Kaia (KAIA): Merging Klaytn & Finschia for Mass Web3 Adoption

The confident rise of The Open Network (TON) in 2024, largely attributable to its Telegram-based mini decentralized apps (DApps), has put the spotlight on the use of web3 technologies in instant messaging platforms. However, the Telegram-linked project isn't the only one that has identified the potential in this area. As early as February 2024, two blockchain platforms with links to popular Asian messaging networks announced their high-profile merger.

The merger of Klaytn (KLAY) — backed by the South Korean instant messaging platform KakaoTalk — and Finschia (FNSA) — operated by the owner of the Japan-based LINE messaging app — may have a far-reaching impact on the entire crypto industry. The merged entity, branded Kaia (KAIA), aims to become the leading web3 platform in Asia. With its deep links to Web 2.0 messaging giants, the Kaia blockchain could also challenge the dominance of TON in the niche of messenger-based mini DApps.

Kaia’s faith in its ambitious plans is well-founded. The KakaoTalk and LINE messenger apps boast a combined user audience of nearly 300 million across several Asian countries. With the vast number of easily accessible target users, Kaia is ideally positioned to become the main bridge between Web 2.0–based online messaging and web3. However, the multimillion army of potential users on KakaoTalk and LINE isn't the only trump card of the Kaia project: the blockchain features great scalability, near-instant finality, excellent throughput capacity and low transaction costs.

With all of these benefits on offer and backing from some of the most prominent players in Asia's instant messaging sector, the Kaia chain might become the crypto industry's up-and-coming growth leader for the year 2025.

Key Takeaways:

Kaia (KAIA) is a blockchain network launched in August 2024 as a result of the merger of two decentralized platforms — Klaytn and Finschia.

The merged chain enjoys the support of and links to two popular Asian instant messaging platforms — South Korea's KakaoTalk and Japan's LINE.

Kaia's native token, KAIA, is used for transaction fee payments and validator reward payouts. Additionally, organizations joining the platform's governance entity, the Kaia Governance Council, need to stake KAIA to qualify for membership.

What Is Kaia?

Kaia (KAIA) is a Layer 1 blockchain that has emerged due to the merger of two web3 platforms — the Klaytn and Finschia blockchains. Klaytn and Finschia had operated as separate networks for several years, Klaytn since 2019 and Finschia since 2018, before their governance communities voted in February 2024 to approve the merger. The Kaia mainnet went live in August 2024.

The merger immediately attracted the attention of industry observers, as it involved two platforms backed by Asian instant messaging giants — South Korea’s Kakao Corporation, the developer of Klaytn and KakaoTalk instant messenger, and Japanese LY Corporation (previously Line Corporation), the entity behind the LINE messenger app and the Finschia blockchain. As of early 2025, KakaoTalk boasts over 50 million active monthly users, mostly in South Korea, while the LINE messenger has around 230 million active monthly users spread across its key markets — Japan, Indonesia, Taiwan and Thailand.

The sheer size of the combined user audience of KakaoTalk and LINE, and their connection to the newly formed Kaia blockchain, suggest the project may become a leading platform by integrating web3 functionality into both messengers, similar to the way TON’s chain has become a champion of Telegram-based mini DApps. However, the goals of the merged project go well beyond the integration of Web 2.0 messaging and web3 functionality, and the Kaia project hopes to leverage its potential reach to become Asia’s leading blockchain platform.

Kaia is an Ethereum virtual machine (EVM)–compatible blockchain that boasts outstanding technical properties, including one-second block generation times, a throughput capacity of 4,000 transactions per second (TPS) and near-instant finality. It also offers low transaction fees (1/10th of Ethereum’s fees).

Kaia’s mainnet is a hard fork of the original Klaytn blockchain. Following the merger, Klaytn's testnet, Baobab, has become Kaia’s testnet under the new name of Kairos.

Aiming to become the largest web3 environment in Asia, Kaia offers decentralized projects and developers opportunities across a wide variety of sectors, with a particular focus on three niches — real-world assets (RWAs), decentralized finance (DeFi) and gaming.

Transition From Klaytn and Finschia to Kaia

The original Klaytn blockchain was launched in June 2019 by GroundX, a subsidiary of the South Korean technology giant Kakao Corporation. The key aim of Klaytn was to provide a low-latency, high-throughput, developer-friendly platform for enterprise-grade applications. Klaytn was forked from Ethereum, and was highly EVM-compatible. It quickly grew popular in the South Korean market, propped up by support from the powerful Kakao Corporation.

