Copy Trading Is a Smart Choice for Beginners

Introduction to Copy Trading

Copy trading is a revolutionary approach to investing that allows beginners to navigate the complex world of cryptocurrency without needing extensive market knowledge. By utilizing this innovative strategy, users can follow and replicate the trades of seasoned investors, effectively leveraging their expertise to enhance their own investment outcomes.

For those who may lack the time or expertise to analyze market trends and make informed decisions, copy trading presents an ideal solution. It simplifies the investment process, allowing users to engage in the crypto market with confidence and ease.

With Bybit’s copy trading, users can seamlessly mirror the strategies of successful traders, making it easier than ever to participate in crypto investing. This automated trading for beginners not only saves time, but also opens the door to the potential benefits of trading without the steep learning curve typically associated with the financial markets.

How Copy Trading Works

Copy trading is designed to be straightforward, making it accessible for beginners. Following is a closer look at the copy trading process on the Bybit platform, highlighting the simple steps to begin crypto copy trading.

Choose a Trader to Copy

The first step in the copy trading journey is to select a trader whose strategies align with your investment goals. Bybit offers a variety of experienced traders, each with different trading styles, risk levels and performance histories. You can easily browse their profiles, examine their past performance and compare various metrics to make an informed choice.

Automatically Replicate Trades

Once you’ve chosen a trader to copy, the next step is to set up the copy trading feature. Bybit allows you to automatically replicate the selected trader’s trades in real time. This means that every time your chosen trader makes a move — whether it’s buying or selling a cryptocurrency — your account will mirror those trades proportionally. This automation simplifies the trading process, ensuring you stay aligned with the strategies of those you admire without needing to constantly monitor the market.

Monitor Your Investment Performance

After you’ve activated copy trading, it’s crucial to keep an eye on your investment performance. Bybit provides user-friendly tools and dashboards that allow you to track how your investments are performing in real time. You can assess returns, analyze trends and evaluate whether your selected trader’s strategies are meeting your expectations. If necessary, you can make adjustments — whether switching to another trader to copy, or modifying your investment amount — in order to optimize your portfolio.

User-Friendly Interface

One of the standout features of Bybit is its intuitive interface. Designed with beginners in mind, the platform simplifies the copy trading process to just a few clicks. Whether you’re selecting a trader, setting up automatic replication or monitoring your investments, everything is streamlined for ease of use. This ensures that regardless of experience level, anyone can start copy trading confidently and efficiently.

Different Types of Copy Traders to Follow on Bybit

Bybit provides users with the opportunity to follow a wide range of experienced traders, each offering a unique approach to the cryptocurrency market. Here’s a breakdown of the different types of traders you can choose to copy, along with their respective strategies.

High-Risk, High-Reward Traders

These traders embrace high-risk crypto trading strategies, often employing leverage to amplify their potential gains. They make aggressive trades aimed at capitalizing on market volatility, seeking quick profits in a rapidly changing environment. While this approach can lead to substantial rewards, it also comes with significant risks, making it suitable for users who are comfortable navigating the ups and downs of the market. If you’re looking for fast returns and are willing to accept higher risk, following these traders could align with your investment goals.

Long-Term, Low-Risk Traders

In contrast, long-term, low-risk traders prioritize stability and gradual growth. They adopt a conservative approach, making trades that are carefully calculated to minimize risk while aiming for consistent returns over time. This strategy is ideal for investors who prefer a steady investment path and are looking for a long-term crypto investment. By following these conservative copy traders, you can build a portfolio that focuses on sustainability rather than short-term gains.

Trend-Following Traders

Trend-following traders utilize market analysis to identify and capitalize on prevailing market trends. They adopt a strategy of going long in bullish markets and short in bearish ones, effectively adjusting their positions based on market conditions. This approach is particularly effective in fluctuating markets, allowing traders to ride the waves of price movements. If you’re interested in understanding crypto trends and want to follow traders who leverage these insights, trend-following traders could be a great fit.

