What Is Optimism (OP): The Simple Layer 2 ETH Scaling Solution

If you're looking for a promising crypto technology to invest in, Optimism stands out as an excellent choice. Its innovative rollup technology has positioned it as a top-tier Layer 2 blockchain that skillfully addresses Ethereum’s scalability challenges.

This article delves into the intricacies of Optimism and its underlying technology, and sheds light on the prospects it holds for investors of OP tokens.

Key Takeaways:

Optimism is an L2 blockchain designed to scale Ethereum in a simple, secure and flexible way via its optimistic rollup technology.

Optimism has combined its mainnet with other L2 chains to form a Superchain, which aims to merge the current siloed structure of L2s into a single interoperable chain to improve user experience with L2 chains.

OP is the governance token of the Optimism network. It’s distributed through two airdrops, with the community eagerly awaiting a third airdrop.

What Is Optimism?

Optimism is a Layer 2 (L2) scaling solution for Ethereum that’s designed to provide lightning-fast transactions at a fraction of the cost. It aims to drive the vision of Ethereum toward achieving decentralization through a transparent and sustainable blockchain for the public good.

As an L2, Optimism is built on top of Ethereum's architecture. Hence, it’s Ethereum virtual machine–equivalent, and acts as a minimal extension of the main Ethereum layer. In this way, developers and crypto users can benefit from speedy transactions at a low fee while still enjoying the security of Ethereum's architecture.

Optimism now aims to further enhance its scalability with a platform called Superchain, consisting of a network of chains built on the OP Stack, which merges its OP Mainnet with other L2 chains. As a Superchain, Optimism aims to create an interoperable and composable ecosystem to simplify the integration of L2s.

How Optimism Solves Scalability Issues on Ethereum

Ethereum is considered one of the most secure and decentralized blockchains in the crypto space. However, the chain has faced perennial network congestion challenges and high gas fees, significantly impairing its scalability. L2s such as Optimism have a simple, flexible and user-friendly solution to this issue.

Optimism handles transactions off the Ethereum blockchain, while taking advantage of Ethereum's infrastructure. During a transaction, Optimism continues to communicate with Ethereum’s Layer 1, ensuring that it still offers similar security and decentralization guarantees. Layer 1 handles security, decentralization and data availability, while Optimism’s Layer 2 handles scaling.

During the process, no changes are made to Layer 1. In a way, Optimism takes away the burden of financial transactions from Ethereum. The removal of this load from Ethereum’s blockchain removes network congestion.

Here are just a few of the benefits that Optimism crypto offers:

Scalability: Optimism can achieve a 10–100x improvement in scalability, depending on the nature of the transaction.

Reduced Fee: Optimism can greatly reduce the overall cost of the transaction. Its rollup technology (discussed in the next section) combines multiple transactions into a single transaction, which helps reduce the transaction cost.

Security: As Optimism’s Layer 2 builds up on top of Ethereum, transactions are settled on the Ethereum Mainnet, allowing users to benefit from the security and decentralized environment of the Ethereum blockchain.

Enhanced User Experience: New projects using Optimism Layer 2 scaling solutions benefit from lower fee, faster transactions — and a better overall user experience.

How Does Optimism Work?

Optimism uses rollups to process transactions in batches, which helps reduce gas fees and network congestion. Rollups can help users save up to 100 times the gas fee, compared to the Layer 1 protocol.

The rollup technology used by Optimism crypto bundles up hundreds of transactions on Ethereum’s Layer 1 into a single transaction. Since there are multiple transactions in a bundle, the gas fee is distributed among all the users. While the rollup is executed on Optimism’s Layer 2, the transaction data is posted to Ethereum’s Layer 1 for processing.

Optimistic rollups are "optimistic" in the sense that every transaction is assumed to be valid on Optimism’s Layer 2, and no computations are performed. If the system suspects fraud, it runs fraud-proofing to verify the transaction.

