MANTRA (OM): Understanding its wild ride and road to recovery

In the morning and daytime hours of Apr 13, 2025, the MANTRA blockchain's native token, OM, sat at a respectable market cap of $6 billion, making it the third-highest-ranked cryptocurrency in the real-world assets (RWA) category, the area the platform specializes in. Everything seemed like smooth sailing for the token.

Then, just after 6 PM UTC, the price of the OM token suddenly began to free-fall, declining from nearly $6 to about $0.50 in the space of just two hours.

A project that started the day as one of the top players in the RWA field was now worth 90% less as the evening approached. OM's abrupt, sharp crash immediately caught the market's attention, with speculation of a rug pull being orchestrated by the project team.

However, MANTRA's CEO, John Patrick Mullin, immediately sprang into action for PR damage control on social media, reassuring the public that the team members weren’t dumping OM tokens at all. Instead, MANTRA's founder and CEO alleged that deliberate actions of some centralized crypto exchanges (CEXs) had caused the catastrophic plunge.

As of our coverage date of Apr 23, 2025, this is a developing story. In this article, we’ll establish what actually happened, who's involved and what awaits the OM token in the foreseeable future.

Key Takeaways:

MANTRA (OM) is a Layer 1 blockchain project that specializes in RWA tokenization and use cases.

On Apr 13, 2025, MANTRA's OM token experienced a sudden crash, losing more than 90% of its value in a couple of hours.

The crash was mainly attributed to some large token holders moving their OM funds to crypto exchanges as collateral, and having their positions liquidated en masse.

What is MANTRA (OM) crypto?

MANTRA (OM) is a Layer 1 decentralized network dedicated to RWA tokenization and utilization in compliance with real-world regulatory requirements. It features high scalability and low transaction fees. The project is one of the earliest initiatives dedicated to RWA use via blockchain technology. Originally, MANTRA debuted as a decentralized app (DApp) on Ethereum (ETH) in August 2020. In October 2024, the project migrated to its own dedicated Layer 1 platform, the MANTRA Chain. The MANTRA blockchain is based on the Cosmos SDK framework, and is part of the wider Cosmos ecosystem.

The MANTRA ecosystem's main products include MANTRA DEX, a decentralized exchange (DEX); a digital identity (DID) management tool; a compliant token development and management solution; and a comprehensive compliance and permissioning system. MANTRA has also partnered with global powerhouses like Google Cloud, and with DAMAC Properties, one of Dubai's most prominent developers, to propel innovative solutions for web3 adoption and real estate development.

MANTRA (OM) price plunge

Starting in late 2024, right after its own dedicated mainnet launch, MANTRA had become a significant player in the RWA corner of decentralized finance (DeFi). By late February 2025, the platform’s native OM token had climbed to a value of nearly $9, with its market cap peaking at around $8.2 billion. Before the fateful events of Apr 13, 2025, OM was the third-highest-capped crypto in the RWA category, trading at $6.27, with a market cap of slightly over $6 billion, according to the CoinGecko portal.

In the evening hours (UTC time) of Apr 13, 2025, OM began to lose its value precipitously, dive-bombing from over $6 to about $0.52 in the space of two hours. The token’s market cap fell to slightly under half a billion dollars — a loss of more than 90%.

CEO John Mullin was quickly online, reassuring the crypto community that no team member had sold their OM holdings, and that this wasn’t a case of the bad ol’ rug pull. Instead, Mullin alluded that after OM tokens were moved to two leading CEXs (Binance and OKX) to use as collateral, the exchanges initiated a cascade of liquidations of positions backed by the token. Both exchanges refuted the allegations, and connected OM’s price collapse to its recent unusually high price volatility, and significant tokenomics changes made to OM in October 2024 that greatly undermined its value.

As a chain of liquidations took place, the token’s price started to plummet, causing significant panic that quickly led to further price drops. The situation only stabilized closer to the end of the day, with OM’s price remaining under $1. As of Apr 23, it’s trading at $0.5543 — a far cry from its rate of over $6 just two weeks ago.

MANTRA (OM) controversies

After investigating, crypto analytics firm Lookonchain concluded that 17 wallets had deposited 43.6 million OM tokens (4.5% of the token's circulating supply) into the implicated exchanges. Two of these wallets are believed to belong to Laser Digital, one of MANTRA's investors. Another investor in the project, Shorooq Partners, is also suspected to be among the 17 wallets. Both Shorooq and Laser Digital have denied the allegations.

