Lombard Finance (BARD): Institutional-grade Bitcoin liquid staking protocol

Bitcoin stands as the undisputed giant of the cryptocurrency space, commanding the largest market capitalization. Yet, much of its potential remains untapped, often sitting idle as a store of value rather than actively participating in the thriving decentralized finance (DeFi) ecosystem. Lombard Finance aims to change this narrative by unlocking Bitcoin's utility and integrating it seamlessly into DeFi.

Lombard is built upon Babylon, the innovative Bitcoin staking protocol. Lombard’s flagship product, LBTC, is a liquid staking token (LST) for BTC.

For more than a year after its launch, Lombard Finance operated without a native governance token. In September 2025, Lombard’s native cryptocurrency, the BARD token, was launched to enable various use cases, including governance, staking and access to exclusive rewards

This article explores what Lombard Finance is, how the LBTC and BARD tokens work, describes the Lombard ecosystem and how you can stake LBTC through Bybit Web3.

Key Takeaways:

Lombard Finance is an institutional-grade liquid staking protocol built on Babylon that’s designed to use its LBTC token to unlock Bitcoin's DeFi potential.

LBTC allows users to earn native Bitcoin staking yield via Babylon and to participate in DeFi opportunities while keeping their assets liquid.

Lombard’s native token, BARD, is used for on-platform governance, staking and access to exclusive rewards and features.

What is Lombard Finance?

Lombard Finance is an institutional-grade liquid staking protocol that focuses on transforming Bitcoin's role in the digital economy. Its core mission is to evolve BTC from simply being a store of value — also viewed as digital gold — into a productive asset that actively generates yield and participates within DeFi. Currently, a significant portion of Bitcoin's $1.89 trillion market capitalization sits idle, lacking the native staking capabilities or cross-chain composability seen with assets such as Ether (ETH).

Founded in April 2024, Lombard launched LBTC in August 2024. Just over a year later, in mid-September 2025, the protocol debuted its native token, BARD.

Lombard Finance addresses this shortcoming by building on top of Babylon, a protocol that supports BTC staking without needing bridges or custodians. Babylon allows Bitcoin's economic weight to secure other proof of stake (PoS) chains and applications, creating a new yield source for holders. Lombard leverages this foundation to offer LBTC, making staked BTC liquid and usable across the DeFi market.

Lombard’s goal is ambitious: to channel Bitcoin's vast liquidity into DeFi. This could potentially double the ecosystem's total value locked (TVL) if even a fraction of available BTC is introduced. Lombard believes this integration will catalyze significant growth and create more sustainable market dynamics by making BTC a core, yield-bearing primitive within DeFi. Lombard Finance is actively building a wide LBTC ecosystem that already boasts over 100 DeFi integrations such as Aave, Uniswap and Pendle. The platform supports multiple blockchains (including Ethereum, Base, Sui, BNB Chain) and Bitcoin Layer 2s (L2s), positioning LBTC as a versatile cross-chain asset.

Lombard boasts institutional-grade level decentralized security, anchored by the 14-member Security Consortium (including prominent names like Galaxy and OKX Ventures) and validating all critical operations alongside audits and bug bounties.

Lombard Finance: Founders and investors

Lombard Finance was founded in April 2024 by a team with deep expertise within DeFi, drawing talent from established crypto projects like Polychain, Babylon, Argent, Coinbase and Maple. This collective experience underpins the protocol's design and strategic direction.

The project was notably incubated by Polychain Capital, a prominent crypto investment firm that also led Lombard's $16 million seed funding round (which was announced in July 2024). This round saw participation from a wide array of significant players in the crypto space — including Babylon, dao5, Franklin Templeton, Foresight Ventures, HTX Ventures, Mirana Ventures, Mantle EcoFund, Nomad Capital, OKX Ventures and Robot Ventures — thus highlighting broad industry confidence in Lombard's vision. Strategic partnerships and contributions from exchanges like Bybit and Bitget are further bolstering its distribution and liquidity aggregation efforts.

What is the Lombard crypto token (BARD)?