On Jun 6, 2023, Optimism made a Bedrock upgrade to its OP Stack, presenting multiple improvements to its mainnet such as lowered transaction costs and greater Ethereum equivalence.

Optimistic Rollups vs. ZK-Rollups

There are mainly two types of rollup solutions on Ethereum: Optimistic rollups and ZK-rollups. While both rollups move the transactions off-chain to process the data, the method used to verify the transactions makes them different.

Optimistic rollups assume that all transactions are valid, so it doesn’t perform heavy calculations on Layer 2. Instead, the rollup moves the batch to Layer 1 without verifying the validity of a transaction, which leads to a significant improvement in scalability.

If anyone suspects a fraudulent transaction, they can challenge the validity of the batch within a week. Optimistic rollups then run a fraud-proof, which verifies information using the data on Layer 1.

On the other end of the spectrum are ZK-Rollups, which are slightly different as they generate a validity proof for every bundle after moving them to Layer 2. The validity proof is then transferred back to Layer 1 serving as a proxy for the corresponding bundle. Since validation occurs on Optimism’s Layer 2, it helps reduce gas prices and validation times at Layer 1.

Each of these technologies has certain benefits and drawbacks. For instance, an Optimistic rollup is preferred for executing smart contracts. In contrast, a ZK-Rollup is an evolving technology that’s mainly relegated to performing simple transactions.

On the downside, the withdrawal period for Optimistic technology is longer than for ZK-rollups because Optimistic rollups have a "challenge period" to deal with. In contrast, ZK-rollups have very fast withdrawal times, which makes them an ideal solution for apps which require simple payments.

How to Use Optimism

Using Optimism is similar to using Ethereum. You'll need to connect to a web3 wallet and add the Optimism network to use it. Then, fund the wallet with ETH to begin transacting.

You can view transactions on the Optimism Explorer, which works similarly to Etherscan. Like Etherscan, Optimism Explorer contains information such as verified smart contract source code and details of transactions. You'll also find specific features of the OP Mainnet, such as a list of L2-L1 transactions (and vice versa).

You can also use the Optimism Bridge, which lets you swap assets between Optimism and L1 chains like Ethereum. Besides the OP Mainnet Standard bridge to transfer your assets, you can also build a custom bridge for ERC-20 tokens not supported by the Standard bridge.

Optimism vs. Other ETH Layer 2 Scaling Solutions

Irrespective of their size, computer networks can only manage a limited amount of traffic. Once a network becomes popular, it's bound to become congested.

Various Layer 2 networks help Ethereum deal with its scalability issue. These Layer 2 networks attach themselves to Ethereum's core, the Layer 1 chain. Optimism is one such scaling solution, but it's not the only one.

Some of these solutions are called sidechains, because they act like roads connecting to the main Ethereum network.

Following is an overview of the three most popular ETH Layer 2 scaling solutions.

Optimism vs. Arbitrum

Arbitrum is an Optimistic rollup technology similar to that of Optimism. It's often said that Arbitrum tweaked the source code of Optimism crypto to develop a distinct Layer 2 scalability solution.

The major difference between Optimism and Arbitrum is how they manage fraud-proofs. Whereas Optimism crypto uses a single-round fraud-proof, Arbitrum utilizes multiple rounds.

Using a single-round proof, Optimism provides instant verification, as it relies on Ethereum’s Layer 1 to complete the transaction. The transaction is almost instantaneous, but the approach suffers from a higher gas cost.

In contrast, Arbitrum offers a fine-combing approach to carrying out transactions mainly on Layer 2. Due to a multi-round fraud-proof, the validation takes time, but this helps reduce the gas fee.

Optimism vs. Polygon

Polygon is a DeFi scaling solution. Unlike Optimism, it's a sidechain, not a Layer 2 solution. Sidechains run parallel to Layer 1, and they have a built-in security framework that doesn’t rely on Ethereum. This is quite different from Optimism, which relies on Layer 1 of Ethereum for the security of transactions.

