Asian Equity Opportunity: How Crypto Natives Can Capture It

Asia equity markets have returned to the spotlight as the performance of the Hong Kong and Shanghai benchmark indices surged amid further optimism from the government stimulus package.

While it remains in question whether the rally represents short-term relief or sustainable longer-term growth fueled by improved economic performance, the rise in these Asian equity indices could mean new opportunities for traders to revisit these markets as trade volume increases. This article will examine the recent equity rally in Asia from a macro and fundamental perspective. We’ll also explore how new innovations in crypto are allowing traders to gain exposure to traditional equity indices, such as the Hang Seng Index (HSI) and FTSE China A50 Index (A50), in a crypto-native way.

Asia Equity Outperforms Its Peers

Recently, Asian equity has been front and center, with major indices soaring to a year high on the back of the policy support measures from the government to stimulate the economy. These measures include cutting interest rates and injecting additional liquidity into banks by allowing them to hold smaller reserves. Reports show that these measures will be able to help release as much as $340 billion to support the stock market.

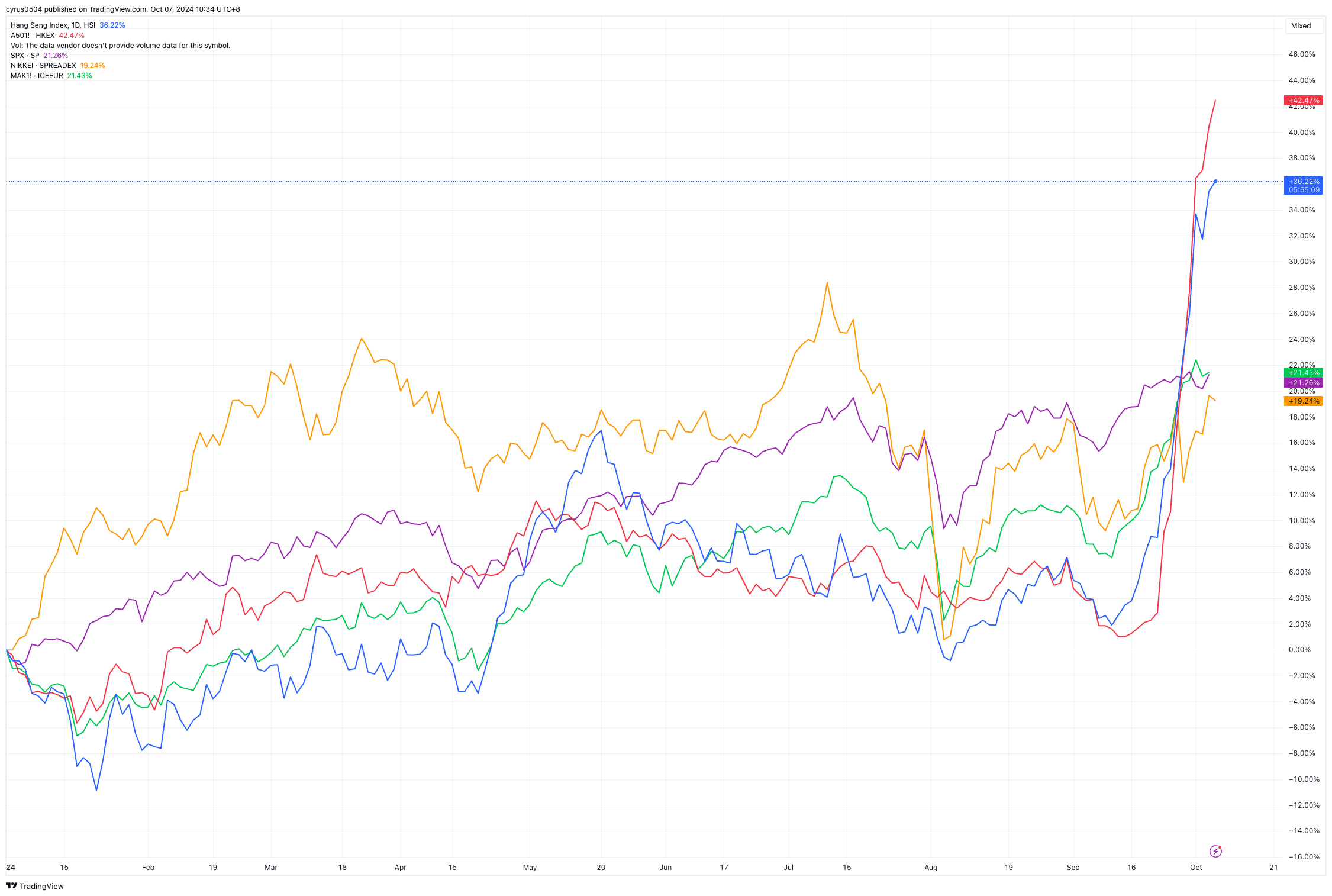

With renewed market confidence, major Asian equity indices have been snapping up sharp gains. The A50 Index, which tracks the 50 largest A-Share companies traded on the Shanghai and Shenzhen stock exchanges, has recorded gains of over 43% YTD, while the Hang Seng, Hong Kong's benchmark equity index, also surged 37% in the same period.

Figure 1: China A50 Index (red) and HK’s Hang Seng Index (blue) outperformed other major indexes. Source: TradingView

