What Is Bitlayer? Enhancing Bitcoin With the Power of BitVM

Bitcoin's decentralized finance (DeFi) ecosystem, known as BTCFi, is proliferating despite the lack of native smart contract functionality on the Bitcoin blockchain. A variety of technologies are being used to work around this limitation and bring DeFi and other decentralized solutions to the Bitcoin ecosystem. One of the key ways to enable such functionality for the Bitcoin environment is via the use of computational engines, or virtual machines (VMs), that are capable of executing smart contracts. Additionally, some Layer 2 platforms are also used to power decentralized apps (DApps) on Bitcoin.

Bitlayer is a decentralized platform that has adopted both of these approaches — the use of relevant smart VMs and Layer 2 processing — to bring DApp functionality to the Bitcoin blockchain. Based on the Turing-complete BitVM engine for Bitcoin and utilizing the efficient off-chain processing of transactions, Bitlayer is an audacious new drive to turn Bitcoin into a DApp powerhouse. Moreover, Bitlayer features support for multiple VMs, including the enormously popular Ethereum virtual machine (EVM).

Thanks to Bitlayer, complex smart contracts and sophisticated BTCFi apps are no longer an oddity within the Bitcoin ecosystem.

Key Takeaways:

Bitlayer is a Layer 2 network designed to support smart contracts and DApps within the Bitcoin ecosystem.

Bitlayer is the first major project leveraging the BitVM computational engine.

The platform features compatibility with multiple VMs (including EVM), Turing-completeness, low gas fees and three-second block confirmation times.

Introduction to BitVM

Bitlayer, a Layer 2 smart contract–capable solution for Bitcoin, is among the most recent notable endeavors to bring DApp functionality to the world's largest blockchain. At the heart of the platform is the BitVM processing engine, which we'll take a minute to introduce before delving into the specifics of the Bitlayer project itself.

BitVM was proposed and introduced by Bitcoin developer Robin Linus in late 2023. It's an add-on processing engine for Bitcoin, capable of supporting Turing-complete computations and programming languages. Turing-complete programming languages can process computations of any degree of complexity as long as the computational task is theoretically solvable. In a practical sense, Turing-completeness allows the development of complex programming logic to support sophisticated DApps.

BitVM is among the pioneering VM technologies aimed at enabling smart functionality on Bitcoin. For a few months following Linus's introduction, BitVM remained a theoretical concept on paper, without any significant projects leveraging it. This all changed in April 2024, with the launch of Bitlayer's Mainnet.

What Is Bitlayer?

Bitlayer is the first major project to implement BitVM technology. The Bitlayer platform acts conceptually similar to an optimistic rollup network, a popular Layer 2 solution. BitVM is Bitlayer's main processing engine, allowing the network to support smart contracts. Additionally, thanks to its Turing-completeness, Bitlayer supports multiple other VMs, including EVM, SolVM, Cairo VM and MoveVM.

The support for EVM is critical, due to the prevalence of this computational engine in the blockchain industry. Thanks to its 100% EVM-compatible nature, Bitlayer can efficiently integrate solutions initially designed for Ethereum and its vast network of DApps.

As a rollup-like Layer 2 solution, Bitlayer processes and batches transactions off-chain, reducing the load on Bitcoin's underlying Layer 1 chain. The Bitlayer network boasts excellent scalability, speed and cost of transacting as compared to direct transfers using the underlying Bitcoin network. Block confirmation times on Bitlayer are only three seconds, while median gas fees as of Aug 25, 2024 are around 10 cents. This is in contrast to Bitcoin's own 10-minute block processing times and recent gas fees of around $0.50 to $1.

Among the most innovative technologies implemented by Bitlayer is the discreet log contract (DLC) contract execution framework. DLC allows two transacting parties to design pre-agreed conditions for contract execution, and then have a mediating blockchain oracle entity sign off on the overall agreement. The parties can then transact (for instance, exchanging payments based on the chain of signed-off conditions).

Compared to the standard ways of exchanging payments on Bitcoin via Layer 2 solutions, such as using the Lightning Network platform, DLC offers the ability to design and scale complex and private payment agreements while reducing the risk of counterparty fraud.

How Does Bitlayer Work?

Transactions on the Bitlayer platform are processed off-chain, and then collated and organized by a Sequencer node for further verification. A Sequencer is typically used to order transaction batches in rollup solutions. Bitlayer uses a Layered Virtual Machine (LVM) to process transactions that are compatible with different VMs.