Like Optimism, Polygon uses the same virtual machine used by Ethereum, so it's easy to outsource smart contracts to Polygon. The Polygon model relies on MATIC tokens to secure the Polygon Network and pay the transaction fee. Therefore, users need to swap Ether for the protocol's native MATIC token.

While the Polygon model has gained significant attention from the crypto community, some users complain about long transfer times, and the reliance on blockchain security in the hands of few actors.

Optimism vs. zkSync

zkSync is a type of ZK-rollup. The letters “zk” stand for “zero knowledge,” which means that one party can prove to another party that they possess certain information (i.e., transaction details) without revealing what that information is.

To prove the validity, each batch of transactions is sent to an off-chain prover generating a cryptographic proof, known as a SNARK (which stands for Zero-Knowledge Succinct Non-Interactive Argument of Knowledge). The proof is subsequently posted on Layer 1.

Although zkSync and Optimism are somewhat similar, zkSync uses a somewhat complex methodology to validate a batch of transactions. The model is not conducive to building DApps, and different ZK-Rollup applications can't interact with each other on Layer 2. On a positive note, zkSync ensures both a much higher throughput and lower cost without sacrificing security.

What Is Optimism Crypto Token (OP)?

Optimism Token (OP) is the governance token of the Optimism network. It’s used to power the Optimism Collective by creating a valuable and healthy ecosystem for its users. The OP token accrues value for token holders, and rewards contributors and developers while incentivizing its users and community through airdrops.

Optimism Airdrop

An airdrop is a marketing technique used by a project’s management team to raise awareness about a relatively new cryptocurrency. As a result, token holders and potential contributors get free tokens “dropped” to their wallets.

While the number of tokens distributed to wallets may differ depending on various contributing factors, these airdrop events remain very popular among crypto enthusiasts who wait patiently to receive such rewards.

Optimism Airdrop #1

The Optimism team released the first batch of OP tokens in an airdrop on Jun 1, 2022. According to its white paper, a total of 248,699 addresses were eligible to claim this initial OP airdrop.

Despite high demand, this first airdrop wasn’t without its share of drama and controversy. About a week before the initial drop, the Optimism team updated the eligibility criteria, which caused an uproar from some disqualified users who claimed they’d lost their eligibility despite interacting with the platform.

Furthermore, one of Optimism’s community members, 0xJohn, proposed that all initial recipients of the OP airdrop who sold their OP tokens should be disqualified from future airdrops. The Optimism governance forum initially brought down the controversial post but later restored it after users protested on Twitter.

Optimism Airdrop #2

On Feb 10, 2023, the Optimism team announced a surprise airdrop to its users. A total of 11.7 million OP tokens were automatically sent to over 300,000 unique addresses of users who had positively participated in the network’s governance.

Optimism Airdrop #3

The Optimism team has yet to announce its third round of OP airdrops. However, the community is hopeful that it will happen as stipulated in the project’s white paper. After airdrop #2, 13.73% of the initial total supply is still available for future airdrops.