Algorithmic and Automated Traders

Algorithmic and automated traders employ sophisticated algorithms and trading bots to execute their trades. This data-driven approach minimizes emotional decision-making, allowing for more precise and timely trade execution. By using these automated systems, traders can capitalize on market opportunities quickly and efficiently. If you prefer a hands-off approach and value automated crypto trading, following these traders can provide a streamlined investment experience. Look for your master traders now.

Benefits of Copy Trading on Bybit

Copy trading on Bybit offers a wealth of advantages, making it an attractive option for beginners and experienced investors alike. Following are some of the key benefits that highlight why this approach can be a game changer in the world of cryptocurrency trading.

Leverage Expertise

One of the most significant benefits of copy trading is the ability to leverage the expertise of experienced traders. Bybit’s copy trading tool allows you to benefit from the strategies and insights of seasoned investors without the need to make complex decisions yourself. This means you can enjoy the potential rewards of trading while relying on the expertise of others — an excellent avenue for anyone who’s either new to the market or lacks the time to research and analyze trades.

Automation and Time Savings

Automated crypto trading is a key feature of Bybit’s copy trading. Once you’ve selected a trader to copy, the system automatically replicates that trader’s investments in real time. This automation allows users to invest passively, saving precious time while still actively participating in the market. Whether you’re juggling a busy schedule or simply prefer a more hands-off approach, copy trading lets you engage with cryptocurrency without the constant need for monitoring.

Risk Management Features

Bybit prioritizes user safety and control through its robust risk management features. The platform includes tools such as stop-loss orders and position limits, enabling users to effectively manage their risk while copying trades. These features help protect your investments, allowing for a more secure trading experience. By implementing these risk management strategies, you can feel more confident in your decisions, knowing that you have measures in place to mitigate potential losses.

Diversification

Diversification is a cornerstone of successful investing, and Bybit makes it easy to spread your risk across various strategies. As a matter of fact, you can follow multiple traders simultaneously, allowing you to diversify your portfolio and reduce exposure to any single trader’s performance. This approach not only enhances your potential for returns, but also helps safeguard your investments against market fluctuations. By diversifying your strategies, you can create a balanced portfolio that aligns with your risk tolerance and financial goals.

