Bitcoin treasury strategy: Top Bitcoin corporate holders

In recent years, Bitcoin (BTC) has evolved from a speculative asset into a strategic reserve for major corporations. From software giants to mining firms, a growing number of companies are now adding Bitcoin to their balance sheets and using it not just as an investment, but as a core part of their financial strategy. This approach, known as a Bitcoin treasury strategy, is rapidly gaining traction worldwide.

In this article, we’ll learn what a Bitcoin treasury strategy involves, see why companies are adopting it and share which firms are leading the charge. We’ll also explore how these strategies are implemented, look at the risks involved — and speculate on what the future may hold for this emerging trend in corporate finance.

Key Takeaways:

Over $85 billion in Bitcoin is now held by public companies, signaling institutional confidence in BTC as a treasury reserve.

Firms adopt Bitcoin to hedge inflation, improve liquidity, diversify reserves and attract investor interest.

The strategy carries risks, such as regulatory shifts and market volatility, that can have an impact on valuations and corporate stability.

What is a Bitcoin treasury strategy?

A Bitcoin treasury strategy is used by a company to allocate part of its cash reserves into Bitcoin (BTC), treating it as a long-term financial asset. Instead of holding excess cash in low-yield bonds or fiat currencies, the firm instead holds it in BTC.

This approach gained traction in 2020 with Strategy (formerly MicroStrategy), which now holds 592,100 BTC, worth over $62 billion as of June 2025. Major business names like Tesla, GameStop and Semler Scientific have followed suit. For these companies, Bitcoin isn’t just a short-term gamble — it's a deliberate move to protect capital, gain exposure to digital assets and improve treasury performance in an evolving financial landscape.

What are Bitcoin treasury companies?

Bitcoin treasury companies are public or private businesses that hold Bitcoin (BTC) as part of their financial reserves. Rather than storing all their excess cash in traditional assets like dollars or short-term bonds, these companies allocate a portion of their balance sheet to Bitcoin.

The main reason? To preserve value, hedge against inflation and diversify their balance sheets. While each company has its own motivations, most fall into the four common categories below.

Why companies are holding Bitcoin:

Operational flexibility: Bitcoin can be moved or traded 24/7, making it easier to manage funds across borders without relying on traditional banks.

Inflation protection: With a fixed supply of 21 million coins, Bitcoin helps hedge against currency debasement.

Growth potential: BTC has historically outperformed many traditional assets, offering upside beyond that of low-yield investments.

Investor appeal: Holding Bitcoin can attract capital from investors seeking indirect crypto exposure. Some companies even raise funds by issuing BTC-linked shares or convertible debt.

In short, these companies use Bitcoin not just as an investment, but as a treasury tool for stability, access and financial growth.

Global boom in Bitcoin treasury companies

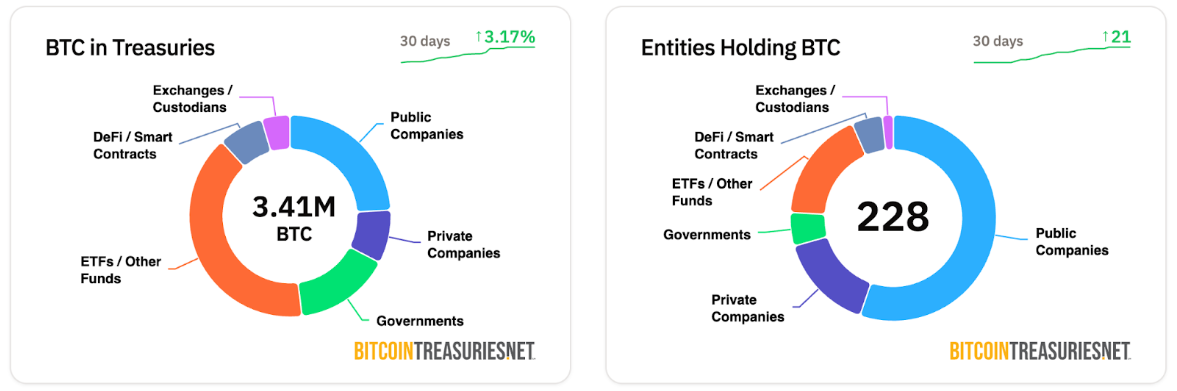

More companies than ever are adding Bitcoin to their balance sheets, and the numbers show just how quickly this trend is growing:

As of June 2025, 131 public companies hold a combined 832,162 BTC, worth over $85.3 billion.

Private companies hold an additional 292,364 BTC, bringing total corporate holdings to over 1.12 million BTC.

Combined, these firms now own an estimated 5.29% of Bitcoin’s total supply.

In just the past 30 days, corporate holdings have increased by 3.88%, reflecting rising interest from both new entrants and existing holders.

How companies implement Bitcoin treasury strategies

Companies use different approaches to add Bitcoin to their balance sheets, depending upon their financial structure and long-term goals. Following are the three main steps:

1. How they buy Bitcoin

Some companies make lump-sum purchases, buying large amounts of BTC all at once, as Strategy did in 2020. Others prefer dollar-cost averaging (DCA), spreading purchases over time to reduce the impact of price swings.

2. Where they store it

Security is critical. Most companies rely on regulated custodians, such as Coinbase Custody or BitGo, to store their Bitcoin. These services offer cold storage, insurance and multi-signature (multisig) protection, all of which are key to minimizing risk.