Optimism (OP) Tokenomics

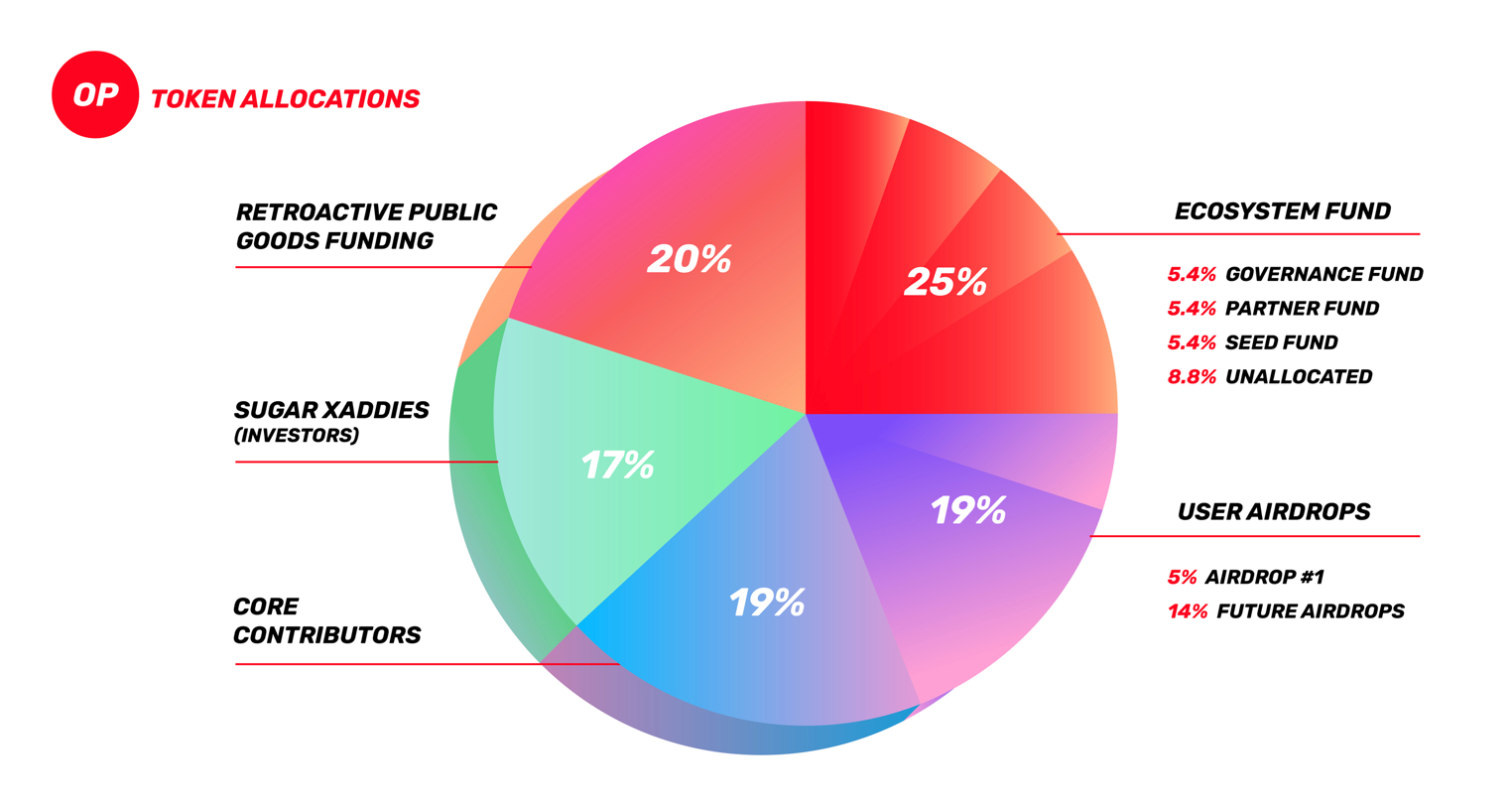

Optimism has a total supply of 4,294,967,296 OP tokens. Of these, 19% were set aside for airdrops, of which 5% were released in the first airdrop and approximately 0.27% in the second one.

According to the official website, OP token allocations are divided into five categories. The lion's share of OP tokens is allocated to the Ecosystem Fund, which represents one-fourth of the entire share.

Below is a brief summation of the overall circulating supply:

25% — Ecosystem Fund:Reserved for funding various community projects within the Optimism ecosystem. Of these funds, the governance, partner and seed funds will receive a 5.4% share. The remaining 8.8% is unallocated and will be decided by community members.

20% — Retroactive Public Goods Funding: This fund will be used to reward projects based upon their impact for the public good. This impact is calculated by a mechanism which tries to adequately and reliably reward public goods. Since there’s no fixed payout for a given period, the Optimism Foundation can tap into these funds anytime.

19% — User Airdrops: Airdrops are used to reward active contributors, token holders and other stakeholders. The first airdrop rewarded the public with a 5% share of the overall token supply. The amount of OP tokens distributed to a wallet is based upon strict distribution criteria. The remaining 14% of tokens are reserved for future airdrops.

