A Realistic Look: What Happens if I Invest $100 in Bitcoin Today?

Investment in Bitcoin (BTC) has progressed from a pastime of hardcore tech nerds to an activity indulged in by just about any investor segment, from the most influential investment banks to small retail investors. The BTC cryptocurrency is now considered a valuable part of any portfolio to capitalize on historically stellar return rates, hedge against risks or diversify away from overreliance on the stock market.

Since Bitcoin has long solidified its position as a popular investment asset, many people are pondering what would happen if they invested an amount as modest as $100 in it today. The good news is that such an investment has great potential for substantial return rates, at least judging by the historical performance of the world's leading cryptocurrency and predictions made by the vast majority of analysts. However, for optimal decision-making and choice, it's imperative that investors develop a comprehensive understanding of Bitcoin, what it is, what it does, its primary value drivers and its history both as a financial asset and as a technological innovation. In this article, we cover it all — and discuss what can happen in the future to your $100 invested in Bitcoin today.

Key Takeaways:

Bitcoin (BTC) is the cryptocurrency of the world's first and largest blockchain platform, the Bitcoin network.

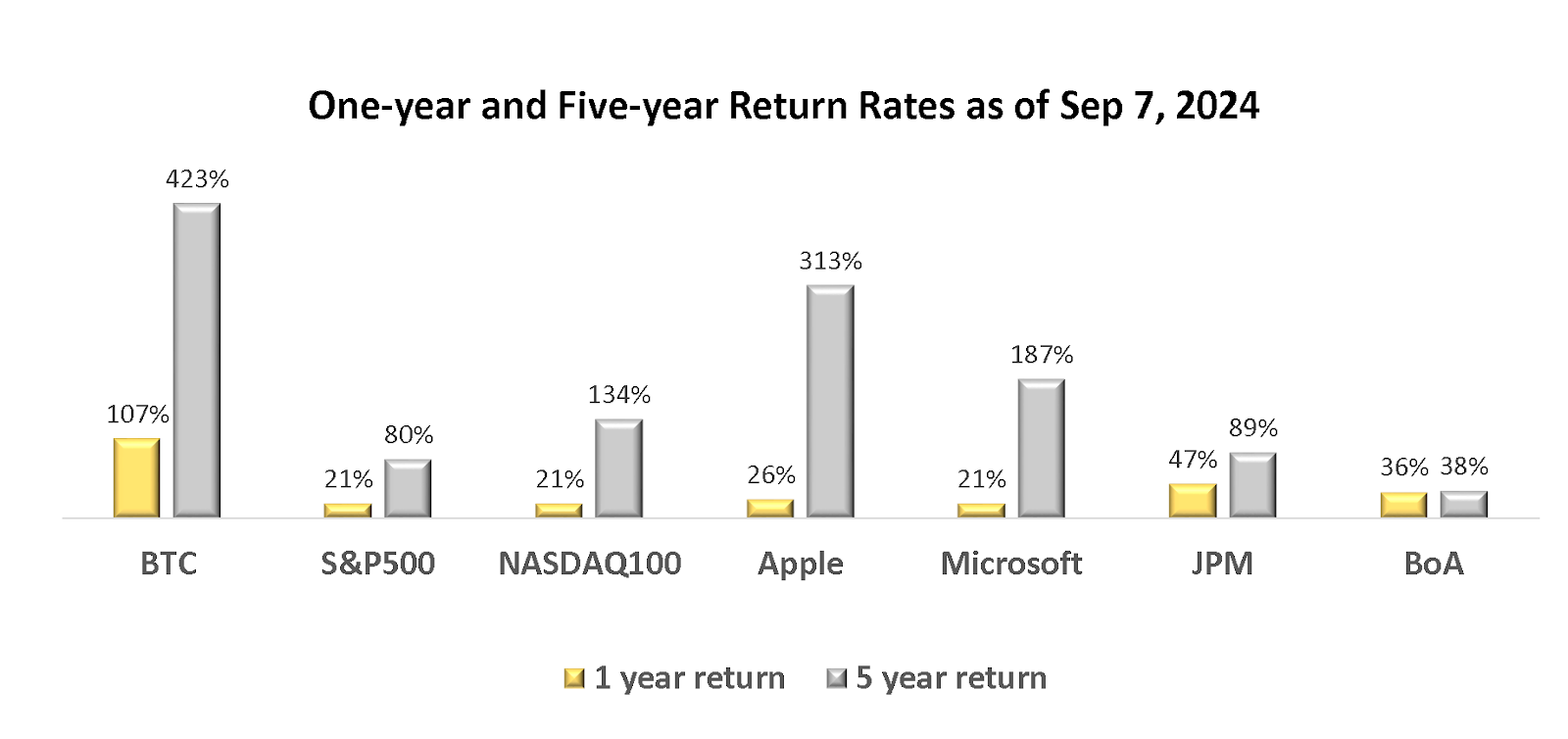

As a financial asset, Bitcoin has vastly outperformed the stock market, with one-year and five-year growth rates at 107% and 423%, respectively.