While market participants are keeping a close eye on the latest from the country’s top economic planner on the update of the stimulus package details, some traders are expecting the Shanghai and Shenzhen markets to catch up after the week-long National Day holiday.

Research from Goldman Sachs shows that stocks may have another 15% to 20% upside from here if the stimulus measures are delivered. However, some participantsbelieve that markets will focus back on fundamentals when the hype cools down.

Strong HKD Demand Suggests Momentum Is Intact

While there's no crystal ball to tell you whether this rally is sustainable, capital flow is one important indicator to watch to see if the money is still in Asia, and looking into the strength of the HKD could be an effective way to do so.

When foreign investors want to enter the Hong Kong stock market, the first thing they do is acquire enough HKD to buy stocks. Looking at the greenback against the HKD could provide information as to how on-demand the Hong Kong currency is. Although the HKD exchange rate is pegged at HK$7.75–7.85 to one U.S. dollar, the rate can move freely within this range. The closer to the lower end of the band, the stronger the demand for the HKD.

Figure 2: USDHKD daily chart. Source: Tradingview

The figure shows the USDHKD daily chart has reached its lowest level since December 2022. This indicates that HKD demand has been at its strongest level in almost two years, which many consider to be a rare situation. Getting into the Hong Kong stock market could be one reason behind the strong HKD.

Fundamentals Remain in Question

While the bulls may seem in charge, hesitation is also rising alongside the expectation-beating rally.

As Investco told Bloomberg, "In the short term, sentiment could overshoot, but people will go back to fundamentals, and because of this rally, some stocks have become really overvalued." This suggests that the rally may not have enough legs once sentiment cools down.