Getting Started: How to Start Copy Trading

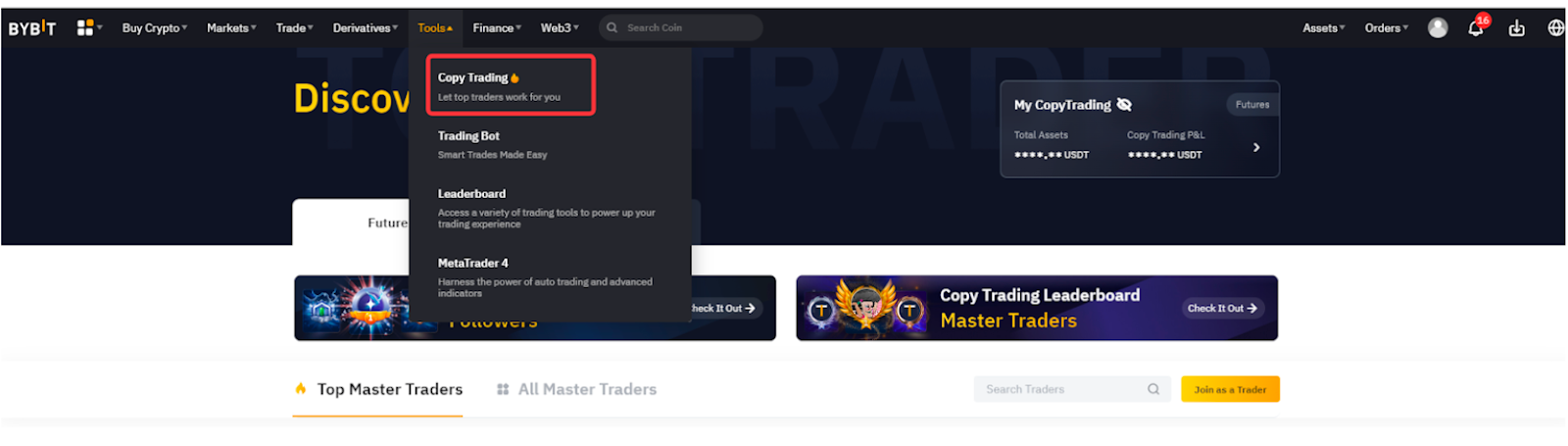

Step 1: Please click on Tools → Copy Trading in the navigation bar to enter the Copy Trading page.

