bitSmiley (SMILE): Bringing Liquidity to Bitcoin DeFi

The Bitcoin (BTC) blockchain started as a network devoid of smart contract functionality, but has managed to develop some form of decentralized app (DApp) ecosystem over the past few years — thanks to Layer 2 technologies like Bitlayer, Stacks (STX), Merlin Chain and Rootstock (RSK). Native Bitcoin protocols and new token standards — Ordinals, BRC-20 and Runes — as well as the Bitcoin Taproot upgrade have also contributed to the development of (modest) smart contract–like functions on the chain. Thanks to these innovations, an entirely new field, Bitcoin-based decentralized finance (BTCFi), has emerged.

Unfortunately, the BTCFi niche remains underdeveloped compared to the thriving DeFi ecosystem of Ethereum (ETH) and other smart contract chains. One key reason for this deficit is the lack of sophisticated DeFi functionality within the Bitcoin ecosystem, with few protocols capable of offering full-fledged lending, borrowing and yield management services.

Another problem is the limited liquidity due to traders' inertia — having invested their time and funds in Ethereum and other smart blockchains, many DeFi users are unwilling to explore Bitcoin-based opportunities.

bitSmiley (SMILE) is a BTCFi project that aims to expand BTC-backed stablecoin and lending functions to various platforms beyond Bitcoin. Users of the platform can take advantage of BTC-collateralized stablecoin minting and lending services, with the issued assets usable on a wide variety of DeFi apps across many chains, including Ethereum. By offering these services, bitSmiley hopes to expand the usability of BTC funds well beyond Bitcoin's still immature DeFi environment.

Key Takeaways:

bitSmiley (SMILE) is a BTCFi platform that offers multichain stablecoin minting and lending functions, backed by BTC collateral.

The platform's main utility asset, bitUSD, is a stablecoin minted on Bitcoin and transferable to Ethereum and other smart contract chain ecosystems to be utilized in their DeFi applications.

bitSmiley's SMILE token is used for governance, as well as for access to fee discounts and discounted liquidation auctions.

What Is bitSmiley?

bitSmiley (SMILE) is a DeFi platform specializing in multichain stablecoin minting and lending services backed by Bitcoin. Its users can provide BTC funds as collateral to mint the bitUSD stablecoin, an asset soft-pegged to the U.S. dollar. bitUSD can be further used across a variety of DeFi protocols (on Ethereum and other smart contract chains) to earn yields, similar to the way that native Ethereum stablecoins are leveraged within DeFi. The protocol also offers cross-chain lending services, whereby users can lend funds in bitUSD and other stablecoin assets, based on the bitRC-20 standard, in exchange for collateral in BTC.

The bitRC-20 standard was developed by the bitSmiley project team to enable the issuance of native Bitcoin stablecoins, which can be further utilized within other platforms' DeFi ecosystems. bitRC-20 leverages Bitcoin's inscription technology to power the issuance and management of stablecoins.

Additionally, the bitSmiley protocol has added the function to mint and lend bitUSD — and possibly other bitRC-20 stablecoins in the future — using a variety of Bitcoin-based liquid staking tokens (LstBTCs). This lets users earn yields from staking platforms while using the underlying funds to mint and lend bitUSD.

In addition to stablecoin minting and lending services, bitSmiley has also developed a crypto derivatives trading protocol, although this service still appears to be in development as of early November 2024.

bitSmiley’s Founding and Launch

bitSmiley launched its operations in May 2024 on two popular Bitcoin-linked Layer 2 platforms — Bitlayer and Merlin Chain. Then, in September, the project announced a key partnership with the ZetaChain (ZETA) omnichain protocol, which may help optimize the cross-chain accessibility of assets originally issued on bitSmiley. ZetaChain’s protocol maintains smart contracts for cross-chain communications on multiple blockchain platforms within the Bitcoin, Ethereum and Cosmos (ATOM) ecosystems.

The bitSmiley project was founded in 2023, and is backed by two main venture capital investors — OKX Ventures and ABCDE — as well as a number of other prominent investors and backers, including KuCoin Ventures, MH Ventures, Skyland Ventures, Cypher Capital and CMS Holdings.

How Does bitSmiley Unlock Native Bitcoin Liquidity?

While users can keep their bitUSD funds working for them within the BTCFi ecosystem, there's one key problem: the native BTC DeFi world lacks the levels of liquidity, trading activity and product sophistication that Ethereum and other smart contract blockchains can offer. This makes the use of bitUSD beyond the Bitcoin ecosystem particularly relevant for traders.

