What Is USDT? A Beginner’s Guide to Tether (2025)

Picture a digital currency that remains stable despite the wild ride of the cryptocurrency market. This intriguing concept has the potential to revolutionize the way we transact and invest in the world of digital currencies. Enter Tether (USDT), a stablecoin that has managed to maintain a steady valuation amidst the turbulence of the crypto market. But what is USDT exactly? It’s a digital token pegged to the value of a fiat currency, providing stability and ease of use in the volatile world of cryptocurrencies.

Key Takeaways:

Tether (USDT) is a widely used cryptocurrency stablecoin designed to maintain a 1:1 ratio with the U.S. dollar, providing secure digital asset trading and liquidity.

USDT plays a vital role in crypto markets by reducing price volatility and allowing users to transact securely while mitigating risk.

As a leading stablecoin, USDT remains an essential part of the digital token ecosystem, continuing to grow in adoption alongside alternatives like USDC and DAI.

Understanding USDT: Tether Explained

Tether (USDT) is a cryptocurrency stablecoin designed to maintain a 1:1 ratio with the U.S. dollar, with each token being backed by Tether’s reserves. As one of the most widely adopted stablecoins, USDT has gained significant market capitalization since its inception, making it a popular choice for those looking to buy Tether.

Besides USDT, Tether is also available in three other currencies: euro (EUR), Mexican peso (MXN) and offshore Chinese yuan (CNH). These Tether tokens are represented as EURT, MXNT and CNHT, respectively.

But why is a stable digital currency so important? In the dynamic world of cryptocurrencies, market volatility can be both thrilling and anxiety-inducing. A stablecoin like Tether offers a less volatile option for traders and businesses, providing a secure digital asset that is less susceptible to the fluctuations of other digital currencies.

The Birth of Tether

Tether was established by Brock Pierce, Reeve Collins and Craig Sellars in 2014, initially launching as RealCoin before rebranding to Tether later that year. The founders intended to create a stablecoin that could provide consistent prices and user-friendly transactions in the cryptocurrency market. Since then, Tether has become an integral part of the digital token ecosystem, providing:

Stability

Liquidity

Consistent prices

User-friendly transactions

to various platforms.

Stability and Pegging Mechanism

The foundation of USDT’s stability lies in its pegging mechanism, which sustains a 1:1 ratio with the U.S. dollar, supported by Tether’s reserves. The peg of this currency is kept stable by keeping the same value of reserves in USD as in the total amount of USDT circulating. These reserves help maintain the peg of this currency against the USD. This stability is essential for traders looking to hedge against market volatility, as it offers a dependable store of value.

But how does Tether ensure this stability? By integrating with various cryptocurrency networks, such as:

Tether can undertake periodic examinations to guarantee security and adherence, addressing any tether claims that may arise.

USDT's Role in the Crypto Market

Tether carries a significant role in the crypto market, offering traders a steady asset to offset market volatility and supplying liquidity for diverse platforms. Its benefits include:

Providing a reliable source of liquidity

Impacting market stability

Reducing price volatility

Allowing cryptocurrency users to navigate the digital landscape with confidence

As a result, USDT is a valuable tool for cryptocurrency users.