On Sep 18, 2025, Lombard launched its native token, BARD, designed to provide a wide range of utilities on the platform. While LBTC operates as a yield-generating asset for BTC liquid staking, BARD’s key functions include:

Governance. This is a key functionality of the token. Holders of BARD can participate in Lombard Finance’s governance mechanism by voting on proposals that shape Lombard’s rules, development and operational mechanism. Among key matters holders can vote on are fee structures for Lombard products, validator set composition, road map milestones and the allocation of grants through the Liquid Bitcoin Foundation (LBF), a nonprofit entity steering the development and growth of the Lombard Protocol.

Staking and security. By staking BARD on Lombard Finance, users can enhance the security of cross-chain LBTC transfers, insulating the protocol's core functionality from vulnerabilities. Cross-chain LBTC transfers on Lombard are processed via Chainlink (LINK)’s Cross-Chain Interoperability Protocol (CCIP). Lombard has partnered with the Symbiotic (SYMBIOTIC) restaking solutions provider to enhance the security of these transfers via the BARD staking model.

Ecosystem development. Through projects and initiatives funded by LBF grants, the BARD model will lead to the expansion and further development of Lombard Finance’s partnerships and integration with other DeFi platforms. These grants may also lead to new projects developed for the overall Babylon ecosystem, contributing to Lombard’s larger footprint both within its own host environment and across different chains.

Access to exclusive offers and rewards. BARD will enable its holders to gain early access to a range of exclusive products and discounts, making BARD token ownership a central reward mechanism on Lombard Finance.

Staking rewards on external platforms. As the protocol’s partnerships and integrations grow, BARD will create opportunities for additional yields and rewards on external protocols, in addition to staking rewards from securing the LBTC cross-chain bridge.

BARD tokenomics

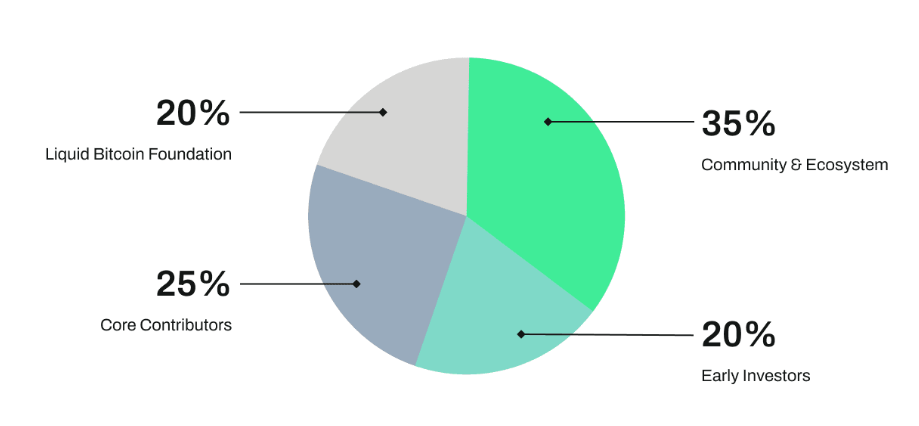

The BARD token was launched with a total and maximum supply of 1 billion. Its supply distribution shares are divided into four major parts (see chart below).

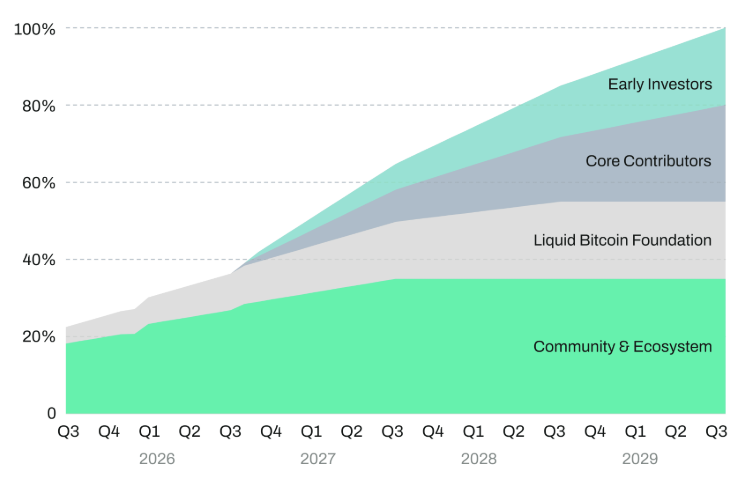

Of the entire supply of 1 billion, 22.5% (225 million BARD) is unlocked from the start, while the remaining 77.5% is subject to vesting schedules. The total supply of 1 billion will be fully unlocked within four years from the token generation event (TGE) date of Sep 18, 2025. The chart below shows the timing of the supply release.