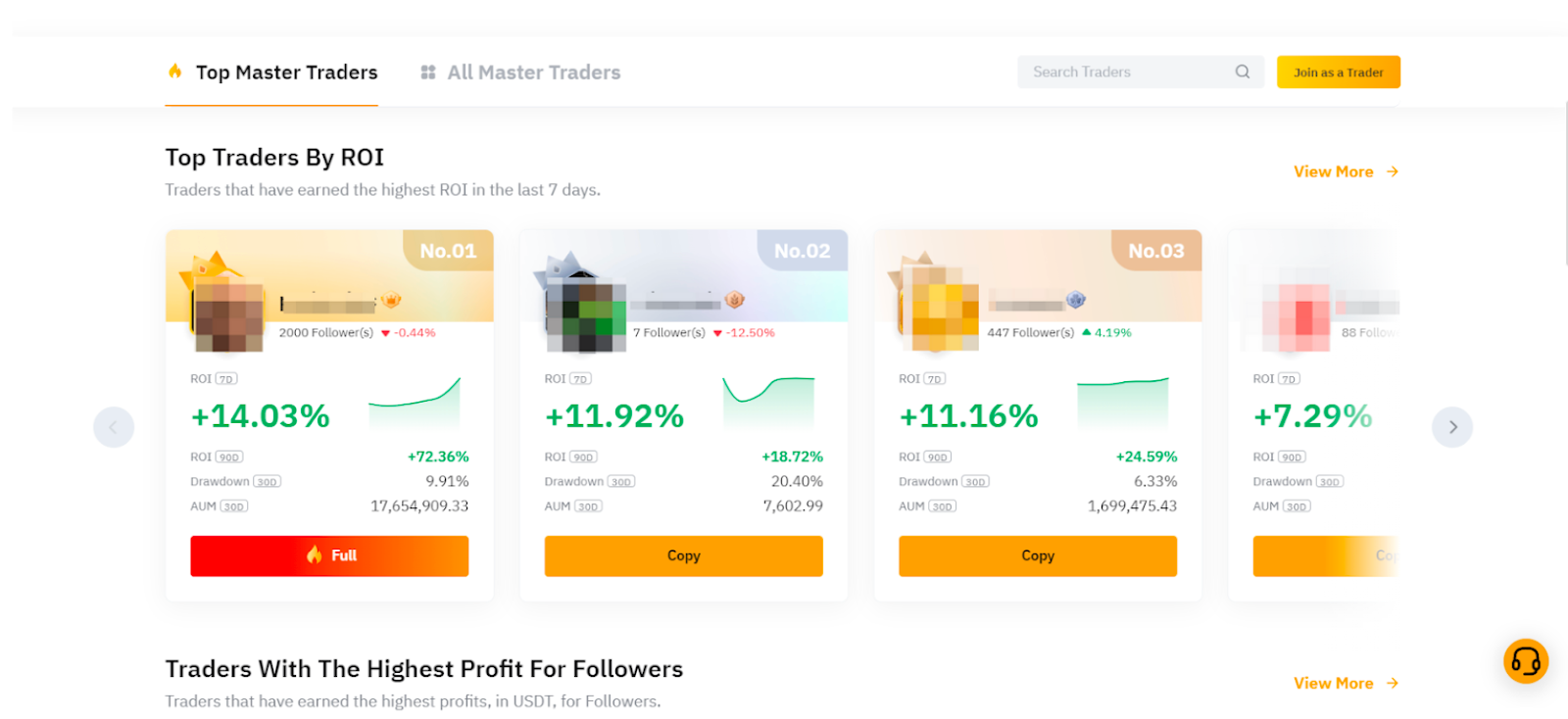

Step 2: To enter the Copy Trading settings page, click on Copy at the bottom of the card of the Master Trader whom you want to follow. Note: Followers can copy up to 10 Master Traders simultaneously.

Here’s a tip: You can click on the Master Trader's card to access the portfolio page and view more comprehensive trading performance data. For more information, please visit this page.

