What Is ApeCoin (APE): The Rise and Fall of the BAYC Token

The launch of ApeCoin (APE), the token of blue-chip NFT Bored Ape Yacht Club (BAYC), generated a great deal of commotion in Mar 2022. To NFT advocates, ApeCoin wasn’t viewed merely as a token, but as the symbol of NFT evolution driven by BAYC, which became a household name at the peak of the NFT boom.

Yet it could not escape the controversies that marred its launch. On top of that, in Jul 2023, the floor price of BAYC fell to a devastating low, which led many to question the value of the APE token.

In this article, we'll take an in-depth look at ApeCoin and various ApeCoin controversies, and consider whether ApeCoin is still a good investment for the long haul.

Key Takeaways:

ApeCoin (APE) is the governance token of the Bored Ape Yacht Club (BAYC) ecosystem, which gained popularity during the NFT boom.

The ApeCoin ecosystem includes NFTs, a metaverse called Otherside and partnerships with projects like CryptoPunks and The Meebits. It has utility beyond just governance, making it a potential long-term investment for those bullish on the BAYC ecosystem.

However, ApeCoin has faced various controversies that have impacted the token's price and raised questions about its long-term viability as an investment.

What Is ApeCoin (APE)?

ApeCoin is an Ethereum-based ERC-20 token developed primarily for the Bored Ape Yacht Club (BAYC) ecosystem. Valued highly by NFT collectors and Bored Ape NFT owners, it's also marketed as a decentralized protocol layer for community-led initiatives.

For those wondering exactly what ApeCoin is, it’s a governance token of the Bored Ape ecosystem that’s gained a tremendous following after the Bored Ape Yacht Club (BAYC) NFT project exploded in popularity. Many celebrities — such as Justin Bieber, Paris Hilton, Snoop Dogg and Serena Williams — own collections of NFTs related to the BAYC ecosystem.

While some may discount ApeCoin as a meme coin, its utility goes far beyond just being the governance token for Bored Ape holders, due to its expanded ecosystem that includes NFTs and a metaverse. This ultimately makes ApeCoin a potential long-term investment for those bullish on the BAYC ecosystem.

The ApeCoin (APE) Ecosystem

ApeCoin is the utility token of BAYC. Since BAYC is an NFT project initiated by Yuga Labs, the coin is technically its brainchild. Two of the four founders behind the development of the BAYC ecosystem are Floridians Greg Solano and Wylie Aronow.

According to the official BAYC website dedicated to ApeCoin, the coin has been launched and is overseen and managed by ApeCoin DAO. This decentralized autonomous organization is an independent body, governed by Bored Ape NFT owners, holders of related NFTs and ApeCoin investors. In other words, whoever owns APE coin or a Bored Ape NFT has the right to vote on proposed changes to the protocol and new projects.

Overseeing the DAO is the Ape Foundation, which ensures that ideas from the DAO community are brought to fruition. The Ape Foundation is headed by five high-profile crypto investors, each of them selected for a one-year term. The current heads, also known as the Special Council, go by the handles of Bored Ape G, Gerry, Vera Li, Waabam and CaptainTrippy. Waabam and CaptainTrippy were voted in by the ApeCoin DAO to replace Reddit co-founder Alexis Ohanian and Animoca Brands chairman Yat Siu, starting Jul 1, 2023.

What Is Yuga Labs?

Yuga Labs — the platform behind ApeCoin and its flagship NFT Bored Ape Yacht Club — first launched BAYC in Apr 2021. After BAYC’s popularity exploded, Yuga expanded its NFT collection to include Mutant Ape Yacht Club and Bored Ape Kennel Club.

In 2022, Yuga Labs sought additional pathways to integrate ApeCoin into different projects related to the BAYC ecosystem. First, it launched a gamified metaverse, Otherside, which uses ApeCoin in its ecosystem. Secondly, it acquired two of the most popular NFTs, CryptoPunks and The Meebits, expanding the use of ApeCoin. CryptoPunks are some of the first non-fungible NFTs on the Ethereum blockchain, consisting of 10,000 digitally pixelated characters. Similarly, The Meebits are 20,000 unique, 3D voxel characters registered on the Ethereum blockchain.

Bored Ape Yacht Club (BAYC)

Yuga Lab’s flagship NFT collection, Bored Ape Yacht Club (BAYC), consists of 10,000 unique cartoon ape NFTs on the Ethereum blockchain. BAYC burst onto the scene with a boom, garnering high-profile support from celebrities like Justin Bieber and Madonna.

