Aleo (ALEO): A Layer 1 Blockchain for Privacy and Security in Web3

Blockchain technology is known for its security, decentralized democratic consensus mechanisms and transparency. All these features make it an attractive environment for technology apps and end users alike. However, the transparency of blockchain networks that’s achieved through open public access to their data can sometimes be a double-edged sword. Many businesses and individuals would like to transact privately without having to reveal their on-chain activities to outside parties.

Aleo (ALEO) is a blockchain platform that maintains user privacy through the use of zero-knowledge proof (ZKP) technology, helping decentralized app (DApp) operators and end users to protect their transaction and account details. Using a smart combination of two validation methods (delegated proof of stake, or DPoS, and its own unique “proof of succinct work,” orPoSW), Aleo aspires to become a leading privacy-focused blockchain network. The Aleo network also offers users nearly instant finality and high levels of scalability.

For DApp operators specializing in privacy-sensitive niches and consumers who would like to transact confidentially, Aleo might be a natural choice — or at the very least a worthy alternative that deserves a closer look.

Key Takeaways:

Aleo (ALEO) is a Layer 1, smart contract blockchain focused on providing a completely private transaction environment for DApps and end users through the use of zero-knowledge proofs.

Aleo's native ALEO token (previously known as Aleo Credit) is used for transaction fee payments, staking, reward payments and governance.

ALEO can be traded on Bybit as a USDT Perpetual contract (ALEOUSDT).

What Is Aleo?

Aleo (ALEO) is a Layer 1 blockchain network that allows users to protect their on-chain activities and data and enjoy complete privacy. It achieves its privacy-preserving properties by using a combination of components, mainly from the family of ZK proof technologies. By offering a private transaction and value storage environment, Aleo addresses a fundamental limitation of blockchain technology for privacy-oriented use cases— that of public access to all on-chain data.

Aleo also offers its users a high degree of scalability and instant finality. The technical efficiencies of the blockchain, coupled with its private environment, are beneficial for niches and industries for whom preserving the confidentiality of transaction activity is critical. One such prominent area is finance, specifically decentralized finance (DeFi) applications. On Aleo's recently launched mainnet, DeFi apps feature prominently. Other types of DApps can benefit from this functionality offered by Aleo, such as private crypto wallet solutions and decentralized identity (DID) apps, both of which are also present within the blockchain's young ecosystem.

The Aleo project was founded in 2020 in San Francisco, CA, by Howard Wu, Raymond Chu, Collin Chin and Michael Beller. After four years of research and development, the project launched its finalized testnet version in May 2024. On Sep 18, 2024, Aleo debuted its mainnet.

With its innovative privacy-oriented concept based on ZK proofs, Aleo has attracted significant attention from the crypto investor community. As of October 2024, the startup has already raised $228 million in venture capital (VC) funding, and boasts no less than 19 institutional investors, among whom is the largest venture capital firm in the world — Andreessen Horowitz (a16z).

Aleo Key Features

As an L1 smart contract blockchain, Aleo combines several innovative technologies to achieve technical efficiency while maintaining user privacy.

Proof-of-Succinct Work (PoSW)

Among the Aleo platform's most innovative and critical features is its PoSW procedure, which is used as part of the network's block validation process. In PoSW, special network actors, called provers, generate ZK proofs for transactions by using special hardware designed to solve computational puzzles. The Aleo blockchain's algorithm determines the difficulty level of these computations and the amount of work that needs to be completed by provers' machines.

In some ways, the PoSW procedure is similar to Bitcoin's proof of work (PoW) block validation model. However, while Bitcoin's PoW is the sole block validation procedure required on the chain, PoSW is only one component of Aleo's overall block validation process (which we’ll look at in more detail below). Proofs generated by provers are passed on to Aleo's validators, who then complete the block validation procedure. PoSW enhances privacy and security while ensuring efficiency within the consensus mechanism.

Leo Language

Aleo’ platform is fully capable of running privacy-preserving smart contracts. In order to facilitate privacy-focused smart contract development on the network, Aleo has introduced the Leo programming language, designed for efficient and intuitive creation of Aleo-based apps and protocols. The language abstracts low-level cryptographic security concepts, allowing blockchain developers to concentrate on building private applications without needing to manage the complexities of ZK proofs. It also supports interoperability between programs, streamlining development on the Aleo network.