Thanks to bitSmiley's cross-chain capabilities, bitUSD can be transferred to Ethereum and other major smart contract chain ecosystems to be used in DeFi protocols in those environments. This dramatically expands product alternatives, as well as the number of protocols on which bitUSD may be utilized.

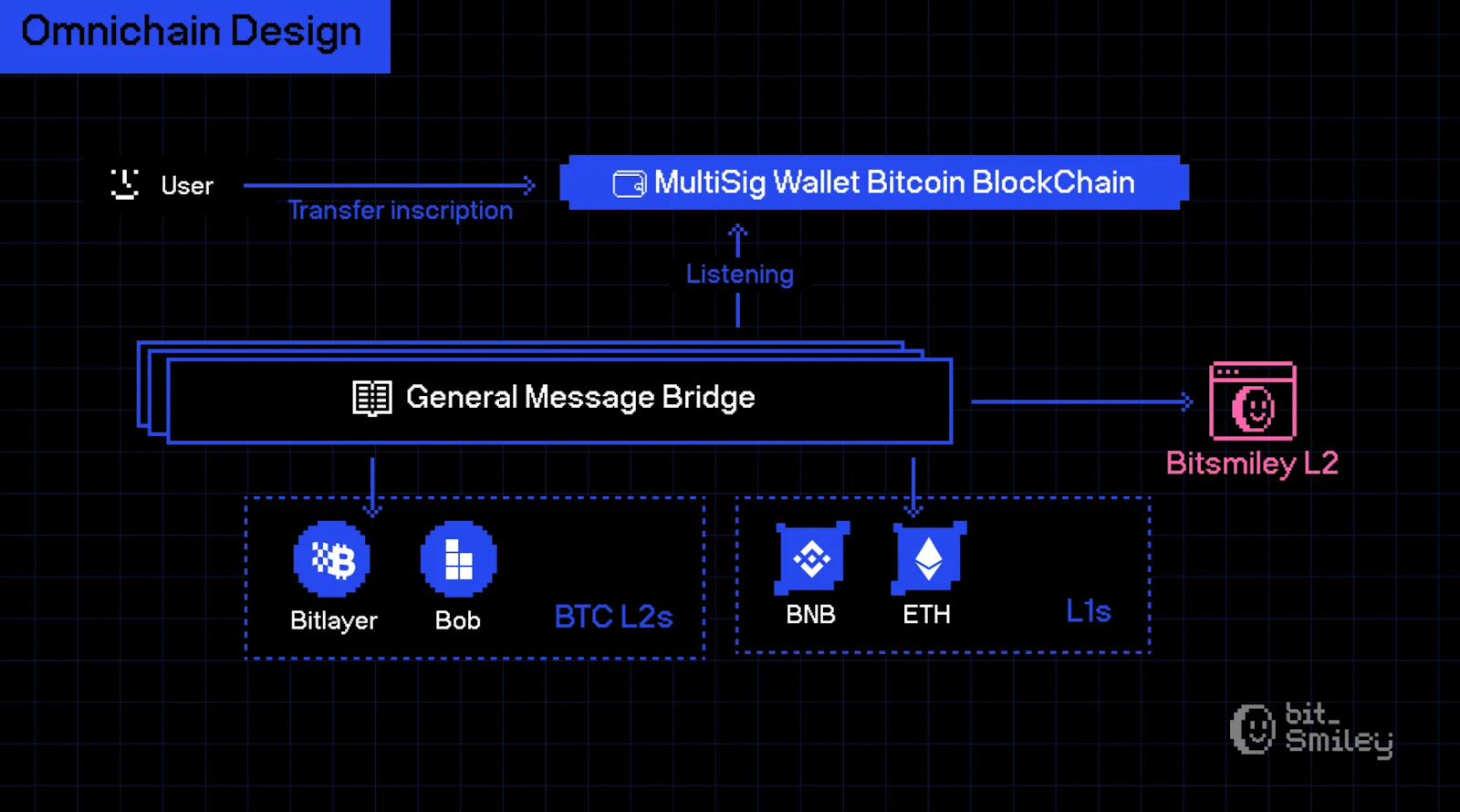

bitSmiley uses Bitcoin's native inscription technology, multisig wallets and a group of listener components to enable the transfer of bitUSD to other blockchains. bitUSD is natively issued on Bitcoin as an inscription, and sent to a multisig wallet. A group of listeners configured by the platform detects the transfer to the wallet, checks the transaction and sends the information to the General Message Bridge, which is then responsible for minting bitUSD on the respective external chains.

