Keeta Network (KTA): The universal settlement layer for digital assets

If you follow the biggest gainers of the cryptocurrency market, one token stands out — KTA, the native crypto of the Layer 1 blockchain Keeta Network. Over the past two months to Jun 19, 2025, the KTA token’s value has shot up by 557.8%, one of the best results in the already buoyant crypto market — all before the network's mainnet launch.

The Keeta blockchain, currently in testnet mode, boasts former Google CEO Eric Schmidt as one of its investors and advisors. It claims to have a throughput capacity of 10 million transactions per second (TPS), by far the best result in the blockchain industry. Mr. Schmidt's association and the chain’s mammoth processing capacity are among the contributors to the KTA token's incredible run.

Keeta's high-performance blockchain doesn't simply offer the best speed in the industry: it features an environment in which crypto assets from different chains can be transferred nearly instantly, creating a unified, cross-chain settlement layer for the web3 world. Keeta also offers a highly compliant process to tokenize real-world assets (RWAs), acting as a bridge between decentralized finance (DeFi) and traditional finance (TradFi).

By putting regulatory compliance at the top of its priority list, Keeta Network’s scalable blockchain enables financial institutions to utilize blockchain technology and expand their product offerings. Keeta has recently partnered with the credit data infrastructure platform SOLO to further solidify its position in this niche to establish the first blockchain-native credit bureau.

In this article, we’ll examine this groundbreaking project in more detail.

Key Takeaways:

Keeta Network (KTA) is a Layer 1 chain with an industry-leading throughput capacity of up to 10 million TPS.

Keeta is designed primarily for efficient and low-cost native cross-chain transfers and compliant tokenization to bridge the worlds of DeFi and TradFi.

The platform's native token, KTA, is used for transaction fee payments, validator rewards, staking, stake delegation and governance.

What is Keeta Network?

Keeta Network (KTA) is a Layer 1 blockchain designed for efficient cross-chain transfers and compliant tokenization of assets. The platform features industry-leading throughput capacity of reportedly up to 10 million TPS. Keeta leverages its stellar processing capabilities to enable swift and cheap asset transfers between different blockchain networks. It also allows TradFi entities, such as banks and other financial organizations to connect to the platform's ecosystem, tokenize RWAs and integrate blockchain technology into their operations.

The Keeta project features a public blockchain network, as well as private sub-networks that can be used by organizations that need to maintain the highest levels of privacy and security in a gated environment.

Much of Keeta’s excellent throughput capacity is due to its directed acyclic graph (DAG) architecture, which differs from a traditional blockchain’s sequential block linkage system. Moreover, the platform’s delegated proof of stake (DPoS) consensus mechanism ensures that its fast finality and throughput are supported by high levels of security and decentralization.

As of mid-2025, Keeta is by far the leading blockchain by TPS. Its 10 million TPS figure is many times higher than that of Solana (SOL), a major decentralized network that’s often regarded as the leader in this statistic. Solana’s maximum TPS is estimated at 65,000, but with the imminent launch of the Keeta mainnet, we’re likely to see the new blockchain establish official leadership in this area if its claims prove to be true. The stress test for its testnet, conducted on Jun 13, 2025, has demonstrated true potential, hitting 11.2 million TPS.

Keeta's stunning rise

Keeta Network launched its native token, KTA, on the Base Layer 2 chain in early March 2025. As of Jun 19, 2025, the network is in testnet mode, with mainnet operations slated for launch by the end of the month, or sometime during the summer.

In early May 2025, at barely two months old, the network's native crypto, KTA, has started its meteoric rise, supported both by enthusiasm regarding the network’s incredible TPS capacity and other factors, not the least of which is the project's association with former Google CEO Eric Schmidt, who is Keeta's advisor and investor. As of mid-June, KTA remains among the biggest gainers in the crypto market, having appreciated by 557.8% in the past two months alone.

How does Keeta work?

Two key architectural properties — the network's DAG format, and its DPoS consensus mechanism — ensure that Keeta Network combines the benefits of security and decentralization with the status of the most scalable blockchain on the market.

Directed acyclic graph (DAG)

Keeta is a DAG-based decentralized network, rather than a classic blockchain. Within Keeta’s DAG, blocks added to the ledger are linked to multiple previous blocks for validation purposes. In contrast, blocks of transactions in traditional blockchains are chained sequentially. This sequential setup often results in the loss of scalability and creates bottlenecks, particularly during periods of high network demand.

One key advantage delivered by the DAG model is its ability to process many transactions in parallel. This ensures that Keeta can maintain high scalability even under significant loads.

Delegated proof of stake (DPoS) consensus

In Keeta’s consensus model, token holders can delegate their tokens to validators who act as network representatives. The more tokens staked with a representative, the greater their voting power during the block validation process.