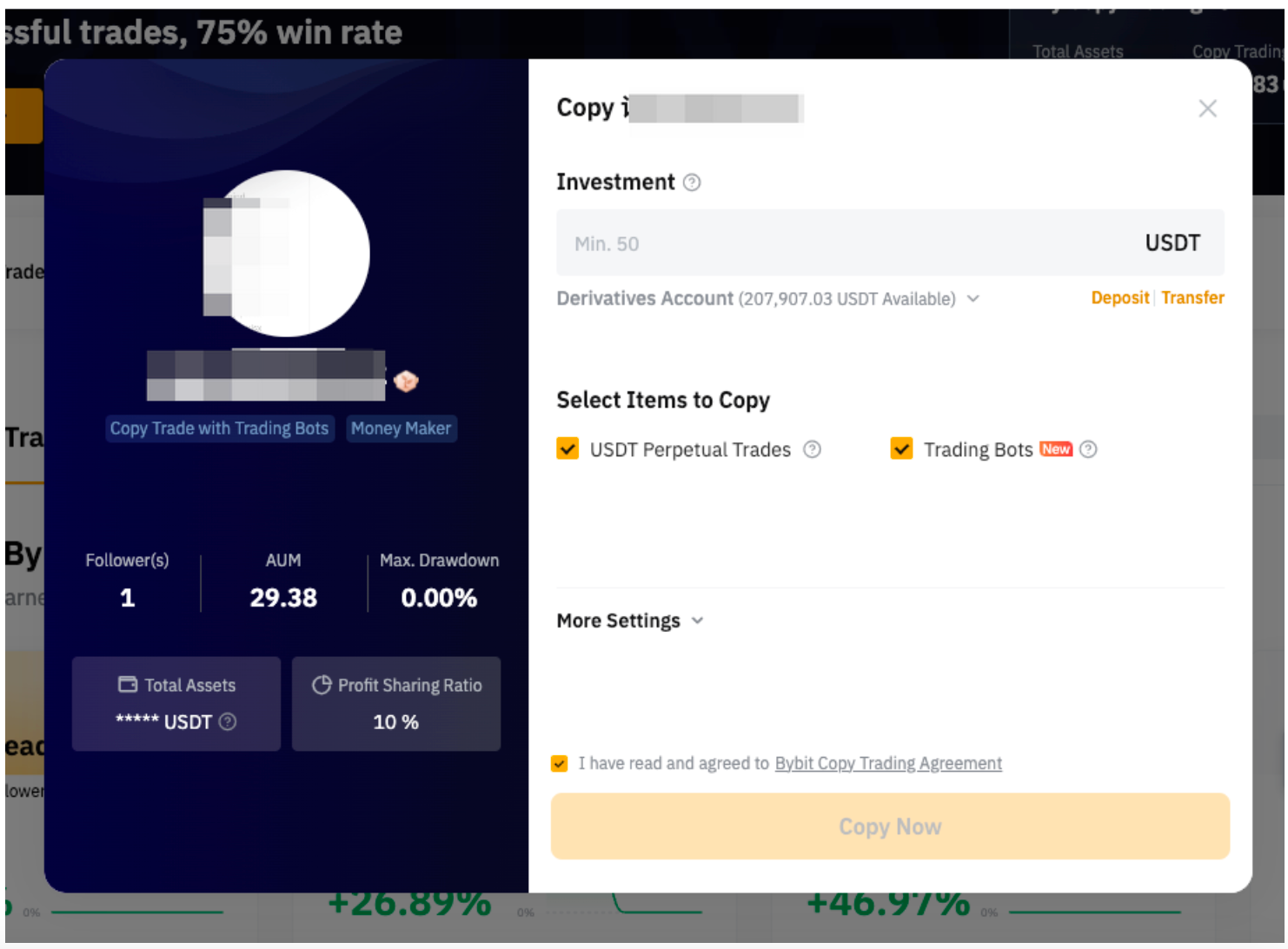

Step 3: Create your Copy Trades by setting your Investment Amount and choosing Select Items to Copy.

Investment: The minimum investment amount is 50 USDT. Please note that your Master Trader can set a higher minimum investment amount required for copying their trades.

Select Items to Copy: Choose either USDT Perpetual Trades or Trading Bots.

If you select USDT Perpetual Trades, you’ll be copying Perpetual contract trades initiated by your Master Trader.

If you choose Trading Bots, you’ll be copying the parameters of the trading bots created by the Master Trader to achieve similar results.