Although the price plunge was immediately compared to the 2022 collapse of the Terra (LUNA) blockchain, many analysts point out that the two crashes are fundamentally different. Terra's crash resulted from structural abnormalities in the algorithmic mechanism regulating UST, the project's stablecoin. In contrast, OM's fiasco is suspected to be the direct result of market-driven manipulation by whales, and possibly exchanges. No security breach, disruption to services or data, or other adverse structural events have occurred on the platform.

While this development is unprecedented for the project, MANTRA has been embroiled in other controversies throughout its history. One of these was its airdrop, first announced in August 2024 and then delayed multiple times. Around 50% of the wallets believed to be bots were cut off from the airdrop list. However, many considered the bot-culling process to have been conducted without much proof.

There have also been reports of vote rigging in the project's governance system in a bid to obscure MANTRA’s centralized model of profit allocation. Additionally, some analysts have accused the project of "forced bridging" to manipulate the market price. Platform users had to migrate their Ethereum-based OM tokens to MANTRA's native OM tokens via bridging, which would increase gas fees and allow the project team to control the token's circulation pace.

How is MANTRA (OM) headed toward recovery?

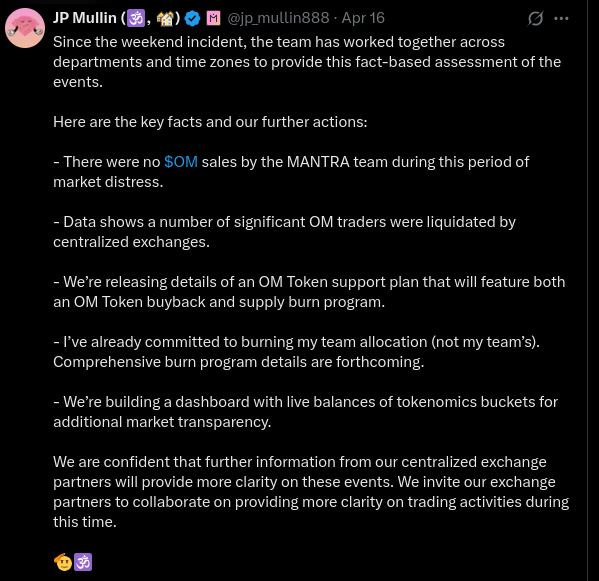

MANTRA’s CEO rapidly reassured users that the team is now working hard to jump-start the token’s recovery. On Apr 14, 2025, Mullin unveiled plans to initiate a buyback scheme, along with the intent to burn all OM tokens held by the project team. The team's supply totals 300 million tokens, representing about 17% of the total supply.

He also denied factually incorrect assertions circulating online that the team effectively controls 90% of OM's supply. Mullin further assured the public that no large-scale selling events by investors have occurred.

As OM’s value has stayed firmly under $1, it remains to be seen how these PR efforts — as well as the planned buyback and burn — will affect the token’s future.

Where to buy MANTRA (OM)

You can buy the OM token on Bybit's Spot market as a swap pair with USDT, or on the Derivatives market as the OMUSDT Perpetual contract.

Naturally, given the ongoing situation with the OM token, buying OM is at your own discretion, as right now the token is truly for the adventurous and brave at heart.

MANTRA (OM) price prediction

As of Apr 23, 2025, the OM token is trading at $0.5543, 93.8% lower than its ATH of $8.99 on Feb 23, 2025, and 3,138.8% higher than its ATL of $0.01726 on Oct 12, 2023.

Curiously, most crypto price prediction portals are optimistic about the OM token's long-term prospects. DigitalCoinPrice predicts an average rate of $1.81 in 2027 and $2.82 in 2030, whilePricePrediction expects the token to trade at $1.85 in 2027 and $6.08 in 2030.

Closing thoughts

It's hard to verify all the allegations flying around regarding the involvement of exchanges and key investors in the MANTRA OM incident. What matters at this stage is that the project team has been quick and proactive in injecting transparency and clarity into the situation.

The free fall in the token's price seems to be over by now. In fact, OM’s decline was over within hours of the incident. Moreover, unlike Terra's LUNA and UST coins, OM hasn't become worthless. All these factors point to potential stabilization and recovery ahead. The question now is: Will the pace and magnitude of the recovery be enough to save the project in the long term? At this early stage after the collapse, few people could answer the question with confidence. We'll eagerly await the developments over the next few weeks to see if MANTRA finds its way out of the woods.

#LearnWithBybit