Learn From Smart Money: BTC Reaches a Fresh ATH Amid Macro Events, but What’s Next?

The price of BTC hit a fresh all-time high as traders and investors braced for the outcome of the U.S. elections and the upcoming interest rate decision from the Fed. As our Weekly Institutional Insights highlighted, the rising odds for a Republican presidency have increased volatility in Treasuries and equities, suggesting significant market implications depending upon election outcomes. Data shows that derivatives traders on Bybit have been setting up for short-term market volatility, while things could be relatively stable toward year-end.

Post-Election Dated Options in Focus

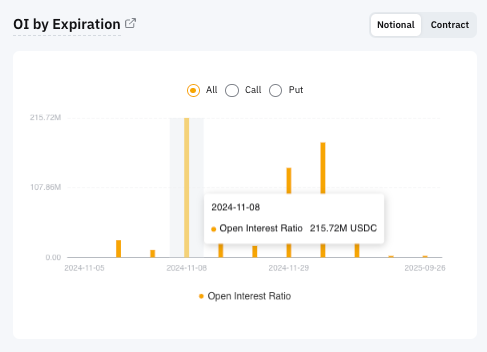

BTC derivatives traders have been focusing on the upcoming macro events, and the U.S. elections are front and center, dominating news headlines globally. Despite the price of BTC remaining in its multi-month range, data shows that traders have been keen to bet on BTC's potential price movement after the U.S. elections. Bybit's Contract Data page indicates that most of the open interest in BTC options was has been on contracts with a Nov 8, 2024 expiration.

Figure 1: Open interest by expiration of BTC options on Bybit. Source: Bybit

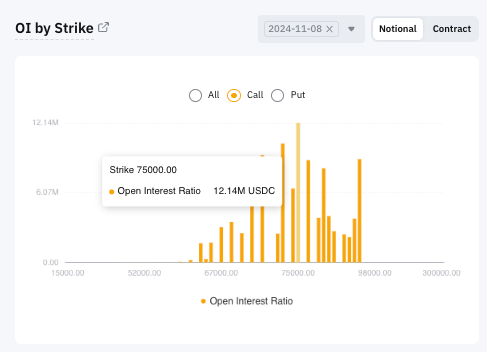

Figure 2: Open interest by strike of BTC call options with Nov 8, 2024 expiration on Bybit. Source: Bybit

Among the calls, the $75,000 strike price seems the most popular choice, while $73,000 and $71,000 have also seen notable open interest. This could mean that some traders are betting on the price of BTC soaring above $70,000 or potentially hitting $73,000 right after the U.S. elections.

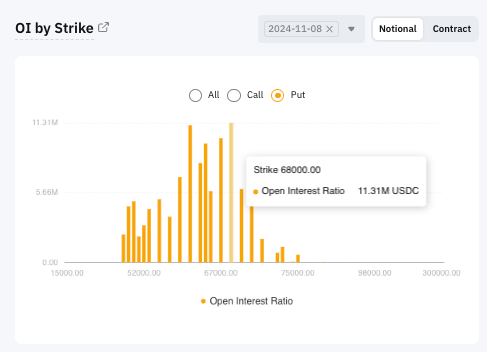

The picture seems clearer when looking at the puts. With the same expirations, most of the open interest has focused on puts with a $68,000 strike, and puts with a $62,000 strike have also received plenty of attention.

So, how can we interpret this overall? At the time of this writing (Nov 5, 2024), BTC has been trading around $68,700 on Bybit. Calls at a $73,000 strike with a Nov 8, 2024 expiration may be considered aggressive, while $68,000 puts with the same expiration could be considered reasonable downside protection for the election trade.

Figure 3: Open interest by strike of BTC put options on Bybit. Source: Bybit

It's worth noting that the implied volatility (vols) of short-dated BTC options has been rising rapidly to over 89% (even realized vols went over 40%), which many consider relatively high. Vols is one of the key components when it comes to pricing options contracts. In a nutshell, the higher the vols, the higher the price of the options contracts, and vice versa. Since the vols of short-dated BTC options have surged to a relatively high level, traders may need to pay a premium if they want to use these options contracts to speculate on BTC prices, which may limit the upside.

Figure 4: Implied volatility of BTC options with Nov 8, 2024 and Nov 29, 2024 expirations on Bybit. Source: Bybit

Figure 5: Historical volatility of BTC options on Bybit. Source: Bybit

Post-Election BTC Potential Development

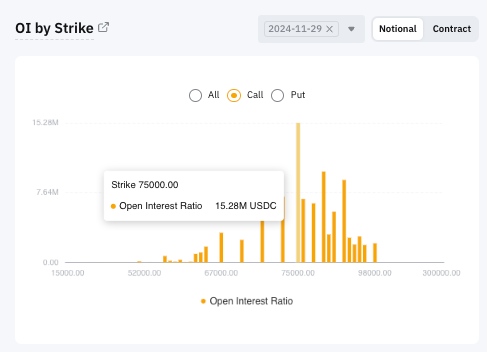

BTC options trading data on Bybit shows that most open interest on BTC calls with a Nov 29, 2024 expiration has been at a strike price of $75,000 (see Figure 6, below). It seems traders aren’t expecting an imminent bull run by the end of the month. However, since the market is filled with uncertainties, market participants could change their setups anytime.

Figure 6: Open interest by strike of BTC call options with Nov 29, 2024 expiration on Bybit. Source: Bybit

Conclusion

Short-term volatility is almost inevitable in the crypto market amid a series of macro events. Traders are expected to actively make trades shortly after the U.S. presidential election results are confirmed. Also, the market could reassert the pacing of the rate-cut cycle from the Fed’s interest rate decision and the press conference afterward. All these events could cause volatility in the crypto market, especially for BTC. That's why trading derivatives can offer leverage and, at the same time, downside protection — and that's exactly what traders need during a volatile market. Follow Bybit 360 and Bybit Options for more insights.

#BybitOpinion #LearnWithBybit

Disclaimer: Investing in cryptocurrencies and their derivatives involves substantial risk of loss, and isn’t suitable for every investor. This article provides facts for educational purposes only, and does not represent any financial advice. Prior to making any investment decisions, please ensure you fully understand the risks involved and seek independent advice if necessary. Our customer support team is available to assist you with any inquiries.