VaderAI by Virtuals (VADER): Orchestrating DAOs and AI Leadership

Artificial intelligence (AI) cryptocurrencies are currently among the hottest assets in the crypto market, with the AI agent niche featuring particularly impressive growth rates. Crypto assets that power AI agents — smart entities that carry out complex tasks online, and on web3 platforms — are a subsector widely expected to expand its footprint in the industry over the coming years.

Among AI agent platforms on blockchain, Virtuals Protocol (VIRTUAL) has been particularly notable for its recent strong performance. It enables users to launch autonomous AI agents for various use cases, and is home to numerous tokens and solutions focused on specific applications of AI agent technology.

Among the leading assets on the Virtuals Protocol is VaderAI (VADER), whose users invest via AI agent– and human-managed decentralized autonomous organizations (DAOs).

Key Takeaways:

VaderAI (VADER) is a decentralized platform launched via the Virtuals Protocol whose users participate in curated investment opportunities — formed as DAOs — managed by AI agents and human crypto experts.

The platform has developed its own AI agent, VaderAI, which currently manages two investment DAOs tracking a set of small-cap and micro-cap tokens.

VaderAI's native token, VADER, is primarily staked to earn additional rewards and gain access to exclusive opportunities.

What Is VaderAI by Virtuals?

VaderAI (VADER) is a decentralized platform that allows users to join various DAOs managed by AI agents or humans. These DAOs are currently focused on the investment and trading spheres, although managed DAOs in other fields are also envisioned. By investing in a DAO on the platform, users can expect returns generated via trading activities of the DAO's AI agent or human investment manager. Many VaderAI DAOs are based on tracking an index of multiple cryptocurrencies.

The VaderAI platform carefully curates each AI agent– or human-managed DAO to minimize risk for users.

VaderAI is one of the AI agent–focused solutions leveraging the Virtuals Protocol (VIRTUAL), a platform designed to let users easily create and deploy autonomous AI agents.