3. How they fund it

To finance their purchases, companies may issue convertible notes (debt that turns into equity), ATM offerings (gradual stock sales) or preferred shares. Some individuals use their cash reserves directly if they have a strong cash flow and want to avoid debt or equity dilution. These methods provide companies with flexibility in managing their Bitcoin exposure, allowing them to balance risk, liquidity and control.

Top Bitcoin treasury companies

As of 2025, corporate Bitcoin treasuries have expanded across sectors and borders. Some firms are focused solely on acquiring Bitcoin, while others operate in industries such as mining, technology and finance, using BTC as a core balance sheet asset.

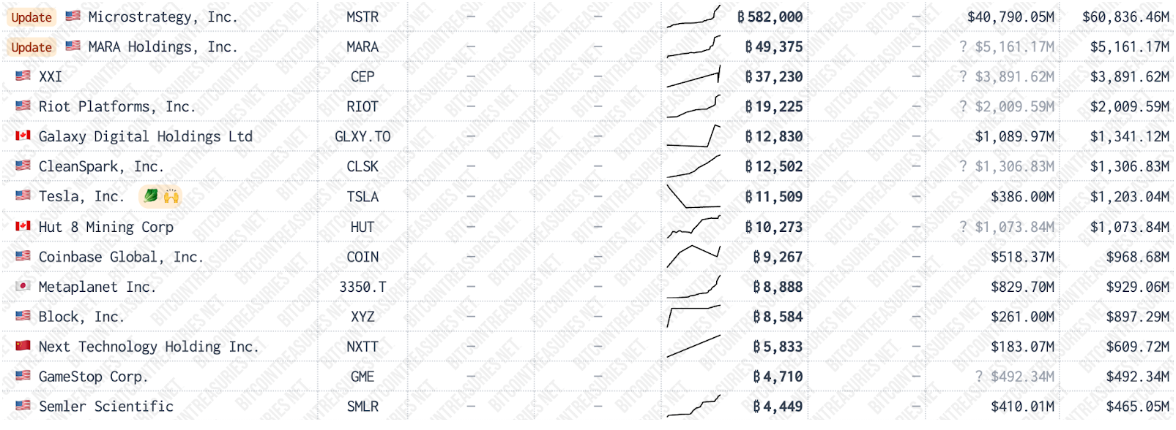

Below are five of the largest publicly known holders of Bitcoin:

1. Strategy (MSTR)

Formerly known as MicroStrategy, Strategy today holds 592,100 BTC, valued at approximately $62.38 billion. As the first major company to adopt Bitcoin as its primary reserve asset, Strategy pioneered the Bitcoin treasury model using convertible notes, equity offerings and ATM share sales to fund continual BTC accumulation.

2. MARA Holdings (MARA)

MARA, a leading US Bitcoin mining firm, holds 49,543 BTC, worth approximately $5.14 billion. The company uses its mining revenue and strategic treasury planning to build one of the largest BTC reserves in the industry.

3. Twenty One Capital (XXI)

Twenty One Capital holds 37,230 BTC (approximately $3.87 billion) and is preparing to go public via a $3.6 billion special purpose acquisition company (SPAC) deal with Cantor Equity Partners. Its focus is on scaling BTC-based financial services.

4. Riot Platforms (RIOT)

Riot holds 19,225 BTC, valued at around $2 billion. Known for its extensive mining infrastructure in North America, Riot integrates BTC holdings with its operational strategy.

5. Galaxy Digital (GLXY)

Galaxy Digital, founded by Michael Novogratz and listed on the Toronto Stock Exchange (TSX), holds 12,830 BTC (worth approximately $1.34 billion). The firm provides financial services across crypto markets, including trading, asset management and advisory services.

Risks of a Bitcoin treasury strategy

While corporate Bitcoin adoption continues to grow, it brings notable risks. A sharp drop in BTC’s price could trigger a cascade of liquidations, especially for firms that use debt or margin to acquire holdings. Regulatory uncertainty also adds pressure, as new rules may restrict the way companies manage or disclose digital assets.

Many Bitcoin treasury stocks trade at premiums above their actual Bitcoin holdings, as institutional investors use them as a proxy, due to limited access to ETFs. But as Spot Bitcoin ETFs become more widely available, demand for these proxy stocks could fade. If their core businesses aren’t strong enough to support high valuations, these companies risk sharp corrections.

For firms using BTC as a treasury tool, managing risk exposure is now as important as buying the asset itself.

Trade crypto stocks on Bybit TradFi now

Since Strategy introduced Bitcoin to its corporate balance sheet in 2020, more companies have followed, viewing BTC not as speculation but as part of a structured treasury approach. As adoption grows, businesses are expected to focus more on risk management — especially around cash flow and debt planning — in order to ensure their strategies remain sustainable during market shifts.

Governments are also paying closer attention. The United States has proposed creating a strategic digital asset reserve, reflecting the growing recognition of Bitcoin’s potential role in national finance. Meanwhile, Bitcoin ETFs are giving traditional institutions easier access to the asset, expanding its acquisition beyond early adopters.

Whether you're overseeing a corporate treasury or starting to explore crypto for the first time, Bitcoin is becoming a more visible part of global finance.

Want to trade crypto-related stocks? Trade MSTR, MARA, COIN and CRCL stock contracts for difference (CFDs) on Bybit TradFi now. For a limited time only, get 50% off trading fees for all stock trades. Learn more here.

#LearnWithBybit