What Is Render Network (RENDER): The Future of 3D Rendering

Artificial Intelligence (AI) and decentralized physical infrastructure networks (DePINs) are two high-growth areas within the blockchain industry. The former involves decentralized protocols and apps that leverage AI algorithms and computations to enable a wide variety of use cases, while the latter refers to solutions that enable a decentralized trade in computing resources over blockchain networks.

Render Network (RENDER) is among the leading projects at the junction of these two high-growth niches. The project, which started out on Ethereum (ETH) in 2020 but later moved to Solana (SOL), enables the decentralized trade in GPU computing power to facilitate the processing of graphics rendering and AI jobs. Since the beginning of its public access era in April 2020, Render Network has been among the most popular decentralized apps (DApps) for processing 3D graphics and animation rendering jobs.

In 2023, the project first added to its arsenal the specialization in AI computations, and later on made a pivotal transition from Ethereum to Solana, rebranding its native token from the original Ethereum-based RNDR to the Solana-based RENDER.

Key Takeaways:

Render Network (RENDER) is a decentralized app that supports the flexible trade in GPU computing resources over a blockchain network to enablecomputer rendering and AI computational processing.

Its platform was originally launched on Ethereum, but migrated to Solana in late 2023.

The project's native cryptocurrency, RENDER, is used to facilitate on-platform governance, for payments to access GPU processing power, and to reward payouts to GPU capacity providers and liquidity providers.

What Is Render Network?

Render Network (RENDER) is a blockchain-based app that facilitates the decentralized trade in GPU power to enable a variety of use cases in computer rendering and AI niches. It was originally launched on the Ethereum blockchain in 2020 with the native cryptocurrency ticker RNDR. In late 2023, the project moved to the Solana blockchain and rebranded its new Solana-based native token to RENDER.

Render Network lets one type of user, Node Operators, provide their computers' idle GPU processing capacity to help another user group, Creators, process their computer rendering and AI computational jobs. By providing a peer-to-peer network for GPU capacity trade, Render Network aims to make rendering and AI computations more accessible to wider segments of creators. Computer rendering is the process of transforming initial 2D graphics model specifications into visually rich 3D or 2D finalized graphics or animation outputs.

The rendering process is computationally demanding, and often requires expensive, high-spec computer hardware. Many smaller studios and individual creators can’t afford such powerful computers, or have to overstretch their budgets to own these machines. Moreover, alternatives in the form of centralized GPU cloud rendering platforms aren't particularly flexible or affordable.

Render Network makes it possible for Creators to access the hardware resources needed for rendering jobs on a flexible and affordable per-use basis. It also helps GPU owners make their hardware capacity available over the network and earn crypto rewards in the process.

Render’s Beginnings

The platform launched publicly in April 2020, quickly establishing itself as the leader of the computer rendering niche in the web3 world. In 2023, Render Network added the capacity to process AI computations in addition to its core specialization — graphics rendering.