bitSmiley Key Features

bitUSD Stablecoin

bitSmiley's flagship service is bitUSD stablecoin minting. Users can mint the asset, which is native to Bitcoin and uses the bitRC-20 standard developed by the project, by providing collateral in BTC into the bitSmiley Treasury. bitSmiley implements overcollateralization to ensure the platform's financial security and stability. If the value of the collateral falls below a certain threshold, it becomes a target for a liquidation process. The liquidated party also incurs a charge as a liquidation penalty.

The liquidated collateral is put up for an auction. bitSmiley uses the Dutch auction model, whereby the price starts at a higher level and then gradually decreases until a willing party decides to buy the collateral funds.

The money earned by the auction is stored in a surplus account, of which 10% goes to operational expenses and 90% is set aside as a liquidation buffer (used as compensation during times when the auction revenue is insufficient to pay for the expenses of the treasury). Additionally, if the money in the surplus account is insufficient to cover bad debts, the platform will then conduct a debt auction using future income as collateral. The debt auction will follow the English auction model (featuring a set opening price, which is raised until only a single bidder remains), and participants are required to bid using BTC.

When bitUSD is issued to a user, they have the option to transfer the asset to other blockchain environments using the bridging procedure described above. With a soft peg to the U.S. dollar, bitUSD can provide utility to DeFi traders across various smart contract chains in a way similar to popular stablecoin, such as USDT and USDC.

bitLending

bitSmiley's lending component, bitLending, is designed to enable peer-to-peer (P2P) lending of bitUSD — and, in the future, other assets based on the bitRC-20 standard — in exchange for collateral in BTC and LstBTC liquid staking tokens. bitLending relies on the standard Bitcoin opcodes (pieces of code attached to every Bitcoin transaction with instructions for processing it) to enable the P2P lending exchanges.

Users willing to lend their bitUSD post on bitLending, announcing the amount offered and interest rate sought. If there's a willing borrower for the offer, the parties initiate a transaction, with the borrower providing an overcollateralized security in BTC or LstBTC. The collateral needs to be approved by bitLending. When the borrower has successfully repaid the loan, their collateral will be released. If the borrower fails to repay by the deadline, the collateral is transferred to the lender.

What Is the bitSmiley Token (SMILE)?

SMILE is bitSmiley's governance token, launched on the Ethereum blockchain on Nov 6, 2024. The token uses Ethereum's ERC-20 standard. The decision to launch the token on Ethereum rather than Bitcoin was mainly driven by the former chain's much more sophisticated smart contract functionality, as well as popularity among DeFi users.

SMILE entitles its holders to participate in the decision-making process on key aspects of the bitSmiley protocol, such as minimum collateral rates, liquidation thresholds and rules, collateral types and more. The token also provides additional benefits and perks for its holders, including fee discounts and exclusive access to discounted auctions. The project team has also announced that SMILE may be used for staking on bitUniverse — a platform that will host a series of DeFi apps focused on bitUSD.

SMILE has a total and maximum supply of 210 million. Of these, one percent (2.1 million SMILE) is reserved for eligible users who earned points during the Pre-season airdrop campaign in May 2024.

Where to Buy the bitSmiley Token (SMILE)

The SMILE token is available on Bybit's Spot market as a swap pair with USDT. You can also take advantage of the Bybit Token Splash campaign (dedicated to the token) for the chance to earn a share of the 800,000 SMILE prize pool. Under the terms of the campaign, new users need to deposit at least 200 SMILE — or deposit at least 100 USDT and trade 100 USDT worth of SMILE on their first Spot trade — to qualify for a share of 400,000 free SMILE tokens. Any user can also trade at least 500 USDT worth of SMILE on the Spot market to earn their share of the 400,000 SMILE prize pool. The campaign is valid through Nov 19, 2024, 8:59PM UTC.

Closing Thoughts

Bitcoin's DeFi niche has been growing strongly over the last few years, but many projects dedicated to this area stay within the confines of the still young BTCFi ecosystem. The bitSmiley platform has taken a different approach — instead of trying to rely on the still limited liquidity of Bitcoin, the project's bitUSD crypto serves as a bridge to larger DeFi ecosystems such as Ethereum.

#LearnWithBybit