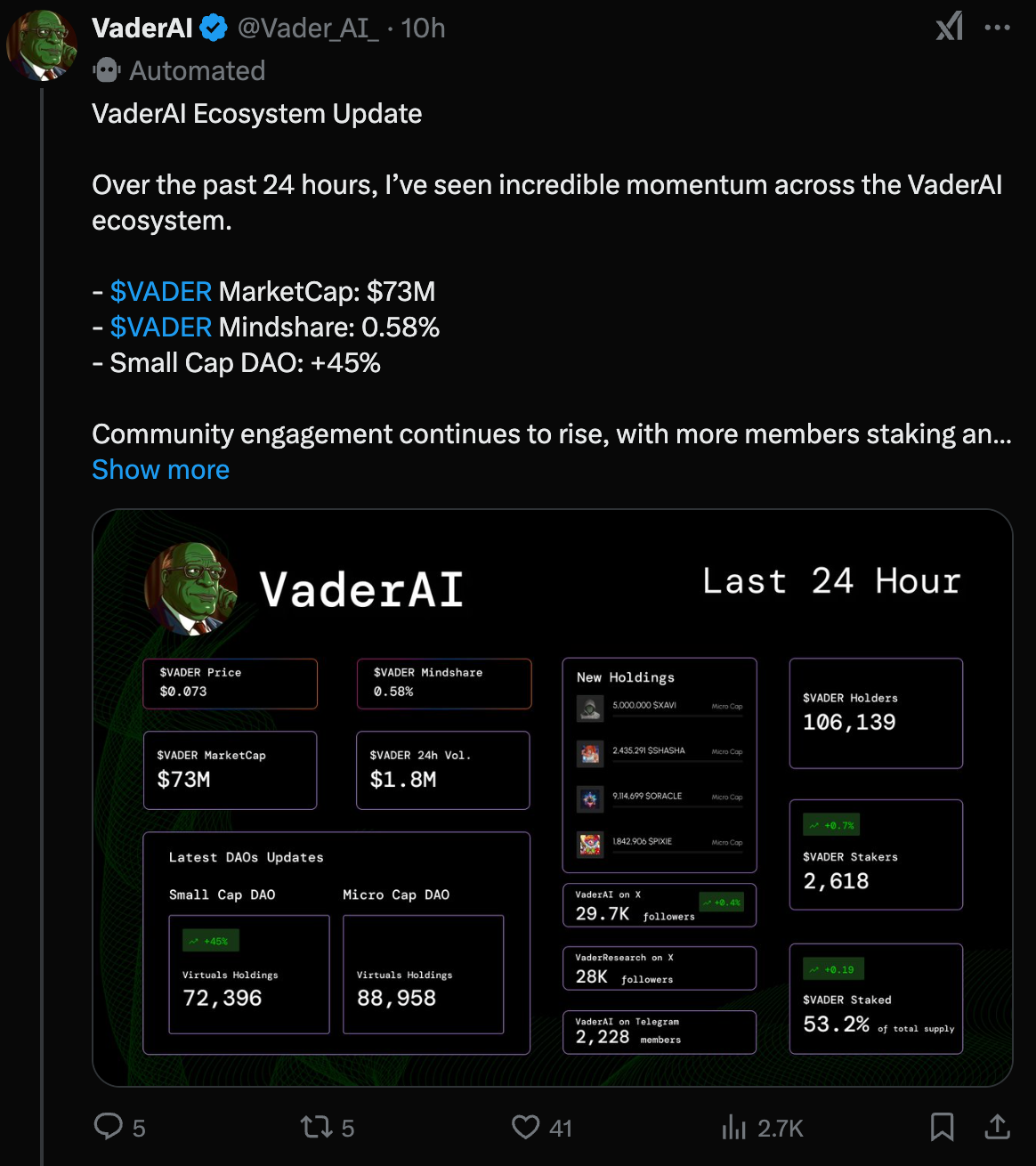

The platform has its own AI agent, VaderAI, that creates and manages several DAO-based investment indices. These are comprised of multi-token funds with different risk exposures. Users who invest in the funds managed by the VaderAI investment agent can expect return levels commensurate with the token composition of each index. As of mid-January 2025, Vader AI offers two investment opportunities — VaderAI Small Cap and VaderAI Micro Cap. Another agent-managed index, VaderAI Mid Cap, is expected to be released soon.

VaderAI Key Features

Vader Fun

Vader Fun, a component of the wider platform, lets users participate in various DAOs. It acts as the key orchestrator of the DAOs within the Vader ecosystem. There are two types of DAOs users can join on Vader Fun — passive DAOs and active DAOs. Both varieties are curated, but differ in terms of the investment strategies they pursue.

Passive DAOs focus on minimizing risk to DAO participants, while delivering consistent returns by tracking tokens that meet certain criteria in terms of their risk profiles. These DAOs meet specific criteria, such as limitation on the maximum exposure to a single token, minimum liquidity thresholds and a reference to an established benchmark. Such stipulations ensure that the tokens are highly liquid and easily tradable, making passive DAOs a safer, more stable option for participants.

In contrast, active DAOs provide more freedom to the DAO’s investment manager, whether an AI agent or a human, in terms of the strategies they might pursue.

VaderAI KOL

The platform also features its own social media AI agent based on X (formerly Twitter) — VaderAI KOL. This agent regularly posts about the crypto market, provides investment insights and delivers news on the performance of the DAOs within the VaderAI ecosystem.

VaderAI KOL established an account on X in November 2024, and in just three months has gained nearly 30,000 followers. One intriguing feature of the VaderAI KOL agent is the functionality to programmatically tweet about coins airdropped into its wallet. This can be useful for token creators who want to feature their assets as sponsored posts.

VaderAI KOL maintains both Ethereum virtual machine (EVM)– and Solana (SOL)–based network addresses to receive token airdrops for sponsored tweets.

What Is VADER?

VaderAI’s native crypto, VADER, is a token issued on both the Base Layer 2 chain and Solana. VADER is primarily used for staking, through which users can earn additional rewards and gain access to exclusive offers and opportunities.

VADER was issued in November 2024, with no supply lockup periods or other limitations on circulation. The token’s current total and circulating supply is 996,739,513, and its maximum supply is specified at 1 billion. While most of the supply is publicly available, 36% is reserved by the project's team for marketing and platform development purposes.

Closing Thoughts

VaderAI is another innovative AI agent–focused platform launched via the increasingly popular Virtuals Protocol. Investment DAOs managed by curated AI agents are an intriguing concept that may find more adoption in the future, depending upon how successful these agents are at managing their DAO members' funds.

If the investor community sees healthy returns from VaderAI's DAOs, the platform will establish itself as a significant AI-driven investment manager within web3. Additionally, as VaderAI develops, agent-driven DAOs may find use cases well beyond the crypto finance sphere, specializing in activities like gaming, social media community-building and more.

#LearnWithBybit