Orbiter Finance (OBT): Elevating Blockchain Connectivity With ZK Tech

The introduction of Layer 2 scaling solutions for Ethereum (ETH) has dramatically improved transaction processing efficiency and lowered the costs of using the industry's largest smart contract chain. Thanks to Layer 2 rollups, users and decentralized app (DApp) operators can now conduct transactions off the main Layer 1 network in a cost-efficient and scalable way. However, the efficiency-driven popularity of Ethereum rollups has led to a peculiar problem — as these Layer 2 networks have mushroomed in number, liquidity and operational fragmentation within the Ethereum ecosystem have increased substantially.

Although rollups are tightly integrated with Ethereum Layer 1, they typically have poor direct interoperability with each other.

Orbiter Finance (OBT) is a blockchain infrastructure project that offers a bridging solution designed to tackle this problem by acting as a cross-rollup communication layer. It helps improve the interoperability between various rollup solutions, both Ethereum-based ones as well as those from other blockchain ecosystems, reducing liquidity fragmentation and creating an omniverse of interconnected chains. Having begun as a cross-rollup bridge, Orbiter Finance eventually evolved into a zero-knowledge (ZK)–based rollup that supports cross-rollup connectivity, combined with ZK technology's security and performance benefits.

Key Takeaways:

Orbiter Finance (OBT) is a decentralized cross-rollup solution that facilitates fast and cost-efficient asset transfers between different Layer 2 networks.

The platform's native token, OBT, is used for governance, staking, cross-chain transfer facilitation and reward distributions to the user community. OBT can be bought on Bybit as a Spot pair.

What Is Orbiter Finance?

Orbiter Finance (OBT) is a decentralized infrastructural project that provides a cross-rollup connectivity solution based on its own ZK-rollup. The platform aims to connect many Layer 2 chains across different blockchain ecosystems in order to facilitate easy transfers of assets between them.

The key problem that Orbiter Finance addresses is the high fragmentation level within the web3 rollup ecosystem. Although Ethereum rollups feature outstanding compatibility with its Layer 1 network — which is, in fact, their core purpose — these platforms aren't well connected among themselves, creating liquidity silos and limiting cross-rollup asset flows.

By providing a cost-efficient and high-performance connecting layer for rollup-to-rollup transactions, Orbiter Finance helps create a unified Layer 2 liquidity ecosystem.

Orbiter, however, isn't just about Ethereum’s ecosystem. The platform's services also cover a pervasive network of Layer 1 and Layer 2 chains, including BNB Chain (BNB), Mantle Network (MANTLE), Sui (SUI), Immutable X (IMX), and Bitcoin (BTC)–linked networks like Core (CORE) and Bitlayer. This is in addition to dozens of Ethereum-focused rollup solutions, including big players like Arbitrum (ARB), Optimism (OP), Base and Polygon (POL).

Orbiter Finance allows users to conduct asset transfers within its vast ecosystem at low gas costs, while also enjoying its excellent throughput and fast transaction confirmations. A typical transaction is confirmed on the network within just 10 to 20 seconds.

Orbiter Finance started in 2021 as a cross-rollup bridging solution. In early 2024, the platform underwent a significant infrastructural upgrade by becoming a ZK-based rollup, while still retaining its focus on rollup-to-rollup asset transfers. The addition of ZK technology has allowed the platform to introduce several new features and improvements, such as better security, hardware accelerators to significantly improve throughput and more efficient transaction validation via the Simplified Payment Verification (SPV) system.

In addition to its main cross-rollup protocol, the project has also introduced an inscription cross-rollup protocol designed for the efficient minting and transfer of inscription-based assets.

How Does Orbiter Finance Work?

The Orbiter Finance network is a smart contract–capable, Ethereum virtual machine (EVM)–compatible ZK-rollup. It uses a network of Maker nodes to facilitate cross-rollup transfers. Makers establish addresses on participating chains and provide liquidity to allow Senders — users who execute cross-rollup transactions — to send assets efficiently and at low costs. By acting as liquidity providers on both the destination and origin chains, Makers support efficient transfer activity via the Orbiter Finance platform.