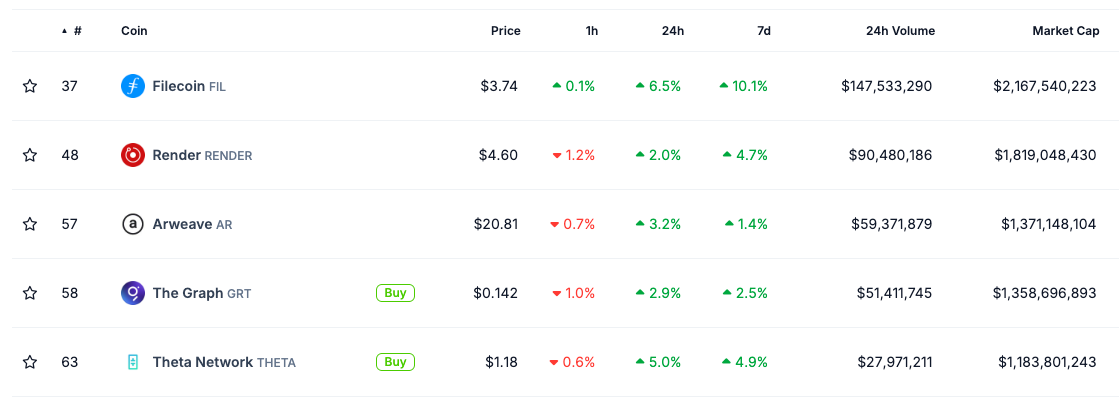

Besides being the absolute, undisputed leader of its highly specialized area — decentralized computer rendering — the Render Network project is also among the leading web3 platforms in at least three high-growth categories: DePIN, AI and the metaverse. A typical DePIN enabling the distributed trade in computing resources between providers and consumers, Render Network is among the top DePIN projects, with the RENDER token ranked second by market cap within the category as of Aug 13, 2024.

Per the same data source (CoinGecko’s portal), RENDER is also the fifth-highest-capped crypto in the AI category and the highest-capped crypto in the metaverse category.

The Render Network project was founded in California in 2017 by OTOY Inc., a market-leading cloud rendering provider. OTOY, founded in 2008, is a major trailblazer within the rendering niche and owns the rights to OctaneRender, the world's first unbiased, spectrally accurate rendering software.

How Does Render Work?

Render Network Architecture

Originally launched on Ethereum, Render Network transitioned to Solana’s blockchain in late 2023 to take advantage of the latter's superior scalability and lower transaction costs. Render Network offers three pricing tiers: Tier 1 is reserved for large-scale, custom requests from enterprise clients, while Tiers 2 and 3 are available to any user. Tier 2 jobs are more expensive, but have a higher priority and offer better performance than Tier 3 tasks.

Of the network’s two main actors, Creators and Node Operators, Creators can be individuals, smaller design studios or even large Hollywood studios that need to access GPU resources to process their rendering jobs. Creators pay for accessing the hardware resources based on a tiered pricing system.

Besides the two main actors, liquidity providers also function within the network by contributing staked RENDER to the liquidity pools on partnered exchanges. Liquidity providers are crucial in allowing RENDER to be available for Render Network's unique Burn and Mint Equilibrium system (covered in a later section).

Node Operators, previously referred to as mining nodes, make their GPU processing capacity available in exchange for rewards in RENDER tokens. Their machines must meet certain hardware capacity requirements, such as a minimum GPU and other specs. While Node Operators have some freedom in terms of job preferences, their actual job allocations are primarily determined by their reputation scores and other factors, as covered below.

Reputation Scoring

A key factor involved in the decentralized trade in GPU resources on Render Network’s platform is reputation scores. Both Creators and Node Operators are assigned reputation scores based on the history of their on-platform activity. Creators with a history of reliable participation and spending have higher reputation scores, which in turn opens up opportunities to access more concurrent GPU resources and providers.

For Node Operators, reputation scores are also of critical importance. Their scores are determined based on the rate of successful job completions and each job’s complexity. More complex jobs provide a larger boost to their reputation scores. Node Operators with higher scores can then access more high-value job processing opportunities on the network.

Resource Allocation

When rendering and AI processing requests are delivered to the network, the platform uses a multi-variable system to allocate the jobs to specific GPU providers. Creator and Node Operator reputation scores are some of the variables used in the allocation process. For instance, the Creator's reputation score largely determines the "priority modifier" added to each job. This modifier signals the job's "appeal factor" to Node Operator nodes.

Besides reputation scores, other job allocation variables are the hardware requirements selected by the Creator, time on the network, pricing tier chosen and OctaneBench score (a popular benchmark for GPU rendering).

In order to standardize and quantify the amount of rendering work required, the Render Network team has developed a measure called OctaneBench. Each unit of OctaneBench denotes a standardized amount of rendering work. More powerful GPUs have higher OctaneBench scores, meaning that they can carry out more rendering work per unit of time. As such, a provider's OctaneBench score essentially signals the processing capacity of their machine.

OctaneBench scores are used to provide a standardized measure for assessing the complexity of rendering jobs. Computer rendering jobs differ substantially based on their complexity, type and duration requirements. Naturally, systems with more powerful GPUs are capable of completing the same amount of work faster than systems with lower-specification GPUs.