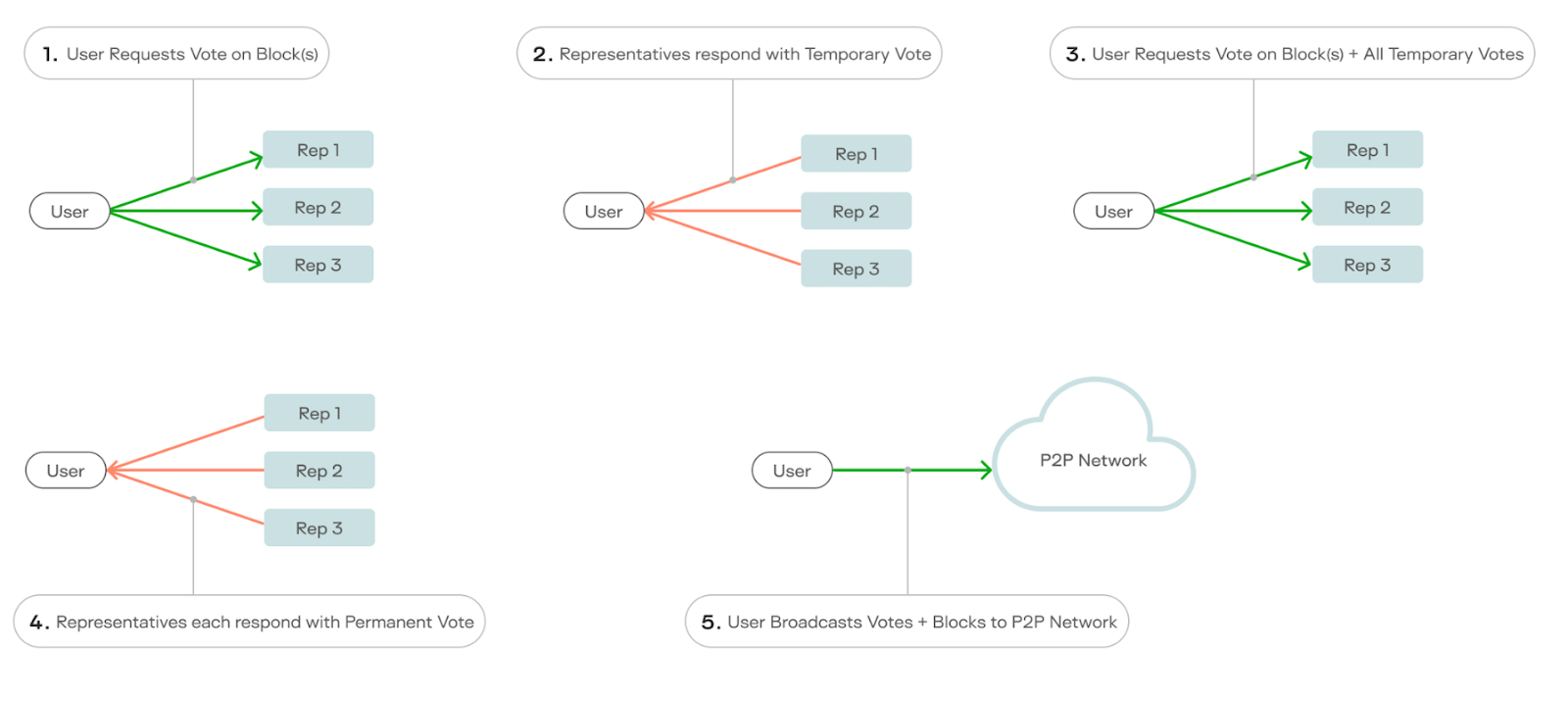

Keeta’s variation of the DPoS validation involves five key steps:

The user/client sends a vote on a new block to be approved.

Several representative nodes on the network react by temporarily approving the block.

The user requests the validation of the temporary votes sent by the representatives.

Network representatives then validate the temporary votes and the block by sending permanent votes.

Lastly, the user notifies the network of the permanent approvals to get the block written permanently to Keeta’s ledger of records. The image below summarizes this process.

Keeta Network key features

Identity profiles

Keeta Network’s identity profiles serve as comprehensive, verified digital identities of users. These financial identities have certificates attached that validate the user's identity, achievements, creditworthiness and more. The certificates are issued by authorized certificate authorities (CAs) with which Keeta has partnered. With these on-chain profiles, users can satisfy KYC requirements at traditional financial institutions, apply for products that require creditworthiness assessment and showcase their professional endorsements.

Each identity profile can be carried as a secure and private "digital passport” that can be updated anytime.

