Oil soars to 6-month high on US-Iran tensions. Brace for "freaky" Friday?

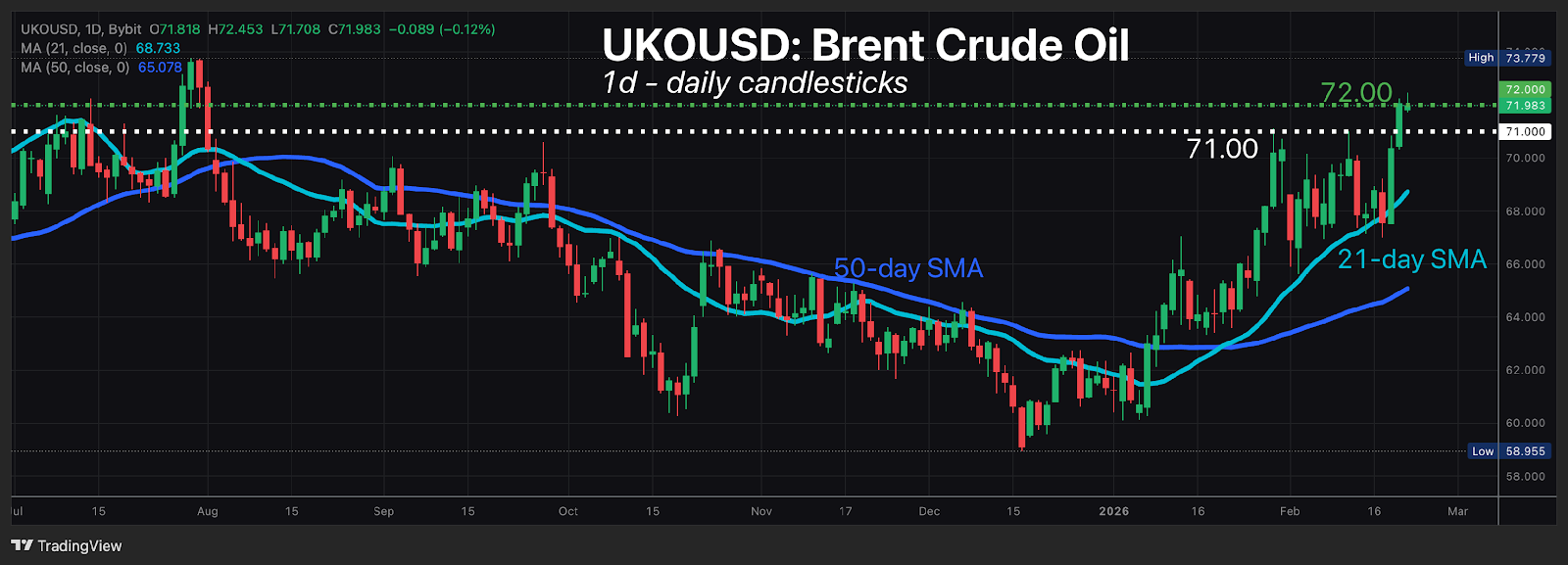

The global oil benchmark, Brent (Bybit: UKOUSD), has surged to its highest level since August 1st, 2025.

Oil prices spiked after US President Donald Trump says Iran has 10-15 days to reach a nuclear deal, even as the US ramps up its military presence in the region.

Markets are driving oil prices higher on fears that military action in the Middle East could threaten global oil supplies (making oil harder to come by).

After all, the region produces about a third of the world's total supply of oil.

ECONS 101: Prices tend to rise when supply becomes lesser, assuming demand stays constant.

Still, seasoned oil market watchers would be well aware that geopolitical risks tend to fade out of prices rather swiftly.

Although these US-Iran tensions may have longer to play out, markets will have little qualm swiftly bringing oil prices back down on signs of positive developments surrounding an Iran nuclear deal.

Even if tensions do escalate, any further spikes in oil prices may prove short-lived, unless oil supplies out of the Middle East see a lasting and significant disruption.

Walmart falls 1.4% on cautious US economic outlook

Before US markets opened yesterday, the world's biggest retailer announced its latest quarterly financial results and also its earnings outlook.

When US markets opened yesterday (Thursday, Feb 19) ...

Walmart shares fell 1.38% for the day, and as much as 4.25% during the cash session, though less than the 6% move we had anticipated in yesterday's report.

The post-earnings declines also lost Walmart its status within the so-called "Trillion-Dollar club", with its market cap now less than US$ 1 trillion.

Elsewhere across TradFi:

SP500 is inching back higher, though still trading between its 50-day and 100-day simple moving averages (SMAs)

Gold (XAUUSD+) has edged back above the psychological $5k level, though still resisted around its 21-day SMA

The US dollar is on its 4th consecutive day of gains, sending the likes of EURUSD+ and GBPUSD+ down to their lowest levels respectively in 4 weeks.

Brace for Friday's big events

Markets may yet be rocked by these 2 major events slated for later today (Friday, Feb 20th)

1) US December PCE and 4Q GDP data: 1:30PM UTC time

The US Personal Consumption Expenditure index is the Federal Reserve's preferred way to measure inflation.

Here's what economists predict for this top-tier economic data release:

PCE month-on-month (Dec 2025 vs. Nov 2025): 0.3%

If so, 0.3% would be faster growth than November 2025's 0.2% month-on-month number

PCE year-on-year (Dec 2025 vs. Dec 2024): 2.8%

If so, 2.8% would match November 2025's year-on-year number

Core PCE (excludes food and energy prices) month-on-month: 0.3%

If so, 0.3% would be faster growth than November 2025's 0.2% Core PCE month-on-month number

Core PCE year-on-year: 2.9%

If so, 2.9% would be faster growth than November 2025's 2.8% y/y number

US 4Q GDP: 2.8%

(updated from the 3% median forecasts by economists surveyed by Bloomberg, we cited in yesterday's report)

If so, 2.8% would be notably slower economic growth than 4.4% in Q3 2025

Gold, stock indices, and cryptos may move lower if sluggish US economic growth, along with still-stubborn inflation, prevents the Fed from lowering US interest rates this year.

2) US Supreme Court ruling on Trump tariffs

SCOTUS has returned from a four-week recess, and is set to issue opinions on President Trump's trade tariffs on Feb 20th, 24th, and 25th.

If the Supreme Court rules against Trump, that could alleviate US economic pressures as tariffs are estimated to cost importers over US$ 16 billion per month.

Such a ruling could see a knee-jerk bounce in risk assets, even though markets are aware that the White House may have other legal tools at its disposal to reinstate trade tariffs.