Soon after its launch, the blockchain became the dominant web3 platform in South Korea. In 2021, the Bank of Korea selected Klaytn as the provider of choice for its central bank digital currency (CBDC) project. Kaia's great technical capabilities primarily derive from the original Klaytn network.

As for Finschia, the origins of this platform go back even further, to 2018, when Japan’s LINE Corporation — now known as LY Corporation, after a merger of several related business entities — developed and launched the LINK blockchain. In 2020, the platform was rebranded from LINK Chain to LINE Blockchain. This wasn't the last name change in its history, as the project’s penchant for rebranding proved unstoppable. Three years later, in April 2023, LINE was rebranded to Finschia.

The Finschia chain aimed to accommodate a wide variety of use cases, sporting an ambitious motto — Blockchain for All.

In January 2024, a proposal to merge Klaytn and Finschia was tendered for consideration by the platforms’ governance communities. One key aim of this proposed merger was to combine the potential reach of the two chains in Asia (estimated at around 250 million users for the two messenger apps at that time) in order to create the continent’s largest web3 environment.

The proposal was approved in February 2024 with overwhelming support, with 90% of Klaytn and 95% of Finschia governance representatives voting in favor of the merger.

In late August 2024, the Kaia mainnet launched, signifying the practical start of the ambitious project. As a fork of Klaytn, Kaia inherited its technical setup. This meant that DApps in the Klaytn ecosystem could seamlessly transition to the new network, with minimal modifications. Finschia DApps, on the other hand, need to be migrated to the new platform. Finschia Foundation, a nonprofit that supported the original Finschia project (and continues to provide support during the merger phase) can provide advice to DApps undertaking migration from the Finschia blockchain to Kaia.

How Does Kaia Work?

The Kaia blockchain uses a specialized block validation process known as Practical Byzantine Fault Tolerance (PBFT). Distinct from proof of work (PoW) or proof of stake (PoS), the two most common network consensus models employed in the industry, PBFT is a modification of the Istanbul BFT (IBFT) consensus algorithm, an innovative network consensus model designed to power secure block validation in distributed networks.

Kaia's PBFT algorithm randomly selects a committee of nodes to process and validate transaction blocks at one-second intervals. One validator node in the committee is assigned the proposer role. This node generates and proposes a transaction block for validation. The committee’s members need to sign the block to endorse its validity. In order for a block to be validated and written to Kaia's permanent ledger, more than two-thirds of the committee members must approve it. The committee isn't fixed, and a new one is formed from the pool of validator nodes for each block to be processed. Given Kaia's one-second block intervals, this committee selection process takes place every second.

Kaia's PBFT is designed to reliably process transaction blocks even when some proportion of validators on the network act maliciously. As such, PBFT is a highly fault-tolerant consensus model, a property it inherited from the original IBFT algorithm.