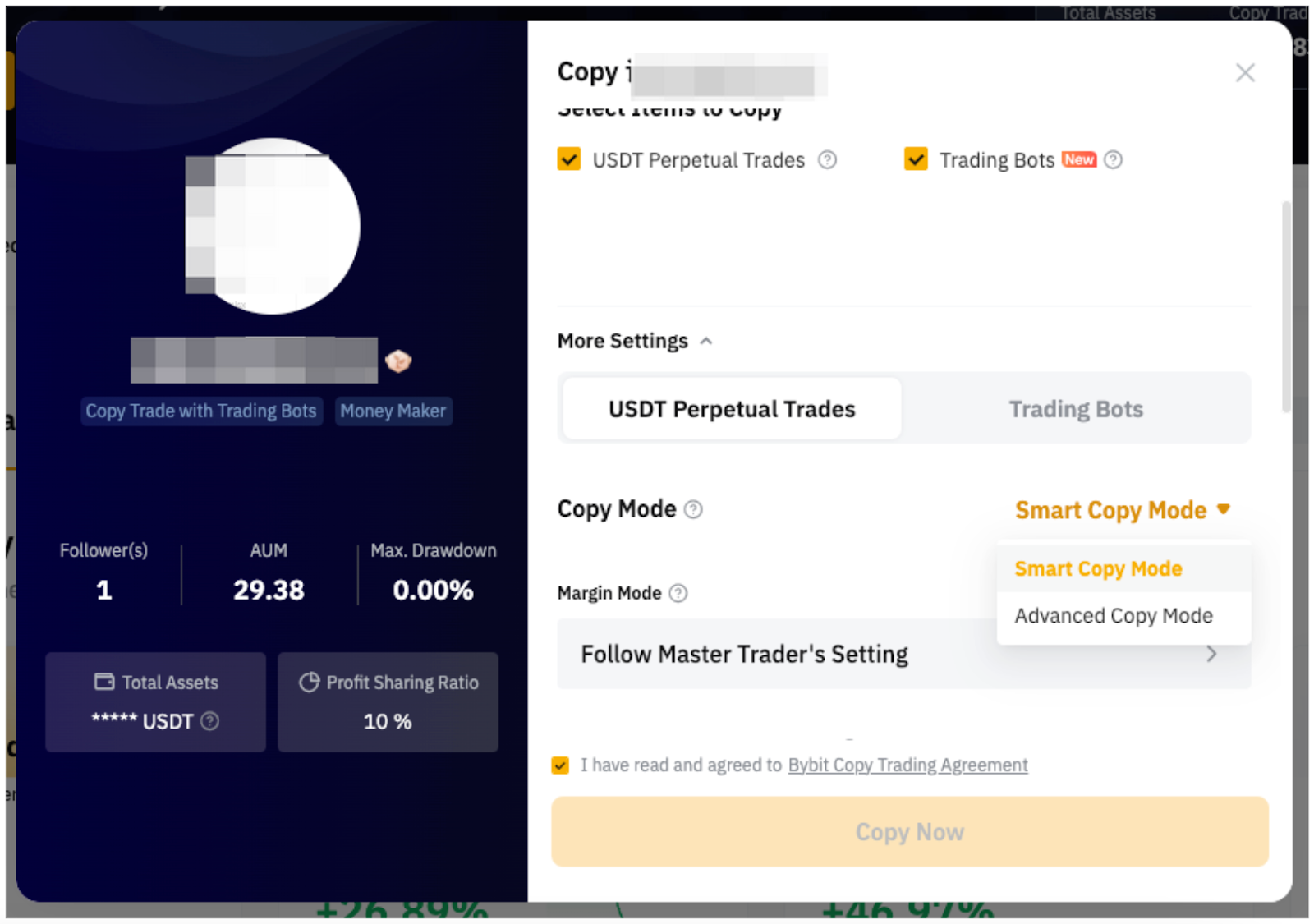

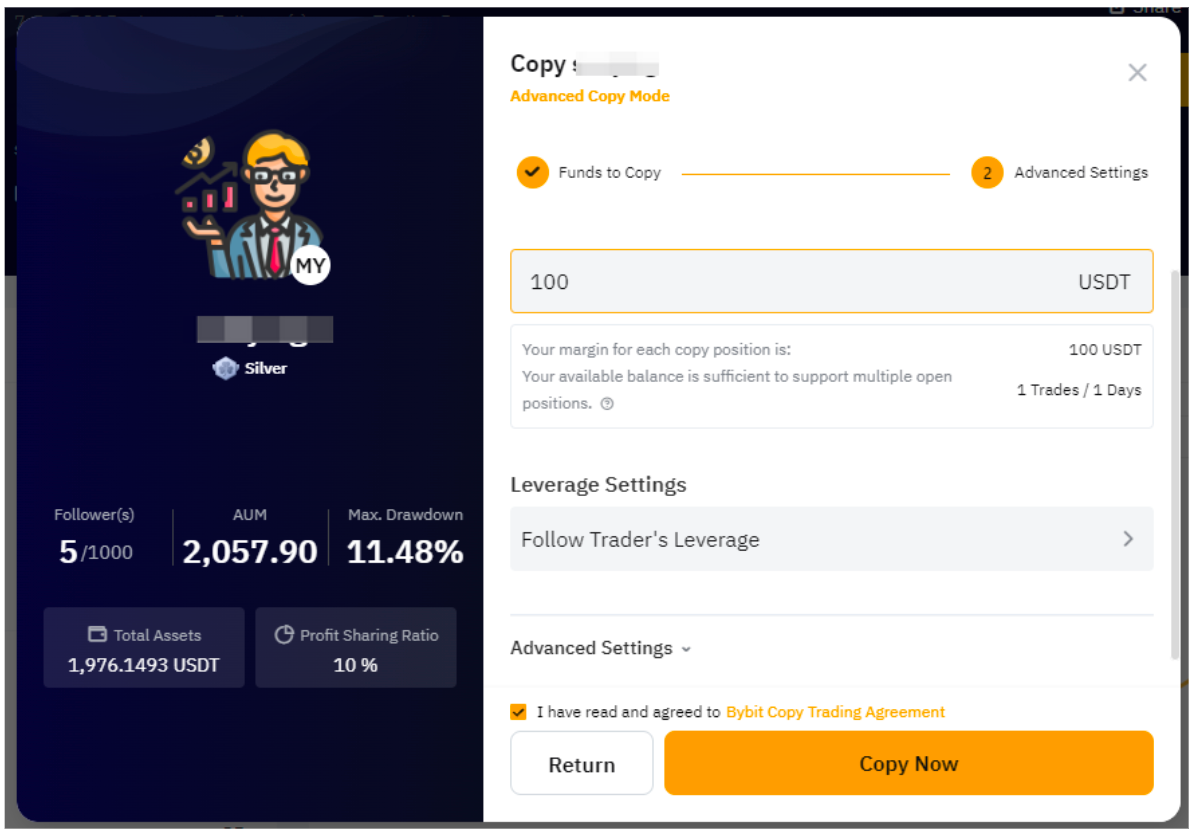

Step 4: Click on More Settings to configure additional trade settings for copying.

Note: For a more detailed explanation of each Copy Mode, as well as Parameter Settings, please visit here.

Step 5: Once the Parameter Settings are confirmed, please check the Agreement Acknowledgment Box and click on Copy Now.

In this window, you can also view the Master Trader’s performance and profit-sharing ratio. The profit-sharing ratio varies according to each Master Trader’s level. For example, if the profit-sharing ratio is 10%, it means that Followers will need to share 10% of their earned profitswith that Master Trader.

Try out your first copy trading now!

Tips for Maximizing Your Success With Copy Trading

To make the most of your copy trading experience with Bybit, consider these essential tips that can help you maximize your profits and minimize risks.

Analyze Trader Performance

Before you decide to copy a trader, it’s crucial for you to conduct thorough research. Review each trader’s historical performance, win rate and risk level. Look for patterns in their trading strategies and assess how they’ve managed different market conditions. By analyzing trader performance, you can better make informed decisions that align with your investment goals and risk tolerance. This step is vital to ensure that you’re selecting a trader whose approach resonates with your financial strategy.

Use Risk Management Tools

Effective risk management is key in any trading strategy, and copy trading is no exception. Always set stop-loss limits to protect your investments from significant downturns.

Diversify Your Investments

Diversification is a powerful strategy for reducing risk exposure. Consider following multiple traders who employ different trading strategies. This approach not only spreads your risk across various assets but also allows you to benefit from a range of market insights and techniques. By diversifying your investments, you can create a more balanced portfolio that’s less vulnerable to the performance of any single trader.

Monitor and Adjust