Orbiter’s original platform architecture involves Makers using externally owned account (EOA) wallets. However, the project has announced plans to implement an Omni/Orbiter Account Abstraction (OAA) protocol to provide better cross-chain interoperability and lower the cost of rollup-to-rollup transfers. Once the protocol is fully implemented, Makers will transition to using OAA addresses.

The Orbiter Rollup uses zero-knowledge proofs (ZKPs) and hardware accelerators to ensure the security and high speed of asset transfers. Additionally, the ZK-based SPV technology lets the network quickly and securely verify the validity of transactions, minimizing the instances of failed transfers and validator challenges in these transfers.

To accommodate the myriad formats of ZKPs, the Orbiter Finance team is currently developing a proof aggregation layer that will process and standardize the various ZKPs to create a unified system for faster proof processing, thereby reducing transaction bottlenecks and further enhancing performance. Additionally, the aggregation of ZKPs will significantly reduce gas costs, improving the efficiency of the network as a whole.

Orbiter Key Features

Orbiter Rollup

At the core of the Orbiter Finance ecosystem is its Ethereum-linked Layer 2 rollup. As noted above, Orbiter was originally a bridging protocol that connected various rollup networks for efficient asset transfers. In early 2024, the platform announced the launch of the Orbiter Rollup to provide a more cost-effective and scalable environment for cross-rollup transactions. By having its own rollup platform, Orbiter can offer additional functions secured by technologies like ZKPs, SPV, OAAs and intent-based transactions.

The Orbiter Rollup operates as a zkEVM platform and finalizes all transactions by recording them on Ethereum Layer 1. This offers users a highly secure transaction environment that’s supported by the underlying Ethereum blockchain.

The rollup also implements intent-based functionality. In the context of blockchain technology, intents are user-defined messages outlining desired transactions with specific conditions, e.g., “Carry out a swap from Ether to Bitcoin provided that a certain minimum acceptable swap rate is met.” An intent is converted into an executable transaction recorded in the blockchain ledger only when an option that satisfies its conditions is found. The Orbiter Rollup acts as an aggregation layer for cross-rollup user intent messages.

Inscription Cross-Rollup Protocol

Orbiter Finance's product line also includes an inscription-focused cross-rollup protocol. Blockchain Inscriptions — small bits of data that can be attached to crypto tokens to create unique digital artifacts — first became popular in 2023 with the launch of the Bitcoin-based Ordinals protocol. In various forms, inscription technology has been adopted in other blockchain ecosystems beyond Bitcoin, including Ethereum.

Orbiter's inscription protocol lets developers mint inscription tokens at just 0.00023 ETH (around 70 cents as of Jan 27, 2025) on supported blockchains like Arbitrum One, Optimism, Base, Linea and Scroll, and facilitates the flexible and efficient transfer of these tokens across rollups.

What Is the Orbiter Finance Token (OBT)?

OBT is the Orbiter Finance’s native crypto token. It was launched on Jan 20, 2025, and is supported on three networks: Ethereum, Arbitrum and Base. This ERC-20 token is used for governance, staking, reward distributions to users via regular airdrops and to facilitate cross-rollup transfer operations.