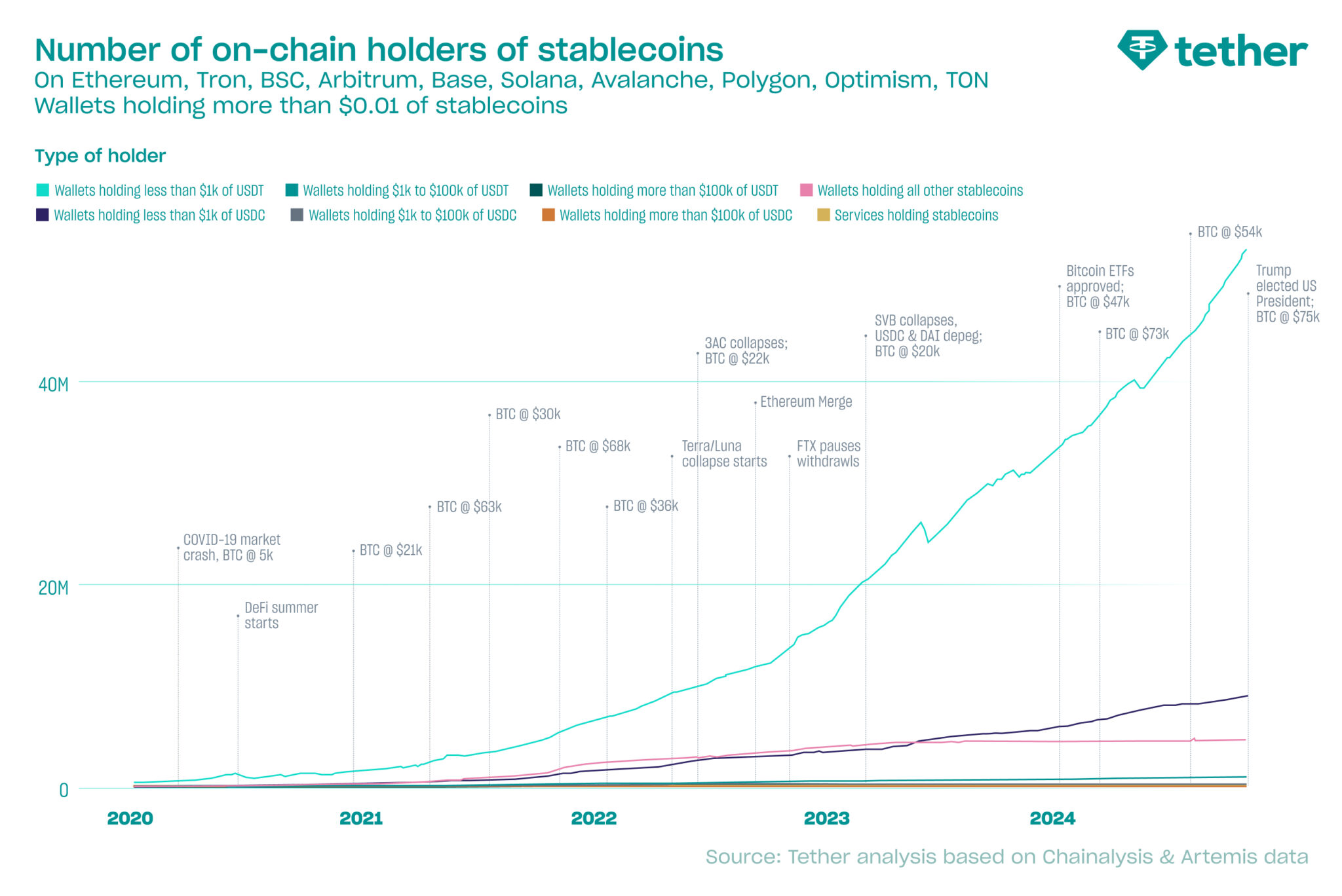

The primary benefit of USDT to traders lies in its stability. With a value pegged to the U.S. dollar, USDT allows traders to circumvent the volatility of other cryptocurrencies while maintaining a stable store of value. This makes it a popular choice for various applications and platforms in the digital token ecosystem. The use of USDT is continuously rising at an accelerated pace, with over 330 million on-chain wallets and accounts recorded to have received USDT as of December2024.

Trading Benefits

During periods of market turbulence, Tether (USDT) provides a safe haven for investors seeking to protect their investments and minimize losses. By maintaining a stable value, traders can take advantage of the benefits of digital currencies without the inherent risks associated with price volatility.

For instance, Chinese importers of inexpensive goods in Russia use USDT on a daily basis to transfer millions home, exemplifying the real-world applications of this stablecoin.

Liquidity Provision

Due to its broad acceptance and substantial reserves, USDT serves as a dependable liquidity source for numerous platforms and exchanges. By providing exceptional liquidity on tier one exchanges, Tether tokens offer traders the ability to take advantage of arbitrage opportunities, asset balancing, and cash equivalents.

The liquidity provided by USDT has a considerable influence on the stability of the crypto market. By supplying a stable and dependable value, USDT:

Heightens liquidity levels

Reduces market volatility

Directs the trajectories of the crypto market

Diminishes the effect of liquidity stresses and price distortions.

Tether's Blockchain Integration

Tether initially functioned on the Omni Layer Protocol, a platform constructed on the Bitcoin blockchain, offering a steady digital asset for the crypto market. Tether then expanded its integration to other blockchains, including Ethereum, TRON and others, increasing its accessibility and utility for various applications and platforms.

With the rising popularity of USDT usage on other chains, especially Ethereum and TRON, Tether discontinued its support for Omni in August 2024 due to its lack of popularity among users. However, Tether has outlined plans to issue USDT on a new smart contract layer above Bitcoin, and is considering RGB as a leading option. As Bitcoin’s decentralized finance (DeFi) capabilities have notably expanded with the introduction of Ordinals and Runes, a USDT comeback is poised to leverage this growth.

By connecting tether tokens with various cryptocurrency networks, Tether’s Blockchain Integration allows for the secure and compliant transfer and trading of Tether token.