Mutant Ape Yacht Club (MAYC)

Launched in Aug 2021, Mutant Ape Yacht Club (MAYC) is a collection of 20,000 ape NFTs based on BAYC. The apes are essentially a mutant version of the Bored Apes. Hence, BAYC owners can actually create their own MAYC NFTs through a smart contract that applies Mutant Serums to their Bored Apes. With three types of serums available, a BAYC owner holding a single Bored Ape NFT can create up to three different Mutant Apes. Ten thousand Mutant Ape NFTs were made available for public sale, while 10,000 Mutant Serums were also airdropped to existing BAYC holders.

Bored Ape Kennel Club (BAKC)

Bored Ape Kennel Club is a collection of 9,602 cartoon dog NFTs launched in Jul 2021. Yuga Labs made these complementary NFT pets for BAYC holders, though the BAYC owners have to spend gas fees in order to mint them. While the pet NFTs all boast distinctive traits, each one is depicted as a Shiba Inu, a canine breed popularized by dog-themed meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB).

Otherside Metaverse

Introduced one year after the establishment of BAYC, Otherside is a 3D metaverse created in collaboration with Hong Kong-based game software company Animoca Brands. Otherside offers users the ability to build their own unique realms featuring Otherdeed NFTs that represent land plots with the remarkable ability to evolve over time.

The Otherside metaverse is split into an 11-part storyline that gives users a compelling narrative gameplay experience. As a fantastical landscape, Otherside combines elements of a cosmic expanse and a peninsula, brimming with an array of peculiar creatures, valuable resources and elusive treasures. All transactions in Otherside are driven by ApeCoin (APE).

ApeCoin Use Cases

The potential use of ApeCoin isn’t limited to governance. As mentioned earlier, Apecoin is also the utility token powering the Otherside metaverse that promises to expand the BAYC universe.

Animoca Brands is also working with Yuga Labs to integrate ApeCoin into its portfolio of blockchain-based games, traditional games and other products. Benji Bananas, a free-to-play action-adventure mobile game featuring an adorable monkey named Benji and his friends leaping through jungles, allows its players to earn ApeCoins.On Mar 17, 2022, Animoca Brands announced that Benji Banana players could earn tokens to exchange for ApeCoin as it transitions to a play-to-earn model on Ethereum.

ApeCoin Staking

Starting from Dec 2022, APE can also be staked. On Dec 5, APE holders will be able to deposit their ApeCoin funds on ApeStake.io, to begin accumulating from Dec 12. During the first year, 100 million APE are being distributed into staking pools as rewards, split into 30,000,000 tokens for the ApeCoin Pool, 47,105,000 tokens for the Bored Ape Pool, 19,060,000 tokens for the Mutant Ape Pool and 3,835,000 tokens for the Pair (BAKC) Pool.

There are four ways to stake your ApeCoins:

ApeCoin (APE) Pool — This pool is for any APE holder, and has no maximum staking amount.

Bored Ape (BAYC) Pool — BAYC NFT holders can stake up to 10,094 APE for each BAYC NFT they own.

Mutant Ape (MAYC) Pool — This pool has a minimum stake of 2,042 APE for each MAYC NFT.

Pair (BAKC) Pool — BAKC NFTs cannot be staked on their own, and must be paired with either a BAYC or MAYC NFT.

Note that if you choose to sell your NFT while it’s staked in the respective pools, all your staked rewards will go to the new owner. Therefore, it’s crucial to unstake your NFT before selling it.