AleoBFT

Aleo's unique consensus algorithm is called AleoBFT — a form of consensus based on the Sui network’s Narwhal and Bullshark consensus algorithm. AleoBFT helps maintain high throughput and scalability on the Aleo network by incorporating zero-knowledge proofs into its blockchain.

AleoBFT involves the work of three network actors — stakers, provers and validators — who operate in unison to maintain the platform's consensus and operations. Stakers delegate funds to validators to assist in their processing of transaction blocks, and receive ALEO rewards from them. Meanwhile, provers generate cryptographic proofs and solve puzzles, which validators verify and include in blocks to secure the network.

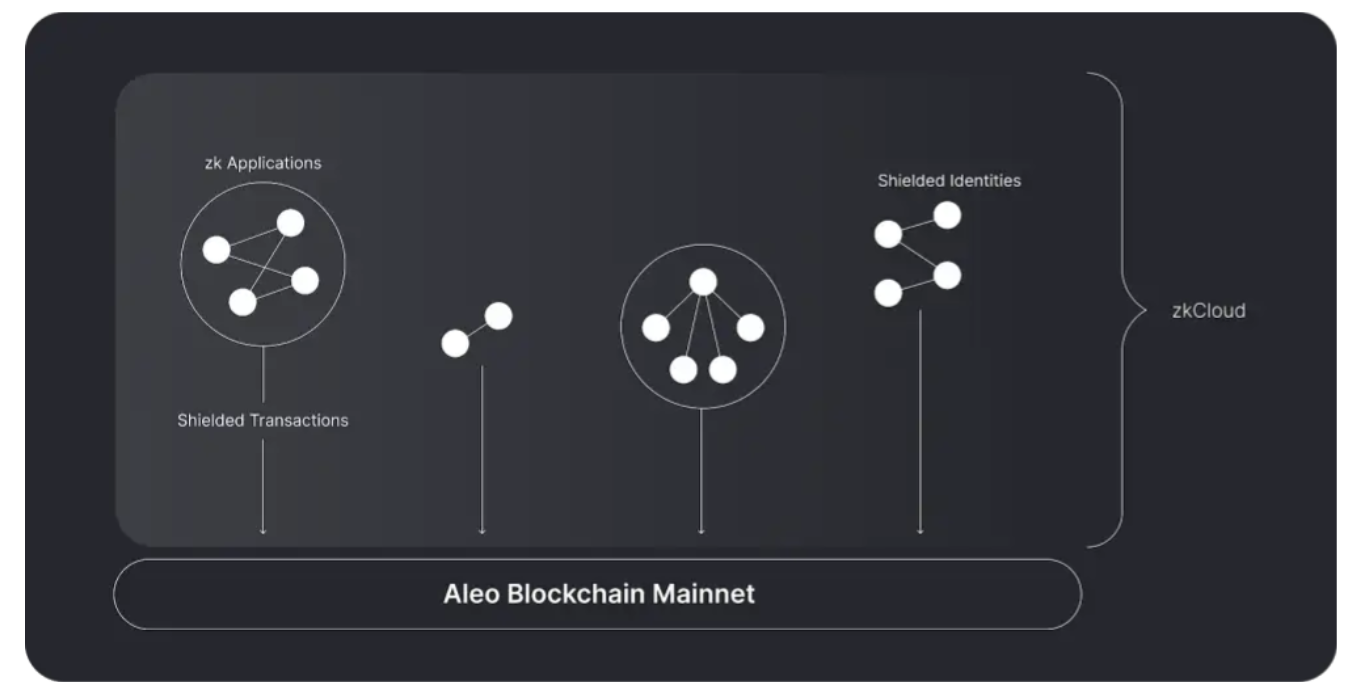

zkCloud

zkCloud is an off-chain cloud environment in which Aleo transactions are executed privately and securely. Using this private off-chain medium allows Aleo to provide virtually unlimited application runtime capacity and significant cost reductions. Two core components of the zkCloud processing environment are snarkVM and snarkOS.

snarkVM

snarkVM is a virtual engine that processes Aleo transactions efficiently and at scale off-chain, with only ZK proofs required for on-chain finalization. It’s written in the Leo programming language, and uses a functional execution model. Functional processing is one of the few main varieties of programming code execution, along with the object-oriented, actor and resource-oriented models, which are more commonly used in popular blockchain virtual engines like the Ethereum virtual machine (EVM) and Tron Virtual Machine (TVM).

snarkOS

snarkOS is a decentralized operating system optimized for running ZK proof–based programs. Serving as the backbone of Aleo's processing environment, it securely verifies transactions and maintains encrypted-state applications in a publicly verifiable way. It also helps Aleo nodes optimize resource allocation so they can participate in the blockchain's operations without excessive hardware expenditure.

