PumpBTC (PUMP): Secure multichain liquid staking for BTC

One of the most exciting parts of working with cryptocurrency is the ability to stake tokens and earn passive income. Unfortunately, some older and more established coins like Bitcoin (BTC) don't natively support staking, due to their proof of work (PoW) consensus model. To overcome this limitation, Bitcoin liquid staking platforms have emerged, which let you temporarily lock away your Bitcoin to support their networks while you earn interest on the side via decentralized finance (DeFi). PumpBTC is one such platform that plans to expand the utility of Bitcoin staking. Built on Babylon, this liquid staking solution lets people stake their Bitcoin securely with even more flexibility and access to DeFi to maximize their earning potential.

Key Takeaways:

PumpBTC uses the Babylon Bitcoin staking protocol to provide liquid staking for wBTC and BTC.b, so that users receive pumpBTC tokens at a conversion rate of 1:1. With PumpBTC, Bitcoin stakers can participate in a variety of DeFi activities with ease.

The PumpBTC ecosystem uses a dual token method that also allows investors to profit from its native cryptocurrency.

Its tokens, PUMP and vePUMP, serve as the ecosystem's governance and reward mechanisms for users to participate in decision-making and boost their staking yields.

What is PumpBTC?

PumpBTC is a multichain liquid staking solution for Bitcoin built on the Babylon native staking protocol. Compared to other Bitcoin staking solutions, PumpBTC hopes to offer more flexibility and security.

Essentially, users attach their crypto wallets to PumpBTC and temporarily stake their Wrapped BTC (WBTC) or Bitcoin Avalanche Bridged (BTC.b) tokens on the Babylon protocol. In return, PumpBTC gives users a yield-bearing token whose value is pegged to Bitcoin at a one-to-one value. The pegged token, pumpBTC, can then be used in a variety of DeFi protocols. For BTC holders, having a more liquid asset while their Bitcoin is staked ensures that they can maximize yields with ease.

The PumpBTC process provides many advantages for users. Compared to direct BTC staking on Babylon, it doesn't permanently lock up users' tokens until the staking period ends. People can still use their assets for other DeFi actions, such as participating in decentralized apps (DApps) or lending funds.

PumpBTC and Babylon: Security, staking and scalability

The integration with Babylon also provides plenty more useful features. Since Babylon is staked directly on the Bitcoin blockchain, minimizing security risks is another benefit. Instead of trusting a bunch of third-party bridges, users can enjoy centralized finance (CeFi)–level security. The native yield from Babylon provides a reliable form of income, no matter what users do with their liquid tokens.

Furthermore, PumpBTC is also connected to several EVM-compatible chains. Through the convenient PumpBTC website, users can also access projects on chains like Ethereum, BNB Smart Chain and Berachain. This provides even more flexibility for liquid staking and ensures PumpBTC is as scalable as possible.

PumpBTC launched just less than a year ago, in June 2024, but it's already expanded to over 27 other DeFi and crypto ecosystems. The site has raised over $10 million in funding from 10K Ventures, Arcane Group, CoinSummer Labs and others. Little is known about the people who launched PumpBTC because the project aims to be pretty decentralized. Its most recent update in early April includes news about creating The Pump Foundation and PUMP, a utility token that people can use to engage in governance.

How does PumpBTC work?

PumpBTC’s architecture prioritizes security and transparency. Many other Bitcoin staking solutions manually pass tokens back and forth over third-party bridges, which allows vulnerabilities to enter the equation. However, PumpBTC's method ensures users remain in control of their own assets. PumpBTC has partnered with fully licensed token custodians, such as CoinCover and Cobo, to implement Multi-Party Computation (MPC) in order to boost the protection of users’ assets. With MPC, after a user places their WBTC or BTC.b into the custodial wallet, multiple private keys are generated, and transactions can only be confirmed if all parties, including the user, are in agreement.

Once the tokens are in the custodial wallet, a smart contract with CoinCover or Cobo delegates the equivalent amount of tokens into the Babylon native yield staking network and triggers the minting of pumpBTC tokens, which are transferred back to the user. These tokens have a one-to-one value ratio with Bitcoin, and people can use them to participate in DeFi yield-earning solutions within the PumpBTC ecosystem.

When BTC holders maximize yields and are ready to redeem their Bitcoin from the Babylon staking protocol, they turn in their pumpBTC tokens. The custodian triggers a smart contract that burns the pumpBTC tokens. Once the tokens are burned, the custodian returns both the Bitcoin (WBTC or BTC.b) and staking yields to the user. Throughout the entire process, users can maintain control of their tokens and view all on-chain transactions, so they can be fully aware of how the system works.