Omni Layer Protocol

The Omni Layer Protocol is a layer built on top of the Bitcoin blockchain that facilitates the generation, transmission, trading, and redemption of digital tokens. This protocol enabled Tether to issue USDT tokens on the Bitcoin blockchain, providing a secure and well-established platform for the digital asset.

By utilizing the Omni Layer Protocol, Tether was able to provide a stable digital currency for the cryptocurrency market, offering users a secure and dependable store of value.

Ethereum, TRON and Other Blockchains

As Tether expanded beyond the Omni Layer Protocol, it integrated with the Ethereum blockchain, issuing ERC20 tokens to enable users to easily transfer and trade Tether on the Ethereum blockchain. This integration increased the accessibility and utility of Tether for various applications and platforms, making it a popular choice for users in the digital token ecosystem.

In addition to Ethereum, Tether now supports a range of other blockchains, with the highest usage on TRON, BNB Chain and Ethereum. On Oct 16, 2024, Tether reported a rapid surge in USDT usage on Layer 2 networks like Optimism, Arbitrum and Polygon over the past year. Its recent release on the TON blockchain has also led to a growth spurt of 3.3 million additional users in just six months.

Tether Ecosystem

Beyond USDT, Tether Limited has also introduced Tether Gold (XAUT), a digital asset backed by physical gold, as well as Alloy by Tether (aUSDT), a stable USD asset backed by Tether Gold, showcasing the company’s dedication to providing diverse options for the crypto market.

Tether Gold (XAUt)

Tether Gold (XAUt) is an ERC-20 stablecoin backed by gold on a 1:1 basis with one fine troy ounce of gold equivalent to a physical bar of gold. This enables holders to benefit from gold’s inflation-hedging qualities without drawbacks such as storage expenses and limited liquidity. XAUt holders can redeem their stablecoins for physical gold at any time, to be delivered at a location chosen by the holder in Switzerland, with redemptions limited to holders holding at least 430 XAUt tokens. XAUt holders can also request Tether Gold help sell their gold in the Swiss gold market, then receive the proceeds from the transaction.

Alloy by Tether (aUSDT)

Alloy by Tether (aUSDT) is a type of tethered asset tied to Tether Gold (XAUt). aUSDT can be minted by using XAUt as collateral, resulting in a synthetic, gold-backed dollar that can be used for spending, investing or saving. The stability of the token is maintained through overcollateralization, whereby users have to deposit more of the collateral than the value of aUSDT they wish to mint. This overcollateralization is managed by liquidators, who may liquidate some of the XAUt collateral if it falls below the level required for maintaining the aUSDT.

Acquiring and Using USDT

The process of acquiring and using USDT is straightforward. Users can purchase USDT on various exchanges using fiat currencies or other cryptocurrencies. Once acquired, USDT can be stored in a secure digital wallet for safekeeping.

USDT can be employed in a range of transactions, including trading, lending, and buying goods and services, whether on or off the blockchain.

How to Buy USDT

USDT can be purchased on various exchanges, such as Bybit, using fiat currencies like euros or U.S. dollars. The transaction fees associated with buying USDT on different cryptocurrency exchanges can vary, ranging from 0.05% to 0.25%. It is advisable to check the specific fees for each exchange before making a purchase.

When acquiring USDT, users can choose from a variety of crypto exchanges that support fiat currency or cryptocurrency transactions, making the process of obtaining and trading USDT convenient and straightforward.

How to Store USDT

Storing USDT in a secure wallet is essential for protecting your investment and ensuring easy access to your funds. There are a variety of wallet options available, including hardware wallets, software wallets, and exchanges.

For added security, users can opt for cold storage, a method of storing cryptocurrencies offline in a secure digital wallet, protecting their USDT from potential cyber attacks and unauthorized access.

Using USDT for Transactions

USDT can be used for various transactions, including trading, lending, and purchasing goods and services, both on and off the blockchain. By offering a stable store of value, USDT enables users to transact with blockchain-based assets while mitigating price risk and enjoying the advantages of transparency, stability, and low fees associated with traditional currencies.

Some examples of goods and services that can be purchased using USDT include:

Booking flights and hotels on Travala.com

Subscribing to Time magazine

Investing in Australia’s first crypto-friendly IPO on STAX.

Is Tether Safe?

Tether is an integral part of the digital token ecosystem, providing stability and liquidity to various platforms and exchanges. However, it has encountered numerous controversies and risks, including transparency concerns related to Tether’s reserves and legal conflicts with regulatory bodies. These challenges have led to doubts about its liquidity and stability, prompting investigations by the Commodity Futures Trading Commission (CFTC) and the New York Attorney General.