While copy trading is automated, it’s still important to periodically check your portfolio. Regularly monitor the performance of the traders you’re following and evaluate whether their strategies continue to align with your investment objectives. If a trader's performance declines or if market conditions change, be ready to make adjustments. This proactive approach ensures that you stay on track to meet your financial goals.

Utilize Promotions

Don’t overlook the value of promotions offered by Bybit, such as the 100 USDT Loss Coverage Campaign. This promotion provides protection for up to 100 USDT in losses, serving as a safety net for new users just starting with copy trading. Leveraging such promotions can enhance your trading experience and provide additional peace of mind as you navigate the market.

FAQs: Copy Trading on Bybit

1. What is copy trading in crypto?

Answer: Copy trading is an automated strategy that allows you to replicate the investments of experienced traders, making it easier for you to invest in the crypto market without having to trade manually.

2. How do I choose the right trader to copy?

Answer: When selecting a trader, consider their performance history, risk level and trading plan. It’s important to choose a trader whose goals align with your own risk tolerance and investment strategy.

3. Is copy trading suitable for beginners?

Answer: Yes. Copy trading is ideal for beginners because it allows them to follow expert traders without needing to understand complex market analysis. Bybit makes it easy to get started with minimal effort.

4. Can I lose money with copy trading?

Answer: Yes. Copy trading carries risks, just like any other form of investment. The performance of the trader you copy may fluctuate based on market conditions, so it’s important to set risk management measures.

5. How much do I need to invest in order to start copy trading on Bybit?

Answer: The minimum investment depends upon the specific trader and market conditions, but Bybit allows users to start with relatively low amounts (as little as 50 USDT), making it accessible for beginners.

For more FAQs, please visit here.