Use Cases of Render Network

Render Network opens up opportunities for use cases in various spheres, including gaming, product design and development, projection mapping, AI and many others. In fact, any industry or professional niche that relies on high-performance computer rendering or AI computations can benefit from Render Network's core functionality.

Film, Games and Other Media

Perhaps the most relevant use cases for Render Network include the film and gaming industries, as well as other sectors that rely on visually rich media outputs. In the gaming and GameFi sectors, Render Network enables high-quality animations involving augmented reality (AR) and virtual reality (VR) technologies.

The platform also supports the creation and application of NFTs and NFT-based gaming assets with advanced, sophisticated features, such as next-generation interactivity.

Product Design and Architecture

Using Render Network, artists and studios can rapidly prototype many alternative product designs with 3D features. This can significantly improve the efficiency and quality of the overall product design and development processes in creative industries.

Projection Mapping and Simulation

Rendering high-resolution projections and simulations in open environments like stadiums and concert arenas requires tremendous amounts of processing power. This is where Render Network comes into the picture, with its ability to provide rendering affordably and on-scale.

Artificial Intelligence (AI)

AI computations and AI-generated visual content are additional areas that benefit from Render Network's vast processing capacity. Recognizing the explosive growth in AI, Render Network has specifically added a new specialization in this area to its functional set. Essentially, through the Render Network SDK, developers can leverage the network's decentralized GPUs for various AI compute tasks.

What Is the Render Network Token (RENDER)?

Render Network’s app was originally launched on Ethereum, with the RNDR token as its native cryptocurrency. The RNDR token is based on the ERC-20 standard, Ethereum's default standard for fungible crypto assets. In late 2023, the Render Network community voted to move the platform to Solana. Along with the move, the project issued a new native cryptocurrency, RENDER, based on Solana's SPL format. Holders of RNDR can convert their tokens to RENDER at a fixed ratio of 1:1.

RENDER is an enhanced version of RNDR, featuring an added escrow smart contract functionality. This ensures that the tokens required to pay the Node Operator for a Creator's requested job are securely held in escrow until the work is confirmed.

RENDER has mostly replaced RNDR as the asset used for payments, governance and other key functions on the network. However, the RNDR token, historically popular among crypto investors, still has many holders who haven't converted their investment to RENDER. As of August 2024, centralized crypto exchanges have converted — or are in the process of converting — customers' RNDR funds to RENDER.

Major crypto data portals, including CoinGecko and CoinMarketCap, report the RENDER token's total supply at around 532 million. However, this figure largely reflects the issuance of the original Ethereum-based RNDR token. As of Aug 9, 2024, the current supply of the RENDER token on the Solana blockchain stands at around 227 million. It’s expected to hit the total supply of 532 million once all RNDR tokens have been fully migrated to RENDER.

Uses of the RENDER Token

RENDER facilitates service fee payments on Render Network and payouts to GPU power providers, and is also distributed as rewards to liquidity providers. Creators currently have the option to pay in RENDER tokens or fiat currency to access processing capacity on the network. Node Operators are reimbursed in RENDER for renting out their machines' hardware capacity. Finally, liquidity providers are rewarded with an additional percentage of RENDER for contributing staked RENDER to liquidity pools on partnered exchanges.

Render Network Governance

Governance is another key functionality of the RENDER token. Holders of the token can take part in the voting process concerning any key changes and improvements to the platform. Those who hold RENDER can participate in the so-called Nation voting on the platform. Additionally, holders of the old RNDR tokens can cast their votes through an alternative mechanism called Snapshot voting.

Given the project team's commitment to migrate all functions of RNDR to RENDER, it's likely that the Snapshot votes using RNDR will eventually be phased out completely.