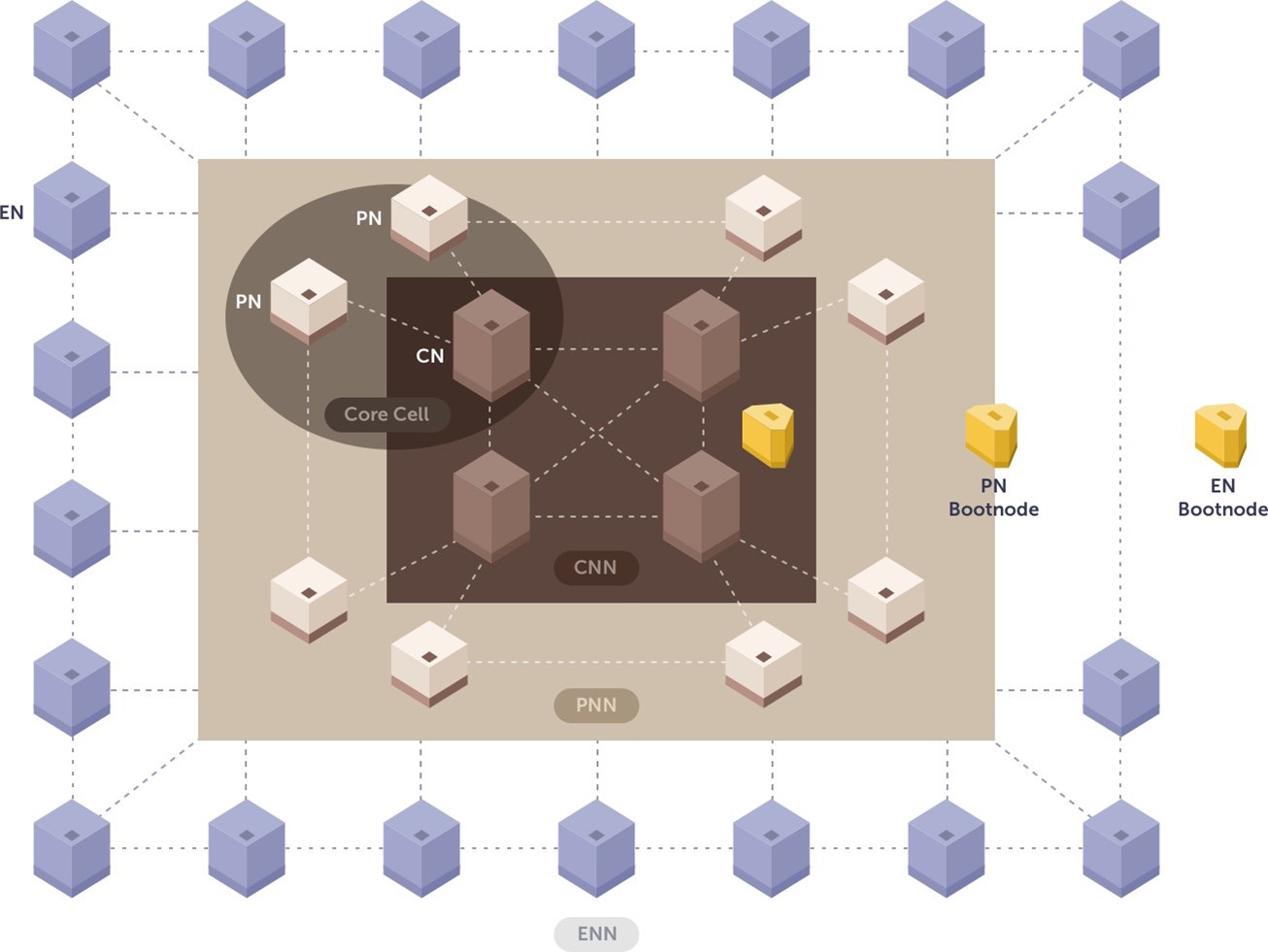

Kaia's Distributed Ledger Technology (DLT) employs a three-layer architecture to power the network's operations. The underlying consensus layer is made up of consensus nodes (CNs), whose job is to process and approve blocks of transactions. These are the validator nodes we discussed above in the context of Kaia's PBFT consensus algorithm.

Above the consensus layer is the proxy layer, which is made up of core cells — mini networks consisting of one CN and two proxy nodes (PNs). PNs serve as an interface linking the underlying and outer layers of the blockchain. Within each core cell, a trio of one CN and two PNs work together to receive data from the outer layer and process transaction blocks.

This outer layer consists of endpoint nodes (ENs) that process data from service chains — app-specific Kaia chains that can be customized for the needs of each application or service.

The image below summarizes Kaia’s three-layer architecture, showing the three layers and the node types operating on each of them.

Further Features

Kaia is an EVM-compatible chain capable of smart contracts. The Kaia Virtual Machine (KVM) powers smart contracts and their processing on the network. KVM is derived from Ethereum’s virtual engine, the EVM, so blockchain developers can easily port Ethereum applications to Kaia with little modification. Common development technologies used in the Ethereum environment — such as the Solidity programming language, and the Hardhat development framework — are available to blockchain programmers building Kaia-based DApps.

The Kaia Governance Council, a group of reputable organizations in the blockchain industry, carries out the platform's governance. Council members consider proposals submitted by advisors and other stakeholders, analyze the proposed changes and vote to decide on them. While the Council currently drives the platform's governance process, Kaia aims to eventually fully decentralize its decision-making structure by introducing a community-based decentralized autonomous organization (DAO). This will provide a more democratized and inclusive way for the wider user community to have a say in the network's strategic direction and rules.