ApeCoin Tokenomics

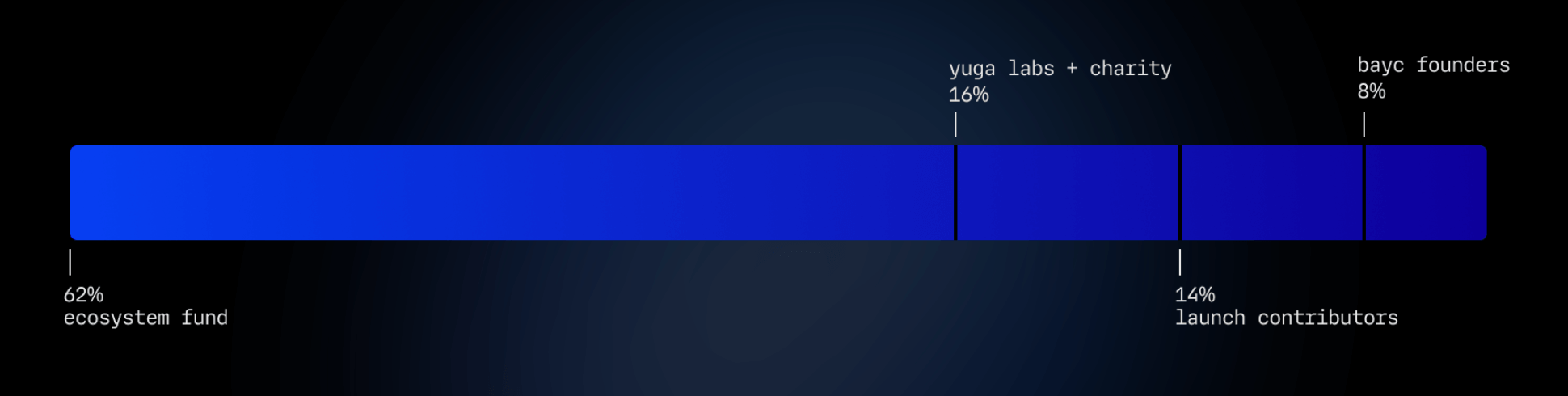

ApeCoin’s total supply is capped at 1 billion tokens, distributed among four main groups as follows:

62% is allocated to the ecosystem fund. Out of this amount, 150,000,000 APE are allocated to BAYC/MAYC. BAYC holders can claim 10,094 APE tokens for each NFT they own, while MAYC holders can claim 2,042 tokens for each NFT. Should a BAYC holder own a Kennel Club NFT alongside a BAYC NFT, they’ll be able to claim 10,950 APE for each NFT. For MAYC holders also holding Kennel Club NFTs, they can claim 2,898 tokens. Meanwhile, the remaining 470,000,000 APE are given to the DAO treasury and resources.

16% is set aside for Yuga Labs. Out of this allocation, Yuga Labs have chosen to keep 150,000,000 APE and donate 10,000,000 APE to Jane Goodall Legacy Foundation.

14%, which amounts to 140,000,000 APE, goes to launch contributors.

8% (or 80,000,000 APE tokens) will be given to and divided amongst the four founders of Yuga Labs and BAYC.

To prevent pump-and-dumps, there’s a 12-month lockup for Yuga Labs, launch contributors and the founders of BAYC. After 12 months, a specific number of tokens will be unlocked on a monthly basis. For the DAO treasury, a portion of 470,000,000 tokens was unlocked at launch, while the rest will be unlocked over 48 months. Since not all of the tokens are unlocked yet, not all of the ApeCoin tokens are in circulation. As of Jul 12, 2023, ApeCoin has a circulating supply of 368,593,750 APE.

ApeCoin DAO

Now that we understand what ApeCoin is, it's time to discover the ApeCoin DAO.

Simply put, ApeCoin DAO is the decentralized governing body behind the BAYC ecosystem and ApeCoin. All APE holders are members of the ApeCoin DAO, and share voting rights. Anyone can become a member of the DAO by purchasing an Ape NFT.

According to its founders, the ApeCoin DAO's primary purpose is to give its members power by respecting their wishes. Based on the community guidelines and desires of the wider BAYC community, the DAO proposes various projects through the APE Improvement Proposal process. After the ApeCoin DAO votes on a proposal, the APE Foundation is then tasked with executing the decision.

ApeCoin Controversy

Despite its glittering launch, ApeCoin has also been fraught with controversies. Let’s take a closer look at some of the disputes in which it’s been embroiled.

Launch Day and Coin Distribution

ApeCoin experienced its very first controversy during its launch day for its token distribution structure, which favors insiders and BAYC founders, who will eventually get 22% of all tokens. Similarly, Yuga Labs will receive 16% of all the proceeds. Moreover, nearly 14%, constituting 140 million tokens, was distributed to launch contributors, many of whom were said to be venture capitalists. Hence, critics assert that the ApeCoin DAO may not be as decentralized as they claim.

Furthermore, on the day of the launch, the price of ApeCoin spiked to $40 per share, but quickly plummeted to $8, which led to many suggesting that there might have been insider trading.

Flash Loan Attack

There were also security issues surrounding the airdrop, as Yuga Labs failed to consider the snapshot mechanism typically used before a token airdrop to ensure that only loyal long-term NFT holders are eligible. This allowed anyone to buy the NFT just before claiming the reward, making it vulnerable to a flash loan attack.