Native tokenization

Keeta features a native tokenization mechanism that supports both fungible and non-fungible tokens (NFTs), eliminating the need for smart contracts. The system is safe, fast, efficient and, importantly, compliant with regulatory requirements of the business world's financial systems. By providing a compliant tokenization process, Keeta enables financial institutions and other entities to leverage the blockchain ecosystem, bridges traditional finance and web3 and drives institutional adoption of crypto.

Anchors

Anchors in Keeta Network let users connect any blockchain or TradFi system to the platform's ecosystem for asset transfers, atomic swaps and other operations. Users can leverage these anchors to exploit Keeta's high-performance blockchain network and cross-chain capabilities.

What is the Keeta crypto token (KTA)?

KTA is an ERC-20 asset issued on the Base Layer 2 chain. It’s likely that when Keeta Network’s mainnet is launched, the KTA token will be migrated to its own chain, Keeta Layer 1. KTA is designed for several functions on Keeta Network, specifically staking and stake delegation, validator rewards, transaction fee payments and governance.

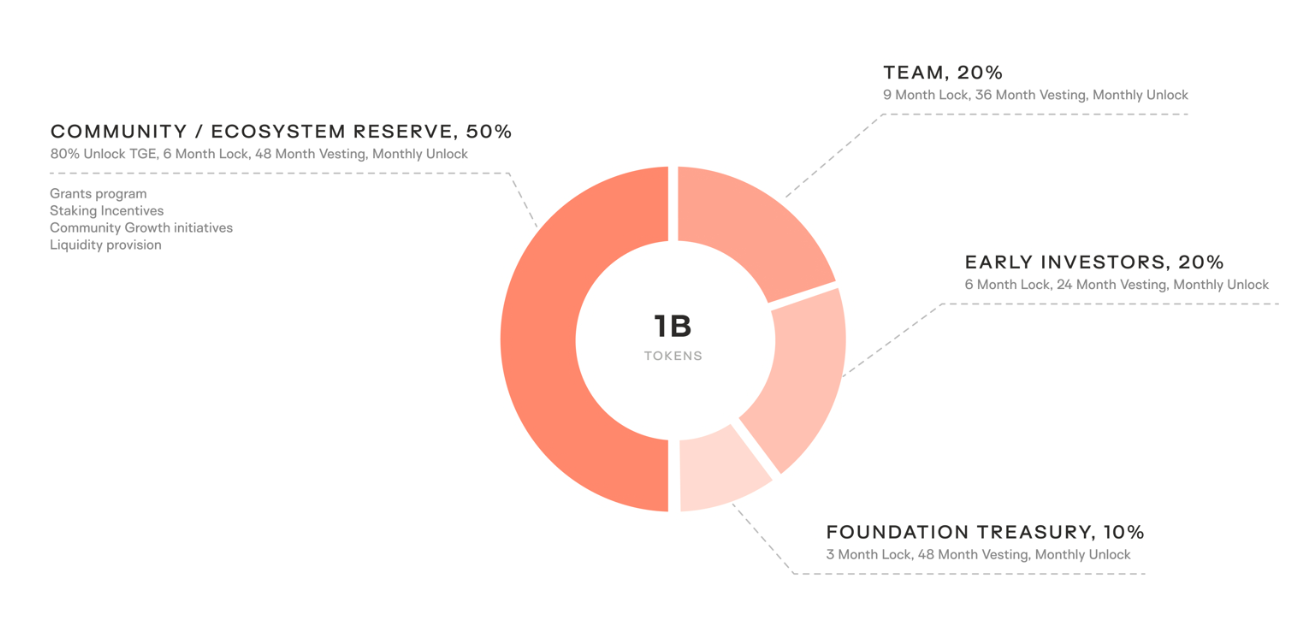

KTA is a supply-capped asset, with a maximum and total supply of 1 billion. The token’s supply allocation shares are per the chart below.

Keeta (KTA) crypto price prediction

As of Jun 20, 2025, the KTA token is trading at $0.711, a 57.5% drop from its all-time high of $1.68 on Jun 9, 2025, and a 10,373.7% increase from its all-time low of $0.00682 on Mar 8, 2025.

KTA’s long-term price outlook is bullish. CoinCodex expects the token to trade at $0.90 in 2027 and $1.84 in 2030, while DigitalCoinPrice is forecasting average prices of $2.48 in 2027 and $3.65 in 2030.

Closing thoughts

Keeta Network is already raising tall waves in the crypto ocean, even before its much-anticipated mainnet launch. The network's TPS of up to 10 million definitely has investors, analysts and industry experts talking. However, the record-setting TPS isn't the project’s only drawcard — and features such as native cross-chain transfers, comprehensive digital identities and compliant tokenization of RWAs are also among the platform's strong points.

All eyes are now on the platform's imminent mainnet debut. If its claimed gargantuan TPS numbers prove true on the mainnet, we might see the emergence of a new leader in the blockchain scalability sphere.

Solana, beware!

#LearnWithBybit