Despite these risks and controversies, Tether remains the largest stablecoin by market cap, with widespread adoption within the crypto world and varied uses from trading to investment.

Transparency Issues

Tether’s transparency regarding its reserves has been questioned, leading to doubts about its liquidity and stability. The lack of independent third-party audits and inadequate reporting has caused concerns and elicited criticism from regulators and the crypto community.

To address these concerns, Tether has implemented several strategies, including publishing a quarterly reserves report and maintaining a liquidity cushion of $3.3 billion. However, Tether has faced ongoing criticism for not being fully transparent, as its reserves report has never been submitted to a third-party audit.

Legal Battles and Fines

Tether has faced legal battles and fines due to its business practices, including an $18.5 million fine from the New York Attorney General’s office for mingling client and corporate funds in February 2021. Additionally, Tether was subjected to a $41 million fine in October 2021 by the U.S. Commodity Futures Trading Commission for providing unlawful off-exchange financed retail commodity transactions with U.S. persons who were not eligible contract participants. In response to these fines, Tether has entered into settlements to bolster its banking relationships and legal structure.

Additionally, Tether’s CEO, Paolo Ardoino, has emphasized the company's commitment to preventing criminal misuse of its currency, noting that Tether has actively worked with law enforcement agencies since its 2014 launch to recover $108.8 million in USDT linked to illegal activities.

However, on Oct 26, 2024, Tether’s operations were reportedly once again put under investigation by the United States government concerning its potential use for money laundering and other illicit activities. Tether has issued a statement in response to this report from The Wall Street Journal, criticizing it as unfounded and irresponsible journalism.

Regulatory Engagement

Despite past regulatory challenges, Tether has recently collaborated with U.S. lawmakers to help shape stablecoin policies, as reported in February 2025. This demonstrates its commitment to compliance and maintaining legal and financial integrity amid evolving regulations.

Comparing USDT to Other Stablecoins

USDT is frequently compared to other stablecoins like USDC and DAI, each presenting distinct features and advantages for users. While all three maintain a 1:1 peg with the U.S. dollar, the backing mechanisms and transparency levels vary between them.

Understanding the differences between these stablecoins can help cryptocurrency users make informed decisions about which option best suits their needs and preferences.

USDT vs. USDC

Both USDT and USDC maintain a 1:1 peg with the U.S. dollar, but USDC is backed by fiat currency deposits stored in regulated banks, while USDT’s backing is less transparent. USDC, issued by members of the CENTRE consortium, is valued for its transparency and fully collateralized nature, while USDT is more frequently utilized for trading and payments.

Although both stablecoins are popular choices for various applications and platforms, their unique features and backing mechanisms make them suitable for different use cases.

USDT vs. DAI

USDT and DAI are both stablecoins, but DAI is a decentralized stablecoin backed by collateralized debt positions, offering a more transparent and decentralized alternative to Tether. DAI is generated, backed, and kept stable through the use of Ethereum-based assets deposited into a decentralized autonomous organization (DAO) called MakerDAO.

By understanding the differences between USDT, USDC, and DAI, cryptocurrency users can make more informed decisions about which stablecoin best meets their needs and preferences.

Summary

Tether (USDT) has made a significant impact on the cryptocurrency market by providing a stable digital asset for traders and businesses. Its unique pegging mechanism, integration with various blockchain platforms, and widespread acceptance make it a valuable tool in the digital currency ecosystem. Despite facing controversies and risks, Tether continues to play a crucial role in the market, offering stability and liquidity to various platforms. By understanding the differences between USDT and other stablecoins, users can make informed decisions about which option best suits their needs, ultimately leading to a more secure and efficient digital currency experience.

Frequently Asked Questions

Is USDT the same as USD?

USD and USDT are two distinct currencies; USD is a physical currency issued and backed by the U.S. government, while USDT is a digital currency backed by an equivalent amount of USD held in reserve.

What is USDT used for?

USDT is a digital currency used to purchase goods and services, or it can be traded on digital currency exchanges. It remains pegged to the U.S. dollar, making it a more stable option for those looking to trade or use digital currencies.

How many USDT are in a U.S. dollar?

Currently, 1 U.S. dollar is equivalent to 0.9995 Tether (USDT), with the exchange rate showing an increase of 0.1% over the past 24 hours. USDT’s market cap is $120.34B.

What are some examples of goods and services that can be purchased using USDT?

Goods and services that can be purchased using USDT include booking flights and hotels on Travala.com, subscribing to Time magazine and investing in Australia's first crypto-friendly IPO on STAX.

#LearnWithBybit

_2.png)