Indeed, an exploiter actually managed to borrow a BAYC NFT on OpenSea for less than $300,000 as collateral to use as a flash loan from a vault that tokenizes NFTs. They then used the flash loan to redeem more Bored Ape NFTs and claim 60,564 APE — which they then sold for over $800,000.

Regulatory Issues

In Oct 2022, the startup behind ApeCoin, Yuga Labs, was investigated by the SEC as to whether ApeCoin and its Bored Ape NFTs were unregistered securities. Although Yuga Labs wasn’t charged in the probe, APE’s price couldn’t escape the fallout from the report, and its price fell by over 10% in just 24 hours.

Leadership Salary Dispute

ApeCoin faced another backlash from its community for the disproportionately high salaries of its DAO leaders. This internal disconnect caused APE’s price to plummet by 28% within a week, as it hit a low of $2.08 in Jun 2023.

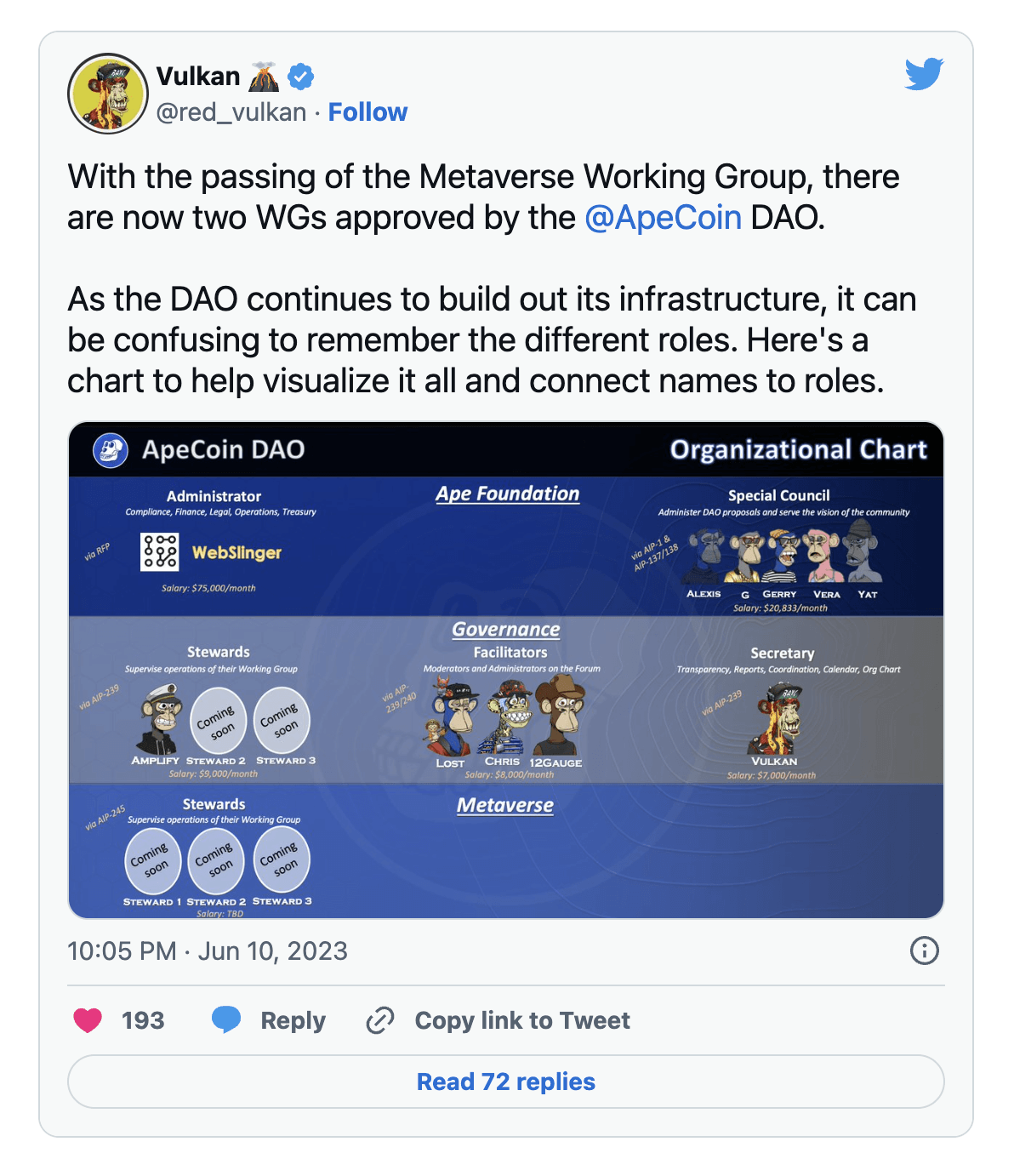

On Jun 10, 2023, the ApeCoin DAO secretary, Vulkan, posted an organizational chart of the ApeCoin DAO leadership infrastructure, detailing the monthly salary for each mentioned role. In particular, the Special Council members’ salaries jumped out to the public with their five-figure number. Many web3 users questioned the high wages, which added up to a six-figure annual sum.