Provers and validators must install snarkOS in order to provide their services and contribute to the Aleo blockchain’s operations.

Aleo SDK

Aleo SDK is a tool kit that helps facilitate the development of ZK-based applications. It includes packages primarily for TypeScript and JavaScript, as well as the Aleo Python SDK for Python developers. The tools included in the platform's SDK products greatly simplify and expedite the process of building privacy applications on the Aleo blockchain.

Varuna

Varuna is Aleo's ZK proof system. At a high level, a ZK proof system allows data to be validated by specific network actors without revealing the full details. Only data that’s required for validity checking is processed.

Varuna is a variation of the Marlin ZK proof system, which supports batching (grouping blockchain transactions before validating them to improve efficiency and reduce cost). Marlin systems facilitate efficient off-chain computations, and are particularly suitable for processing ZK proofs, making them ideal for privacy-preserving DApps due to their scalability and efficiency.

How Does Aleo Work?

Aleo uses a unique record-based model for user and smart contract addresses stored on the network. It represents an eloquent combination of the unspent transaction output (UTXO) model used by Bitcoin (BTC) and the account-based model employed by the Ethereum (ETH) blockchain. In addition, it supports easy traceability of the funds being sent and received on the chain, while maintaining a high degree of smart contract programmability.

Aleo’s block validation model represents a combination of the PoSW procedure described above and the DPoS system used to finalize transaction blocks. Aleo's total block validation time takes only about 2–5 seconds. There’s a minimum fee of 0.005 ALEO tokens, the platform's native cryptocurrency, for the most basic transactions. Larger transactions attract higher fees based on the level of complexity involved.

Network Participants

There are three main actor types on the Aleo network — stakers, provers and validators — who work together, carrying out their respective functions and using the platform's rewards and staking dynamics to power the overall functionality of the blockchain.

Stakers are users who would like to participate in securing the Aleo chain and earn rewards without having to run specialized nodes, like a prover or validator node does. Stakers delegate their ALEO funds to validator nodes to qualify for a share of block rewards.

The minimum staking requirement for delegators is 10,000 ALEO (roughly $46,500 as of Oct 4, 2024), which can prove rather substantial for the average crypto user. Anyone who would like to take advantage of staking Aleo in a more affordable way has the option to use the liquid staking function from the Pondo platform, which has a significantly lower token stake minimum of 10 ALEO ($46.50) in order to qualify for a share of block rewards.

As noted earlier, provers are network actors who generate ZK proofs by solving computational puzzles. The prover who wins the computational race to solve a puzzle earns a reward on top of the standard staking reward, called a Coinbase (unrelated to the Coinbase crypto exchange company). While the winning prover receives two-thirds of the Coinbase reward, the remaining one-third is passed on to validators, who finalize transaction blocks based on the ZK proofs sent by provers.

Validators are network actors responsible for completing the block generation process on Aleo. They’re the entities to whom stakers delegate funds. To qualify for their role, validators need to have a minimum of 10 million ALEO ($56,400,000) staked on them. Due to this substantial token stake requirement, Aleo's validators are usually relatively large institutional entities, including companies like Coinbase and one of the world's largest staking providers, Everstake. At the time of this writing (Oct 4, 2024), there are 16 full validator nodes on the Aleo chain.

What Is the ALEO Token?

The ALEO token, previously known as Aleo Credit, is the native crypto asset of the Aleo chain. Acting as the chain's gas fee asset, ALEO is used to pay for services and computational resources sourced on the platform. Rewards for provers, validators and stakers are also disbursed in ALEO tokens. Stakers use ALEO to delegate crypto funds to validators.

ALEO also acts as a governance token. Holders of the token can participate in the decision-making process regarding any changes to the blockchain.