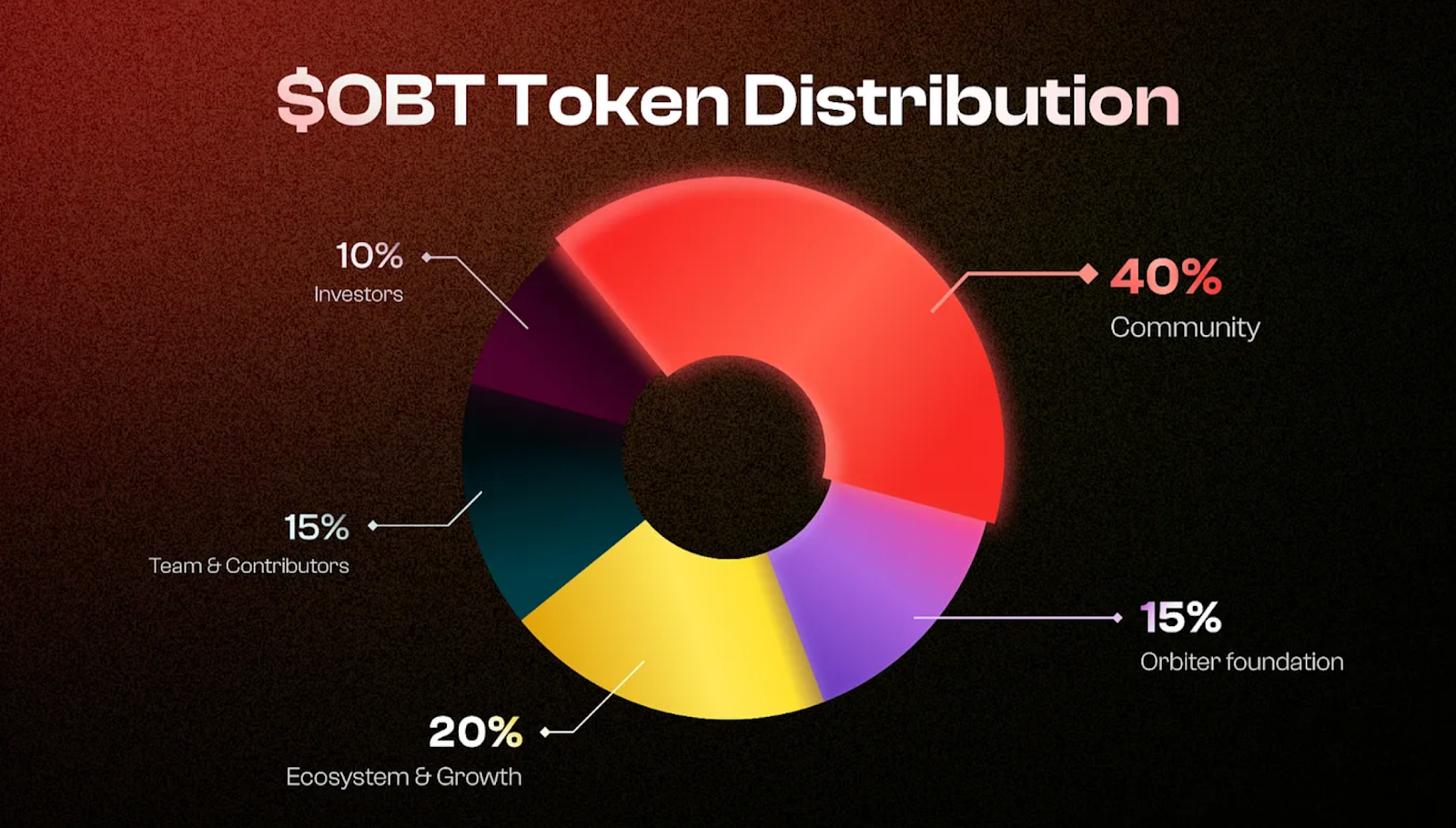

The token’s total and maximum supply is 10 billion. The chart below shows its supply distribution shares.

Rewards in the form of OBT airdrops are a key initiative supported by the Orbiter Finance project. The funds dedicated to community development by the project will be distributed to users via incentives and regular airdrops. Meanwhile, 22% of the token's supply is reserved for the initial airdrop campaign. User eligibility snapshots for the campaign were taken on Jan 16, 2025 and Jan 19, 2025, for loyalty points and NFT usage data, respectively. By January 25, all groups of eligible users could claim their airdrop allocations.

Following the initial airdrop, OBT tokens will continue to be distributed to eligible users every six months, with 3% of the token's supply allocated for each semi-annual airdrop event.

Where to Buy the Orbiter Finance Token (OBT)

The OBT token is available on Bybit’s Spot market as a swap pair with USDT.

Closing Thoughts

Four years ago, Orbiter Finance's decentralized cross-rollup bridge made transferring assets across different Layer 2 platforms an easy and cost-efficient process. With the launch of its own rollup network in 2024, the project aims to retain leadership in the niche of rollup-focused cross-chain transactions. As Ethereum continues to experience scalability and cost issues, rollup technology will remain highly relevant. With the manifold rollups in existence, the need for the cross-platform solution provided by Orbiter Finance will also remain as pertinent as ever.

#LearnWithBybit