19% — Core Contributors: A hefty amount of tokens will be distributed to core team members. These people are the force behind the Optimism Collective initiative. The fund will acknowledge their efforts by gradually allocating a specific amount to each team member. It's worth noting that each allocation comes with a lockup period.

17% — Sugar Xaddies (Project Investors): Investors continue to play a big role in supporting the project. Accordingly, 17% of the total allocation is reserved for such investors. Any funding to investors will also include a lockup period.

Of the 4.29 billion OP tokens already distributed, the token supply will inflate at a rate of 2% per year. This mainly includes all tokens except those which are reserved for core contributions and Sugar Xaddies. After the first year, token holders will vote to determine the Foundation’s annual OP distribution budget.

The Optimism Foundation seeks to utilize all the tokens by the end of Year Four. However, the actual unlocked amount depends on various contributing factors.

Optimism Crypto Price Prediction

As of Jul 19, 2023, the price of OP was $1.49, a 53.92% drop from its all-time high (ATH) of $3.22 on Feb 24, 2023, and more than a 250% increase from its all-time low (ATL) of $0.40 on Jun 18, 2022.

Price prediction experts are highly bullish on OP. Leading price forecasting website PricePrediction believes OP will hit $4.35 in 2025, and achieve a maximum price of $28.33 by 2030. Another prominent platform, DigitalCoinPrice, shares more cautiously bullish sentiments, forecasting OP’s price to reach $5.35 in 2025 and $15.59 in 2030.

Can Optimism reach $100? It could — if it follows a moderate growth trajectory in the future coupled with the continued growth of the Ethereum ecosystem. It’s also one of the best L2 blockchains driving Ethereum’s scalability, and is deemed a favorable asset to hold for long-term investors.

That said, the above isn’t financial advice and doesn’t guarantee OP’s future price. Always do your own research before you buy any token, including Optimism.

Is Optimism (OP) a Good Investment?

Optimism has been hailed as a simple, flexible and highly efficient L2. As such, it continues to attract a growing number of Ethereum developers and crypto users looking to enjoy secure and fast transactions at a fraction of the gas fees.

In early 2023, Optimism launched Superchain, which is designed as a platform of chains that aims to integrate the silos in the present L2 structure to create a single interoperable and cohesive ecosystem.

In June 2023, the implementation of the Bedrock upgrade marked a significant milestone in Optimism's road map toward establishing its Superchain. Following the successful completion of the Bedrock hard fork, Optimism experienced a remarkable surge in daily transactions, with numbers soaring by approximately 67% to 500,000.

Furthermore, Optimism has partnered with a popular centralized exchange, Coinbase, which joined as a core developer on the platform’s ecosystem. In February 2023, Coinbase launched a new L2 blockchain powered by Optimism’s OP Stack, called Base, which is on a mission to onboard over one billion users into crypto.

While the above considerations point to a bullish future for Optimism, as an investor, you also need to consider some unfavorable aspects of the project’s tokenomics.

Following the airdrops, Optimism’s price declined sharply for a time. You'll need to approach the project cautiously since, based on the previous airdrops, the increased token supply might devalue the OP token’s price in the short term.

Where to Buy Optimism Crypto Token (OP)

Bybit users will be glad to know that our platform offers the opportunity to buy and trade OP tokens as a Spot pair (OP/USDT and OP/USDC), and as a USDT Perpetual Contract (OPUSDT) or USDC Perpetual Contract (OP-PERP). Simply create a Bybit account and fund it with either USDT or USDC to make your preferred trade.

The Bottom Line

Optimism is a unique project, creating the rails for highly impactful projects that don’t have a business model to succeed. In addition to the backing of a good team, it has a large community and a pool of dedicated investors.

There's little doubt that another bull run will see OP reach its target of becoming the dominant Layer 2 scaling solution for Ethereum — much sooner than expected.

#Bybit #TheCryptoArk