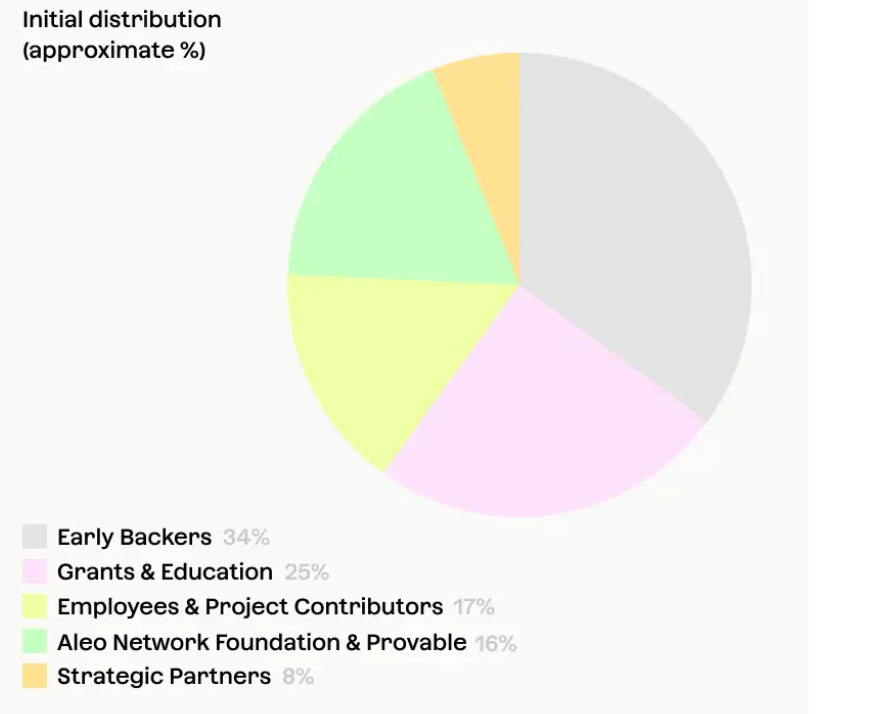

ALEO was launched on Sep 18, 2024, and has a total supply of 1.5 billion. There’s no maximum supply limit for the token. ALEO's initial supply allocation shares are per the chart below:

Where to Buy ALEO

The ALEO token is available on Bybit's Derivatives market as a Perpetual contract with USDT (ALEOUSDT). Under the contract, you can trade ALEO with up to 25x leverage using Bybit products like Futures Grid, Futures Martingale and Futures Combo. The Derivatives market on Bybit offers you the opportunity to trade perpetual futures, standard futures, options and other derivative product types via contracts based on popular stablecoins and high-cap cryptos.

ALEO Price Prediction

As of Oct 7, 2024, the ALEO token has been on the market for slightly over two weeks. It’s trading at $3.82, which is 43.8% lower than its all-time high (ATH) of $6.72 on Sep 28, 2024, and 44.1% higher than its all-time low (ATL) of $2.62 on Sep 20, 2024.

Despite the token's limited history, its confident start on the market points to healthy growth potential. As such, long-term price forecasts for ALEO are generally bullish. DigitalCoinPrice predicts an average rate of $9.93 in 2025 and $28.67 in 2030, while CoinCodex expects the token to rise to a high of $17.76 in 2025 but ease back to a lower high of $15.38 in 2030.

Closing Thoughts

The public nature of blockchain platforms has been heralded as one of the technology's main advantages. However, data security, privacy and the ability to conceal sensitive transaction details from the public eye are often critical when it comes to real-world business applications.

The Aleo team, unlike many others involved in the blockchain industry, recognized this need years ago and, after several years of development and testing, has delivered a product that can appeal to businesses whose functional models hinge on privacy and confidentiality. This is particularly relevant for the finance sector, of course. It's no wonder, therefore, that among the DApps in Aleo's still young ecosystem, DeFi solutions feature prominently.

With a mainnet launch in September 2024, Aleo is still in the early stages of its market presence and development. However, as we move toward the end of the year and further into 2025, the concept of a privacy-preserving blockchain will undoubtedly find more fans, both in the finance niche and beyond. As this concept’s popularity grows, so too will appreciation for the infrastructure provided by Aleo, one of the rare blockchain projects that considers privacy its raison d'être.

#LearnWithBybit