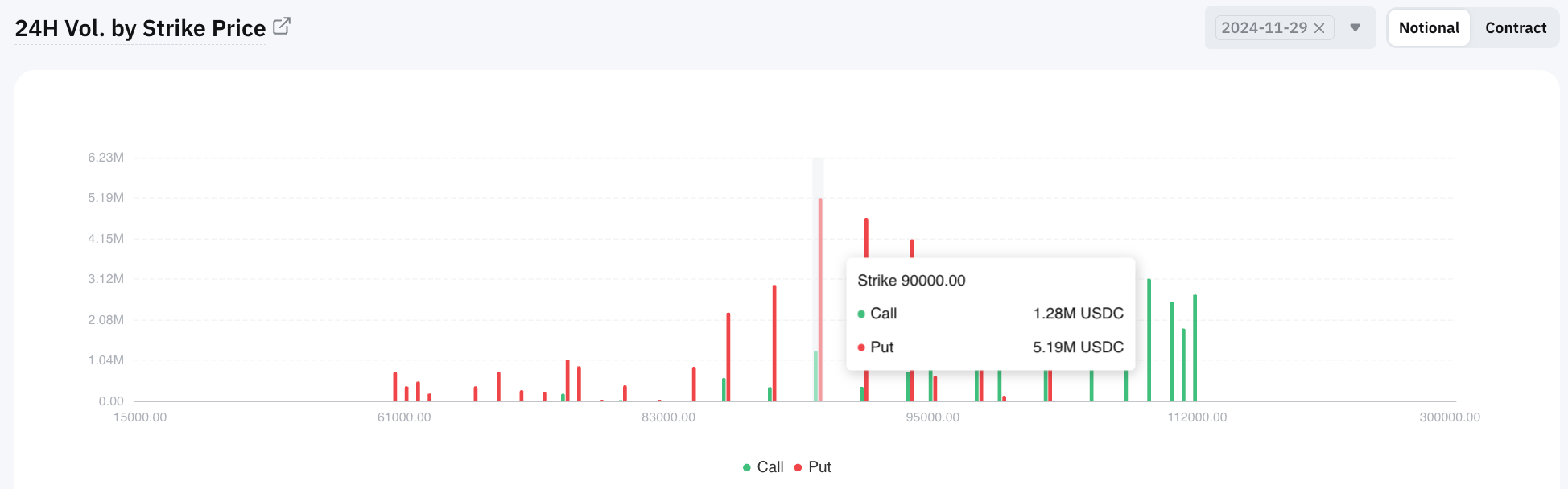

Meanwhile, the market’s optimism that BTC will hit $100,000 by the end of the year seems to support the current price momentum. Shorter-dated options could show that traders are also looking for downside protection. The Bybit Contract Data page shows that BTC Options with a Nov 29, 2024 expiration have a strong 24-hour inflow to $90,000 puts. This could indicate that some traders are also anticipating some degree of price correction by the end of the month.

Figure 5: 24-hour volume by strike for BTC Options with a Nov 29, 2024 expiration on Bybit. Source: Bybit

Smirk, Not a Smile

Implied volatility for BTC Options on Bybit also indicates a possible downside protection in play among options traders. A smirk skew, or left skew, is a skew curve that’s steeper on one side (the left side) than the other. Traditionally, a smirk skew curve could mean that traders have been protecting their portfolios against a possible declining market. At the time of this writing (Nov 21, 2024), BTC Options contracts on Bybit with Nov 29, 2024 and Dec 27, 2024 expirations have both shown a smirk skew. However, this doesn’t necessarily mean traders are bearish on the price, and could just be part of the trading strategy. For example, traders could set up collars by buying out-of-the-money (OTM) puts and selling OTM calls simultaneously, so that they can profit in case BTC’s price drops, gain upside exposure and potentially offset the cost of buying the puts.

For more options strategies, visit the Options section in Bybit Learn.

Figure 6: Implied volatility of BTC Options with Nov 29, 2024 and Dec 27, 2024 expirations. Source: Bybit

Conclusion

The current BTC leverage trading may be complex, but tells a revealing narrative about market sentiment. The divergence between high leverage and increased hedging activities also reminds us that market dynamics are rarely straightforward, and adopting a disciplined approach to risk management seems increasingly important in this diverse market.

#BybitOpinion #LearnWithBybit

Disclaimer: Investing in cryptocurrencies and their derivatives involves substantial risk of loss, and isn’t suitable for every investor. This article provides facts for educational purposes only, and does not represent any financial advice. Prior to making any investment decisions, please ensure you fully understand the risks involved and seek independent advice if necessary. Our customer support team is available to assist you with any inquiries.

.png)