Bitcoin is widely expected to continue to produce high returns. Investing just $100 in BTC today is forecast to be worth around $3,400 in ten years' time.

Understanding Bitcoin

What Is Bitcoin and How Does It Work?

Bitcoin is a decentralized network designed for the secure exchange and storage of a digital asset — the BTC cryptocurrency. It's the world's first distributed network based on blockchain technology. Launched in January 2009 by its still anonymous founder, Satoshi Nakamoto, the Bitcoin network was envisioned to allow individuals to conduct secure and anonymous financial transactions, based on a digital asset independent from the influence of central banks and traditional finance institutions.

The Bitcoin blockchain's digital asset, used for value storage and transactions, is the BTC cryptocurrency, also known as Bitcoin. Technically speaking, Bitcoin denotes the name of the distributed network only, while the BTC crypto asset is referred to as Bitcoin.

Transactions on the Bitcoin blockchain are verified and confirmed using a consensus mechanism that involves the work of so-called mining nodes, or miners, network actors who are collectively responsible for enabling the platform's operations. This highly decentralized control system is designed to ensure Bitcoin's independence from either a single centralized entity or small, powerful group.

Miners validate transaction blocks on the Bitcoin network using a competitive computational procedure called proof of work (PoW). Every ten minutes, on average, one miner wins the computational race and gets the privilege of adding a new block of transactions to the network's immutable and permanent ledger of records. As a reward for performing the work, the miner receives a certain amount in the BTC cryptocurrency. As of 2024, the standard Bitcoin mining reward is 3.125 BTC.

Besides being used within the Bitcoin blockchain as a means of secure value exchange and storage, BTC is extensively used on cryptocurrency exchanges as a popular trading asset. In more recent times, traditional finance (TradFi) investment firms have also added BTC to their portfolios, both as a direct holding on the blockchain and through products like Bitcoin ETFs.

What Makes Bitcoin Valuable?

Several factors have contributed to Bitcoin's value as a financial asset and, as we'll cover later, its solid long-term market performance. Some of these key factors are as follows:

Bitcoin has a supply cap, ensuring that there will never be more than 21 million BTC bitcoins in existence. As of early September 2024, there are approximately 19.8 million BTC in circulation, with the remaining approximately 1.2 million to be generated through the mining procedure on a schedule up to (and possibly beyond) the year 2140. Many investors highly value this supply limitation as a critical long-term price support factor.

The rate of new BTC emission via the PoW procedure is subject to a mining reward halving rule. Mining rewards are halved every four years, gradually decelerating future supply inflation rates. The next halving event, which will reduce the mining reward from 3.125 to 1.5625, is expected to occur around late March 2028.

Bitcoin is a highly secure asset that allows investors to conduct confidential transactions. Blockchain’s decentralized and independent nature ensures that powerful actors, such as governments and central banks, cannot control and unduly affect it.

Over the past few years, BTC has emerged as a viable financial asset to help diversify investment away from overreliance on TradFi asset classes. Since BTC inherently functions differently from the way TradFi assets and products operate, it often features low or negative correlations with them, a characteristic valued by investors focusing on portfolio diversification.

Investing in Bitcoin Today

Is Bitcoin a Good Investment Today?

Bitcoin might be a great way to invest in order to both diversify your portfolio and, importantly, capitalize on the cryptocurrency's stellar return rates. While Bitcoin is a volatile asset and has gone through its fair share of crashes and downturns, from a multi-year perspective, it’s done incredibly well compared to the stock market.

As of the time of this writing (Sep 7, 2024), BTC has outperformed many major stocks and the stock market in general, both over shorter-term (one year) and long-term (five years) investment periods. Below is a chart demonstrating BTC's return rates over these periods, along with the same data for two leading stock market indices, the S&P 500 and Nasdaq-100 — as well as the stocks of the two largest technology companies by market capitalization, Apple and Microsoft, and the two largest banking organizations on the stock market, JPMorgan Chase & Co and Bank of America.

We've chosen the top tech stocks, since in recent years, Bitcoin has been most correlated with the stock market's technology sector. Many Bitcoin investors also consider leading tech companies' stocks in their decision-making. In contrast, the top banking stocks were selected for analysis as this sector is known to share relatively low correlations with Bitcoin and is often used by investors who prefer assets with greater stability than cryptocurrencies or technology stocks.