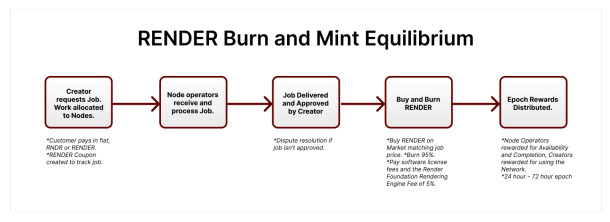

Burn and Mint Equilibrium (BME)

In order to keep the costs of rendering and AI jobs predictable and stable for Creators, Render Network has introduced a Burn and Mint Equilibrium (BME) system for the RENDER token to determine price via a supply-and-demand equilibrium. Under the BME system, Creators pay for their jobs by converting fiat currency to RENDER using a number of distributed liquidity pools. Naturally, this conversion could lead to an uncontrolled increase in RENDER's supply as the jobs are paid for. To avoid this, additional RENDER used to pay for processing jobs are burned.

The RENDER token emission distribution per epoch (spanning one week) is then adjusted based on the network usage. Per epoch, Creators can be refunded a percentage of their RENDER spent that epoch in the form of RENDER, further incentivizing them to request for jobs within the network. Node operators are rewarded in two ways: availability rewards for their activity within the network, or completion rewards for successful job completion. Liquidity providers are rewarded for staking RENDER in liquidity pools on partnered exchanges.

Render Network has also implemented a net emissions cap by recycling some burned RENDER each epoch to ensure that network participants can still receive rewards in the long term, even when the supply cap for RENDER has been reached.

Where to Buy the RENDER Token

The RENDER token is available on Bybit on its Spot market, and on its Derivatives market as a perpetual contract, with USDT. All of the trading involves the new RENDER token. By the end of July 2024, Bybit had completed its conversion of all RNDR assets and contracts to RENDER.

RENDER Token Price Prediction

As of Aug 16, 2024, the RENDER token is trading at $4.53, which is 66.5% lower than its all-time high (ATH) of $13.53, achieved on Mar 17, 2024, and over 12,000% higher than its all-time low (ATL) of $0.03666, recorded on Jun 16, 2020 (as the old RNDR token).

Long-term price forecasts for RENDER are bullish.PricePrediction expects the token to trade at $13.98 in 2025 and $87.29 in 2030, whileDigitalCoinPrice predicts a more moderate rise to $11.70 in 2025 and $33.92 in 2030.

RENDER, both in its new format and as the old RNDR token, is a popular asset in the crypto investor community. Some consider that the token has the potential to reach levels as high as $50 or even $100. Attaining a price of $50 in a few years is quite feasible for the token, and at least one major crypto forecast portal, PricePrediction, sees the token climbing to this level by 2029. Render Network is a project full of promise and potential, and while $50 might seem challenging, it's certainly not out of the question if an investor adopts a long-term hold strategy.

The $100 level, however, is a much more challenging proposition, at least within the next five years. For RENDER to reach such heights within this time frame, the overall crypto market would need to receive a massive structural boost, in addition to Render Network maintaining its leadership roles in several market categories.

Is Render Network a Good Investment?

RENDER has long been considered among the most popular product-oriented cryptocurrencies to own. The project's leadership positions in several key niches — DePIN, AI and the metaverse — have always attracted the attention of investors. Within its specialized but highly lucrative area, computer rendering, the platform retains virtually unchallenged dominance.

All these factors make RENDER a darling of many institutional and retail investors. Short of any unexpected, and rather unlikely, project-specific fiasco, RENDER would fail to deliver only if the entire crypto market — including the most stable and popular crypto assets in it — also failed. Well-supported by a highly functional business model, RENDER is considered by some analysts to be one of the best cryptocurrencies to own, particularly for long-term investment.

That said, it's important to note that crypto projects can be highly volatile, and it’s recommended you do your own research before investing in any cryptocurrency.

Closing Thoughts

Supported by the booming niches of AI, gaming and the metaverse, Render Network is a key crypto project at every level of the industry. By enabling more affordable, flexible and scalable rendering services, the platform is a major catalyst for the explosive growth in visually sophisticated products and services on the market.

With the addition of AI computational capacity in 2023, Render Network has further solidified its competitive position. As of 2024, few, if any, crypto projects on the market hold leading positions in as many high-growth sectors as Render Network.

#LearnWithBybit