Kaia Key Features

Kaia Accounts

Kaia uses an account-based model similar to the one employed by Ethereum, as opposed to the unspent transaction output (UTXO) model commonly associated with the Bitcoin (BTC) blockchain. However, the similarities between Ethereum’s and Kaia's account structures end here.

One distinct feature of Kaia accounts is the ability for users to generate multiple key pairs. On most other blockchains, including Ethereum, an address can be associated with only one public-private key pair. This has several disadvantages, the most relevant of which is reduced security. By allowing multiple key pairs for account addresses, Kaia improves the overall security of account management for ordinary users and smart contract owners alike.

Each key pair generated for the address can be assigned a specific purpose or role. These role-based keys essentially mimic the functionality offered by multisig wallets, further enhancing account security and enabling more flexible access control modes.

There are two types of Kaia accounts: externally owned accounts (EOAs), which are used for cryptocurrency storage and transfers, and smart contract accounts (SCAs), which are capable of processing and storing smart contract code. While DApps leverage SCAs to power their functionality, most individual crypto users choose EOAs.

To make the management of EOAs easier and more user-friendly, the project team has developed a native wallet solution for the blockchain, Kaia Wallet, which operates as a browser extension. Available for Google Chrome, Kaia Wallet lets you manage your account via the familiar web-based interface.

The platform also offers a solution for multisig accounts, Kaia Safe, which may better suit the needs of institutional users with sophisticated access control requirements.

Fee Delegation

A novel feature built into Kaia accounts is fee delegation, the ability for a user to send KAIA, the network's native token, without having to cover the transaction fee. Instead, the sender requests in the message that the fee is to be covered by the recipient party. The platform even supports partial fee delegation, whereby the sender can stipulate a specific proportion of the fee to be covered by the receiver.

The fee delegation feature may be used for multiple transaction types, involving both EOAs and SCAs.

What Is the KAIA Coin?

KAIA is the Kaia platform's native cryptocurrency. It represents a rebrand of Klaytn's native token, KLAY. Following the Klaytn and Finschia merger, all KLAY tokens on the network were transferred automatically to the new KAIA tokens. For Finschia's FNSA token holders, the procedure to convert to KAIA is a bit more involved. They can utilize the Kaia Portal to burn their FNSA tokens held on the Finschia chain, and then claim the equivalent amount of KAIA on the new blockchain.

KAIA is used to pay for smart contract operations on the network and gas fees for transactions. It also has some staking functionality built in. Organizations admitted to the Kaia Governance Council need to stake at least 5 million KAIA to join.

The token is also used to pay block validation rewards. Earlier, we described a procedure involving node committees that process transaction blocks on the Kaia chain. For each generated block, 9.6 KAIA is split between the committee members involved in validating that block and two critical funds on the platform — the Kaia Ecosystem Fund (KEF) and the Kaia Infrastructure Fund (KIF). The validator committee members earn 50% of the block reward, while KEF and KIF receive 25% each.

KAIA’s total supply as of Jan 13, 2025 stands at nearly 5.9 billion. Since the token is continually issued for block rewards, its supply is subject to inflation and has no maximum cap.

Where to Buy KAIA

The KAIA token is available on Bybit's Spot market as a swap pair with the USDT stablecoin, and via the Derivatives market as a USDT-based perpetual futures contract.

KAIA Price Prediction

As of Jan 13, 2025, the KAIA token is trading at $0.209, which is 48.9% lower than its ATH of $0.4067 on Dec 3, 2024, and 83.7% higher than its ATL of $0.1131 on Nov 4, 2024.

Long-term price forecasts for KAIA are generally bullish.DigitalCoinPrice predicts an average rate of $0.72 in 2027 and $1.12 in 2030, whileCoinCodex expects the token to trade at $ 0.2178 in 2027 and $ 0.68 in 2030.

Closing Thoughts

The merger of Klaytn and Finschia has produced an enormously influential platform with potential access to nearly 300 million users of KakaoTalk and LINE. Moreover, this multimillion-strong potential audience isn't the only source of users that Kaia could tap into. Offering outstanding scalability, a highly secure consensus mechanism, low transaction costs and a unique account model capable of handling multiple key pairs per address, the Kaia blockchain is ripe for adoption by the enterprise world.

As of the start of 2025, the merged chain is still in the early months of its operation. While it might be a bit early to declare Kaia as the next big thing in the crypto industry, the project is quickly shaping up as one of the best candidates for that designation, at least in the vast expanse of the Asian continent.

#LearnWithBybit