As evident from the chart above, Bitcoin has soundly beaten both the arguably more volatile tech sector and the stable banking sector of the stock market over both analysis periods. It has also absolutely trounced the overall stock market, as measured by S&P 500, and its technology-focused part, as measured by the Nasdaq-100.

Thus, historical data is unequivocal: BTC is an asset that's well worth investing in for reaping healthy returns, at least judging by its past performance.

For many investors who may be accustomed to regulated assets, such as stocks and bonds, cryptocurrency investment used to be taboo, due to uncertainty about regulatory protection. However, this is changing fast with the approval of 11 Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) in January 2024. Following the approval, many retail and institutional investors, including the leading investment funds, have added Bitcoin ETFs to their portfolios. This development has often been cited as one growth factor for Bitcoin's future price and prospects.

Potential Returns and Risks of Investing in Bitcoin

With its 107% yearly and 423% five-year growth rates, Bitcoin has earned its reputation as an asset capable of delivering excellent returns, typically far higher than those available in the stock market. Naturally, past performance may not always be a decisive predictor of future returns. However, the world’s largest cryptocurrency is widely expected to keep growing in the long term, with many analysts predicting excellent return rates in the future as well.

For instance, while BTC's current price (as of Sep 7, 2024) stands at $54,309, the aptly named PricePrediction portal sees the crypto climbing to $90,486 (67% growth) in 2025 and $552,658 (918%) in 2030. Another popular crypto price prediction resource, DigitalCoinPrice, forecasts Bitcoin reaching $128,188 (136%) in 2025 and $401,135 (639%) in 2030.

Along with the potential for these incredible returns, investment in Bitcoin does, however, have certain risks associated with it. This is to be expected for any high-growth asset. The crypto market and Bitcoin itself are known for their volatility, and BTC’s price can fluctuate significantly over shorter periods. In the past, Bitcoin went through multi-month periods of declines or stagnation, some of which lasted for over a year, often referred to as crypto winters.

Besides the volatility risk, there are also regulatory issues, with many countries still in the process of regulating Bitcoin's use on financial markets.

Can You Make Money From Investing $100 in Bitcoin?

Based on past return rates and future price forecasts, investing $100 today (September 2024) in Bitcoin is likely — though not absolutely guaranteed, of course — to result in significant growth of the principal amount. Historical returns and many price predictions indicate approximately triple-digit growth percentages over the next several years, resulting in a few hundred dollars in profit from a $100 investment.

If you invest $100 in Bitcoin at today's price of $54,309, you’ll receive 0.00184 BTC. Let's see how much this amount would fetch in 2025 and 2030. While there’s a wide variety of BTC price forecasts by analysts, investment funds, market researchers, pundits, social media influencers in finance, prediction portals and more, most of them — or at least the majority of those who don't chase sensationalist or contrarian headlines — agree on very healthy expected returns for BTC. We'll use the forecast growth rates from the two popular price prediction portals mentioned above for our estimates — PricePrediction and DigitalCoinPrice.

Per PricePrediction's estimates, your 0.00184 BTC bought today will deliver you approximately $167 — i.e., $67 in profit — in 2025. In 2030, that amount of BTC will be worth about $1,017 per the portal's expectations.

If using DigitalCoinPrice’s forecast, your 0.00184 BTC bought for $100 today will be worth around $236 in 2025 and $739 in 2030.

Getting Started With Bitcoin Investment

How Can a Beginner Invest in Bitcoin?

There are different ways beginners can invest in Bitcoin. The most conservative way is simply to buy Bitcoin and hold it for a number of years, typically at least three to five, in order to take advantage of the asset's historically proven solid multi-year gains. This is known as the HODL (or “hold on for dear life”) strategy.

Another conservative strategy is dollar cost averaging (DCA). Using this method, you make regular investments at set intervals — e.g., weekly, fortnightly or monthly — for the same dollar amount each time. Both HODL and DCA require that the investor doesn't alter their strategy, regardless of Bitcoin's price movements.

More experienced investors may also choose to actively trade Bitcoin on a cryptocurrency exchange in order to take advantage of BTC price fluctuations, with both great return opportunities and risks lying within.

While you can buy your initial BTC on a decentralized exchange (DEX), the optimal and most user-friendly way for beginners to purchase it is via an established centralized exchange (CEX). For Bitcoin newbies, the Bybit CEX offers some of the easiest and most intuitive ways to buy and trade Bitcoin.

For those who prefer to stay within the realm of tightly regulated markets, there are also Bitcoin ETFs available for investment.

How to Store Bitcoin

If you actively trade Bitcoin on a CEX, you’ll typically store your funds directly within the cryptocurrency exchange’s account. Those who need a long-term storage solution away from centralized platforms can use blockchain wallets, which come in two main varieties — hot and cold wallets.