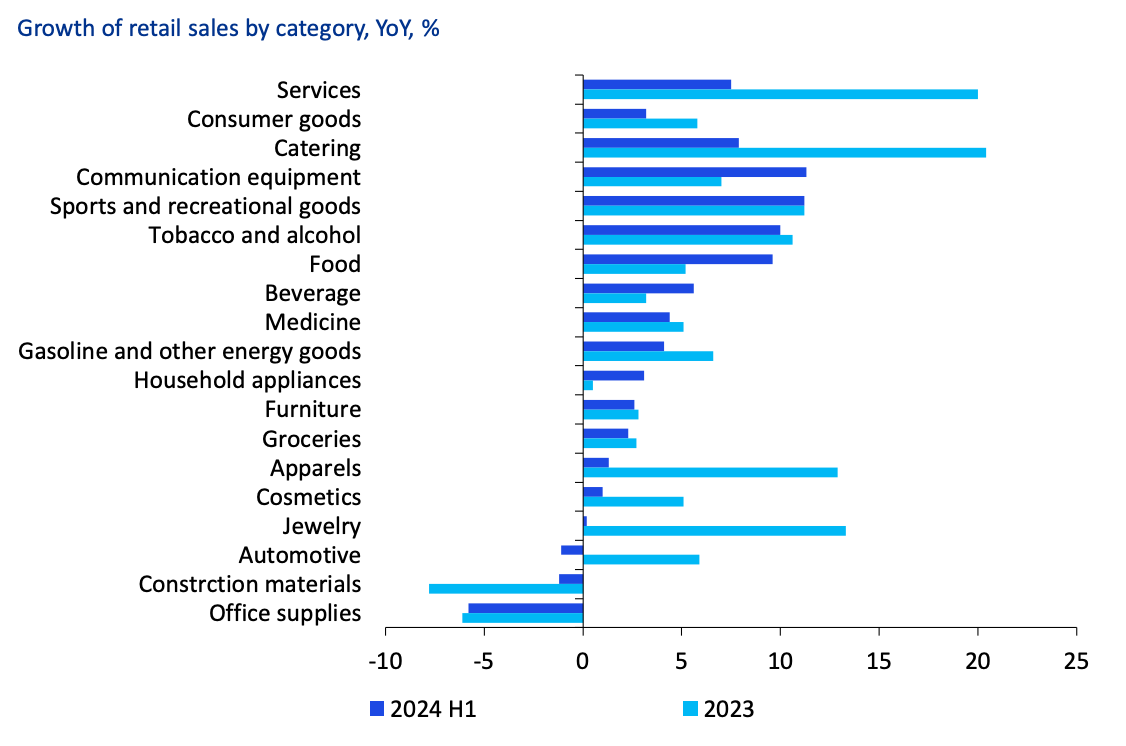

In fact, recent economic data has been suggesting a less rosy picture. Research from KPMG indicates that the country's economy expanded 4.7% in Q2 2024, down from 5.1% the quarter before, and lower than expectations. Consumption has also been slowing down due to sluggish income growth. In addition, retail sales growth declined to 2.6% in Q2 2024 from 4.7% in Q1 2024.

Figure 3: China consumption slowed as residents’ income growth declined. Source: China Economic Monitor 2024 Q3, KPMG

The report also highlighted that other important economic indicators — such as manufacturing investment, infrastructure investment and property market growth — were below expectations for the same period. However, weaker-than-expected data could also mean that the government may want to offer more policy support to bolster the economy.

Capturing Asia’s Equity Opportunity With Crypto Innovations

The recent stock rally in Asia has not only received attention from TradFi investors, but also has been one of the hottest topics among native crypto traders and speculators.

With Bybit Gold & FX, native crypto traders can now gain exposure to these indices by trading stablecoin-based settlement CFDs, including A50, HSI and other major equity indices globally. Thus, crypto-native traders can capture this Asian equity opportunity hassle-free. The platform also provides FX, commodities and crypto CFDs.

Earlier in the article "Unlocking Stablecoin Potential: Bybit Gold & FX Merges Crypto with Traditional Assets," we explained how Bybit Gold & FX enhances trading strategies and portfolio building.

Learn more about Bybit Gold & FX here and its features here.

Conclusion

The relationship between crypto and traditional financial markets is growing closer as crypto becomes more mainstream. With innovations like Bybit's MT5, crypto trading has expanded even further into traditional assets, allowing crypto traders to capture these trading opportunities in a crypto-native way. Even though it may be too early to say whether the rally is sustainable, tools like Bybit's MT5 could be useful when trading the related indices in either direction.

#BybitOpinion #LearnWithBybit

Disclaimer: Investing in cryptocurrencies and CFDs involves a substantial risk of loss and is not suitable for every investor. This article provides facts for educational purposes only and does not represent any financial advice. Prior to making any investment decisions, please ensure you fully understand the risks involved and seek independent advice if necessary. Our customer support team is available to assist you with any inquiries.