Most of the 225 million BARD that are currently available are set aside for the Lombard community and ecosystem. This critical allocation, making up 35% of the entire supply, is split as follows:

Airdrop Season 1 — 4% (40 million BARD). This airdrop rewards two primary groups: early users of the protocol’s Lux loyalty program, and early strategic liquidity providers to the platform’s pools.

Ecosystem activation — 11%. This immediately accessible sub-allocation is designed for various incentives and reward programs. Part of it is designated for Airdrop Season 2.

Community sale — 1.5%. The sale provided individuals with a pre-TGE opportunity to buy BARD, boosting non-institutional participation.

Ecosystem development — 18.5%. This sub-allocation is designed to support the protocol’s development and expansion, primarily through commercial partnerships.

Where to buy the Lombard crypto token (BARD)

The BARD token is available on Bybit both as a spot pair with Tether (USDT) and as a USDT-based perpetual futures contract. From now till Sep 29, 2025, 10 AM UTC, you can also take advantage of Bybit’s events dedicated to the token to earn from a 700,000 BARD prize pool.

The first event, exclusive to new users, lets you earn rewards from a prize pool of 250,000 BARD. To participate, sign up for a new Bybit account and complete your KYC verification. Then, either deposit at least 250 BARD, or deposit at least 100 USDT and trade 100 USDT worth of BARD for your first Spot trade. The first 3,125 users who satisfy the event requirements will receive a reward of 80 BARD.

The second event allows both new and existing users to earn rewards from a pool of 100,000 BARD. The first 2,500 users will earn 40 BARD if they deposit at least 1,500 BARD, or deposit 1,000 USDT and trade 1,000 USDT worth of BARD on Bybit’s Spot market via their first trade using their Bybit account.

Finally, the third event allocates rewards from a pool of 350,000 BARD. Both new and existing users are eligible. To participate in the event, simply trade at least 500 USDT worth of BARD on Bybit’s Spot market. The more you trade, the larger your share of the prize pool. Maximum rewards are limited to 1,500 BARD per user.

What is Lombard's LBTC token?

LBTC is Lombard Finance's flagship product — an institutional-grade liquid staking token (LST) that represents Bitcoin staked through the Babylon protocol. Designed as a universal liquid BTC standard, LBTC is fully backed 1:1 by native Bitcoin, ensuring its value is directly tied to the underlying asset.

The token is yield-bearing, capturing rewards generated from securing PoS networks via Babylon staking. Crucially, LBTC remains liquid, meaning holders can freely use it across various DeFi applications — such as lending protocols, decentralized exchanges (DEXs) and automated vaults — without sacrificing their underlying staked positions or associated yield.

LBTC is also designed for cross-chain compatibility, natively minted on supported blockchains like Ethereum, Base and Sui and using secure infrastructure [such as Chainlink's Cross-Chain Interoperability Protocol (CCIP) and Lombard's own Security Consortium]. This avoids the risks associated with traditional bridging or wrapping methods, thus aiming to provide a more secure and seamless way to utilize Bitcoin across the multichain DeFi ecosystem.

How does Lombard Finance work?

Lombard Finance simplifies the process of putting Bitcoin to work within DeFi through its LBTC token. The mechanism is designed with security and user experience in mind, leveraging the Babylon protocol and a robust Security Consortium.

Here’s how the process works.

Stake Bitcoin: Users deposit native BTC from any Bitcoin wallet to a unique, secure deposit address generated by Lombard. This address is tied to the user's chosen destination chain and wallet address where LBTC will be minted.

Mint LBTC on Lombard: Once the BTC deposit receives sufficient confirmations (typically six) on the Bitcoin network, Lombard's Security Consortium verifies the transaction. Using a trustless relayer system and Chainlink’s CCIP, the corresponding amount of LBTC is then securely minted on the user's selected destination blockchain (e.g., Ethereum or Base).