Transactions collated by the Sequencer are then verified via the interaction of two key entities — the Prover and the Challenger. Earlier, we noted that Bitlayer is based on optimistic rollup technology. However, there are also elements of zero-knowledge (ZK) proof technology used to verify transactions on the platform. The Prover submits transactions from Layer 2 to Layer 1, and produces ZK proofs for these transactions if challenged with regard to any of them. The role of the Challenger is to monitor transactions and raise fraud proofs if a malicious or incorrect transaction is detected. This is when the ZK proof submitted by the Prover is used to address the challenge and confirm transaction validity.

Thus, while the actual transactions are backed by ZK proofs, the process of challenging their validity is inherently optimistic in nature — that is, a transaction is assumed to be valid unless a Challenger steps in and questions its validity. A system of monetary penalties and rewards is in place to ensure that the Prover and the Challenger exhibit correct and fair behavior on the network. For instance, the Prover needs to pledge a certain amount of BTC in order to participate in the processing activity. If a Prover’s ZK proof is successfully challenged, they risk losing their pledged funds.

Bitlayer Architecture

Layered Virtual Machine (LVM)

Bitlayer's LVM provides EVM support to execute smart contracts and generate the latest states and zero-knowledge proofs in Bitlayer. It’s fully compatible with EVM and Solidity, the default programming language for Ethereum DApps. LVM is the component designed to ensure that programming code generated in Solidity can be adapted and interpreted by the Bitlayer processing environment. According to the project's documentation as of late August 2024, LVM supports Solidity up to version 0.8.25, released in March 2024. The project team has announced that in the future, Bitlayer aims to implement support for later versions.

Sequencer

The Sequencer node is a key network actor on Bitlayer, and is primarily responsible for collating, organizing and submitting transactions in batches for further processing by the Prover and the Challenger. Bitlayer's Sequencers ensure that transaction batching is optimized in order to closely maintain the platform's impressive three-second block time.

Asset Bridge

Bitlayer's Asset Bridge is the component of the platform responsible for the secure and efficient transfer of assets between Layer 2, Bitlayer and Layer 1, Bitcoin. The bridge uses the DLC contract model described earlier to ensure the smooth movement of crypto assets between the ecosystem's layers.

Bitlayer Key Features

Layer 2 Smart Contract Capabilities

Bitlayer is capable of smart contract execution at the Layer 2 level, thanks to BitVM and LVM, with the latter capable of accommodating EVM-compatible computations. The ability to process smart contract code on Layer 2 lessens the load placed by the transactions on the underlying Bitcoin layer. The Turing-complete nature of the platform and its EVM compatibility mean that DApps of virtually any complexity can be handled by the Layer 2 network. Bitlayer’s platform already accommodates DApps in areas such as DeFi/BTCFi, Gaming, Infrastructure and more.

Cross-Chain Transactions

Bitlayer's Asset Bridge can be used for cross-chain transactions. This bridging technology relies on the BitVM engine and Bitlayer's own implementation of the DLC automated contract model — Optimistic-DLC (OP-DLC). Earlier, we noted that the DLC framework relies on oracles to sign off on pre-agreed transactions between parties. With OP-DLC, the function of oracles is carried out by the nodes of the BitVM Federation — a network of nodes overseeing the transactional activity on Layer 2.

Bitcoin Security and Decentralization

Bitlayer enjoys the underlying security and decentralization benefits provided by Bitcoin. The Bitcoin blockchain is among the most secure in the crypto industry, with some observers considering it to be absolutely the most secure decentralized network. Arguably, Bitcoin's block validation model, proof of work (PoW), is generally considered more secure than the proof of stake (PoS) model used by Ethereum and the majority of other smart contract blockchains.

Besides its highly secure block validation method, Bitcoin also boasts one of the largest networks of mining nodes, making it a highly decentralized environment. As of Jul 20, 2024, there are over 1 million Bitcoin miners on the network. The highly decentralized nature of Bitcoin also contributes to its exemplary security profile.

As such, Bitlayer benefits from the combination of its ability to process complex smart contracts and the security features of its underlying Layer 1 platform — the Bitcoin chain.