Both of these store your funds directly on the underlying blockchain, i.e., the Bitcoin network. However, there are differences in the storage mode. A hot crypto wallet is software that stores your private keys in digital format online. Being always online, hot wallets allow you to conveniently transact whenever you need. Hot wallets come in the form of mobile apps, desktop applications, web-based apps and browser extensions. Some popular hot wallets include MetaMask, Trust Wallet and Exodus. Bybit also offers a user-friendly web3 wallet, Bybit Wallet, which is fully integrated with the exchange itself.

Unlike hot wallets, cold crypto wallets store your private keys offline on a hardware device or written somewhere safe. Hardware wallets are the most commonly used type of cold wallet. Typical devices for cold wallet storage are specialized cold wallet dongles, USB dongles, PCs and even smartphones that aren’t connected to the internet. Ledger and Trezor are the two most popular hardware wallets among crypto users.

A cold wallet could be described as an environment in which you simply sign crypto transactions with your private key while staying offline. This helps minimize the probability of your private key data being hacked.

Frequently Asked Questions

How much was $100 in Bitcoin 5 years ago?

Bitcoin's opening price five years ago (Sep 7, 2019) was $10,353, as reported by Yahoo Finance. Back then, $100 could buy 0.0097 BTC.

Today, at a current price of $54,309, 0.0097 BTC would be worth around $525, for a $425 profit.

How much will $100 in Bitcoin be worth in 10 years?

Estimates for Bitcoin — or any other asset, for that matter — for periods as long as 10 years in the future are always going to be less certain. Over the course of a decade, a large number of factors in areas as diverse as the economy, politics, technology, finance and social issues, as well as specific tech fields like artificial intelligence (AI), will impact financial markets and Bitcoin.

Most popular price prediction portals haven't yet made explicit forecasts for BTC for 2034, ten years from today. PricePrediction forecasts BTC will reach nearly $1.7 million in 2033 and around $2.65 million by 2040. Extrapolating from this data, we could assume that Bitcoin's price in 2034 could be close to $1.85 million.

Based on this estimate, $100 in Bitcoin today (0.00184 BTC) will be worth $3,406 in ten years' time. Not a bad amount at all for just a $100 investment today!

How much should I invest in Bitcoin to make a profit?

The actual amount to invest will always depend upon your specific circumstances, financial situation, risk tolerance and trading experience. To test the waters, the most conservative investors may start with modest amounts — for example, $100. Naturally, those who believe in Bitcoin's bright future, have solid trading experience and don't mind a certain level of risk associated with crypto may want to invest in larger amounts.

How long should I hold my Bitcoin to maximize potential returns?

Historically, Bitcoin has tended to produce significant returns over multiple years. The longer you hold your investment, the higher returns you could realize. Over shorter periods of time, Bitcoin's volatility or prolonged bear markets might negatively affect returns. However, over multi-year periods, BTC has bounced back to produce growth rates that have left many stock market investors seething with envy.

What if I’d invested $1,000 in Bitcoin 10 years ago?

Ten years ago, in early September 2014, Bitcoin was valued at $391. At that time, an investment of $1,000 would have fetched around 2.56 BTC. This amount of Bitcoin is worth nearly $139,000 today — a sizeable fortune started 10 years ago for the price of a laptop.

What other cryptocurrencies could I choose to invest $100 in?

Depending upon your risk tolerance, trading style and familiarity with the crypto market, you might invest $100 in various crypto assets. Those who prefer stability and relatively lower risk might consider other high-cap cryptocurrencies, such as Ethereum (ETH), Solana (SOL), Cardano (ADA) or Avalanche (AVAX).

On the other hand, if you don't mind high-risk investments, then lower-cap coins (with market caps typically below $2 billion or even $1 billion) can potentially represent excellent value. While the risks associated with investing in these coins might be higher than their high-cap alternatives, there’s always the potential for some of these coins to produce stratospheric return rates and significant profits in a very short period.

The key to investing in such low-cap, high-growth assets is to thoroughly research the crypto projects associated with the coins — such as using the resources provided by Bybit Learn.

Closing Thoughts

Over the past 15 years, crypto investments in the Bitcoin market have produced countless success stories and, of course, failures as well. In 2024, it's estimated that there are over 40,000 Bitcoin millionaires, many of whom made their fortunes by investing modest amounts years ago in an asset that had been viewed skeptically and predicted to crash out of existence — but is still here and kicking. In 2024, Bitcoin remains a high-growth asset with a history of success on the market over many years.

Naturally, the mammoth growth rates of yesteryear are no longer part of the cryptocurrency's characteristics. At the same time, Bitcoin continues to produce returns that vastly outperform most other asset classes' results. If you have $100 to invest today, it's hard to justify choosing a better asset than Bitcoin.

#LearnWithBybit