Use LBTC in DeFi: The minted LBTC is now available in the user's wallet. Holders can deploy LBTC across various integrated DeFi protocols — lending it on platforms like Aave, providing liquidity on DEXs like Uniswap or Curve, using it as collateral or depositing it into automated yield vaults.

Redeem LBTC: Users can unstake their LBTC at any time to retrieve their original Bitcoin. This involves burning the LBTC token and initiating an unstaking process via the Security Consortium and CubeSigner's secure key management. There's a withdrawal period (currently around nine days) required by Lombard and Babylon before the BTC is sent to the user's specified Bitcoin address.

The core benefit of LBTC lies in its ability to unlock multiple layers of value simultaneously. Holders earn native yield from Babylon staking, potentially accrue additional rewards (such as Lombard Lux points) and gain access to diverse DeFi yield opportunities, all while maintaining the liquidity of their Bitcoin position. This transforms BTC from a static asset into a dynamic, yield-generating component of the DeFi ecosystem.

Expanding beyond LBTC

Lombard Finance launched LBTC in August 2024, marking the beginning of the platform’s public operations. Since then, Lombard has expanded well beyond simple BTC liquid staking with additional products and solutions, including:

eBTC, a liquid restaking token (LRT) launched via EtherFi (ETHFI), creates opportunities to leverage BTC for liquid restaking. Unlike liquid staking, which is mostly limited to securing base blockchain networks, liquid restaking lets you earn yields while securing a wide range of blockchains and associated services, such as oracles, bridges and data availability (DA) layers.

BTCK — a wrapped BTC representation on the Katana Inu (KATA) Layer 2 chain

Lombard Ledger — A settlement layer secured by Lombard’s Security Consortium that’s designed to ensure seamless settlement of Bitcoin transactions on Lombard Finance

Lombard Vaults — Yield-generating vault products for LBTC and other Bitcoin-based assets.

Lombard SDK — A framework for developers to streamline the integration of BTC liquid staking into external platforms, such as exchanges and wallets. Bybit was among the first platforms to integrate the Lombard SDK, allowing its users to benefit from seamless and user-friendly BTC liquid staking.

How to stake LBTC on Bybit Web3

Lombard Finance (via its LBTC token) offers a compelling way for Bitcoin holders to put their assets into use, earn yield via Babylon staking and gain exposure to the expansive DeFi ecosystem — all while maintaining liquidity. Supported by a robust consortium and growing partner network, Lombard is positioning LBTC as a secure and versatile liquid Bitcoin standard.

It’s easy to participate in the Lombard ecosystem through Bybit Web3. By following a simple process within the Bybit App, you can utilize your Bybit Web3 Seed Phrase Wallet to stake BTC and mint LBTCv, Lombard's vault token that represents deposits in automated yield strategies. This provides you with a seamless gateway to access Bitcoin liquid staking and DeFi yields.

Closing thoughts

Lombard Finance is among the pioneers of BTC liquid staking solutions. By offering its core service via the LBTC LST, Lombard helps unlock Bitcoin's substantial potential within DeFi. Given Bitcoin's massive market capitalization — and the fact that most BTC holdings remain idle outside of yield-bearing DeFi activities — Lombard aims to capture significant opportunities in this space.

The recent launch of Lombard Finance’s native BARD token marks another key milestone. With BARD, the protocol seeks to expand into new markets and applications. BARD's wide range of utility functions — including staking, governance and yield opportunities on external platforms — provides additional potential to enhance Lombard's ecosystem and broaden its use cases.

Additionally, a series of new solutions introduced after the LBTC launch — such as Lombard Ledger, eBTC, Lombard SDK and Lombard Vaults — further demonstrate the platform's active growth and development. One particularly notable addition is eBTC, an LRT that positions the protocol as both a liquid staking provider and a BTC liquid restaking pioneer via its cooperation with EtherFi. These initiatives indicate a continuing evolution of Lombard's offerings, setting the stage for its future expansion and wider adoption among BTC holders.

#LearnWithBybit