Special Council members Yat Siu and Vera defended their substantial salaries by drawing comparisons to public company directors and emphasizing the value they contribute. Furthermore, Special Council member Bored Ape G stressed that they’ve been helping with the decentralization of the DAO through the change of administrative leadership, which also helped the DAO to save on costs, thereby producing evident results.

However, to many critics in the web3 sphere, true decentralization would mean that everyone in the community gets to vote for the salary of those in the Special Council, instead of their salaries being decided by a small group of people.

ApeCoin Price Prediction

ApeCoin is priced at $1.92 as of Jul 12, 2023, which is 92.8% lower than its ATH of $26.70 on Apr 28, 2022, and 3.72% higher than its ATL of $1.85 on Jul 7, 2023.

Despite the ongoing controversies and the NFT market crash, many experts remain relatively optimistic on APE’s future. PricePrediction expects a minimum increase of up to $4.57 in 2025, hitting a maximum of $5.59 and followed by a sharp rise to exceed $30 by 2030. DigitalCoinPrice anticipates a more moderate increase, reaching a maximum of $7.02 in 2025 and potentially crossing $20 in 2030.

Is ApeCoin a Good Investment?

Taking into account all this information begs the question: Is ApeCoin still a good investment?

While ApeCoin may have had a stellar debut, garnering interest and support from many celebrities, its sky-high value was unable to hold. Furthermore, the recent price crash illustrates its inability to sustain its long-term value and suggests that ApeCoin is more of a hype. Hence, despite relatively favorable outlooks regarding its price prediction, it may not be a good investment in the long run. Specifically, as the controversies surrounding its associated NFT continue to swirl, ApeCoin’s future will remain murky.

Even as the ApeCoin DAO attempts to add more utility to the token by creating the Otherside metaverse, its exact use cases remain unclear, even within the metaverse game. As the metaverse continues to evolve, however, and the token's use cases begin to take shape, ApeCoin may still see positive growth in value should the metaverse truly gain traction. However, this in turn depends on whether its flagship NFT, BAYC, can pull through the current NFT market slump.

Investors who are bullish on the NFT comeback and willing to take risks might still consider ApeCoin a good investment — since, after all, BAYC is still far more valuable than countless other NFTs.

Note that these views should not be taken as investment advice. It’s crucial to do your own research before investing in volatile altcoins.

How to Buy ApeCoin (APE)

Anyone can buy APE from reputable crypto exchanges like Bybit. There are various ways to trade ApeCoin on Bybit. You can buy APE as a Spot pair, or trade it as a Perpetual Contract or as a Leveraged Token on the Spot market.

You can use either USDT (APE/USDT) or USDC (APE/USDC) to trade APE as a Spot pair, and USDT (APEUSDT) to trade APE as a Perpetual Contract. When you trade APE as Perpetual Contract, you can go long or short on APE, using USDT as a margin, with no expiration date.

When you trade APE as a Leveraged Token, you can choose to long (APE2L/USDT) or short (APE2S/USDT) it. There are two methods for trading APE as a Leveraged Token: You can buy and sell APE on the Spot market, or subscribe or redeem according to the Perpetual Contract position of the underlying APE tokens in the basket.

Each Leveraged Token represents a basket of Perpetual Contract positions, so when you buy a Leveraged Token, you're purchasing a basket of the underlying Perpetual Contract assets. This means Leveraged Tokens are useful as short-term investments in trending markets. A Leveraged Token doesn’t require margin or collateral, and since it’s under the Spot category, there’s no risk of liquidation.

The Bottom Line

ApeCoin's recent controversies and price drop makes it an unappealing investment for now. Still, if there’s a resurgence in the popularity of NFTs (BAYC in particular), ApeCoin would likely see a rebound in its price as well. Investors comfortable with taking risks might view this as an opportune moment to buy ApeCoin. Nonetheless, risk-averse investors are advised to exercise caution and consider avoiding this token.

#Bybit #TheCryptoArk