PumpBTC points

PumpBTC also has some intriguing mechanisms outside of its token staking process. The rest of the ecosystem is a community-led system run with PumpBTC points, a reward mechanism that encourages people to participate in the platform. You can earn them by participating in various activities and challenges, such as referring other people to PumpBTC and staking PUMP on PumpBTC or Babylon.

Simply holding pumpBTC tokens lets you earn one point per token per second. But if you choose to interact more actively with PumpBTC's ecosystem by staking PUMP in multiple liquidity pools or being a Team Captain in the referral program, your points will be boosted. Having these points allows you to unlock additional ecosystem rewards as the platform evolves.

PumpBTC OS

In early April 2025, PumpBTC announced an enhancement to its protocol with the introduction of PumpBTC OS to incorporate AI-driven staking into its operating system. The integration of AI facilitates the automatic search for the best yields across networks, and the customization of strategies according to your risk profile.

PumpBTC crypto coins

The PumpBTC network contains multiple cryptocurrency tokens. Though they all share similar names, they have vastly different purposes. In addition to the pumpBTC token used for liquid staking transactions, there are also PUMP and vePUMP tokens.

PUMP

The PUMP token is the governance token of the PumpBTC system. It's an ERC-20 and BEP-20 coin distributed to liquidity providers, and can be used to vote on decisions within the ecosystem and for staking to boost rewards. It can also be used to lower fees and enhance returns across PumpBTC's products. There’s a total supply of 1 billion PUMP tokens, which will be allocated as follows:

Community ecosystem: 38%

Investors: 20%

Contributors: 19.5%

Airdrop: 9%

Marketing: 5%

IDO: 5%

Liquidity: 3.5%

To jump-start the user-led governance system, PumpBTC will be distributing 90 million tokens to loyal PumpBTC users at the time of token generation. You can check your eligibility for this airdrop by visiting the official PumpBTC airdrop website. Depending upon how much you’ve participated in PumpBTC in the past, you can have quite a few PUMP tokens automatically sent to your wallet.

vePUMP

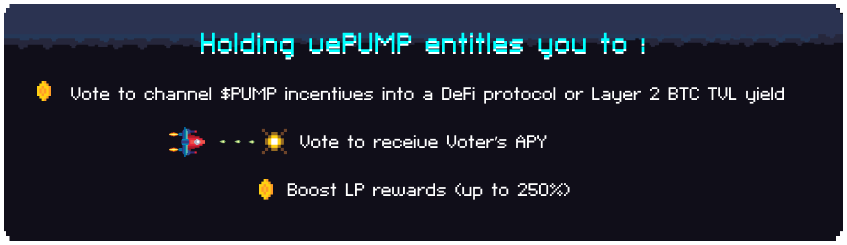

When users stake PUMP, they receive a non-fungible ERC-721 token called vote-escrowed PUMP, or vePUMP for short. It’s a secondary token (linked to the primary PUMP token) that grants stakers even more governance powers. Unlike standard PUMP, vePUMP isn’t used for basic decisions. Instead, vePUMP holders are entitled to a degree of influence over key ecosystem decisions. The longer a token is locked up, the more vePUMP the holder receives. In addition, vePUMP allows people to boost their liquidity provider rewards and gain a share of protocol revenue from the entire ecosystem.

Where to buy PUMP

PUMP is still quite a new token, so it's not yet available on most exchanges. However, Bybit's commitment to highlighting promising new tokens means interested users can access PUMP through Bybit’s exchange. Bybit is running a Launchpool event until Apr 8, 2024, 10AM UTC, in which 2.5 million PUMP will be divided among users. Users can stake PUMP, BTC or USDT and in return get a share of free PUMP tokens.

Even if you don't plan on participating in the Launchpool event, buying PUMP as a Spot pair on Bybit is also possible (PUMP/USDT). Moreover, you can opt to add PUMP tokens to your investment portfolio in just a few steps with Bybit's Spot Grid Bot, which uses artificial intelligence (AI) to ensure that you always buy low and sell high.

Closing thoughts

Ultimately, PumpBTC facilitates effortless collaboration between key players in the Bitcoin staking ecosystem, bridging the gap between traditional Bitcoin holders and the rapidly evolving world of DeFi. By integrating with the Babylon staking protocol and employing MPC-secured custodians like CoinCover and Cobo, PumpBTC offers a secure, flexible liquid staking solution.

Whether you're looking to earn passive income, participate in governance with PUMP and vePUMP or simply diversify your crypto portfolio, PumpBTC creates new, scalable opportunities for engagement with Bitcoin in a modern DeFi context.

#LearnWithBybit