Bitlayer Ecosystem

DApp Center

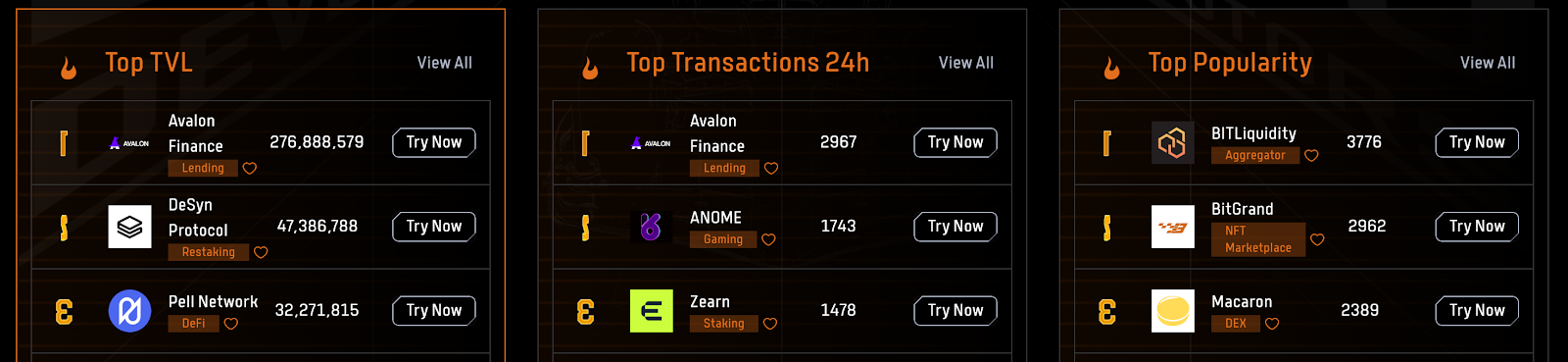

You can explore the ecosystem of Bitlayer DApps using its DApp Center portal, which allows you to browse available apps by categories such as DeFi, Launchpad, Gaming/NFT, Infrastructure and more. There are more than 100 apps already supported by the platform, with Bitlayer's Leaderboard ranking them according to their total value locked (TVL), transactions and popularity level.

Bitlayer runs a Leaderboard competition that rewards ecosystem projects with Bitlayer Gems, virtual points that will be converted to the platform's planned native token, BTR, upon its future token generation event (TGE). Projects are rewarded with Gems based on their level of achievement in four areas — the number of effective transactions, effective user addresses on the network, TVL and popularity votes on the Leaderboard.

Bridge & Earn

Bitlayer has partnered with Meson Bridge to facilitate the easy transfer of three popular assets — USDT, USDC and ETH — from Ethereum to the Bitlayer Mainnet. Meson’s bridging solution specializes in stablecoin transfers. Using the Bridge & Earn section on Bitlayer's homepage, you can access the bridge and quickly transfer any of the three supported assets to Bitlayer.

Bitlayer vs. Ethereum

While 100% EVM-compatible, Bitlayer has several significant differences that distinguish it from Ethereum. Some of these differences might convince crypto users, developers and operators to choose the platform over the world's largest smart contract chain. Below are the key differences between the two blockchain environments:

Bitlayer's gas fees are lower than Ethereum's. The Ethereum network often sees its gas fees spike into double digits during network congestion. In contrast, Bitlayer's gas fees can stay consistently low, thanks to its efficiency mechanisms like optimistic execution.

Bitlayer boasts higher security. Thanks to utilizing Bitcoin as its Layer 1, Bitlayer arguably enjoys a higher security profile than Ethereum.

For developers and DApp operators, Bitlayer opens up a route to access the vast holdings in BTC funds, which are higher than the total crypto funds held in ETH and all Ethereum-based tokens combined. Although ETH is more actively used than BTC in the world of DApps, the total amount of crypto funds held in BTC is head and shoulders above those locked in ETH — or in any other crypto asset, for that matter. As of August 2024, BTC is still a highly dominant cryptocurrency, representing well over 50% of all crypto funds in existence. Bitlayer provides a platform with the potential to access this mammoth amount, a lot of which still remains uncommitted to the DApp industry.

Bitlayer's current DApp ecosystem is much more limited than Ethereum's. The total number of DApps on Bitlayer is, at best, a bit more than 100. In contrast, Ethereum is home to more than 4,000 blockchain applications.

Closing Thoughts

The first projects aiming to bring smart contract functionality to Bitcoin were initiated back in 2018. However, the Bitcoin community is still awaiting the groundbreaking solution that would put the world's largest blockchain on equal footing with Ethereum in the DApp competition. With its EVM compatibility, Turing-completeness, three-second block time and gas fees vastly lower than Ethereum's, Bitlayer might eventually turn out to be that groundbreaking innovation the community is eager to see.

Having launched its Mainnet in April 2024, the Bitlayer project is still at the beginning of its journey. The platform's fundamentals look stellar. Only time will tell if Bitlayer is the catalyst to ignite the exodus of DApps from Ethereum to Bitcoin.

#LearnWithBybit